In December 2008, we put together an article titled "The Changing Face of the Greek Hospitality Market" outlining the situation in the Greek hotel market at that time. Nearly eight years later, and after a volatile period inside and outside the country, we think it is appropriate to update our findings since we all live in ”a completely different world” which has been profoundly transformed in terms of the sense of general prosperity prevailing in the Western economies since the mid-2000s. Thus, we wonder: "Has the Greek Hospitality Market Even Changed?"

Our original article included phrases such as "Greece…one of the safest countries in the Mediterranean region and a stable economy directly linkedOur original article included phrases such as “Greece…one of the safest countries in the Mediterranean region and a stable economy directly linked with Europe” or “…These efforts will support foreign and local investors to reposition the country’s tourism industry towards a more up-market product” and “…tourism in Greece is over-dependent on tour operators for the majority of holiday makers…” While some of these sentences still remain true, the interval of nearly eight years since December 2008 – and the momentous events that occurred both on a global and national level during that period – led to the need of writing an entirely new introductory note. with Europe" or "…These efforts will support foreign and local investors to reposition the country’s tourism industry towards a more up-market product" and "…tourism in Greece is over-dependent on tour operators for the majority of holiday makers…" While some of these sentences still remain true, the interval of nearly eight years since December 2008 – and the momentous events that occurred both on a global and national level during that period – led to the need of writing an entirely new introductory note.

Seven Years in a Nutshell

In 2009, the country’s GDP recorded a sharp decrease due to the general economic uncertainty on an international level that originated from the sub-prime mortgage financial crisis triggered in 2007. Nonetheless, the further deceleration of the Greek economy has been also attributed to its structural problems as highlighted by the Bank of Greece and other financial institutions. This eventually led to the bail-out of the country in May 2010 and the signing of a Memorandum of Understanding (MoU) on specific economic policy conditions with the European Union (EU) and the International Monetary Fund (IMF). Although Greece secured a second EU-IMF bailout package in July 2011 and restructured part of its public debt in March 2012, the country's debt sustainability remains doubtful even today. A fragile three-party coalition took office after elections in June 2012 and a year later one of these parties withdrew from the coalition, leaving the other two parties in charge. In exchange for the second bailout, Greece promised to step up its efforts to increase tax collection, reduce the size of government, and rein in health spending, while austerity measures aimed at generating €7.1 billion in savings during 2013-15. However, the austerity prolonged Greece's economic recession and depressed tax revenues. In 2014, the Greek economy began to ‘turn the corner’ on recession. Greece achieved three significant milestones in 2014: balancing the budget - not including debt repayments; issuing government debt in financial markets for the first time since 2010; and generating 0.8% GDP growth - the first economic expansion since 2007. Despite the recovery, widespread discontent due to previously-mentioned austerity measures that the government had to impose on people to meet the terms of the second bailout led to national legislative elections in January 2015 when the left-wing party picked up the slack. Between January and July 2015, conflicts of interest between the government and the country’s creditors over the implementation of the bailout measures and disbursement of funds called into question Greece’s future in the Eurozone. To stave off a collapse of the banking system, the Greek government imposed capital controls in June 2015, shortly before rattling international financial markets by becoming the first developed nation to miss a loan payment to the IMF. Unable to reach an agreement with creditors, the government held a nationwide referendum on July 5 on whether to accept the terms of Greece’s bailout, calling Greek people to vote for “no” which eventually was the outcome of the referendum. However, the government subsequently agreed to a new €86 billion bailout in order to avert Greece’s exit from the monetary bloc. On August 20th, Greece signed its third bailout which allowed it to cover significant debt payments to its EU and IMF creditors and ensure the banking sector’s access to emergency liquidity. The left-wing government—which retook office on 20 September after calling new elections in late August—successfully secured the disbursal of two delayed-tranche bailout funds. Despite the economic turmoil, Greek GDP fell by only 0.3% in 2015, boosted in part by a strong tourism season. It is estimated that GDP growth for 2016 will be subdued by 0.7%. Currently, Greece has to also face the rising issue of immigration from Middle East countries in conflict.

The tourism industry could not remain unaffected by the aforementioned downturn in the Greek economy. The year 2012 was rather ‘slow’ for the tourism sector in Greece, whereas tourism statistics for the period 2009-11 demonstrated a rather volatile trend as a result of the socio-economic turbulence that characterized the country during this period. The same period has also left a heritage of issues in the Greek travel and tourism industry. Several businesses, and particularly small and medium-size ones accounting for more than 95% of Greek tourism enterprises, faced severe problems of liquidity and lending. In 2013 though, tourism receipts increased by 16% compared to 2012 while international arrivals handled a record of 17.9 million, beating the previous record of 15.9 million, set in 2008. In 2014 and 2015 tourism in Greece achieved a period of significant growth with 22.0 and 23.6 million international arrivals, respectively. Tourism receipts in 2015 reached €14.13 billion, up from €13.44 billion in 2014. Preliminary estimates for 2016 indicate 25 million total foreign tourist arrivals – excluding cruise ship passengers – and €15 billion in tourism receipts. The remarkable performance of some of the country’s leading companies was also a determinant of the positive outcome in tourism during the last two years. More specifically, after the acquisition and merger with Olympic Air, Aegean Airlines became Greece’s national carrier and demonstrated excellent performance. The company expanded its clientele, increased its international and domestic routes and destinations, reduced its fares, and managed to boost passenger traffic. Low cost carrier Ryanair enhanced its presence in the Greek market by introducing six new domestic and international flights from Athens resulting in a much better performance. Greek online travel agency Travelplanet24 represents one of the best “success story” examples that developed during the crisis, as it demonstrates the evolution of a small start-up company to a global giant with rapidly increasing turnover and international presence. Finally, numerous luxury Greek hotels ameliorated their services and facilities and made it to the top of lists in world renowned magazines and websites, such as National Geographic and Conde Nast Traveler.

Tourism Economy and Statistics

The primary tourism destinations in Greece are the two largest cities, namely Athens and Thessaloniki, and the coastal destinations popular for attracting leisure travellers. While beach resort visitation is widespread among the islands and other beachfront areas, Crete, Rhodes, Kos, Corfu, Cyclades, and Halkidiki are more developed and conveniently accessible and therefore attract the largest share of annual tourist arrivals. Tourists typically fly either directly to these destinations or stop over in Athens for one to two nights as part of a package holiday.

According to the latest report by the World Travel and Tourism Council, the direct contribution of Travel & Tourism (T&T) to GDP was €13.3 billion (7.6% of total GDP) in 2015, is forecast to fall by 0.5% in 2016, and rise by 4.0% per annum, during 2016-26, to €19.5 billion (9.3% of total GDP) in 2026. The total contribution of T&T to GDP was €32.5 billion (18.5% of GDP) in 2015, is forecast to fall by 1.8% in 2016, and rise by 3.9% per annum to €46.7 billion (22.4% of GDP) in 2026. In 2015, T&T directly supported 401,000 jobs (11.3% of total employment). This is expected to rise by 0.6% in 2016 and by 2.7% per annum to 529,000 jobs (13.5% of total employment) in 2026. In 2015, the total contribution of T&T to employment, including jobs indirectly supported by the industry, was 23.1% of total employment (822,000 jobs). This is expected to fall by 0.6% in 2016 to 817,000 jobs and rise by 3.0% per annum to 1,095,000 jobs in 2026 (28.0% of total).

According to the report “Tourism Strategic Planning 2021” compiled on behalf of the Association of Greek Tourism Enterprises (SETE) in 2013, approximately €3.3 billion should be invested in tourism (both by the private and public sector) for each of the next six years in order to attain a target of 24 million international arrivals per year, increasing at the same time the per capita expenditure to approximately €800. The accomplishment of this goal would generate additional direct annual revenues of €18 billion and a total of about €50 billion, as compared to a total of €32 billion in 2012, further adding nine points to the country’s GDP. In order to establish the Greek tourism strategic planning, six key products are defined in the report that represent Greece’s competitive edges (Sun and Beach, City Break, MICE, Cultural Tourism, Nautical Tourism, and Medical Tourism) and a series of essential supplementary products and services.

Visitation

INTERNATIONAL ARRIVALS AT BORDERS, GREECE 2006-15 (000s)

.jpg)

Until recently, Greece had the strong advantage to be considered as a stable country showing a relative resilience as a tourist destination towards major global events. As such, fluctuations in tourist arrivals were not as great as in other, more vulnerable countries. During 2009 though, the negative publicity stemming from the rumours regarding the potential bankruptcy of Greece and the historically largest bail-out program implemented by the IMF in order to avoid this situation, led to a socio-political and economic turbulence resulting in significant fluctuations in tourist arrivals during 2009-13. Inbound tourist arrivals were clearly influenced by the turbulence inside the country, first by recording a 6.4% decrease due to the economic instability recorded in 2009 and then a 5.5% drop in 2012 because of political instability. Yet, total international tourist arrivals increased from 16 million in 2006 to 23.6 million in 2015, achieving a Compound Annual Growth Rate (CAGR) of 4.4%. Lately, the relative socio-political stability since the summer 2012 has led tourist arrivals to a vivid recovery which evidently shows the resilience of the Greek tourism industry and its dynamics recorded in every year since then.

The year 2014 was a milestone for Greek tourism since international arrivals achieved a record year with 23% growth compared to 2013. In 2015, even though international arrivals kept rising, the growth rate shrank to 7.1%. The reason for this decline was the negative image of Greece emerging after the rumors concerning an upcoming Grexit and the liquidity problems that visitors thought they would confront as a result of the bank capital controls imposed by the government.

Seasonality

One of the biggest, yet still-unsolved, issues Greek tourism traditionally faces is its highly seasonal pattern of incoming travellers. Most tourists visit Greece during summer months, leaving the rest of the year with lower visitation rates. In our article in 2008, two of the main limiting factors that impede a change in this pattern were highlighted, while one more is added now:

- The lack of direct flights from major source countries towards various Greek destinations during the winter months that greatly limits the number of visitors travelling to and within Greece during that time, with the exception of Athens and Thessaloniki;

- The lack of appropriate infrastructure throughout the country capable of attracting visitors during the off-peak tourism period, beyond Athens. Not only are many shops, bars, and restaurants closed over the winter months, particularly on the islands, but the limited number of alternative tourism facilities such as golf, conference, and thalasso/spa during that time further limits the tourism potential. Moreover, the need to enhance transport infrastructure by developing regional centres with upgraded airports is imperative if Greece is to emulate the picture of other Mediterranean countries which have succeeded in smoothing their tourism seasonality. In December 2015, the government, as part of the country's third bailout, signed its first big privatization deal with German airport operator Fraport, awarding it a €1.2 billion contract to lease and manage 14 regional airports. Fraport and its Greek partner, energy firm Copelouzos, will lease and manage 14 provincial airports in popular tourist islands, including Corfu, Mykonos, and Santorini, for 40 years. It will also invest €330 million by 2020 to upgrade facilities. It is also estimated that, by the end of the 40-year lease, the Greek-German consortium will increase the number of passenger movements to around 52 million.

- The weak positioning of Greece in various niche markets (city-break, sea tourism, health tourism, etc.) in comparison with other competitive countries. According to various sector studies, the size of these tourism market segments is undoubtedly significant both in terms of number of trips and expenditure, since they encompass sophisticated travellers seeking differentiated experiences. The lack of a strategic plan towards that direction has not allowed Greek destinations to reveal their full potential in attracting tourism throughout the year.

SEASONALITY OF INTERNATIONAL VISITATION, GREECE 2007-15 (000S)

.jpg)

Greece traditionally experiences very high numbers of international arrivals from May to October, a period when approximately 85% of the visitors arrive, and very low numbers of foreign tourist visitation between November and April. In our article in 2008 we had specifically highlighted the crucial need in changing this pattern for the favor of Greek tourism. However, the country still falls short in complementary tourism infrastructure and organized holiday home establishments, both suitable for attracting tourists during off-peak season. It is worth-mentioning that after 2008 the gap between summer and winter tourist influx gradually increased and each year’s peak equals, depending on the year, seven to ten times December’s arrivals.

Government Initiatives for Strategic Investments

In recent years, the Greek government has taken important initiatives and made several steps towards the development of a friendlier environment for investments to create long-term and wide-range results that are likely to have a significant beneficial impact on the National Economy. The most important are:

- With the Law "Acceleration and Transparency of Implementation of Strategic Investments" or Fast Track Law (3894/2010), the Greek government aims at providing the international and Greek investment community with a stable and transparent set of investment rules, procedures, and administrative structures for the implementation of large scale public and private projects. The Law tries to abolish critical obstacles that have inhibited major investment in Greece. Bureaucracy, the complexity of legislation, and lack of transparency, all of which today deter investors and significantly delay the implementation of large scale projects, are eliminated.

- Recognizing the need to have a comprehensive legal framework for all land use in relation to strategic investments, Greece has introduced a new legislation (4146/2013), the Special Spatial Development Plans of Strategic Investments, to address specific needs in this area. Until recently, the land development model within the Greek territory discouraged large investments and the introduction of new tourist products and infrastructures as there was no clear and stable framework for spatial planning and environmental licensing. This law signals a significant effort to overpass planning problems which have hindered integrated developments in the past, allowing for a more secure legal environment. Unfortunately, despite the importance of this new framework for the development of tourism, it proved to be a rather controversial subject that gathered numerous negative reviews. Last summer, different groups of professionals and environment activists demanded, through the Council of State, the cancellation of the Spatial Planning Law claiming that the implementation of its regulations will lead to degradation of the natural, cultural, and residential environment.

- Greece is amongst the latest nations to join other European countries that have established the so-called Golden Visas designed to attract economic benefits to the country. According to that initiative, investors from non-European Union countries who buy a property worth at least €250,000 in Greece are awarded with special visas that provide residence permits to them and their family members. Moreover, the holder of a Golden Visa and his family members are awarded with a free pass to 26 Schengen-member countries in Europe. 1,326 residence permits have been issued since the beginning of this initiative while an extra 1,794 family members have been granted with permits as a result of these transactions. According to some recent data published by the Ministry of the Interior (September 2016), the main investors' countries of origin are China (547 licenses), Russia (331) Ukraine (62), Lebanon (59), Egypt (58), Iraq (46), Syria (35), Jordan (27) and Turkey (26).

International Feeder Markets

Since 2008, nearly all Western Europe countries have experienced a period of economic recession, including the primary source market countries for visitation to Greece. Apart from the fact that the economies of the principal four source visitation markets to Greece (namely Germany, the United Kingdom, France, and Italy) deteriorated in the past seven years, tourism from these countries is still mainly controlled by tour operators. However, new and promising markets emerged from the Russian Federation, Ukraine, Serbia, Romania, and Poland. Visitation from these source markets helped Greece’s tourism industry to avoid experiencing a larger decline. During the last seven years, tourism was negatively affected by the local political situation, creating uncertainty, negative comments about the socio-economic situation in the country, and intensive rumors of Greece exiting the Eurozone. Especially during 2015, the negative climate was aggravated by the political uncertainty caused by the previously-mentioned referendum and the imposition of capital controls that coincided with the beginning of the tourist season. Eventually, tourism managed to rebound and witnessed another record year in international arrivals.

INTERNATIONAL ARRIVALS BY SOURCE COUNTRY - GREECE 2015 (% SHARE OF TOTAL)

.jpg)

Europe is by far the dominant source market. The United Kingdom and Germany together accounted for approximately 22% of the total tourist arrivals, while France, Italy, and the Netherlands accounted for a total of over 15%. Arrivals from Asia (mainly originating from China), recorded the highest CAGR, although they still represent a moderate percentage of the total visitation. More specifically, according to data provided by SETE, during the period 2010-15 Greece exhibited the biggest growth rate compared to any other tourism destination for the Chinese market, while only in 2015 the number of travelling visas issued to Chinese citizens reached 80,853. The Russian market had a strong and fast-growing presence for the last six years and after a year of declining demand in 2015, mainly due to visa restrictions, it seems that demand is likely to rebound in 2016. Another very promising market for Greece, which exhibits constant growth, is the Unites States market. More specifically, based on provisional data by the Bank of Greece, summer season bookings to Greece from the United States increased by 42.7% in the 1st quarter of 2016, while arrivals and revenues for the same period increased by 28.9% and 28.6%, respectively. In addition, American tourists are the biggest spenders and their number is expected to grow even bigger than last year’s record of 750,000.

Hotel Market Supply

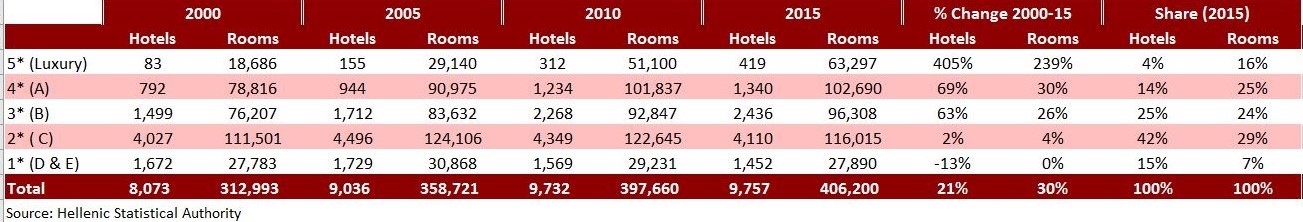

The lack of a reliable classification system for hotels in Greece, coupled with the limited existence of international hotel operators, the current highly-seasonal pattern of visitation, and the absence of a consistent marketing plan to promote tourism have set the Greek hospitality market as challenging to a number of potential visitors. However, an increasing number of international hotel brands have already entered the Greek hotel market, especially at the high-end spectrum of the market. Even so, the share of branded hotels in Greece is still lower than in other countries. The following figure indicates the availability of hotel units and rooms in Greece over the past 15 years.

As of the end of 2015, there were 9,757 hotels throughout the country. About 60% of the hotel supply was related to one- and two-star categories, with a further 25% in the three-star category. However, due to the larger size of upscale properties, 25% of hotel rooms in Greece were four-star, and around 16% of total hotel room supply was classified as five-star. Furthermore, based on 2015 figures, the average size of a five-star hotel is 151 rooms. Each four-star hotel is nearly half the size of a five-star unit, featuring on average 76 rooms, while as hotel categories lower, so does the average hotel room count. Despite the prolonged and tough economic conditions that Greece has been going through over the last years, both domestic and foreign entrepreneurs kept on investing in the Greek hotel market, launching 122 new, five-star units representing 16,371 rooms.

SUPPLY OF HOTEL UNITS AND ROOMS, GREECE 2000-15

International and Local Brands

Greece lacks upscale properties and more importantly international or domestic brands which represent only 24% of the total room number and 6% of the total hotel count, with the majority of hotels being independent or family-run. Over the 2005-13 period, there has been a significant growth in branded hotels, with their capacity growing by approximately 40,000 rooms to a total of 95,041 rooms in 538 hotels in 2013[1]. This trend clearly reflects the still-existent and predominant mentality amongst Greek hoteliers that prevents them from giving away the management of their properties.

According to HVS’s in-house data on hotel branding in Greece, Starwood Hotels and Resorts is the third international hotel group in Greece with 2,518 (2015) rooms under affiliation. The largest international group is TUI with some 14,000 rooms, of which a large proportion is part of its joint venture with the national brand of Grecotel. Some indicative groups and brand names of the upscale hotel market are: InterContinental Hotel Group with InterContinental, Crowne Plaza, and Holiday Inn brands, Starwood Hotels and Resorts with Luxury Collection, Westin, Sheraton, Marriott with Autograph Collection, Hilton Worldwide with Hilton, Accor with Sofitel, and Novotel, Rezidor Group with Radisson Blu, Best Western Hotels and Resorts, whereas Hyatt Hotels and Resorts and Iberostar Hotels have established only a limited presence. A relatively large share of hotels has been secured by brands directly managed by or affiliated with some major European tour operators such as the predominantly all-inclusive resort hotels of Robinson Club, Magic Life, Atlantica Hotels and Resorts, and Sentido Hotels. The latest worth-mentioning additions to hotel supply are the internationally branded units of Amanzoe, a 42-pavilion luxury resort located close to Porto Heli, Peloponnese; the 101-room King George Hotel in Athens that was rebranded under the Luxury Collection brand name of Starwood; the 66-room luxury Nikki Beach Hotel in Porto Heli, Peloponnese; Marriott with Autograph Collection in Elounda and Chania, and the 318-room former Minos Beach Resort in Militos Crete that was renovated to become the second Radisson Blu hotel in Greece.

The national hotel chains of Mitsis, Aldemar, Louis, Helios, Divanis, Amalia, Electra, Chandris, Kypriotis, and AKS own and/or operate a significant proportion of the total upscale room capacity. Nonetheless, in the current globally-competitive tourism market, international hotel operators, taking full advantage of their strong brand awareness, benefit an entire destination wherever they obtain presence. National chains, or even local independent hoteliers, have been lately increasing their efforts to overcome the limitations in distribution channel accessibility or weak market positioning by joining market consortiums (e.g. Leading Hotels of the World, Small Luxury Hotels, etc.) whereas, especially for small hotel units on the Greek islands, several recently-founded Greek hotel management companies have experienced significant expansion (e.g. Hotel Brain, CHC, Aqua Vista, etc).

DOMESTIC AND INTERNATIONAL BEDNIGHTS AT HOTELS, GREECE 2006-15 (000s)

.jpg)

Demand for Transient Accommodation

Over the past years, an average of about 80.0% of the total hotel bednights in Greece has been of international nature. Traditionally, international bednights reach a peak during the summer season, whereas demand from domestic travelers (both business and leisure) is spread throughout the year. In addition, the lack of specialized tourism products such as golf courses, large convention centres, and marinas that can absorb the potential demand from larger number of tourists creates a burden on the destination by virtue of not being able to attract business from niche markets that could boost international arrivals, especially during the shoulder months.

Destination Management

Greece must move away from the “sea and sun” formula that worked well in the past and currently provided by other country competitors. There is a clear shift towards the higher end of the hotel market making luxury hotels less vulnerable to the tourism industry’s current limitations and at the same time more profitable due to better operational performance. The new upcoming source markets for European destinations such as Russia, China, and the U.S.A., as well as affluent European citizens and residents of the Gulf region, are mainly interested in upscale hotel accommodation. As long as quality and value for money are realized, tourists from these source markets are prepared to pay high room rates.

According to the “Greek Tourism Strategic Plan: 2021 Growth Roadmap”, the focus onwards should be on establishing a strong and diversified product portfolio. Seven core priority products have been defined:

- Thematic Sun and Beach Tourism, where value can be added and the typical holiday period can be extended by focusing on “thematic vacation” such as wellness, romance, relaxation, and luxury;

- Nautical Tourism, aiming at growing the cruise line sector and extending the offering for sailing holidays;

- City Break Tourism, where tourists will visit Athens and Thessaloniki to enjoy shopping, food, and sightseeing;

- Cultural and Religious tourism, by upgrading and boosting the historical heritage and religious sites of Greece;

- Medical Tourism, a sector with tremendous growth opportunities, if the expertise of personnel is to be combined with the development of existing facilities and infrastructure;

- Meetings and Incentives, placing Greece even higher in the list of countries popular for meeting and conference facilities within Europe;

- Integrated Resorts – Holiday Housing, by taking advantage of the modification in the current legislation – which encourages the development of integrated resorts and supports the acquisition of residence permits for non-EU citizens – new investments in existing or new destinations could emerge.

The Most Significant Changes in the Country’s Hotel Market

The most significant recent and upcoming changes in the country’s hotel market are highlighted below:

The tourism investment by TEMES S.A. in the Messinian Peninsula is set to create the first fully-integrated resort community in Greece. The first phase of Costa Navarino was completed in 2010 with the development of two integrated resorts, both situated on a beachfront property near the town of Pylos, Messinia, Peloponnese. More specifically, in May 2010, two five-star hotels featuring 321 and 445 keys commenced operations, managed by Starwood under its Luxury Collection and Westin brands and the development is known as the “Navarino Dunes”. In the summer of 2013, the owning company secured the building permits for several residential villas to be developed for outright sale. The development of the second phase of Costa Navarino, known as “Navarino Bay” which includes the development of an upscale hotel and approximately 135 villas, recently commenced. Costa Navarino is considered to be the largest tourism development currently operating in Greece with a total investment of €1.2 billion. At the end of 2014, Saudi Arabian investment company “Olayon Group” acquired a 25% stake in the project.

Dolphin Capital Investors aims at creating upmarket, chic, and elegant destinations in South East Europe, offering multiple hotels, residences, golf, and leisure activities in truly integrated communities located on various locations in Greece:

- On the south shores of Argolida, Peloponnese close to Porto Heli, the so-called Porto Heli Collection investment is planned to be developed on a land plot measuring 347 hectares and its first phase includes: Amanzoe, a 42-pavilion hotel and spa and the Amanzoe Beach Club, operating since August 2012; 36 Aman Villas serviced by Amanzoe, four of which are completed; the 66-room Nikki Beach Hotel, featuring hotel suites as well as apartments for sale, which opened in July 2014; 11 Seafront Villas, the shells of which have already been constructed and one is completed. Next phases include a 102-room Chedi hotel and beach club, 40 Chedi club suites, 40 Chedi-branded residences, an 18-hole signature golf course, a 70-room golf boutique hotel, a golf clubhouse, and 225 golf residences.

- The proposed Sitia Bay Golf Resort is planned to be positioned in the market as a luxury golf resort operated under a management contract with Hilton Hotels’ Waldorf=Astoria brand. The proposed investment is envisaged to be developed on a 280-hectare land plot featuring a hotel unit with 177 guestrooms and a residential component comprising of 620 (150 branded and 470 non-branded) villas, totalling 80,000 m² of buildable space. In addition to guestrooms and villas, the resort will contain a spa/wellness centre of 2,500 m², conference facilities, an 85-berth marina, an 18-hole championship golf course, and extensive food and beverage outlets. According to the owning company, the final construction permits for Phase 1 was received on 14 October 2009. However, the project is still on hold.

Various additional tourism projects, including similar facilities and characteristics, are planned to be materialized in other Greek destinations, each one of them being at a different stage of the licensing and/or planning process.

Miraggio Thermal Spa Resort is located in the Kanistro region in Halkidiki within an area of 330 acres. The complex features a high quality five-star hotel with 640 beds (300 rooms, of which 65 feature a swimming pool, as well as 30 suites), a hydro-therapeutic spa center, a 90-berth marina, and a settlement of 150 holiday homes (which will be available for outright). The hotel commenced operations in the summer of 2016 and aspires to be this year's most exciting new addition to the world of wellness and luxury. The implementation of the project was delayed for about seven years due to bureaucratic issues; two years ago the Greek state eventually approved the continuation of the investment that is undertaken by Russian investment companies Med Sea Health and Mare Village and estimated at around €150 million.

Oaktree Capital's Ikos Resorts and the Greek hotel company Sani S.A. recently announced their merger aiming at strengthening their hotel brands and expanding tourism investments throughout Greece. According to media reports, the agreement involves plans of investment projects amounting to €200 million within the next five years and creating around 1,000 jobs. The joint venture also involves Goldman Sachs Asset Management and Hermes GPE.

Expected in the near future, the former San Stefano Hotel near the village of Benitses in the island of Corfu will be re-launched in the market featuring 200 guest rooms (including suites and bungalows). In addition to guest rooms, the Hotel is planned to feature numerous food and beverage outlets, a multifunctional meeting space, 2,300 m² of wellness facilities, and a residential element comprising about 80 villas. The entire development is agreed to be flagged under the Angsana brand of Banyan Tree Hotels and Resorts.

A trend is emerging in Athens with a number of new hotels expected to open in 2016. Electra Hotels and Resorts leased the building of the former Ministry of Education on Mitropoleos street in Athens’ city centre and has begun (since September 2016) the operation of a five-star hotel with 216 rooms. In December 2016, Wyndham Hotel Group is expected to enter the Athens market with a 276-room hotel after the renovation of the former Athens Imperial hotel in Karaiskaki Square. The hotel is further expected to feature 2,500 m² of meeting space, a restaurant, a bar, a spa, and a 450 m² roof-top restaurant with great views of Athens.

As of 2016, the Minos Imperial Luxury Beach Resort located in Lassithi, Crete and owned by the Geniatakis family will be affiliated with Radisson Blu. The hotel will operate under the new name Radisson Blu Beach Resort.

Marriott returned to Greece in 2015 when the Domes of Elounda Resort in Crete became affiliated with the Autograph Collection brand. A second hotel of the same owner and under the same franchise affiliation opened in August 2016 in Chania, Crete called domes Noruz, featuring 83 rooms.

As part of the Hellenic Republic’s privatization program, the Hellenic Republic Asset Development Fund (HRADF) sought to attract investments in Greek public real estate properties. Over the last two years, various tender processes, relevant to tourist assets in various destinations within the country, drew the attention of potential tourism investors:

- In January 2013, the HRADF announced the conclusion of the international bidding process for the development of the Kassiopi area on the island of Corfu. The Board of Directors of HRADF approved the binding financial offer by NCH Capital for the acquisition of 100% of the stake of the Special Purpose Vehicle, to 8which HRADF will transfer the concession rights of the property development for a period of 99 years. This is an investment of approximately €100 million, including €23 million for the acquisition of the leasehold, €2.3 million of an earn-out clause, and an estimated amount of €75 million for the development of the property. The total area of the property is 490,000 m² and the investor will have the right to develop a gross buildable area of about 36,000 m².

- In October 2013, the HRADF’s Board of Directors accepted Donskoy Tabak’s improved offer of €14 million regarding the greenfield development of the real estate in the Paliouri area of Halkidiki, concluding the respective tender process. The property measures 210,742 m² and includes the currently-abandoned tourist units of Xenia Hotel (3,658 m²) and Paliouri Camping Facilities (1,128 m²). Potential exploitation plans for the property could include up to 3,658 m² of luxury hotel (via leasehold or concession) and 19,954 m² of vacation residences (freehold). The property should be developed in accordance with the procedures for urban-planning maturity prescribed in law 3986/2011 and the relative Special Town Planning Development Plan.

- In November 2013, Agios Ioannis, a beachfront land plot on the peninsula of Sithonia, Halkidiki measuring 261,000 m² featuring a seafront of 2,000 meters and usable area of 200,000 m² was sold to a construction company based in Northern Greece for €9.61 million after an international tender process conducted by the HRADF. An additional investment of approximately €50 million in tourism facilities is expected.

- The Xenia Hotel in Skiathos (2,550 m²) was built in 1963 and has been in operation since 2000. The property, which has been partially characterized as a listed building based on its special architectural and historic interest, was sold in December 2013 to construction company TE.NA based in Ptolemaida for a period of 99 years. The hotel was sold for €2.628 million after the Board of Directors of HRADF accepted the company’s improved offer by 30%. The investment of €8.5 million, which will create 100 jobs, will be completed in two years.

- In July 2014, the HRADF announced the higher bidders of the tender for the “Afandou Property” consisting of two neighbouring beachfront land plots located in the Afandou area of the island of Rhodes totalling 161.5 hectares. The deal for the Afandou assets amounted to €42.1 million. US-based M.A. Angeliades Inc. offered €26.9 million and was declared the investor for the 1.36 km² North Afandou plots that include an 18-hole golf course. The company T.N. Aegean Sun Investments Ltd. was declared the investor for the South Afandou plot after submitting an offer of €15.2 million. Reportedly, the investors are expected to put around €300 million in the area to build hotels, bungalows, and revamping the golf course. The area is given over to the investors under a 50-year lease. An area of 28.6 hectares is foreseen as protected natural environs and natural beauty.

- In December 2015, the board of the National Bank of Greece announced the signing of the contract for the sale of Astir Palace Hotel in the Southern Athenian suburb of Vouliagmeni. The property was sold for €400 million to an Arab-Turkish property fund called Jermyn Street. The new owners’ plans for the property include two 6-star hotels to replace the current Arion and Westin units, 15 bi-level luxury villas, and the upgrade of the marina.

- In March 2016, the HRADF announced the tender for the Leto Hotel in Mykonos which is located in an enviable position in the center of Mykonos Town and features 25 rooms. The specific sale attracted the interest of approximately 50 companies from Greece and abroad. The company Asteras 2020 S.A. finally acquired the asset for the amount of €16,901,123 surpassing the initial bidding price by 69%.

- In September 2016, one of the most important privatization deals, which was set as a prerequisite by the creditors for disbursing further financial aid to Greece was finalized. A new memorandum of understanding (MoU) has been signed between the Greek government and Lamda Development investment venture for the sale and long-term lease of the old airport of Hellinikon at the price of €915 million. The investment will reach the amount of €8 billion and is expected to create 10,000 direct jobs, while the rapidly-expanding project is expected to employ about 70,000 people in the long run. According to the chairman of the HRADF, this project ‘aspires to transform the former airport into the largest urban regeneration project in Europe and become the largest metropolitan park in Europe’.

Currently, there are several other tourism projects in the pipeline, of various sizes and in different stages of development, that reflect the increasing interest of domestic and foreign investors in the Greek tourism industry and which are also expected to play a significant role in formulating the country’s supply. The ones previously outlined are only a sample of them.

Conclusion

The period 2009-12 has left a heritage of problems in the Greek travel and tourism industry. Several businesses, especially small and medium-size ones which account for more than 90% of all Greek tourism enterprises, faced severe problems of liquidity and lending and found themselves in an unfavourable position. However, the period 2013-15 has been one of remarkable results for the Greek tourism industry despite the ongoing financial uncertainty and as the country is about to experience another record-setting year. On one hand, this optimism is based on the prospects for the global economy, the slight improvement of the economies in tourism-generating countries but also the ‘turbulence’ in other destinations such as Egypt and Turkey that redirects tourism inflows to alternative destinations. On the other hand, it also relies on the confidence that source markets have displayed with regards to the Greek tourism and the appeal of the Greek tourism industry, which is expected to further improve once the socio-political situation normalises and the upgrade of the Greek tourism product takes place to account for a more modern and diversified offering.

Greece has been associated with the ‘sea and sun’ concept since the 1960s, a natural association for a country where sunny beaches and coastal retreats have been – and continue to be – the main tourist attractions. However, many industry experts recognize that Greece has a lot more to offer than the highly seasonal, coast-dependent, and low cost driven tourism industry, especially given that the country’s temperate climate can support tourism throughout the year. Besides, Greece is becoming expensive for this kind of mass tourism as labor costs are prohibitively high, making the country uncompetitive when compared with destinations such as Turkey, Bulgaria, and Croatia.

Greek tourism industry representatives launched a non-profit private marketing company for the Greek tourism called Marketing Greece S.A. The company aims to place Greece on the list of the ten most important and attractive destinations worldwide through active utilisation of social media, its website, collaboration with the offices of the Greek National Tourism Organisation (GNTO) abroad, as well as roadshows, events, and forums. Although initially planned to have the GNTO as a shareholder, this was not staged due to bureaucratic issues. Nevertheless, it will work in close cooperation with the GNTO to efficiently promote Greek tourism.

Although nowadays the Travel and Tourism industry represents circa 20% of the country’s GDP, there is still no coherent strategic plan (at least one that would be actively implemented as a whole) for the destination despite the good intentions from all interested parties that form the greater tourism product. These intentions should have already been transformed into a well-defined structure/scheme that would assist towards the diversification of the Greek tourism offer, expanding it from an exclusively ‘sea and sun’ product to all kinds of alternative forms of tourism. Destination Management Organisations are still in their infant stage of development when they should have already held the ‘spearhead’ of the country’s marketing strategy in the global competitive environment of attracting inbound tourism. The time is high for such obvious, yet radical for the Greek reality changes; otherwise the tourism industry will continue to rely on individual initiatives, stemming mainly from the private sector, that might be insufficient in the ever-changing global environment.

0 Comments

Success

It will be displayed once approved by an administrator.

Thank you.

Error