|

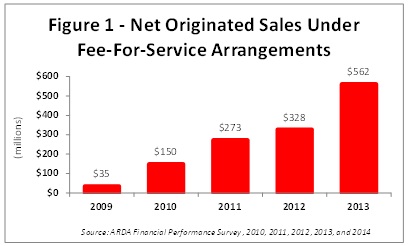

As was recently affirmed at the Shared Ownership Investment Conference (SOIC), held in Miami in October 2014, current industry trends have created a unique opportunity for new entrants into the shared ownership arena. In recent years, a capital-light strategy has emerged within the industry whereby timeshare organizations such as Wyndham Vacation Resorts, Hilton Grand Vacations Club, Bluegreen Vacations, and Hyatt Vacation Club provide sales and marketing on a fee-for-service basis. According to the ARDA Financial Performance Survey, 2014 Edition, the overall percentage change in net originated timeshare sales under fee-for-service arrangements between 2012 and 2013 was an increase of 71.2%. The growth of fee-for-service during the past five years has been significant, as illustrated in Figure 1.

What is “fee-for-service”? Quite simply, it refers to services, such as sales and marketing, which are provided to a third-party developer for a fee. Before the emergence of sales and marketing fee-for-service arrangements, the barriers for an individual developer to enter the shared ownership (timeshare) industry were very high and in many cases, not feasible. The large investment required to set up an effective sales and marketing organization, as well as the specialized expertise necessary to operate an effective program, are examples of items that previously blocked the majority of hotel owners and resort developers from entering the shared ownership industry. Without an experienced and effective sales and marketing organization, the timeshare model cannot be successful. However, given the advent of the fee-for-service structure, a lack of experience, expertise and/or a sales organization are no longer barriers.

Under a fee-for-service structure, the sales and marketing expense is negotiated and typically set at a ratio tied to annual gross sales. In some contracts, the timeshare company will establish a minimum annual sales volume to be produced at the resort. Thus, revenue and expenses are highly predictable for the hotel owner, which provides for more effectively budgeting and planning. This also provides comfort for lenders because having a proven sales and marketing organization in place effectively removes the largest risk for a lender -- the unknown ability of the developer to sell the timeshare product within an appropriate time frame.

The fee-for-service model also provides advantages for established timeshare companies that offer this service; it allows them to produce incremental revenues by leveraging both their established marketing distribution channels to produce tour flow at the “contracted” resort, and their skilled sales force to close transactions. The model further enables a more rapid expansion of resorts affiliated with their brand without affecting their balance sheet by incurring significant capital investments in real estate.

Who would benefit from this new capital-light model in the shared ownership industry?

- The developer of a mixed-use resort which can benefit from the addition of a timeshare component;

- Resort condominium developers facing slow demand for whole ownership sales;

- Hotel owners with excess inventory which could be isolated to a certain wing of the hotel or to specific buildings.

For more information and assistance in learning more about how the fee-for- service and capital-light models benefit your timeshare and / or potential timeshare asset, contact [email protected] and [email protected].

Kathy Conroy, MAI is the CEO/Director-Partner of HVS’s Consulting & Valuation and Shared Ownership Services divisions in Florida. She has been an active participant in the hotel and shared ownership industry for more than 30 years. She is a noted national authority on the valuation of vacation ownership properties, and has authored books on timeshare property assessment, and timeshare property valuation for ARDA and the Appraisal Institute, respectively.

Gary Johnson is a Senior Analyst for HVS’s office in Florida, specializing in hotel and shared ownership asset advisory. He has appraised and/or consulted on more than 250 hotels, vacation ownership resorts, and mixed-use developments located in more than 20 states and ten countries. In addition to expertise in valuation and consulting of all types of hotel products, Gary has significant expertise in shared ownership real estate, including private residence clubs, fractional properties and timeshare resorts.

0 Comments

Success

It will be displayed once approved by an administrator.

Thank you.

Error