Long one of the economic and cultural wellsprings of America’s heartland, Oklahoma City has noted some strong accomplishments of late. Forbes recognized Oklahoma City as the “Most Recession-Proof City” in early 2008, just before the worst effects of the recent recession had taken hold. The prediction seems to have proven true, as the “On Numbers Economic Index,” a monthly measure of the economic health of 102 U.S. metropolitan areas, ranked Oklahoma City first in the nation for five out of the last seven months as of February of 2013. Federal, state, and local government; military bases; energy; aviation and aerospace; higher education; bioscience; high technology; agriculture; and manufacturing across Greater Oklahoma City’s ten surrounding counties form a diverse, fertile foundation for economic activity and hotel demand. The city is also becoming a bigger player on the convention, tourism, and hospitality fronts, priming the area’s hotel industry for growth in the coming years.

Economy Update

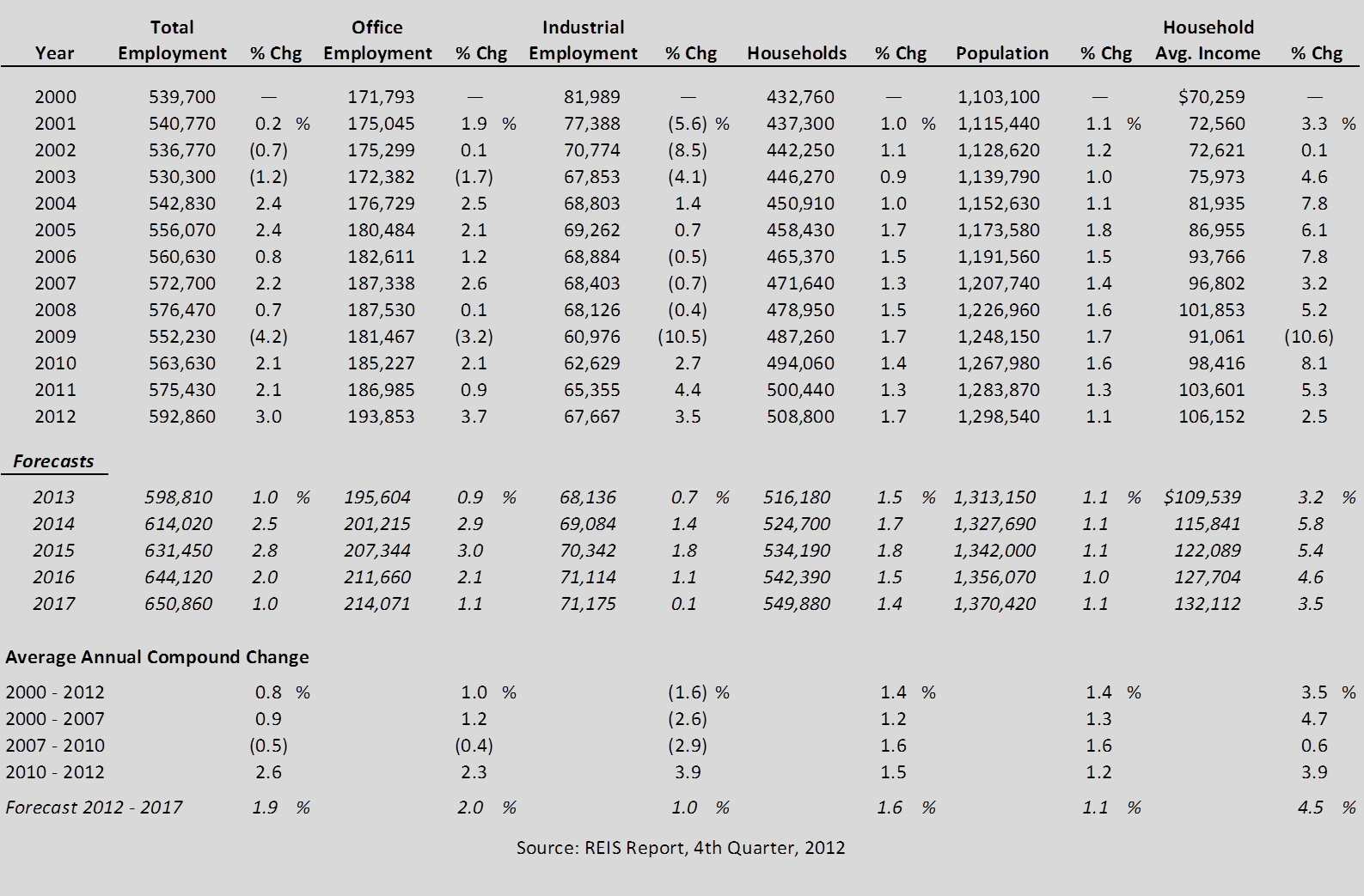

The following table illustrates historical and projected employment, population, and income data for the overall Oklahoma City market.

AND HOUSEHOLD INCOME STATISTICS

While education, health care, and government still form its foundation, the diversification of Oklahoma City’s economy into areas such as oil and gas production has broadened the economic base and brought higher-paying jobs. Boeing moved hundreds of engineering jobs from Wichita to Oklahoma City in 2012, and Continental Resources relocated its headquarters to Oklahoma City last year. The pro-business environment, low cost of living, and value that Oklahoma City brings to businesses should contribute to continued economic growth.

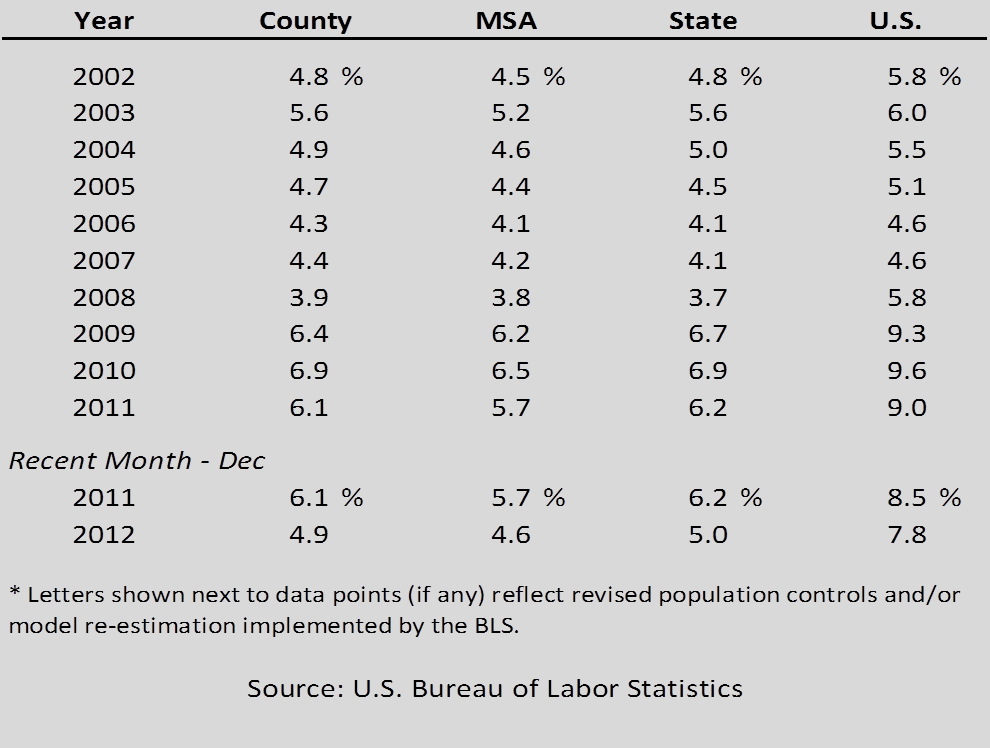

The following table illustrates unemployment statistics for Oklahoma County, the Oklahoma MSA, the state of Oklahoma, and the U.S. from 2002 through 2011.

Furthermore, the emergence of wind energy projects and the stability of oil and gas exploration in Oklahoma have provided major sources of revenue and employment in Oklahoma City. Devon Energy opened its 50-story, $750-million World Headquarters Tower in October of 2012, and the $100-million expansion and redevelopment of SandRidge Energy's headquarters is scheduled for completion in 2014. Chesapeake Energy also continues to expand its campus in the northwestern section of the city. With infrastructure and abundant natural resources in place, Oklahoma City is well positioned for growth in alternative energy sources such as wind, solar, and compressed natural gas, which should provide for healthy levels of employment in the future.

Office Space Market Update

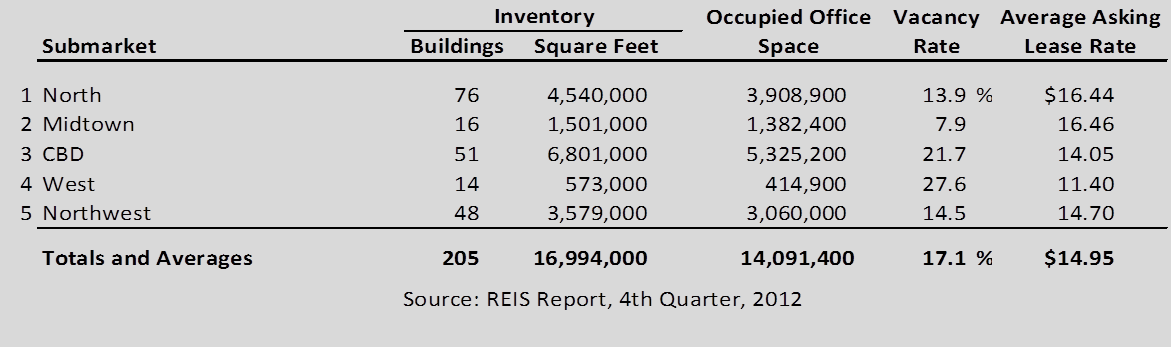

The following table details Oklahoma City’s office space statistics, which are important indicators of the market’s propensity to attract commercial hotel demand.

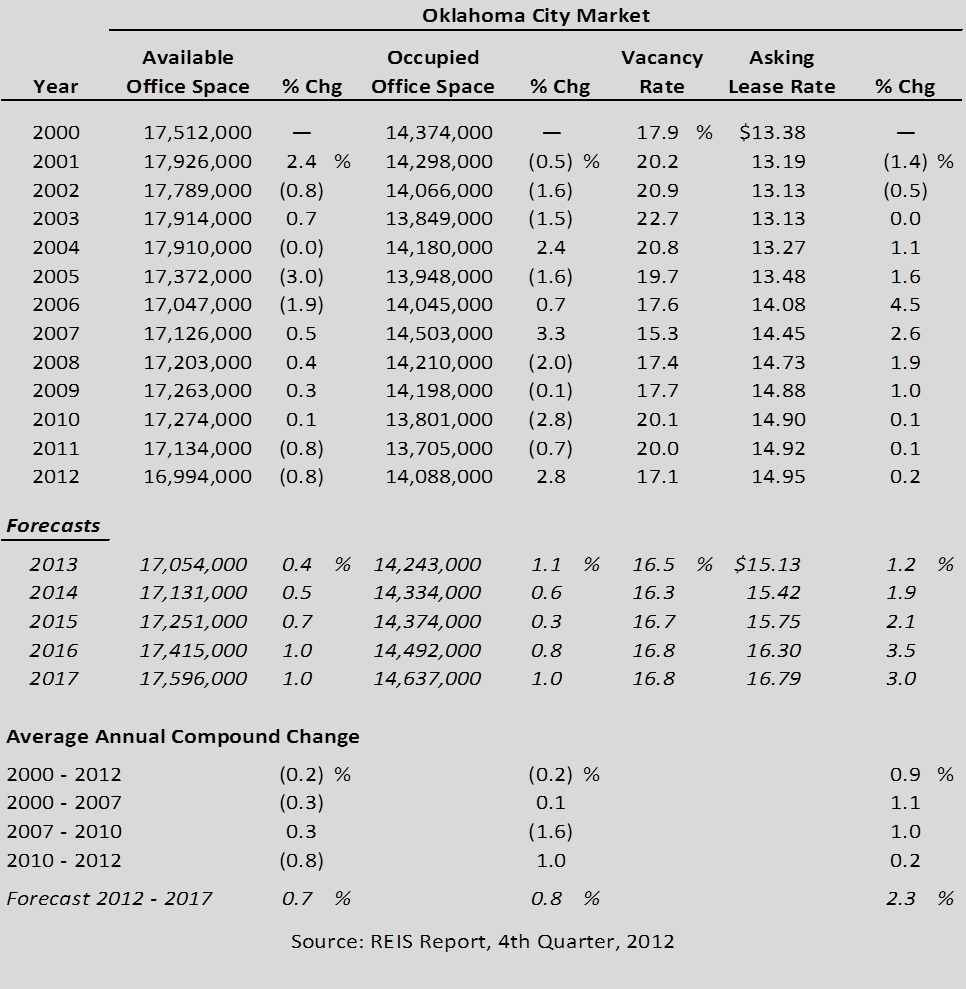

The following table illustrates a trend of office space statistics for the overall Oklahoma City market.

Hotel Construction Update

Strong occupancy, rate recuperation, and increasing demand in Oklahoma City have encouraged new hotel projects throughout the metro area. According to HVS research, at least nine new hotels (in addition to hotels in the preliminary planning stages) are currently in the pipeline for Oklahoma City, including:

• Aloft (Under Construction)

• Hilton Garden Inn Bricktown (Under Construction)

• Homewood Suites by Hilton Bricktown (Under Construction)

• Holiday Inn Express (Under Construction)

• Hampton Inn (Site Work)

• TownePlace Suites by Marriott (Site Work)

• Embassy Suites

• Oklahoma City Convention Center Hotel

• Remington Park Hotel

While many new hotels are expected to enter the market in the coming years, the percentage increase to the overall market supply will be moderate; however, there will be a large increase in the overall rooms available in the downtown area. Depending on how quickly this supply enters the market, hotels in other submarkets may lose occupancy as demand moves Downtown. These proposed hotels complement a handful of other projects in various stages throughout the downtown area. A larger convention center hotel is anticipated to open in conjunction with the new convention center in Downtown Oklahoma City in late 2018, creating a substantial boon for the city’s lodging industry and reputation as a destination city for meetings and groups.

Outlook on Market Occupancy and Average Rate

As with the city’s overall economy, lodging trends in Oklahoma City are solid. As of August of 2012, Oklahoma City’s hotel occupancy growth ranked second only to Oahu, Hawaii, and the industry’s marked growth since the recession is even more impressive given that local occupancy levels took a relatively minor hit compared with the plunge seen in other metropolitan markets. High-quality new supply entered the downtown submarket in 2007 and 2009; this supply was quickly absorbed and bolstered the downtown lodging market. Overall, citywide occupancy has been very strong, with occupancy bracketing the 70% mark over the past five years. Average daily rate growth for Oklahoma City hotels began to slow in 2008, and rates declined until early 2010. Rates finally began to rebound as new supply was absorbed in 2012.

Despite all the proposed new supply that is expected to enter the Oklahoma City area over the next several years, occupancy is anticipated to remain strong or decrease only slightly depending on how many hotel projects come to fruition. There is a significant amount of unaccommodated demand in Oklahoma City, which this new supply is expected to satisfy; however, the well-timed entrance of these new hotels will be crucial to the potential impact on the overall market. The entrance of higher-rated hotels should also allow hotels in the market to increase their rates.

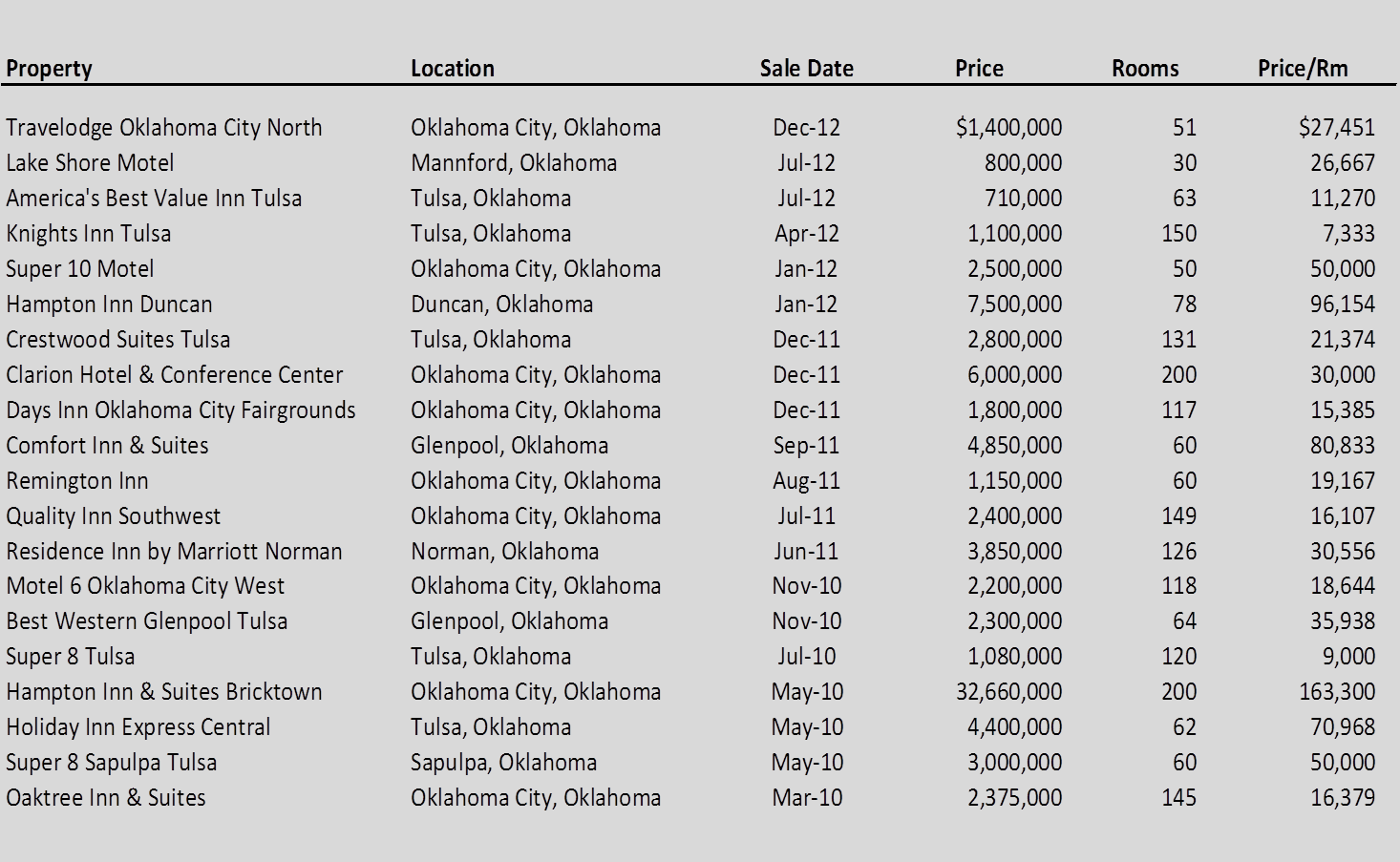

Recent Hotel Transactions

The following table summarizes hotel transactions in the state of Oklahoma since March of 2010.

REVIEW OF HOTEL TRANSACTIONS

Conclusion

Oklahoma City’s endurance of the recession and its economic growth since can be counted in the number of new business relocations, expansions, and projects, many of which are set to extend over the next several years. These projects notably include new hotels, and balancing the addition of hotel supply with projected demand growth will be extremely important to the health of the market moving forward, especially with respect to maintaining occupancy and average rate increases. The new convention center hotel and associated improvements have the potential to take the Oklahoma City hospitality industry to the next level, and new, well-advised, well-timed hotel projects should contribute to and benefit from the city’s already strong, diverse economy.

Great Article McKenna! Very Insightful.

Well done, McKenna! Good article.

Great Job McKenna!

Nice job McKenna. Oklahoma City seems to be booming!

great job McKenna!

Great article McKenna!

Nice job McKenna!

Very interesting article McKenna! Thank you!