The pace of revitalization and new development throughout the Denver Metropolitan area, underpinned by strong economic and lodging industry fundamentals, continues to spur investor interest in Denver hotels. Nine Fortune 500 companies, low unemployment, and strong commercial real estate fundamentals contribute to the metro area’s attractive economic climate. Denver was ranked fifth in Forbes’ “Best Places for Business and Careers” in 2013, and forecasts conducted by the Metro Denver Economic Development Corporation indicate Metro Denver’s economy will outperform the nation this year.

The Denver lodging market has recovered well from the recent recession, with 2012 RevPAR performance surpassing the pre-recession high. Moderately strong lodging demand, buoyed by area employers, leisure visitation, and the convention market, continues to apply upward pressure on hotel rates. While the pace of new hotel construction slowed significantly following the economic downturn, a high volume of proposed hotels is now in the pipeline. Fueled by healthy demand and high yields, investor enthusiasm is on the rise and is pushing the pace of transactions.

Economy Update

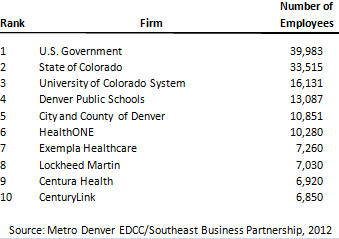

The Metro Denver Economic Development Corporation forecasts a full recovery of the jobs lost during the last recession. Company expansions in the area's healthcare and financial sectors account for significant growth in jobs. The following table lists Denver’s top employers.

MAJOR EMPLOYERS

Metro Denver’s residential real estate market is projected to continue to outperform the nation with growth in new construction activity and home prices, along with a reduced pace of foreclosures. According to research by the Denver-based Goss Institute for Economic Research, Colorado's housing sector rebound is stimulating growth in other sectors, including durable and non-durable manufacturing firms. Spurred by the pace of housing starts, the Goss Institute's monthly index of expected Colorado business activity reached a six-month high in February of 2013.

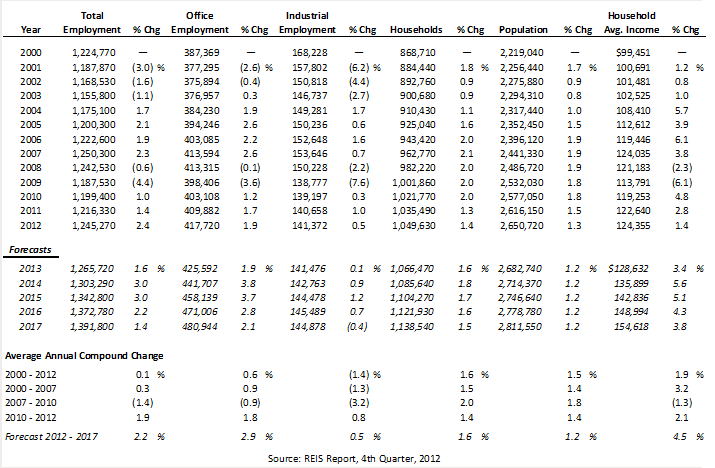

The following table illustrates historical and projected employment, population, and income data for the overall Denver market.

EMPLOYMENT, HOUSEHOLDS, POPULATION, AND HOUSEHOLD INCOME STATISTICS

For the Denver market, of the roughly 1,200,000 persons employed, 34% work in offices and are categorized as office employees, while 11% are categorized as industrial employees. Total employment decreased by an average annual compound rate of -1.4% during the recession of 2007 to 2010, followed by an improvement of 1.9% from 2010 to 2012. By comparison, office employment reflected compound change rates of -0.9% and 1.8% during the same respective periods.

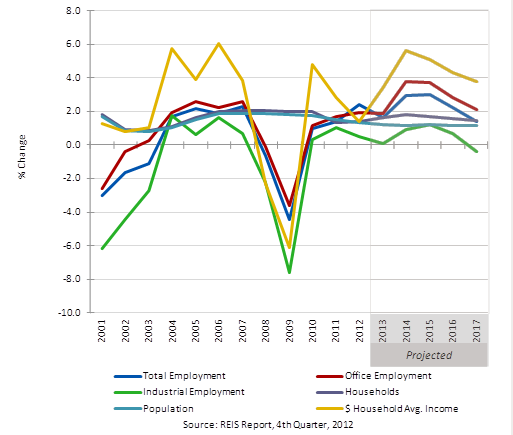

The chart below illustrates historical and projected dynamics of employment, population, and household trends in Metro Denver from 2001 through 2017.

COMPARATIVE EMPLOYMENT, POPULATION, AND HOUSEHOLD TRENDS

REIS projects total employment and office employment to each expand by 1.8% in 2013. Total employment is forecast to improve at an average annual compound rate of 2.2% from 2012 to 2017, and office employment is forecast to improve by 2.9% on average annually during the same time frame.

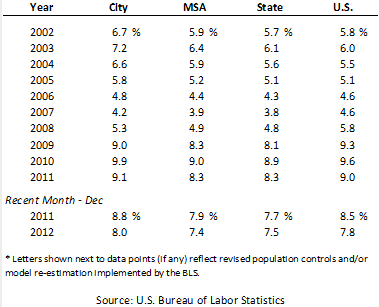

The following table presents unemployment statistics for Denver, the MSA, the state of Colorado, and the U.S. from 2002 through 2011.

UNEMPLOYMENT STATISTICS

Unemployment rates in the Denver area decreased year-over-year from 2003 through 2007 before beginning to rise in 2008, concurrent with the recession; this trend continued through 2009 and 2010. In 2010, Colorado ranked among the top U.S. states for workforce development and training1. According to the Denver Business Journal, Colorado ranked 38th in the U.S. for change in the number of private-sector jobs between 2001 and 2010, with a loss of approximately 64,800 jobs; according to the same study, the state reversed the job-loss trend between 2010 and 2011 by gaining approximately 8,200 new private-sector jobs. While public-sector employment has continued to decrease, the most recent comparative month in 2012 also illustrates improvement in total unemployment trends. The strong fundamentals of Denver’s economy, coupled with a housing market that is stabilizing faster than most and a well-educated workforce, should bring accelerated job growth as the economy rebounds.

Prominent industries in Denver range from retail, banking, and healthcare to aerospace, telecommunications, and energy. Major improvements and infrastructure projects continue to improve Denver’s amenity package and drive construction-related employment. A $544-million South Terminal Redevelopment Program at Denver International Airport is expected to improve the market's accessibility, as well as its national and international presence. Supporting local businesses, including hotels, $2 billion in RTD rail developments will add 140 miles of rail, 4 rail lines, and bus-transit linking the Fitzsimons, DIA, the Western Corridor, and Downtown submarkets by 2016. FasTracks and projects such as the Union Station redevelopment are spurring construction and retail activity along the rail lines, as well. Buoyed by the Colorado Convention Center and the market's extensive collection of hotels, Denver’s convention industry has achieved competitive status as one of the nation's top destinations. The area's special events venues, cultural activities, and tourism attractions support a strong leisure market.

Office Space Market Update

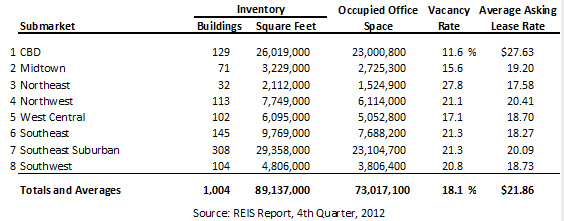

The following table details Denver’s office space statistics, which are important indicators of the market’s propensity to attract commercial hotel demand.

OFFICE SPACE STATISTICS – MARKET OVERVIEW

Vacancy and average asking lease rates across Denver vary widely, with the lowest vacancy and highest lease rates in the Central Business District submarket. Below-average vacancy levels are further illustrated in the Midtown and West Central submarkets, while the remaining submarkets post well above-average levels. Vacancies are highest in the Northeast, with corresponding low rents.

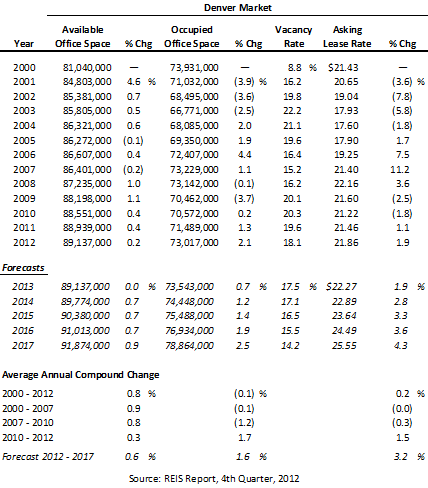

The following table illustrates a trend of office space statistics for the overall Denver market.

HISTORICAL AND PROJECTED OFFICE SPACE STATISTICS – GREATER MARKET

The inventory of office space in the Denver market increased at an average annual compound rate of 0.8% from 2000 through 2012, while occupied office space contracted at an average annual rate of -0.1% over the same period. From 2007 through 2010, occupied office space contracted at an average annual compound rate of -1.2%, reflecting the impact of the recession. The onset of the recovery is evident in the 1.7% average annual change in occupied office space from 2010 to 2012. From 2012 through 2017, the inventory of occupied office space is forecast to increase at an average annual compound rate of 1.6%, with available office space expected to increase 0.6%, resulting in an anticipated vacancy rate of 14.2% in 2017.

Convention Trends

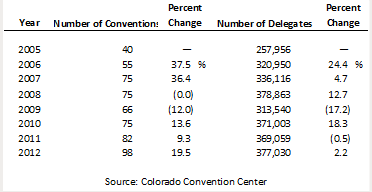

The 769,000-square-foot Colorado Convention Center, in conjunction with an estimated 8,400 downtown rooms and 42,000 hotel rooms metro wide, is expected to continue to draw sizeable levels of group demand to Denver. The 2012 convention year realized 16 more conventions and over 7,900 more delegates than in 2011. Four conventions with over 5,000 delegates and eight more with 3,500 to 4,999 delegates each are on the books for 2013. The following table details statistics for the Colorado Convention Center from 2005 to 2012.

CONVENTION STATISTICS – COLORADO CONVENTION CENTER

Hotel Construction Update

The following proposed hotel projects are actively in the construction or planning stages for Metro Denver:

• Westin DIA

• Renaissance Downtown

• Marriott Church Ranch Westminster

• Homewood Suites/Hampton Inn & Suites by Hilton Downtown

• Union Station Hotel Downtown

• Woolley's Classic Suites DIA

• Home2 Suites by Hilton Lakewood

• Drury Inn Stapleton

• Boutique Hotel LoDo Downtown

• Hampton Inn & Suites by Hilton Aurora

• Candlewood Suites Brighton

• Holiday Inn Express & Suites Golden

• Homewood Suites by Hilton Highlands Ranch

• Holiday Inn Express Peoria

• Full-Service Hotel & Conference Center Fitzsimons Village Aurora

While several new hotels are expected to enter the market in the coming years, the percentage increase to the overall market supply will be minimal. The active development projects in the Denver Metro area are anticipated to continue to induce lodging demand.

Outlook on Market Occupancy and Average Rate

Having sustained significant RevPAR losses during the recession, upscale and luxury hotels in Metro Denver have made a strong rebound in recent years. While discounted rates during the downturn allowed lodgers to trade up in accommodations, hotel operators report that integrity in hotel rates by tier has returned to the market. Backed by renovations at several area properties, demand growth continues in 2013, with a rise in average rate and RevPAR supported by all product categories, particularly in the Downtown and Airport submarkets. In addition, slightly soft group demand trends in 2012 are reported to have improved in 2013. Hotel operators report that yield strategies are in full force with local negotiated corporate and advance group booking rates holding strong. While new competitive supply will open over the next few years, the anticipated mix of product types and locations is expected to induce new demand to the market. Overall, Denver’s resilient lodging fundamentals should allow the market to sustain moderate growth in the near future.

Recent Hotel Transactions

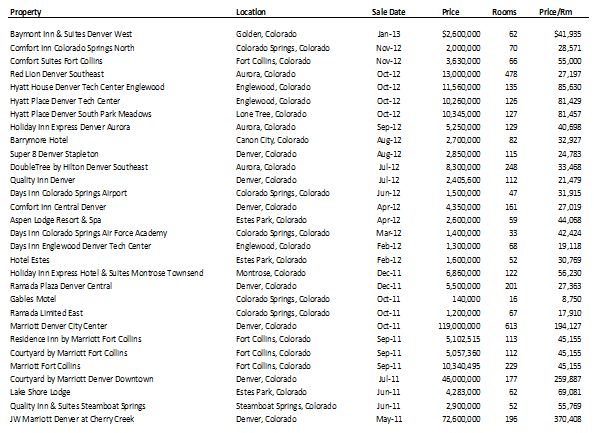

The following table summarizes hotel transactions in Colorado over the past two years.

REVIEW OF HOTEL TRANSACTIONS

Most hotel sales during this period were of limited-service, extended-stay, and select-service lodging assets. Few local full-service and luxury hotel transactions were reported, as owners took advantage of the economic recovery and the opportunity to recoup past RevPAR losses. An increased pace of lodging asset trades is anticipated in 2013, spurred by strengthened market conditions, improved hotel performance, and recent asset renovations.

As of early 2013, equity interest in the lodging sector remains strong, and debt is increasingly available. Loan-to-value ratios are rising and interest rates have declined to new lows. These factors, combined with continued strong industry fundamentals, are expected to attract more lodging investors and sellers to the market as the year progresses. REITs are again in acquisition and disposition mode, although their activity has moderated from 2010/11 levels. Market participants expect transaction activity to continue to increase over the course of 2013, as improved conditions encourage owners to sell their assets. Notably, the majority of the investment activity in the current cycle has been focused on institutional-grade assets encompassing both full-service and well-branded select-service properties in strong markets, particularly in gateway cities. Assets lacking these attributes are now also benefitting from positive economic trends. As the cycle evolves, investor interest is expected to broaden outside the premier sectors and markets. Nevertheless, challenges will remain for some hotels, particularly aging assets and those in need of unfunded capital improvements.

Conclusion

Increased demand has supported average rate growth for Denver area hotels and the market’s recovery from the last economic downturn. Transactions and values continue to climb, as local hoteliers have regained some pricing power. As access to capital and investment channels broadens, HVS expects a continuation of investor interest in Denver-area upscale and upper-upscale hotels, especially given recent performance trends and healthier economic fundamentals in the metro area. Allowing for the impact of new competitive supply, Denver’s strong lodging fundamentals should allow the market to sustain moderate growth in the near term.

While several new hotels are expected to enter the market in the coming years, the percentage increase to the overall market supply will be minimal. The active development projects in the Denver Metro area are anticipated to continue to induce lodging demand.

1 U.S. Chamber of Commerce and National Chamber Foundation

0 Comments

Success

It will be displayed once approved by an administrator.

Thank you.

Error