Texas has continued to grow into a top destination for hotel owners who want to expand their portfolio as a result of its strong economy, consistent population growth, vibrant tourist attractions, and diverse markets. Key cities in Texas include Houston, Dallas-Fort Worth Metroplex, Austin, and San Antonio, while the state’s emerging markets are secondary cities/towns around these cities that are often overlooked by hotel investors. This article examines the top cities within Texas in terms of revenue per available room (RevPAR) and provides expert insight into the most attractive and often overlooked submarkets for prospective hotel investors in Texas.

Market Trends—The Texas Triangle Metropolitan Areas

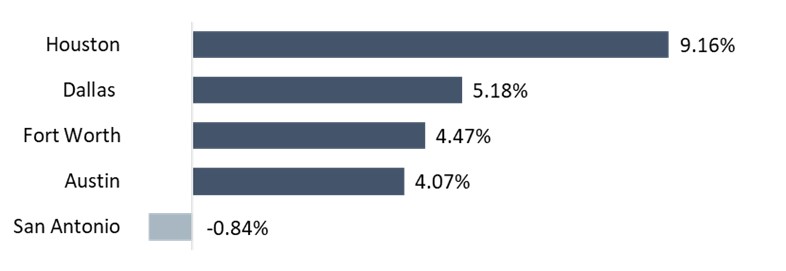

Texas's four main urban centers—Austin, Dallas-Fort Worth, Houston, and San Antonio—are connected by Interstates 45, 10, and 35, forming what is known as the Texas Triangle.Metropolitan Areas’ RevPAR Change for YTD May 2024

Houston

The Houston hotel market had a strong start to 2024, with significant gains across all key metrics compared to the same period in 2023. Houston’s central location makes it a convenient hub for both leisure and business travelers. The city was ranked tenth on Resonance Consultancy’s 2024 list of “America’s Top 10 Best Cities.” (Austin was ranked 15th and Dallas 16th.)Notably, Houston, located in Harris County, is one of the few metropolitan areas where the surrounding cities are also experiencing year-over-year (YOY) RevPAR increases. According to the Texas Comptroller’s hotel occupancy tax receipts, of the nine cities with over 400 rentable rooms in Harris County, six cities experienced positive RevPAR growth through YTD May 2024.

Dallas-Fort Worth Metroplex

According to a Lodging Econometrics report, at the end of the first quarter of 2024, Dallas led the country with 185 hotel projects in the planning phase, which will deliver over 21,000 rooms to the market. Concurrently, Dallas ranked second nationwide for active hotel construction, with 25 projects currently underway. Due to the steady influx of new supply, occupancy rates have yet to return to the peak levels of over 70% recorded in 2016.Nonetheless, the Dallas-Fort Worth Metroplex remains one of the top markets in terms of demand in 2024, providing reassurance to current and future investors. This is largely due to promising developments entering the market, led by the $3.7-billion renovation of the Kay Bailey Hutchison Convention Center in Dallas. The renovation will add 500,000 square feet to the facility’s footprint, bringing the total size to 2.5 million square feet. Work commenced in early July 2024 and is expected to be completed in 2028 or 2029.

Additionally, suburban areas surrounding Dallas have continued to experience tremendous growth. For instance, the city of Frisco, located 40 minutes north of DFW, reported $84.8 million in economic activity in 2023, a 58% increase from 2022. This growth mitigates investment risk by providing opportunities in pockets outside of the Dallas-Fort Worth metroplex.

Austin

Since the pandemic, hotel owners in Austin have capitalized on the city’s rapid rise as a premier destination for the relocation of both major corporations and new residents. This trend is highlighted by a remarkable RevPAR growth of 29.5% between May 2019 and May 2024. During the same period, RevPAR grew by 26.2% in Dallas, 22.2% in San Antonio, and 14.6% in Houston, underscoring Austin’s exceptional performance in comparison to other major Texas markets over the past half decade.Looking ahead to 2025 and beyond, the future of hospitality in Austin remains promising, as the city continues to expand and enhance its attractions to appeal to both corporate and leisure demand.

San Antonio

San Antonio greatly benefited from “revenge travel” in 2022 but experienced a notable slowdown in 2023. Hotels occupancy dipped slightly from 62.2% in 2022 to 61.5% in 2023, along with a decrease in rooms revenue of over 17%. From May 2022 to May 2023, RevPAR fell by 7%. The total RevPAR decline in 2024 was limited to just 0.84% due to a rise in average rate.San Antonio is now witnessing reduced group travel, as the city struggles to keep up with competitors for large conferences and events. It is also experiencing softer leisure demand, as the rise of inflation is discouraging families from traveling. Nonetheless, the outlook for San Antonio is hopeful, as the city remains a top leisure destination in Texas with some of the most popular attractions in the state.

Top-Performing Hospitality Submarkets in Texas, as of YTD May 2024

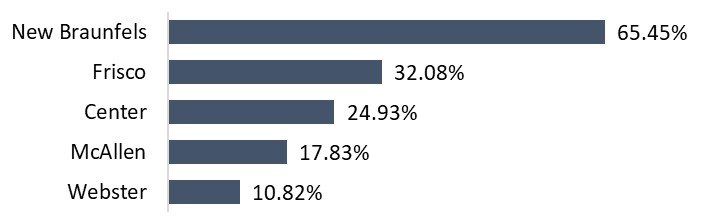

Below, we have compiled a list of other Texas submarkets that are not part of the key cities and have ranked them by the YTD RevPAR growth gain in 2024. Some of these cities are not on the radar of many hotel investors, so here, we analyze why we believe they are emerging markets.

RevPAR Growth by Submarket (YTD through May 2024)

New Braunfels

Its affordable real estate and expanding jobs market, with a record of 39,000 new jobs added in 2023 alone, have helped solidify New Braunfels at the top of our list, with the largest YOY RevPAR growth through May 2024 at 65.45%. With 3,400 existing hotel rooms, New Braunfels is one of the top-performing cities in terms of YOY RevPAR increase. May 2024 year-to-date (YTD) RevPAR is up 65.45% when compared to the same period in 2023.

Frisco

Frisco, located just outside Dallas-Fort Worth, is considered one of the fastest growing cities in the country. Its hotels are also experiencing this growth, as their RevPAR improvement YTD through May 2024 sits at 32.08%. Looking forward, countless projects are under construction that are expected to further boost hotel demand, including the following:

- The Hall Park Redevelopment, a 162-acre office park undergoing a $7-billion redevelopment over the next 20 years

- The Dallas Open, a partnership between the Dallas Cowboys and GF Sports & Entertainment to bring a new ATP 500-level tennis tournament into the area

- Universal Kids Resort, the company’s first-ever theme park designed for families and young children

- Various other multimillion-dollar developments that will reshape the city of Frisco

Center

McAllen

Webster

Webster, featuring 1,442 hotel rooms, continues to experience growth in hotel revenues, with several factors contributing to its appeal. After a slow 2023, the city has rebounded in 2024, with a 10.82% RevPAR increase YTD through May 2024 compared to the same period in 2023. The city's proximity to the NASA Johnson Space Center and Clear Lake area attracts a steady stream of business travelers and tourists interested in aerospace and outdoor recreation. Additionally, the construction of the new Great Wolf Lodge has contributed to occupancy growth, as construction workers needed accommodations for the duration of the project. The area's expanding corporate presence, medical facilities, and entertainment options further stimulate hotel demand, supporting strong RevPAR growth in 2024 and beyond. This positive trend underscores Webster's position as a thriving hospitality market within the Greater Houston area.

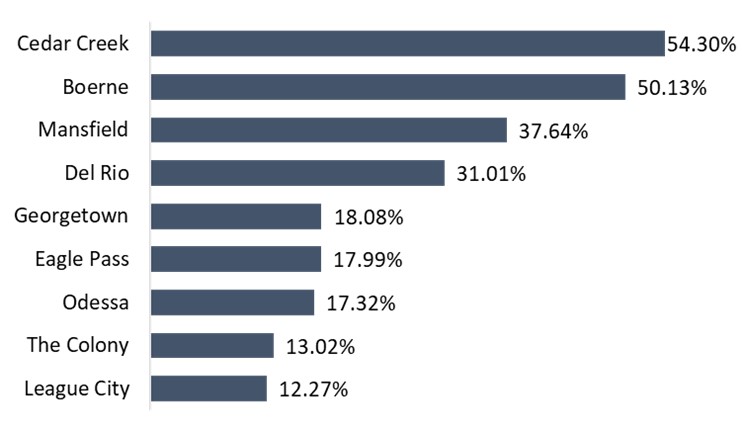

Other Submarkets to Consider

In addition to the above markets, we have compiled a list of the other Texas submarkets that have experienced a RevPAR increase of over 10% this year. While every market is different, such a significant increase in RevPAR is a leading indicator that the local economy is growing and that hotel demand will likely be strong moving forward.

Additional Growing Submarkets (YTD through May 2024)

Source: Texas Comptroller Hotel Occupancy Tax Receipts

If you are a hotel investor looking to identify your next Texas-based investment, start your search by thoroughly considering the trends and metrics discussed in this article. We have highlighted significant submarkets (both key cities and emerging markets) within the state based on demand generators, upcoming developments, and recent hotel revenue levels. Prioritizing these factors can help you capitalize on Texas’s robust growth and make your next hotel investment a success. Contact either Andrew Frosch or Matt Almy of HVS Brokerage & Advisory to continue the discussion of this article or address any of your investment sales needs.

With over 35 offices across the United States, HVS aims to be your first choice for comprehensive, innovative, and insightful solutions to help foster the success of our clients and the hospitality industry. If you’re looking for your next investment opportunity, we have over 15 properties listed in Texas.

Sources

https://lodgingmagazine.com/lodging-econometrics-dallas-continues-to-lead-u-s-construction-pipeline/

https://comptroller.texas.gov/transparency/open-data/hotel-receipts/

https://www.visitfrisco.com/articles/post/visit-friscos-monumental-year-scores-848-million-in-economic-impact/

0 Comments

Success

It will be displayed once approved by an administrator.

Thank you.

Error