Colorado Springs, situated near the base of Pikes Peak at the eastern edge of the southern Rocky Mountains, features a diversity of attractions and economic drivers. Part of the greater Front Range economic base, which includes a high concentration of military installations and companies that contract heavily with the government, Colorado Springs is home to the North American Aerospace Defense Command (NORAD) and the Air Force Academy. The introduction of telecommunications and high-tech firms to the area over the past several years has helped give the economy a broader base. The area also hosts the national headquarters for Olympic athletics and athletic associations, and The Broadmoor hotel and resort has been a high-profile international travel destination for nearly a century. The hotel industry in Colorado Springs, driven by demand from tourism, the government, and commercial entities, suffered setbacks during the recent recession but has since made a marked recovery in terms of transactions and overall performance.

Black Forest & Waldo Canyon Fires

Natural catastrophes have dealt successive blows to the area over the past 14 months. Colorado Springs was still recovering from the impact of last summer’s Waldo Canyon fire when, in June of 2013, another fire blazed in the Black Forest northeast of the city. The Black Forest fire destroyed 14,280 acres and more than 500 homes. The two fires resulted in meeting and group cancelations throughout the city, as well as canceled or postponed vacations during the market’s peak season. Federal funds helped boost tourism following the Waldo Canyon fire in support of a “Welcome Back” campaign, with the City targeting regional and national markets to bring in repeat visitors. City officials are seeking new funds and promoting more campaigns in an attempt to undo the negative effects on group and leisure travel suffered by Colorado Springs over the past two summers.

Economy Update

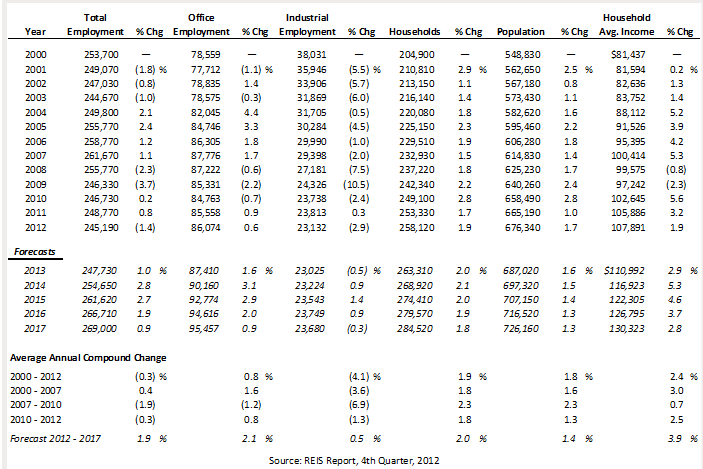

The following table illustrates historical and projected employment, population, and income data for the overall Colorado Springs market as of year-end 2012.

HISTORICAL & PROJECTED EMPLOYMENT, HOUSEHOLDS, POPULATION, AND HOUSEHOLD INCOME STATISTICS

While total employment for Colorado Springs has fluctuated since 2000, consistent growth is forecast through 2017. Office employment is expected to experience considerable gains, while industrial employment should realize minimal growth. Household and population growth has been very consistent during the period illustrated, and forecasts are for a continuation of this trend. Household average income has illustrated moderate growth since 2000, a trend that is anticipated to continue.

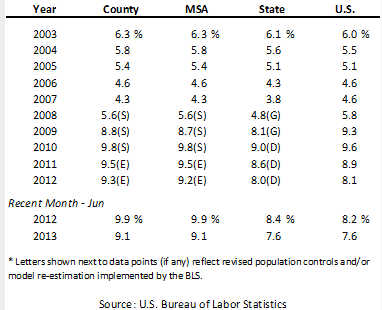

The following table illustrates unemployment statistics for El Paso County, the Colorado Springs MSA, the state of Colorado, and the U.S. from 2003 through 2012. A year-to-date through June comparative period is also included.

UNEMPLOYMENT STATISTICS

Unemployment rates in the Colorado Springs area generally declined from 2004 until 2008, at which time the recession took hold. Unemployment remained elevated in 2009 and 2010; however, unemployment decreased in 2011, remaining relatively stable through 2012. The most recent comparative period illustrates another decline, although the county and MSA rates remain higher than the state and national levels. Most of the job losses in Colorado Springs took place within the technology sector; however, local employment has remained healthy at major government institutions. Interviews with economic development officials reflect a positive outlook for employment in the area.

The Colorado Springs economy has become more diverse over the last 25 years, expanding from its reliance on surrounding military entities into the broader industries of aerospace, software engineering, manufacturing, tourism, and health care. The large military presence in the area provided some employment stability during the downturn, but the lack of growth in this sector has slowed the city’s rebound. The government/military sector is expected to remain a cornerstone of the market given the significant presence of Fort Carson, NORAD, Peterson Air Force Base, Schriever Air Force Base, and the U.S. Air Force Academy; the local military bases had an estimated $6-billion impact on El Paso County during 2011.

Tourism attractions including Pikes Peak, the Garden of the Gods, and the Royal Gorge Bridge and Park, as well as the Olympic Training Center and the U.S. Air Force Academy, have helped Colorado Springs regain its economic footing. According to economic development officials, the area is now experiencing slight growth, especially along the north side of the Interstate 25 corridor, with several mixed-use developments under construction.

Energy companies such as Ultra Resources, Hilcorp Energy Company, and Mustang Creek have expressed interest in drilling for oil in El Paso County. Both Hilcorp Energy and Ultra Resources have already drilled exploratory wells in the county along the Niobrara shale formation and have received permits for further drilling. While Ultra Resources announced in March of 2013 that the company is suspending operations in the market, Mustang Creek is looking to target a different area known as the Pennsylvania Section. The company has a lease on approximately 200,000 acres and aims to begin drilling exploratory wells in Elbert and El Paso Counties by late 2013. City officials expect the drilling will spur new jobs.

Office Space Market Update

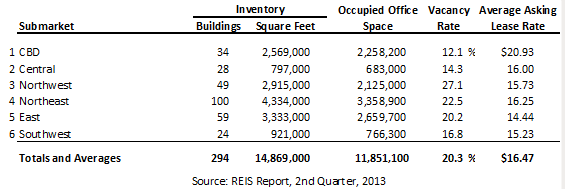

The following table details Colorado Springs’ office space statistics, which are important indicators of the market’s propensity to attract commercial hotel demand.

OFFICE SPACE STATISTICS – MARKET OVERVIEW

The Northeast submarket of Colorado Springs contains the largest inventory of office space. The Central Business District (CBD) is the fourth-largest submarket in the city but has the lowest vacancy rate and the highest asking lease rate. Vacancy remains high in the Northeast, East, and Northwest submarkets.

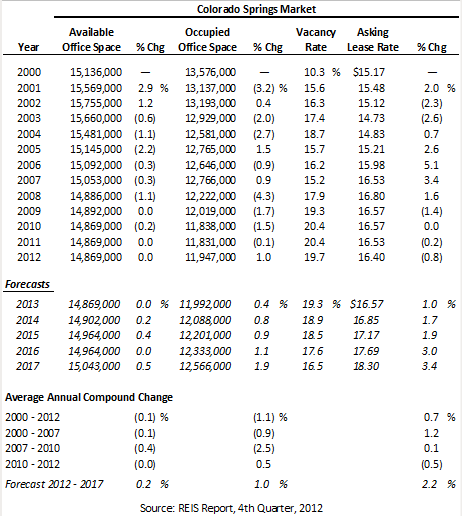

The following table illustrates a trend of office space statistics for the overall Colorado Springs market.

HISTORICAL AND PROJECTED OFFICE SPACE STATISTICS – GREATER MARKET

Available office space in Colorado Springs has remained relatively stagnant since 2008. Occupied office space decreased from 2008 through 2011, and vacancy peaked in 2010 and 2011. The market has shown positive signs recently, as occupied office space increased in 2012 and vacancy declined. Asking lease rates have yet to recover in the Colorado Springs market, declining consistently since 2008; however, moderate growth is forecast for lease rates through 2017.

Airport

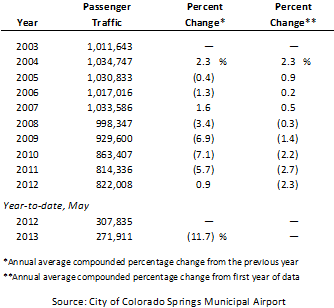

Annual passenger levels at Colorado Springs Municipal Airport have been declining since 2007, as illustrated in the chart below.

COLORADO SPRINGS AIRPORT PASSENGER TRAFFIC

Denver International Airport is relatively close and offers more flights to more destinations at generally lower prices; hence, many traveling to/from the Colorado Springs area will fly into Denver and drive the 80 miles to Colorado Springs. Beginning in May of 2012, new flights and routes from Frontier Airlines helped reverse the airport’s five-year trend of declines; however, the promising outlook for the airport did not last long. In February of 2013, it was announced that Frontier would end all service to Colorado Springs beginning in early April. Since the announcement, airport administrators have looked into replacing Frontier, but no new airlines had signed on at the time of this report.

Hotel Construction Update

According to HVS research, one new hotel is currently under construction in the Colorado Springs area:

- Holiday Inn Express (I-25)

Several properties in Colorado Springs are undergoing renovations or conversions, with other projects in the planning stages. The 80-room Holiday Inn Express referenced above is being redeveloped from an existing office building at Interstate 25 and West Bijou Street, just outside of Downtown; this hotel is expected to open by the end of 2013. A 300-room hotel and water park are in the speculative stage; the multi-use project has been rumored for a location on the north side of the city. The partially completed 300-room Renaissance hotel on the northern end of the city was auctioned off in October of 2011 to its original contractor, who is seeking a new buyer with the capital to see the project through finalization. The hotel reportedly went under contract in June of 2013. If the sale goes through and the construction resumes, the hotel’s completion should take approximately one year. One new hotel has opened in 2013, an 82-room Holiday Inn Express located southeast of the intersection of Powers Road and North Carefree Drive.

While several new hotels are expected to enter the market in the coming years, the percentage increase to the overall market supply will be minimal; however, the addition of these new hotels is likely to continue to slow the recovery of hotel occupancy in the local market.

Outlook on Market

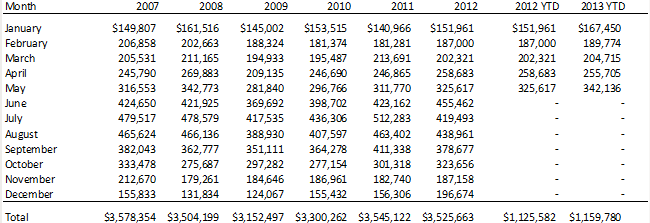

Colorado Springs’ LART fund lodging tax collects 2% of the previous month’s hotel revenues, providing evidence of the growth or decline of overall hotel activity in the city. The following chart shows LART revenues since 2007.

LART HOTEL TAX REVENUES FROM 2007 TO YTD 2013

Hotel tax revenues decreased in 2008 and again, more dramatically, in 2009. The economic rebound that took hold in 2009 brought increased tax revenues, a trend that continued through 2010, 2011, and through mid-year 2012. This growth was quickly halted in July of 2012 when the Waldo Canyon Fire became a national media story. The fire caused many groups to reschedule and many leisure travelers to cancel their trips. The timing of the fire was especially unfortunate since it occurred during the strongest month of this seasonal market. While lodging tax revenues were down overall in 2012, hotel revenues realized gains beginning in October of 2012, a trend that generally continued through May of 2013.

Occupancy and Average Rate

The preponderance of government and military operations in Colorado Springs continues to affect the dynamics of the local hotel market. While these sources provide a steady amount of hotel demand, the low government per-diem rate poses a particular obstacle for area hotels. The per-diem allowance decreased from $88 to $84 in 2011 and dropped to $83 in 2012. The $83 per-diem rate was extended into 2013, disappointing local hoteliers who were hoping for an increase. The market’s seasonality makes the pressure on rates more difficult to manage, as midscale hotels try to balance low-rated government demand with higher-rated leisure demand during the peak summer months.

Occupancy was largely down during 2012, which can mostly be attributed to the impact of the Waldo Canyon Fire. Average rates increased in 2012, a positive sign for the slow-to-recover Colorado Springs market.

Recent Hotel Transactions

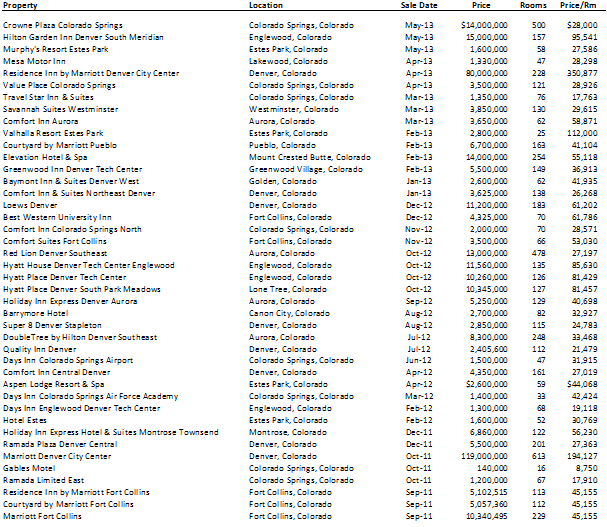

The following table summarizes hotel transactions in the state of Colorado over the past two years.

REVIEW OF HOTEL TRANSACTIONS

The largest of these sales were the Marriott and Residence Inn by Marriott at the Denver City Center, which sold for $119 million and $80 million, respectively. The vast majority of the hotels transacted in Colorado during the last two years represented limited- and select-service properties priced under $10 million. The most recent confirmed sale was the Crowne Plaza in Colorado Springs, which sold in May of 2013 for $14 million, or $28,000 per room. The 500-room hotel, which is the largest in Colorado Springs, was rebranded as the Hotel Elegante. The Value Place and TravelStar Inn & Suites in Colorado Springs also sold in 2013.

Two Colorado Springs hotels face foreclosure this year. According to public records, the Antlers Hilton owes roughly $36 million, due by November 19, 2013. If this balance goes unpaid, the hotel will be put into a public auction on November 20, 2013. The Comfort Inn near the World Arena is scheduled to be auctioned on the same day if the $5 million remaining on its loan is not paid.

Brokers’ Outlook

According to interviews with hotel brokers active in Colorado Springs, limited-service hotel cap rates are ranging between 9% and 10% depending on the historical operations of the property, with the rooms revenue multiplier ranging from 3.0 to 4.0. Exposure time is approximately twelve months, with several hotels reportedly listed for sale in the market. Brokers report that now is a good time to hold on to a hotel, with typical risk. Select-service properties boast similar investment parameters and a twelve-month exposure time. Full-service hotels are noting slightly lower cap rates, as expected, with a higher amount of risk.

Conclusion

Although slowing business levels, a depressed housing market, and reduced levels of discretionary spending affected the Colorado Springs area during the recent recession, the market has entered into a period of recovery. The large military presence in the city provided some employment stability during the downturn; however, because of freezes and reductions in government spending, reliance on these operations is also creating a slower rebound. Hotel managers in particular have expressed concerns regarding the repression of rates due to the heavy reliance on government per diem. Meeting and group demand in the market has been slow since the recession, though demand from the segment had realized a rebound before the onset of the Waldo Canyon Fire. The federal funds for tourism and the City’s application for state funds from the Regional Tourism Act are also expected to help boost leisure visitation. As retail growth continues in the northern section of the city and the potential for oil-drilling revenues spurs the economy, the outlook for the market is cautiously optimistic.

Great overview on this important Colorado market!

Great article you guys. Our best family vacation ever was to Colorado Springs last year!

Great read, thanks to you both for putting this together!