The COVID-19 pandemic has had a profound effect on the global economy, leading to widespread inflationary pressures. Governments around the world responded with unprecedented levels of fiscal and monetary support to stimulate their economies, the impact of which was felt months later as economies reopened and consumers once again began spending. This trend, along with supply chain issues, led to a noticeable increase in the cost of goods and services.

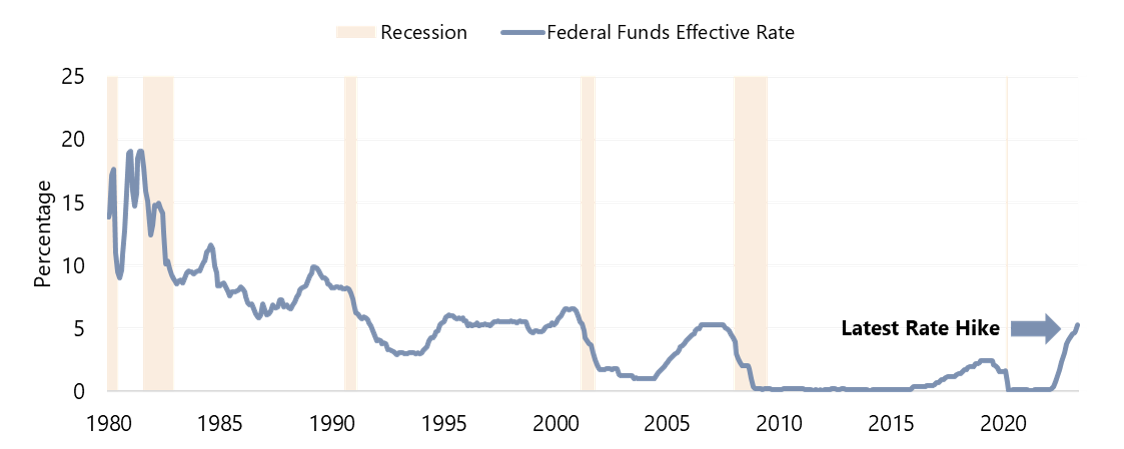

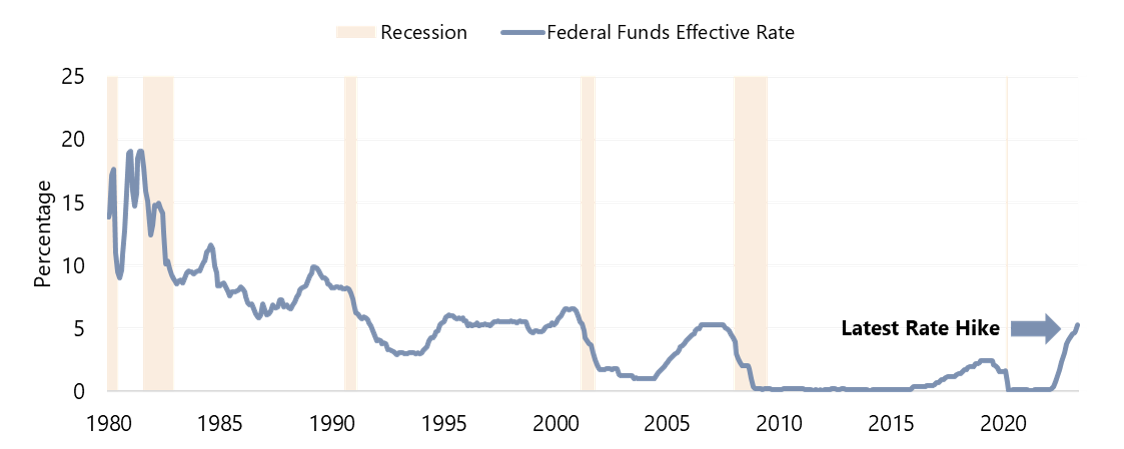

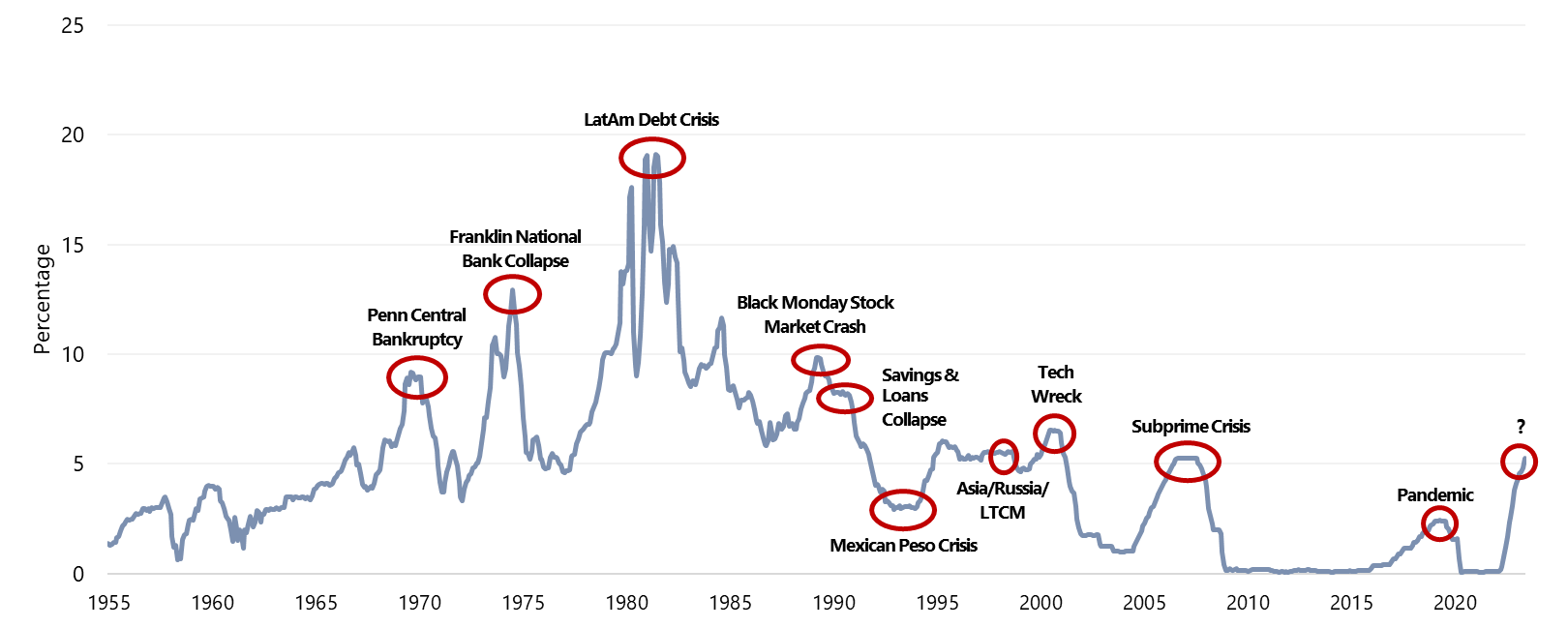

The COVID-19 pandemic has had a profound effect on the global economy, leading to widespread inflationary pressures. Governments around the world responded with unprecedented levels of fiscal and monetary support to stimulate their economies, the impact of which was felt months later as economies reopened and consumers once again began spending. This trend, along with supply chain issues, led to a noticeable increase in the cost of goods and services.In response to the inflationary pressures resulting from these factors, the United States Federal Reserve System (known as the Fed) has embarked on an interest rate-hike cycle in an effort to taper inflation. However, the rate increases have been the fastest in recent history, since the federal funds rate (FFR) reached a peak in 1980, as illustrated below by the sharper slope of the recent hike cycle.

Federal Funds Effective Rate

Source: FRED

Source: FRED

While the FFR remains low by historical standards, the speed and increase of the hikes have led to concerns about their delayed impact on the economy, and secondary or unintended consequences, particularly on the financial and commercial real estate market.

As an example, in March 2023, Silicon Valley Bank (SVB), at that time the sixteenth largest bank in the U.S., collapsed due to ill-fated investment decisions that were compounded by rising interest rates, a struggling tech industry, and mismanagement. The bank, like many others, invested billions in long-dated U.S. government bonds, including mortgage-backed securities, which lost significant value as the Federal Reserve hiked interest rates in an effort to combat inflation. As concerned tech companies and individuals withdrew their deposits, SVB was forced to sell its bonds for liquidity at a loss and was subsequently hit with a run on the bank as customers and investors panicked.

At an emergency meeting on Sunday, March 12, 2023, the Fed, U.S. Treasury, and FDIC eased the stress on these banking entities through the new Bank Term Funding Program (BTFP). The BTFP offers loans to banks, savings associations, credit unions, and other eligible depository institutions pledging U.S. Treasuries, agency debt and mortgage-backed securities, and other qualifying assets as collateral. Nevertheless, since the collapse of SVB, a total of four banks in the U.S. experienced a similar fate or were forced to close by regulators to avoid contagion or systemic risk in the financial system.

On the international front, Credit Suisse, which had been plagued by a series of investment losses, scandals, and mismanagement resulting in continued outflows, was purchased in March 2023 by UBS Group AG with additional support from the Swiss National Bank and the Swiss government.

The immediate action taken by government entities calmed markets, but it did not fully guarantee deposits beyond the FDIC threshold at all other banks. As of the time of writing, the U.S. Treasury was considering the possibility of guaranteeing deposits at all banks, beyond the FDIC threshold, in order to avoid similar contagion. Some argue that the fact that this has not already been done, in light of recent events, is already cause of concern. Understandingly, depositors remain worried about the health of their banks, with some reallocating funds to other entities, particularly the larger banks deemed systemically important banks (SIBs), or in simpler terms, “too big to fail.”

Similar to how it took one year after the Fed and Treasury’s fiscal and monetary stimulus to result in rising inflation, exactly one year after the Fed started its interest rate hike-cycle, we are now starting to see the real-life impact of such hikes. In addition to the bonds and mortgage-backed securities on these banks’ balance sheets losing value, higher rates have resulted in a slowdown in residential and commercial real estate activity. With short-term treasury yields in the ballpark of 5%, some investments in commercial real estate have become less attractive, particularly office and apartments. Why would an investor purchase real estate at 4–6% capitalization rates and assume risk and management when risk-free returns are available at similar rates, or when other assets such as hotels are available at more attractive rates?

Impact on Transaction Activity and Pricing

As reported by MSCI Real Capital Analytics (MSCI), transaction volume for all U.S. commercial real estate dropped 56% in the first quarter of 2023 as compared to the prior year, and annual price growth was negative at 8.0%. While the volume of hotel-only transactions fell 55%, in line with the national average, annual price growth was still positive at 4.3%. Discussions with market participants reveal that Q1 2023 activity was decidedly slower than any period last year, as the market is being held back by sellers still expecting 2021/22 pricing despite less favorable 2023 debt-market dynamics.The MSCI Commercial Property Price Index (CPPI) is a transaction-based index that measures commercial real estate price movement using repeat-sales regression methodology. MSCI reported in the first quarter of 2023 that prices of all U.S. commercial real estate are falling at an annual pace of decline not seen since late 2010, after the Global Financial Crisis. The primary cause of the decline was reported to be rising mortgage costs. At this point, as has been the case in prior cycles, it is likely that capitalization rates will continue to increase to account for the rising cost of capital, resulting in further decreases in value.

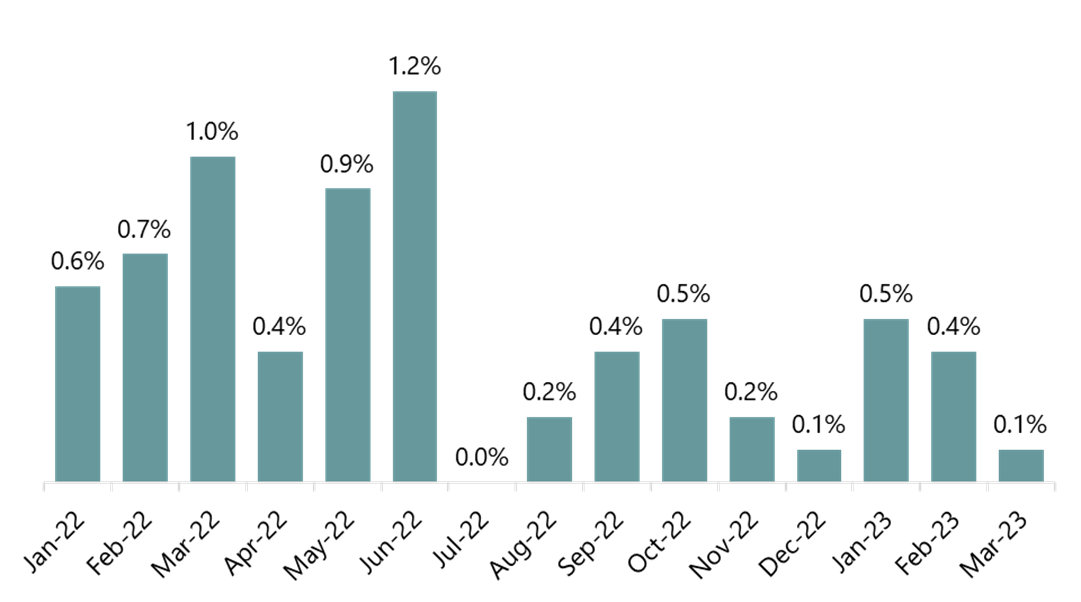

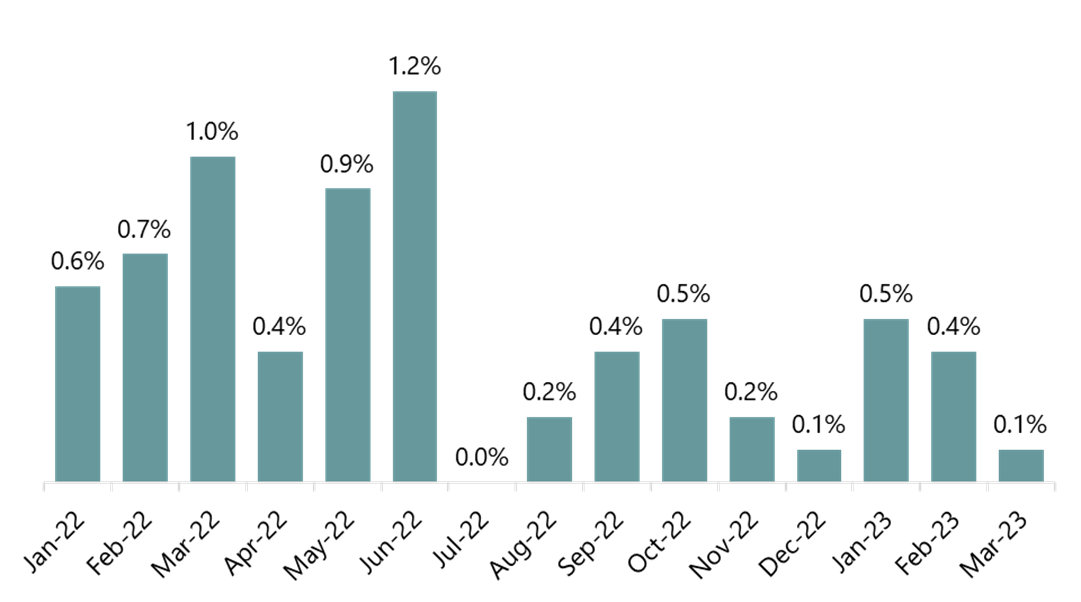

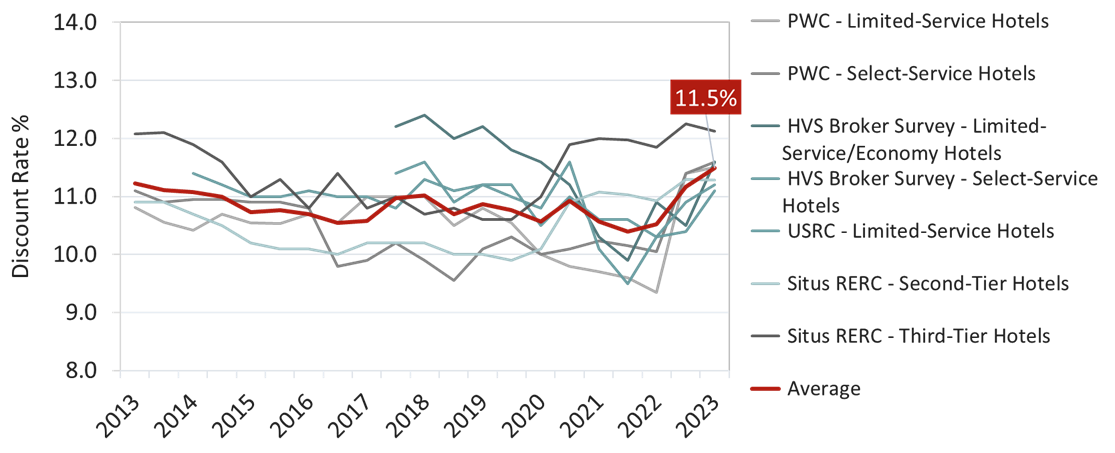

Changes in InflationIn addition to a recent slowdown in transaction activity and drop in commercial real estate prices, it is evident that the Fed’s rate hikes are succeeding in slowing down inflation, albeit slowly. The following chart shows the monthly CPI change over the last 13 months.

Monthly Percentage Change to CPI

Source: BLS

Source: BLS

It is evident from the data above that the change in the month-over-month CPI since July 2022 has been significantly lower than those in the prior months. While inflation over the last twelve months ending March 2023 remains elevated at 5.0%, the annualized data from the nine-month period ending March 2023 illustrates an annual CPI change of 2.66%. This is closer to the Fed’s target rate of 2.0%, and a significant improvement from the CPI peak of 9.1% recorded just a few months ago in June 2022. The data does appear to show that the Fed hikes, which started in March 2022 and have continued through the time of writing, are working to slowly moderate inflation thus far; therefore, it may not be necessary for the Fed to push forward with additional rate hikes when it is understood that monetary policy tends to have delayed effects.

Creating further confusion in the markets, the Fed, despite providing forward guidance, has somewhat fluctuated in its policy stance. In the years since 2020, Fed chairman Jerome Powell went from “not even thinking about thinking about raising rates” to saying that inflation was believed to be transitory, to embarking on an aggressive rate-hike cycle to slow inflation. On March 7, 2023, after a full year of rate hikes, Powell further noted, “The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated.” Within days of this statement, the financial markets were rattled by instability in the banking sector, with analysts and chief economists at entities such as Goldman Sachs, Moody’s Analytics, and Barclays reiterating that the Fed should pause further rate hikes. Nevertheless, the federal funds rate was increased again in March and May of 2023.

It is important for hotel investors to be cautious and take notice that providing stability in the financial markets appears to be an increasing challenge for policymakers. When one issue appears to be addressed, unintended consequences arise in other sectors, surprising policymakers and resulting in reactionary changes to the policy. In recent history, we have not experienced a scenario where the FFR has increased so high so fast; therefore, the unintended consequences of such hikes remain to be fully realized.

Given recent concerns in the financial markets and the recent data illustrating an improvement in inflation, many believe the Federal Reserve should indeed consider pausing further interest rate hikes until we can understand the impact, and potential unintended consequences, that such policy is already having on various aspects of the economy. Historically, nearly all Fed hiking cycles have ended in a deleveraging of the economy, as illustrated below in a few examples. In a recessionary scenario, a more dramatic fiscal and monetary effort will be necessary to revive the economy once again.

Fed Rate Trend Compared to Market Events

Source: FRED, Beutel Goodman, as of August 31, 2022

Source: FRED, Beutel Goodman, as of August 31, 2022

Effect on the Lodging Industry

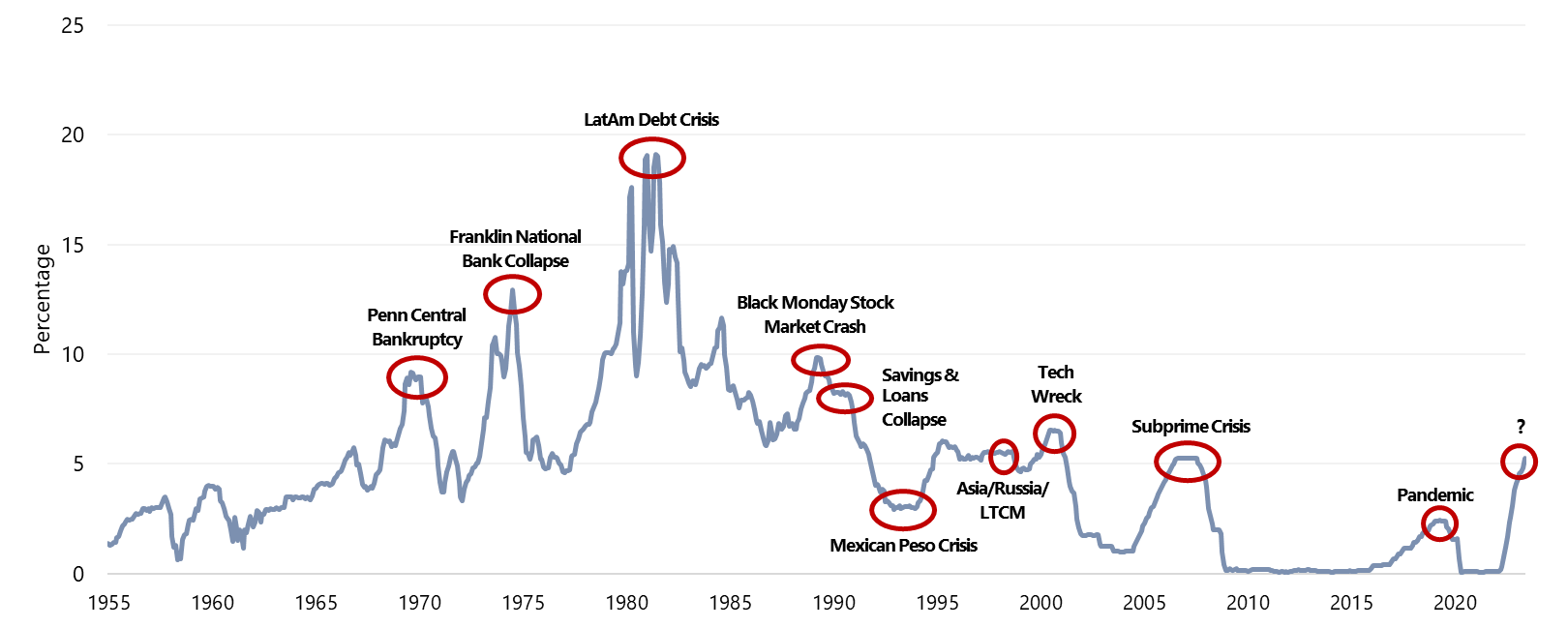

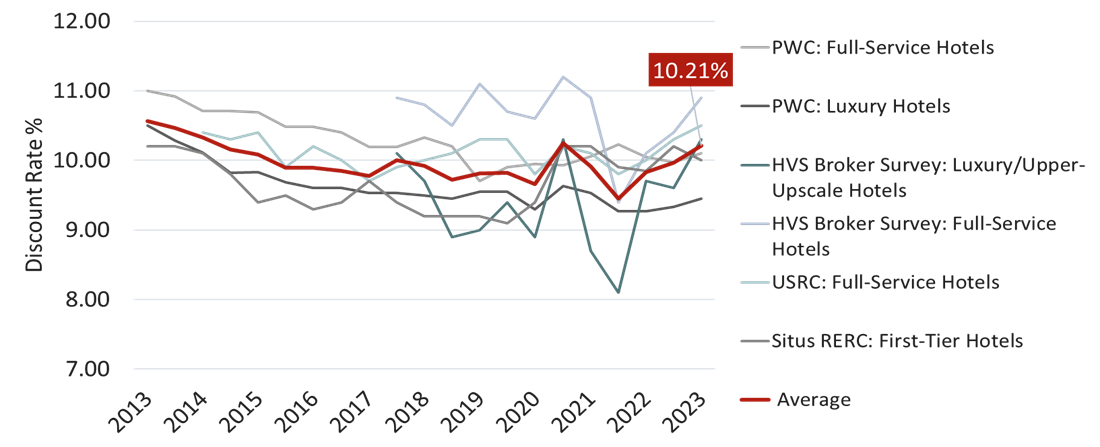

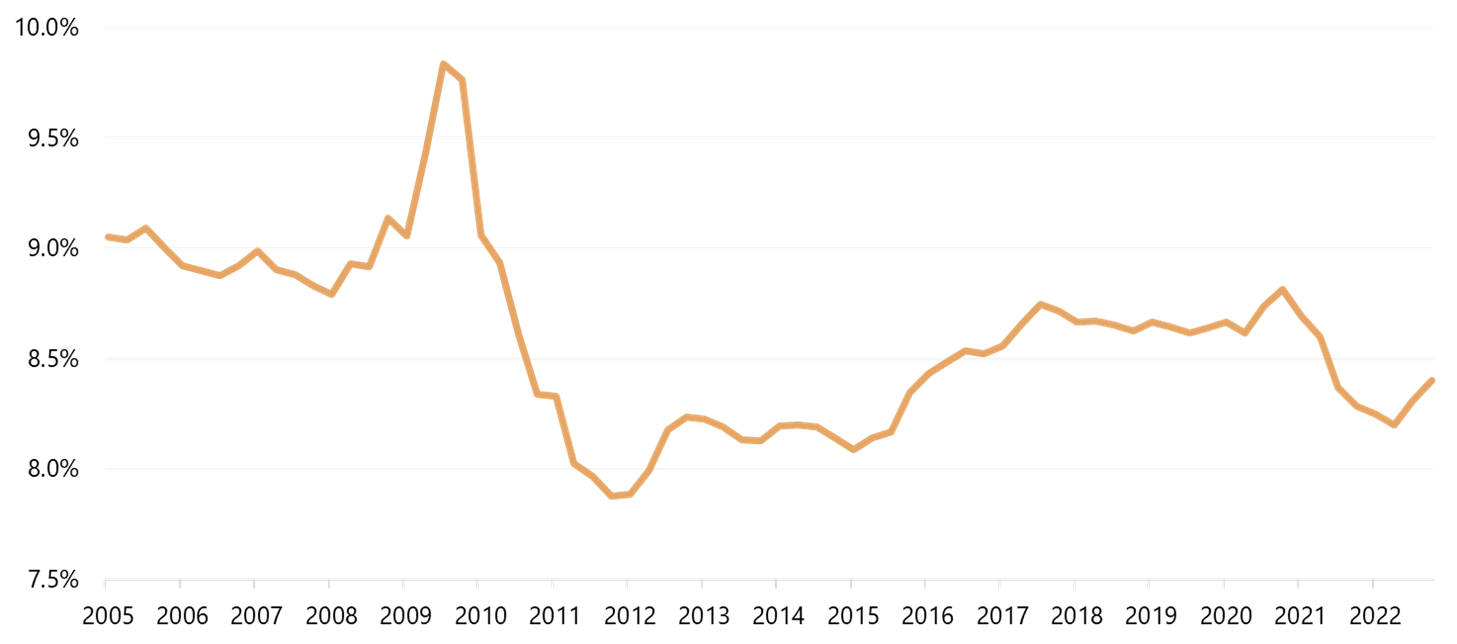

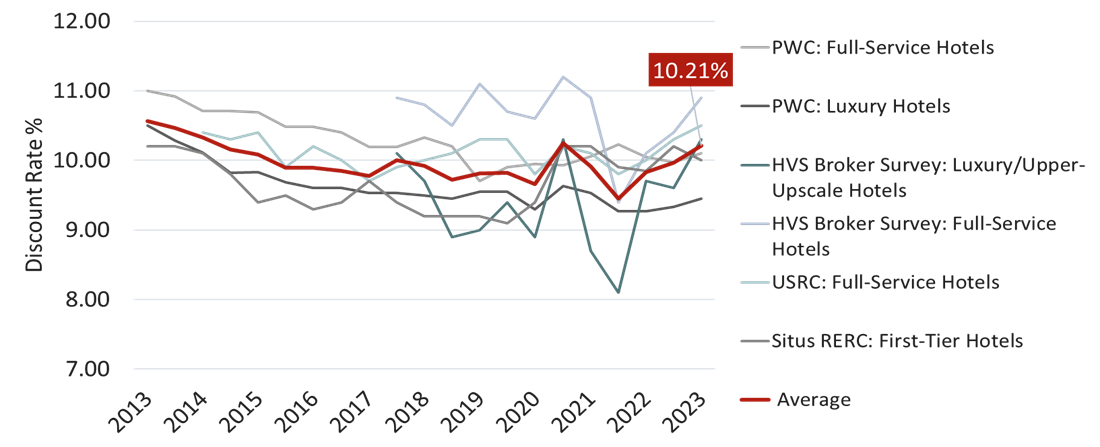

On the hotel transaction front, an increase in interest rates has historically led to a rise in capitalization rates, as illustrated in the years of the Great Recession (2008–2010). Although it is too early to confirm if this is the start of a new trend, MSCI data shows that hotel capitalization rates increased slightly to 8.41% in the first quarter of 2023, after reaching a recent low point of 8.19% in the second quarter of 2022. A similar dynamic was reported across a variety of investor surveys, as illustrated below.Hotel Capitalization Rates

Source: MSCI

Source: MSCI

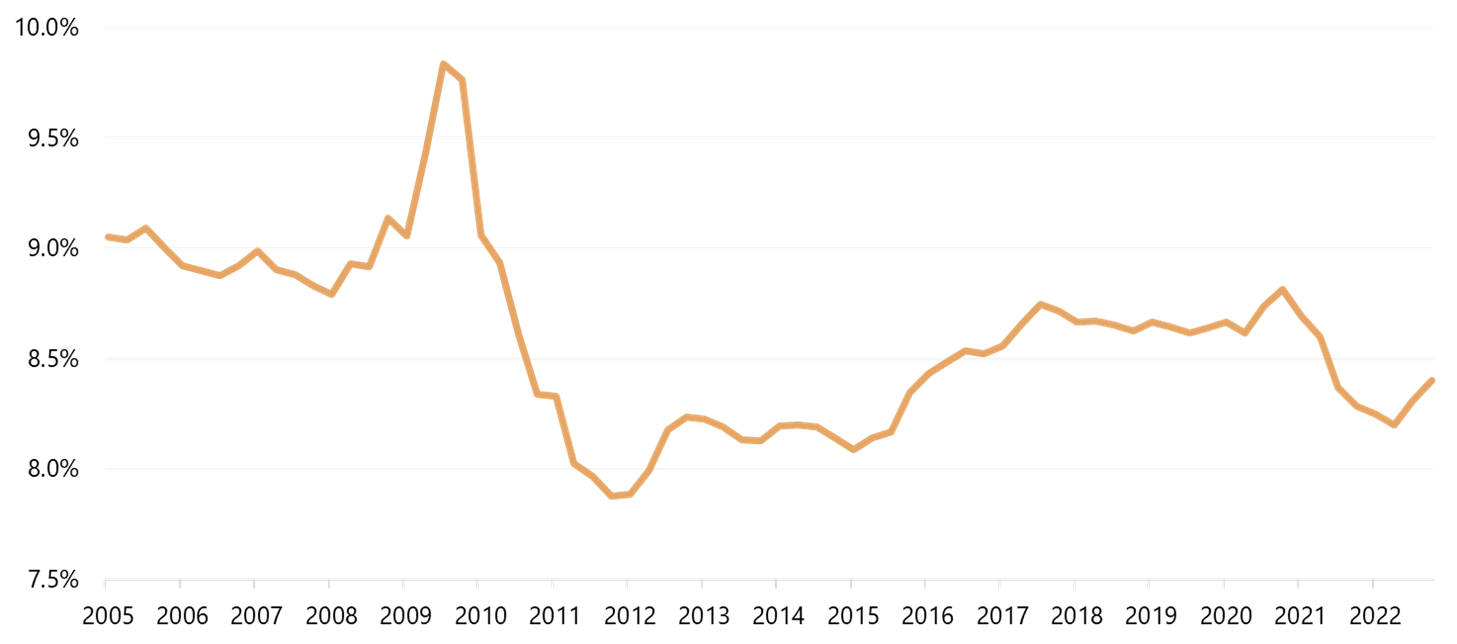

Investor Surveys

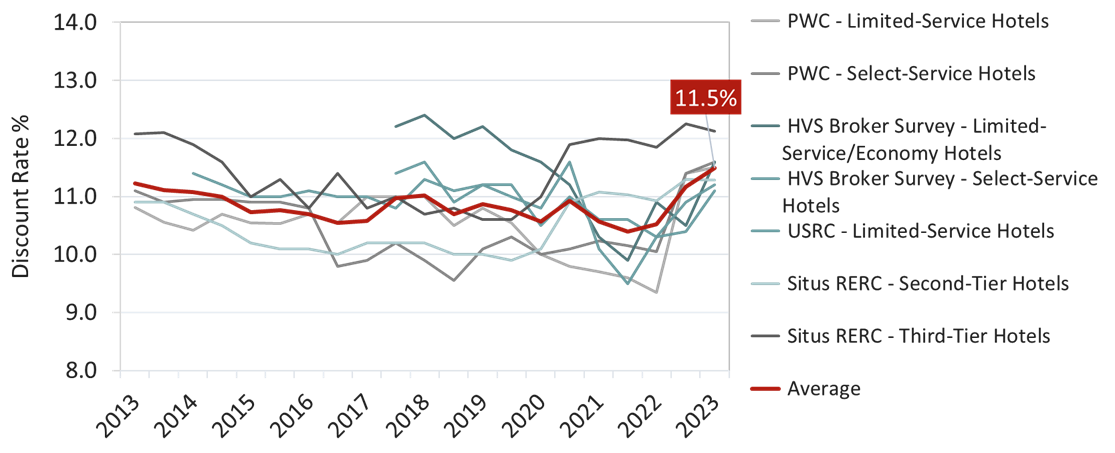

Sources: HVS, PWC, USRC, Situs RERC

Sources: HVS, PWC, USRC, Situs RERC

Investor Surveys

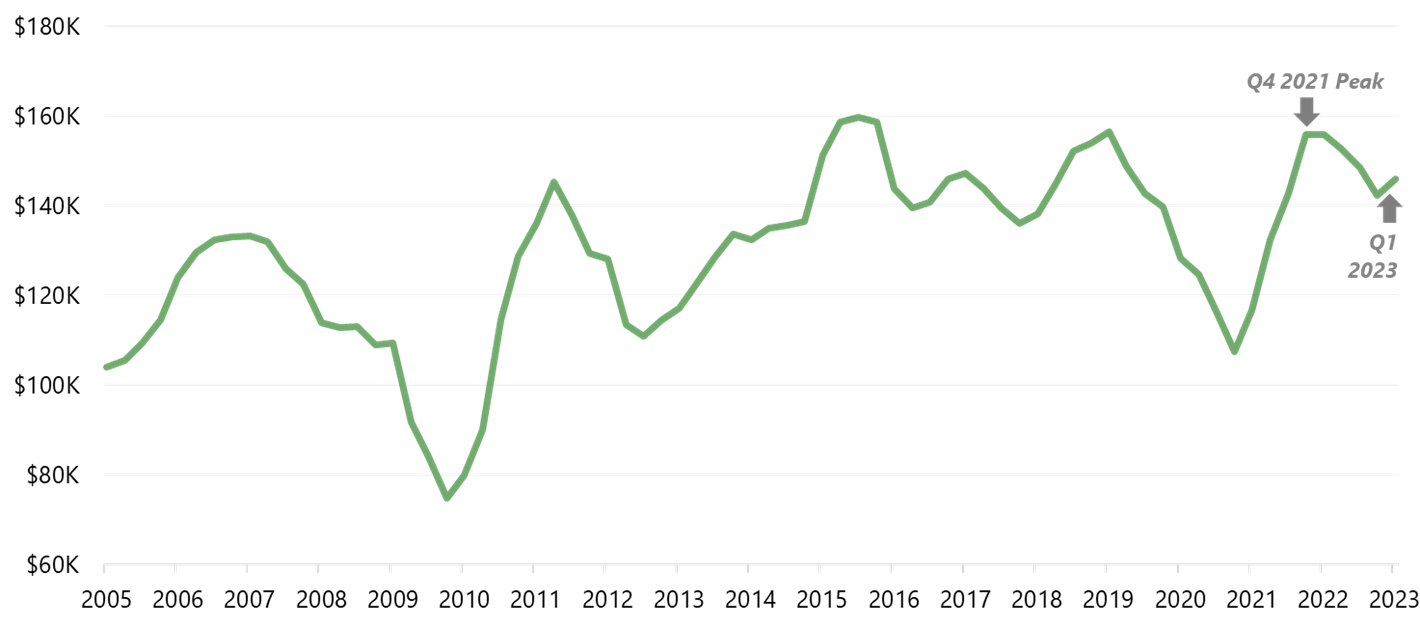

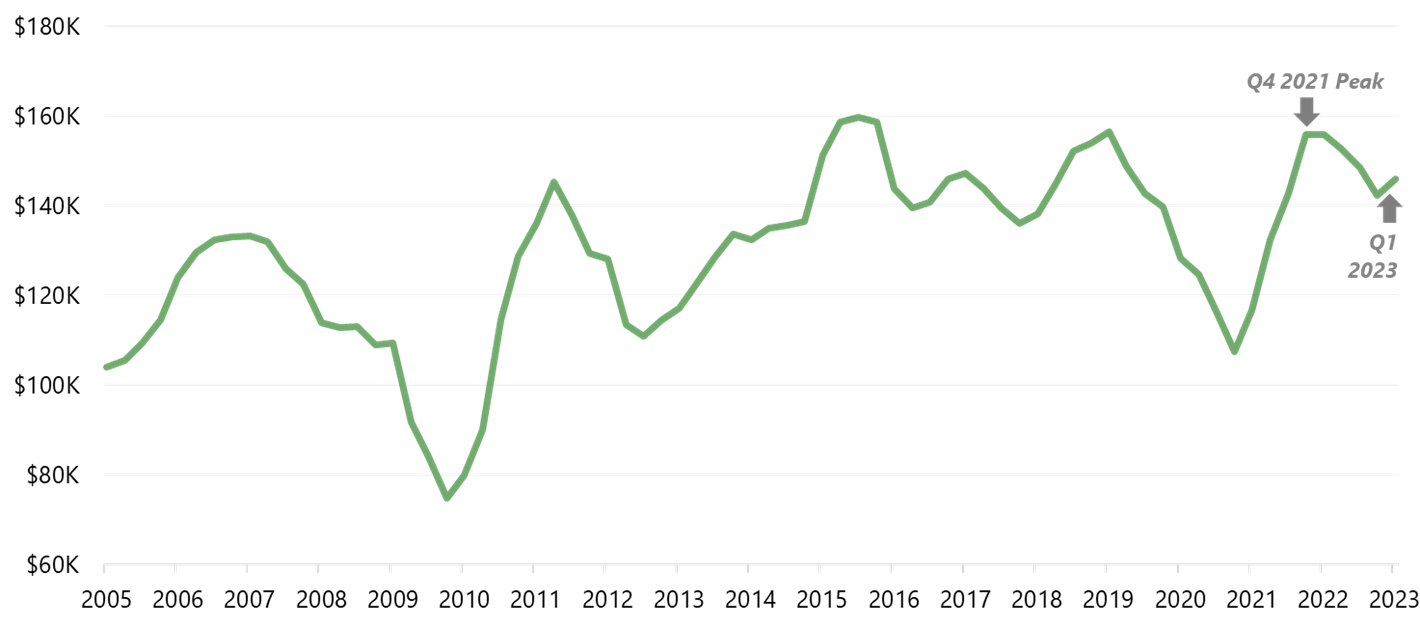

Inversely, as illustrated below, the average price per key for hotels sold in the first quarter of 2023 decreased slightly when compared to the recent peak in Q4 2021, with a 6.3% decline from the peak in Q4 2021 to Q1 2023. This data is based on all properties that sold for over $2.5M, and fluctuations can be influenced by the types and locations of assets that trade during a particular period.

U.S. Hotel Price ($/Unit)

Source: MSCI

Source: MSCI

However, when analyzing the hotel-specific MSCI CPPI repeat-sales regression data for the first quarter of 2023, the pricing of hotel repeat-sales exceeded that for the same period in 2022. Notably, hotel CPPI price data increased by 4.6% in the first quarter of 2023, while, as mentioned earlier, the same data for all commercial real estate showed a decrease of 8.0% in the same period. While hotel transactions and pricing are being affected like other asset classes, the impact has not been as dramatic as in other asset classes, such as office and multi-family. This is partly due to the lodging sector being a darling of the post-COVID economy. This trend has been influenced by a number of factors:

- A surge in post-pandemic travel

- Limited increases in hotel supply, or even decreases in some submarkets as hotels have been converted to alternate uses, such as emergency housing

- Relative attractiveness when compared to other asset classes, such as office and multi-family

- A belief that hospitality assets have historically been great inflation hedges since hotel room rates can be adjusted daily, unlike other asset classes

Following the COVID-19 recession and shutdowns, and benefiting from the ensuing pent-up demand, hotels’ top-line performance levels have surged in recent years. Rising inflation has aided in the post-COVID recovery, with hotels posting record RevPAR levels in 2022 and further growth expected in 2023. Data through March 2023 show that RevPAR levels nationwide continue to increase when compared to 2022, setting a new record in each subsequent month.

Operationally, those who have seen and lived through multiple economic cycles understand that a potential recession, which has historically followed a Fed rate-hiking cycle as shown previously, could result in a deleveraging of the economy and a decrease in hotel demand, leading to lower occupancies and ultimately lower ADRs until the markets fully recover.

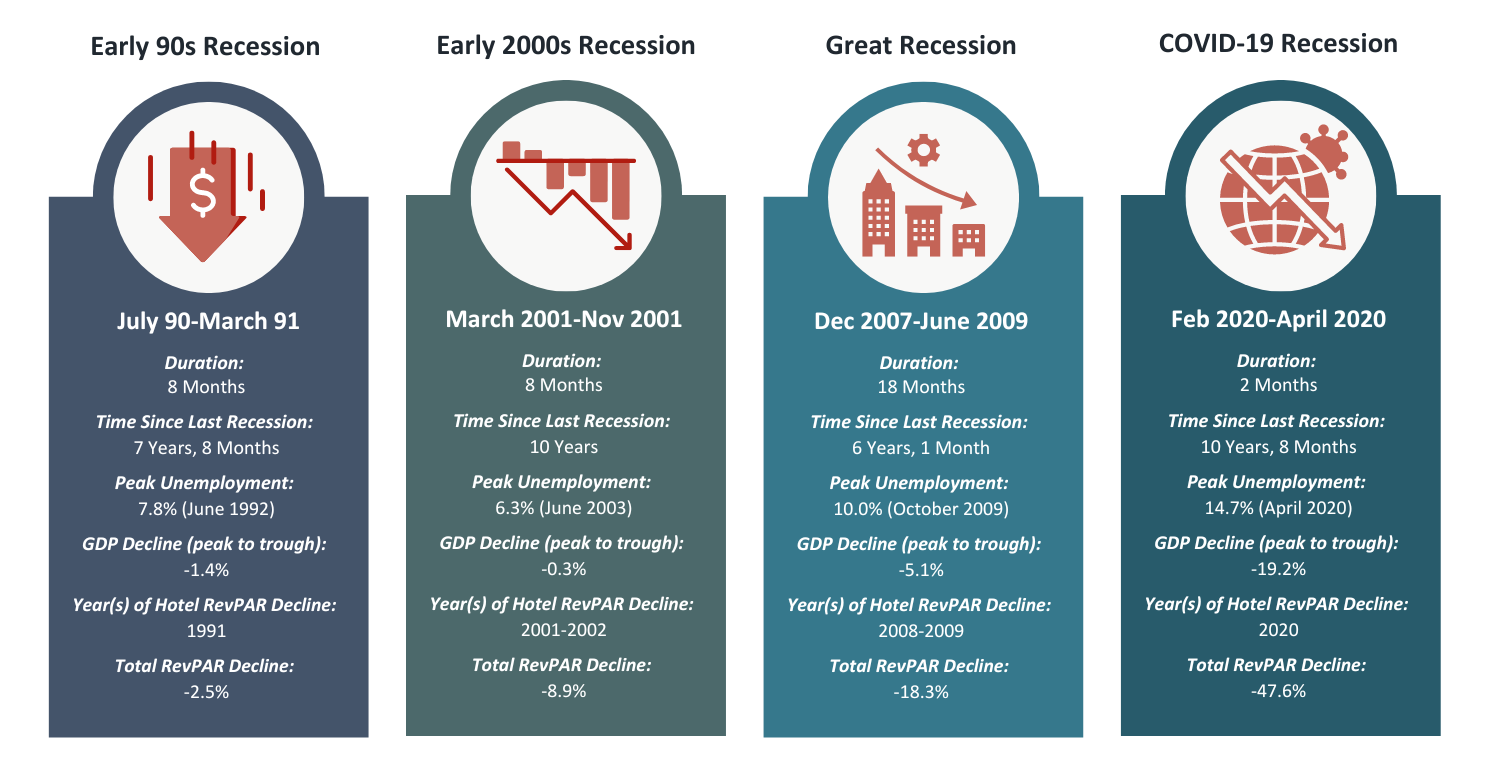

In the last 40 years, the U.S. has experienced four official recessions, and in each recession, hotel RevPAR levels have always decreased, as illustrated below.

While a potential Fed-induced recession may slow such growth and lead to a correction, the likelihood that the severity of the hotel performance decline experienced during COVID-19 will repeat is minimal, and the range of possibilities for a correction in the hospitality sector fall more in line with the prior three recessions.

Conclusion

The Federal Reserve's effort to combat inflation through interest rate hikes has caused concerns about its delayed impact on the economy, secondary consequences, and potential impact on the commercial real estate market, as evident in the latest data. The data show that the current FFR may already be sufficient to win the war against inflation, while an additional rate hike risks slowing down the transaction market further. The continuous rise in interest rates is resulting in a noticeable slowdown in commercial real estate transaction activity and pricing levels due to higher costs of capital.Despite rising capitalization rates, hotel values and transaction activity have been affected less than other asset classes. Hotels have continued to benefit from record RevPAR levels, and the sector’s relatively higher cap rates have allowed it to become more attractive when compared to other asset classes. The transaction market, understandably, remains challenged by the rising cost of debt, recent banking issues, and the standstill between buyers and sellers.

While the road ahead remains rocky for all asset classes, hotels are expected to continue to benefit from improving operational fundamentals in the meantime. Lodging assets are poised to benefit from the inevitable increase in lending that will come once buyers and sellers begin to agree on price in light of recent dynamics and start transacting again.

About Luigi Major, MAI

Luigi Major, MAI, is Managing Director, Advisory of HVS Americas. A trusted advisor, he serves clients across the Americas to deliver tailored solutions to meet their needs, leveraging the breadth of HVS resources and expertise. He has participated in thousands of assignments throughout the United States, Latin America, and the Caribbean. Luigi earned his bachelor's degree from the University of Houston's Conrad N. Hilton College of Global Hospitality Leadership and joined HVS in 2007. Contact Luigi at (310) 270-3240 or [email protected].

An excellent broad overview of the current landscape. Great article, Luigi!