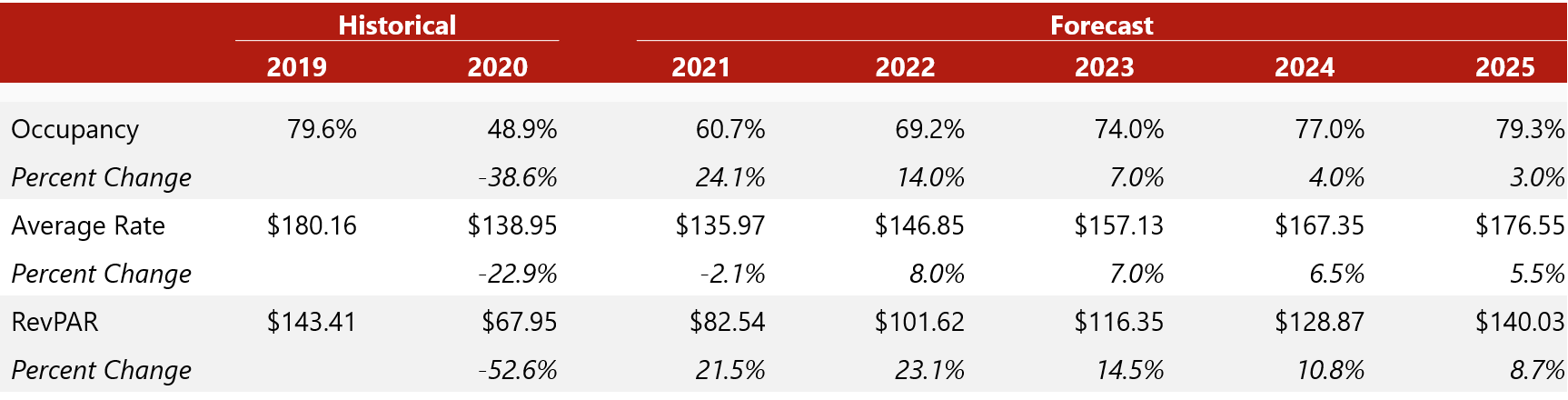

The Los Angeles hotel market, along with the rest of the world, experienced an unprecedented drop in demand in 2020 following the start of the COVID-19 pandemic. Hotel occupancy declined to 49% in 2020, compared to 80% in 2019, while average daily rate (ADR) decreased to $139 in 2020 from $181 the previous year. Overall, revenue per available room (RevPAR) decreased 52.6%, the largest decline in the history of the market. Based on the latest dynamics of supply and demand, below we present our latest forecasts for the recovery of L.A.-area hotels in 2021 and beyond. As with the rest of the industry, while occupancy is anticipated to recovery more quickly, ADR losses often take many years to recover. Our forecast assumes a recovery to 2019 levels after 2025, as illustrated in the following table.

The Los Angeles hotel market, along with the rest of the world, experienced an unprecedented drop in demand in 2020 following the start of the COVID-19 pandemic. Hotel occupancy declined to 49% in 2020, compared to 80% in 2019, while average daily rate (ADR) decreased to $139 in 2020 from $181 the previous year. Overall, revenue per available room (RevPAR) decreased 52.6%, the largest decline in the history of the market. Based on the latest dynamics of supply and demand, below we present our latest forecasts for the recovery of L.A.-area hotels in 2021 and beyond. As with the rest of the industry, while occupancy is anticipated to recovery more quickly, ADR losses often take many years to recover. Our forecast assumes a recovery to 2019 levels after 2025, as illustrated in the following table.

Major factors contributing to our forecast are summarized as follows:

- Occupancy and ADR in 2020 both experienced deeper declines than originally anticipated by HVS in the forecast presented last year at this time. While the post-lockdown recovery in the summer of 2020 seemed promising, the start of the third wave of COVID-19 in the late fall resulted in a major setback for area hotels due to the reimplementation of strict government travel restrictions. These restrictions included guidance that hotels should only be open to essential workers and travel, as well as a mandatory ten-day quarantine upon arrival in the state. While the restriction on hotels has since been lifted, the quarantine still officially remains in place.

- As a world-class gateway market, international visitation has traditionally been a significant demand generator for the Los Angeles market. In the year-to-date February 2021 period, per the latest data available, international arrivals at Los Angeles International Airport (LAX) remained 85% below the level registered for the same period in 2020, as many international borders remain closed, illustrating the lack of recovery in international travel a year into the pandemic. As with most airports around the country, flights continue to be added on a monthly basis, primarily to domestic destinations. LAX has also made significant progress over the last twelve months on its $14-billion capital improvement plan. These upgrades are necessary, as the city plans to host several large events in the coming years, including the Super Bowl in 2022 and the Summer Olympics in 2028.

- L.A. lost a net total of 395,000 jobs in 2020, and unemployment soared to 10% by year-end 2020, compared to 4% in 2019. Of the job losses, 39% were in the leisure and hospitality sector and 9% were in the film sector. L.A. was disproportionally impacted by job losses in the hospitality sector given its reliance on tourism and international visitation. With the reopening of the economy in early 2021, we would anticipate a recovery in the local job market. Similarly, while filming activity remains low amid COVID-19 restrictions, total filming days have recovered quarter-over-quarter after reaching a low point in the second quarter of 2020.

- Hotels and submarkets throughout Los Angeles County have experienced uneven declines or recoveries, as the mix of demand and clientele can vary widely within the region. As an example, coastal hotels, which would have been expected to benefit from “drive-to” leisure demand, still struggled, as the client base is often international, while hotels located near industrial/warehouse/transportation hubs have nearly recovered all of their COVID-related losses.

- Los Angeles features 205 million square feet of office space. According to REIS, office vacancy increased from 14% in 2019 to 15% in 2020, while average asking lease rates decreased from $41 to $39. With more work-from-home flexibility provided by many companies, REIS forecasts that vacancy rates will increase through 2023, peaking at nearly 18%, with average asking lease rates remaining relatively flat throughout that period. With 2.1 million square feet of office space completed in 2020 and another seven million under construction with planned openings in 2021 and 2022, our opinion is that these vacancy and lease rate forecasts are optimistic in light of the major shifts occurring in the office space sector in urban locales. Nevertheless, with most workers expected to return to the office starting in the summer of 2021, we anticipate demand associated with business travel will also start to return to submarkets heavily dependent on corporate-related demand.

- Within Los Angeles, urban submarkets including Hollywood and Downtown Los Angeles have been the most affected over the last twelve months. Entertainment companies, such as Netflix, which generated a significant number or room nights for the Hollywood submarket, have significantly curtailed business travel. Downtown L.A. (DTLA), home to nearly 39 million square feet of office and the Los Angeles Convention Center, has been affected by a dearth of office employees and a complete lack of conventions. While the greater region has started to record occupancy levels in the 60% range, as of March 2021, occupancy levels in the most affected submarkets remained in the 30s and 40s.

- Although convention activity remains non-existent at the Los Angeles Convention Center and at the city’s major meeting venues, in early April 2021, the State of California finally provided guidance related to how and when groups would be able to meet again. Effective April 15, large groups can meet indoors or outdoors throughout California, and group sizes are limited to a maximum of 200 or 400 people, respectively, in the less restrictive tiers. According to our conversations with market participants, large-scale group activity is scheduled to return to L.A. and the convention center as early as July 2021. A recently released goal from the Governor of California to fully open up the economy by June 15 will further allow for larger groups and conventions to return.

- Major theme park attractions in the greater metro area are a significant driver of demand in the market. These attractions have remained closed since the start of the pandemic. However, on April 30 2021, attractions such as Disneyland, Universal Studios, Knotts Berry Farm, Six Flags Magic Mountain will be allowed to reopen with reduced capacity.

- Following a surge of exciting new hotel openings in 2019, including The Hoxton, SOHO Warehouse, Silver Lake Pool & Inn, Santa Monica Proper, and The West Hollywood EDITION, new openings maintained the pace in 2020 through early 2021. These new hotels included The Wayfarer DTLA, Hotel June, Hotel Mariposa, AC Hotel by Marriott Los Angeles South Bay, The Glenmark Hotel, and the Pendry West Hollywood. Notably, nearly all recent new supply comprises either independent hotels or soft/ lifestyle brands, marking a departure from traditional brands.

- New supply in 2021/22 will include some exciting and highly anticipated properties, including the Fairmont Century Plaza, Godfrey Hotel Hollywood, Caption by Hyatt Hollywood, Thompson Hollywood, and CitizenM Downtown Los Angeles.

- Despite new openings, as of February 2021, the Los Angeles submarket had experienced a 6.3% decrease in supply compared to the same time in 2020, before the start of the pandemic, reflecting the temporary or permanent closure of approximately 6,500 hotel rooms. As mentioned previously, the severe drop in demand in some submarkets, such as Downtown Los Angeles, has not warranted the reopening of some hotels, including the NoMad Hotel, the InterContinental Century City, The Mayfair Hotel, and The Standard DTLA, and it has caused the permanent closure of the Palihouse West Hollywood and The Standard West Hollywood.

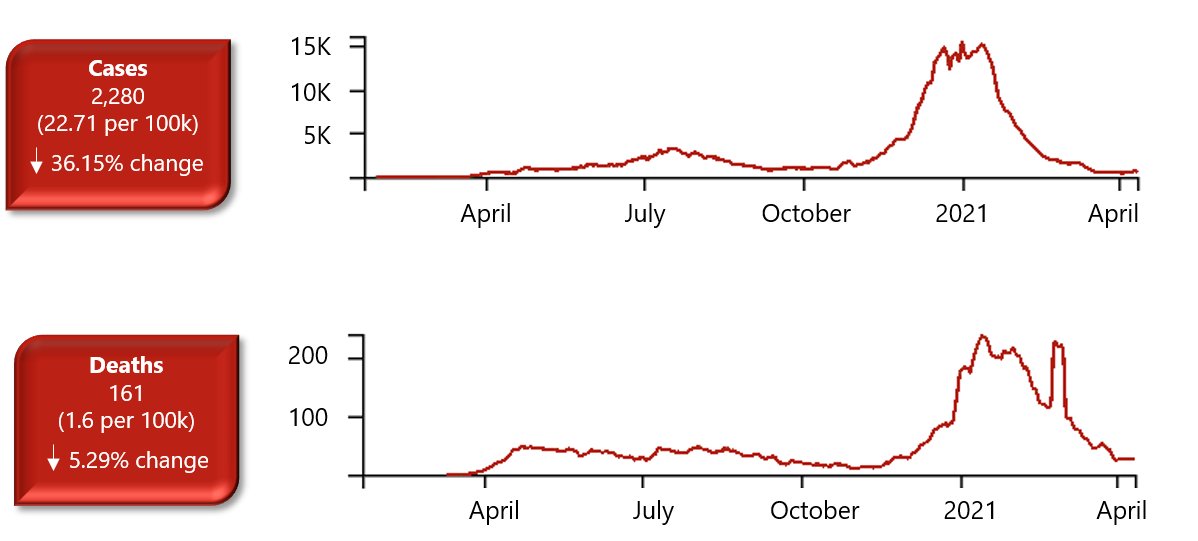

- Following the peak of the pandemic in early January, restrictions began to be removed across the state and county in late January, and a full reopening has progressed gradually since that time. As of April, Los Angeles had the lowest case numbers since the start of the pandemic, and over 29% of the population had been fully vaccinated. The increase in vaccinations locally and across the country is providing individuals with the confidence to travel again.

Seven-Day Moving Averages | Los Angeles County, California

Tue Jan 21 2020 - Thu Apr 22 2021

- In terms of hotel transactions, 2020 was a unique year for the Los Angeles market. Nearly half of all hotel sales were acquisitions of mostly economy hotels by government entities seeking to house the homeless. A selection of 13 such transactions revealed that these assets sold on average at $175,000 per room. Aside from these atypical transactions, the remaining sales revealed derived cap rates of 7.2%, which can be considered slightly higher than the historical norm for this market. Some notable sales included the Viceroy L’Ermitage Beverly Hills ($840,000 per room), the Georgian Hotel Santa Monica ($744,000 per room), and the Renaissance Los Angeles Airport ($217,000 per room). Investor appetite for assets in L.A. and Southern California remains strong, all things considered, and at times appears unaffected by some of the latest dynamics of the industry.

HVS regularly consults throughout California, with Consulting & Valuation offices in Los Angeles and San Francisco. Luigi Major, MAI, and his team are available to assist you with any consulting needs. Follow Luigi on LinkedIn or Twitter or message him directly at [email protected].

Los Angeles County’s COVID-19 Guideline Highlights (as of April 15, 2021)

Los Angeles County remains in the Orange Tier (the second out of four tiers in California’s Safe Reopening Plan), reflecting “moderate” community transmission levels.

Movie theaters, restaurants, churches, museums, zoos, and aquariums can operate at 50% of indoor capacity, while gyms can operate at 25% of indoor capacity.

Theme parks can operate at 25% capacity, and outdoor live-event venues can operate at 33% capacity.

Large group events are limited to 15% capacity for venues that can host 1,500 people (200 people max), and 10% capacity for larger venues (2,000 people max), if all attendees are tested for COVID-19 or show proof of vaccination.

Other requirements for meetings are listed here.

0 Comments

Success

It will be displayed once approved by an administrator.

Thank you.

Error