The capital markets have experienced a signficant shift in the past six months, and financing for hotel projects is both less available and more expensive than it was in the first half of 2022. Driven by successive increases in the federal funds rate, interest rates have risen and are now typically in the 6% to 8% range, depending on the asset and market. At the same time, concerns related to a potential recession and the impact of inflation on operating costs and consumer spending have induced a layer of caution about the near-term outlook for the industry. As a result, loan-to-value ratios have declined and amortization periods shortened, reflecting the market’s perception of elevated risk in the near term. These factors have combined to make current mortgage capital relatively expensive compared to both recent levels and long-term norms.

The capital markets have experienced a signficant shift in the past six months, and financing for hotel projects is both less available and more expensive than it was in the first half of 2022. Driven by successive increases in the federal funds rate, interest rates have risen and are now typically in the 6% to 8% range, depending on the asset and market. At the same time, concerns related to a potential recession and the impact of inflation on operating costs and consumer spending have induced a layer of caution about the near-term outlook for the industry. As a result, loan-to-value ratios have declined and amortization periods shortened, reflecting the market’s perception of elevated risk in the near term. These factors have combined to make current mortgage capital relatively expensive compared to both recent levels and long-term norms.All else being equal, higher capital costs put downward pressure on values. The buyer side of potential transactions usually feels the direct impact of the higher cost of mortgage capital first, resulting in a widening gap between buyer perceptions and seller expectations of value. This gap will typically cause a decrease in transaction activity, as investors await better market conditions and greater clarity about the near-term outlook for the economy and lodging industry. However, some investors do not have this option. Owners faced with impending debt maturities must seek refinancing, for example, while funds nearing the end of their holding periods may have to put some assets on the market.

Investors seeking financing in this environment typically do so with the expectation of refinancing the debt when market conditions improve. Thus, while the near-term cost of capital is high, the longer-term expectation is that the property will be refinanced at more favorable terms. Consistent with this expectation, current loans are typically for a shorter term (two to four years), with new financing assumed at the end of this period. The timing of the assumed refinancing usually aligns with the expected recovery in EBITDA levels, which further supports the assumed refinancing.

HVS has developed a debt-equity model that recognizes both the current market conditions and the prevailing expectation of refinancing in three to five years at the more favorable terms that are expected in the future. This model is based on the Simultaneous Valuation Formula, developed by Suzanne R Mellen, MAI, CRE, FRICS. The financing terms that would be available in the current market are established and the resulting mortgage is assumed to be in place for three years. The terms of the future or refinancing loan are developed, reflecting the assumed return to levels consistent with longer-term norms. This two-part mortgage scenario yields a blended overall discount rate that captures the upside inherent in the future refinancing, including the costs associated with the refinancing.

The following case study illustrates how the refinancing scenario flows through an investment analysis and its resulting impact on current discount rates and values.

Case Study

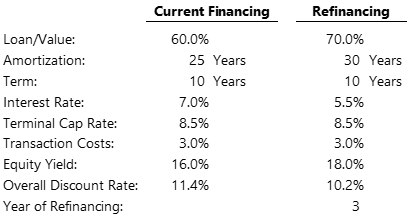

The following chart summarizes the investment parameters assumed for both the current loan and the future refinancing.

The current financing terms reflect market conditions as of Q4 2022. These terms are notably less favorable than those available in the first half of the year. The equity yield rate selected for this example reflects investors’ willingness to take a lower return on investment in the near term, recognizing that the most significant elements of the equity return will occur in the latter years of the assumed ten-year holding period. The resulting overall discount rate (or weighted average cost of capital) is 11.4%, a substantial increase over the 9.5% to 10.5% that would have been the norm for a typical hotel earlier in 2022.

For the purposes of this case study, we have assumed the current debt will be refinanced at the end of the third year. At that point, the debt market is expected to improve, returning to interest rates and loan-to-value ratios more consistent with historical norms. With a higher degree of leverage, equity return requirements should increase. The combination of these more favorable assumptions results in an overall discount rate of 10.2% as of the refinancing date.

Investment Parameters in the Current Market

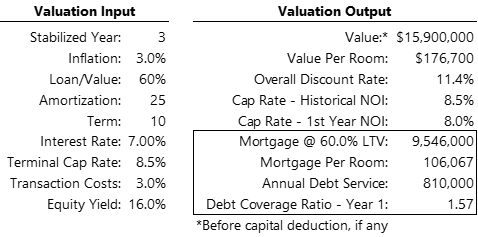

The following chart illustrates the parameters that apply in the current market.

As illustrated in the preceding chart, at current mortgage terms and equity return requirements, the hotel would be valued at $15,900,000. These returns yield an overall or blended discount rate of 11.4%. At a 60% loan-to-value ratio, the mortgage would be $9,546,000, with annual debt service of $810,000.

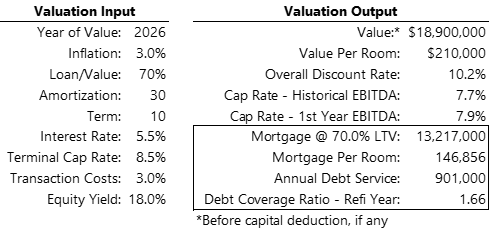

Investment Parameters in the Future, Normalized Market

Based on the expectation that the debt market will return to more normalized parameters, the hotel is assumed to be refinanced at the end of the third year. The equity return requirement has been increased in recognition of the higher loan-to-value ratio. The same calculations are performed using the future, normalized debt parameters. These assumptions and the resulting valuation are set forth in the following chart.

As illustrated in the preceding chart, at future, normalized mortgage and equity return requirements, the hotel would be valued at $18,900,000. These returns yield an overall or blended discount rate of 10.2%. At a 70% loan-to-value ratio, the mortgage would be $13,217,000, with annual debt service of $901,000.

The appreciation indicated by the future refinancing model is caused by both the improvement in forecast cash flows and the normalization of the debt market. The impact of these factors is illustrated by examining the cash flows to the equity position, which can be grouped into four components.

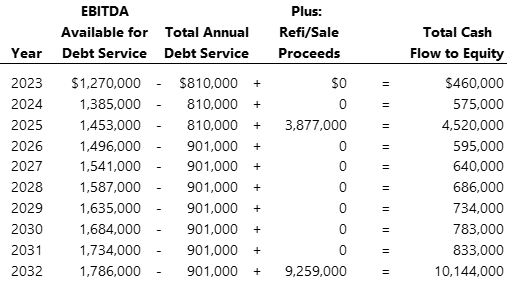

Years 1–3: The cash flow to the equity position equals the forecast EBITDA for each of those years less the debt service amount of $810,000.

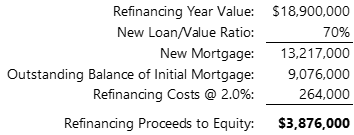

End of Year 3: The refinancing yields a mortgage of $13,217,000, which is used to pay off the outstanding balance of the initial mortgage (originally $9,546,000, $9,076,000 as of the date of refinancing), as well as the costs associated with the refinancing. The remaining $3,876,000 is paid to the equity. These calculations are illustrated below.

Years 4–10: The cash flow to the equity position equals the forecast EBITDA for each of those years less the refinanced debt service amount of $901,000.

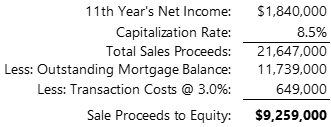

End of Year 10: The hotel is assumed to be sold at the end of the ten-year holding period. The proceeds from the sale are used to pay off the existing mortgage balance and transaction costs. The remaining $9,259,000 is paid to the equity. These calculations are illustrated below.

Cash Flow to the Equity Position

The following chart illustrates the calculation of the cash flow to the equity position over the ten-year holding period. The calculations include the annual net income after debt service plus the capital infusions generated by the refinancing at the end of year three and the sales proceeds at the end of the assumed holding period.

Present Value of the Equity Position

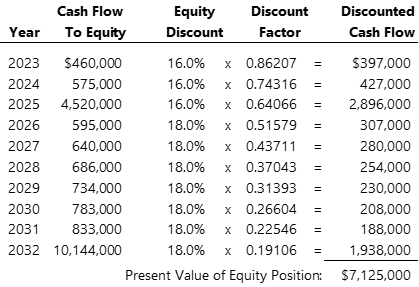

The present value of the equity cash flows is calculated by discounting each year’s forecasted cash flow at the equity yield rate selected for that period.

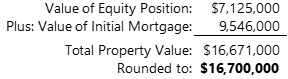

The value of the initial mortgage is added to the present value of the equity interest, yielding the current value of the property under the refinancing assumption. These calculations are shown below.

Assuming the investment is refinanced at more favorable terms in three years, the current value of the hotel is $16,700,000, which is 4.8% higher than the value indicated based solely on current parameters (i.e., without refinancing). The forecast EBITDA represents a 10.75% internal rate of return on the current value of $16,700,000. In other words, the overall discount rate as of the current date, including the debt and equity return requirements over the ten-year holding period, is 10.75%.

This overall discount rate represents the weighted average cost of the capital for the investment over the ten-year holding period, assuming the project is refinanced at the end of the third year. At 10.75%, this blended discount rate is 65 basis points (bps) lower than the 11.4% discount rate derived from the current parameters and 55 bps higher than the 10.2% discount rate derived from the future parameters. The position of the blended rate reflects the influence of the pattern of the cash flows, with the majority of the return occurring in the latter seven years and thus at the lower overall discount rate.

Hi Anne, Thank you for writing this article. I have a new perspective on valuation and how this blended discount rate can help improving values of the assets. many thanks, Anand Rai HVS - India