Boise Convention Overview

The Boise Centre is Idaho's largest convention center, offering roughly 86,000 square feet of meeting space. Boise generally competes with two other regional markets for convention business: the Spokane Convention Center in the state of Washington and the Salt Palace Convention Center in Salt Lake City, Utah, which also features a brand-new, 700-room convention hotel. While remaining somewhat competitive in the 400-to-500 person or less group segment, Boise predominantly thrives in the small-to-midsize convention group segment due to its lack of a major convention hotel.Although group demand was suppressed following the onset of the COVID-19 pandemic and further affected by the popularity of virtual and hybrid events, in-person convention activity came roaring back in 2022. There are some opportunities for a more robust convention capture in Boise; however, the market remains one of the strongest in the Rocky Mountain region, further supported by planned commercial developments.

Boise Hotels’ Continued Triumph

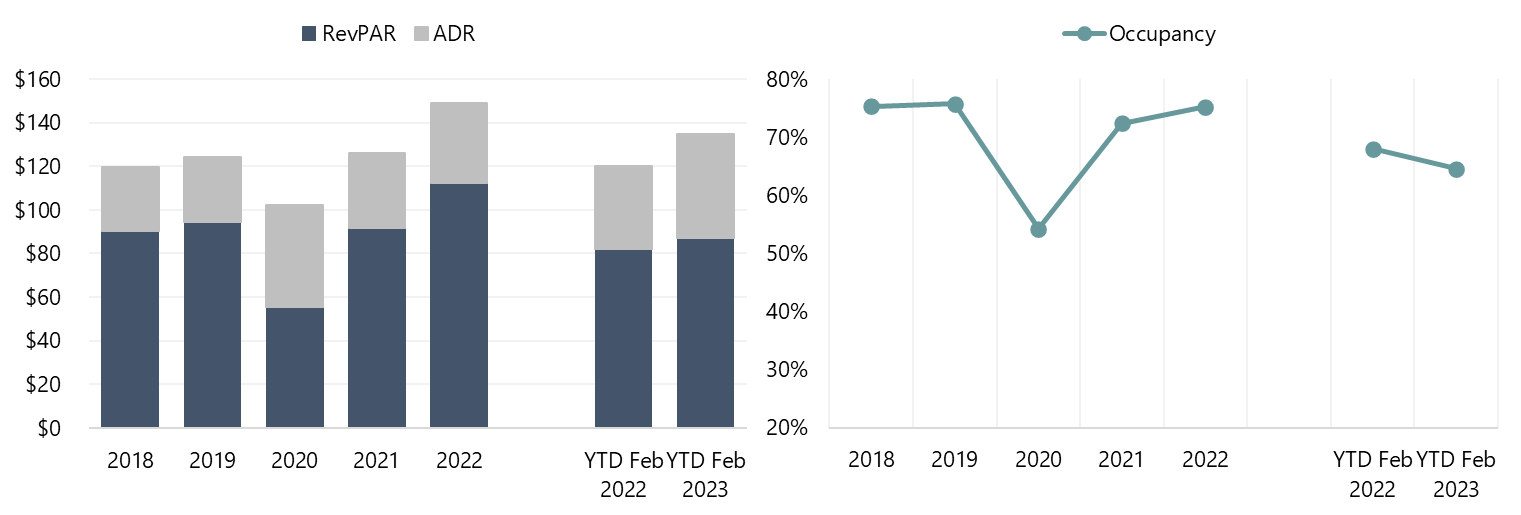

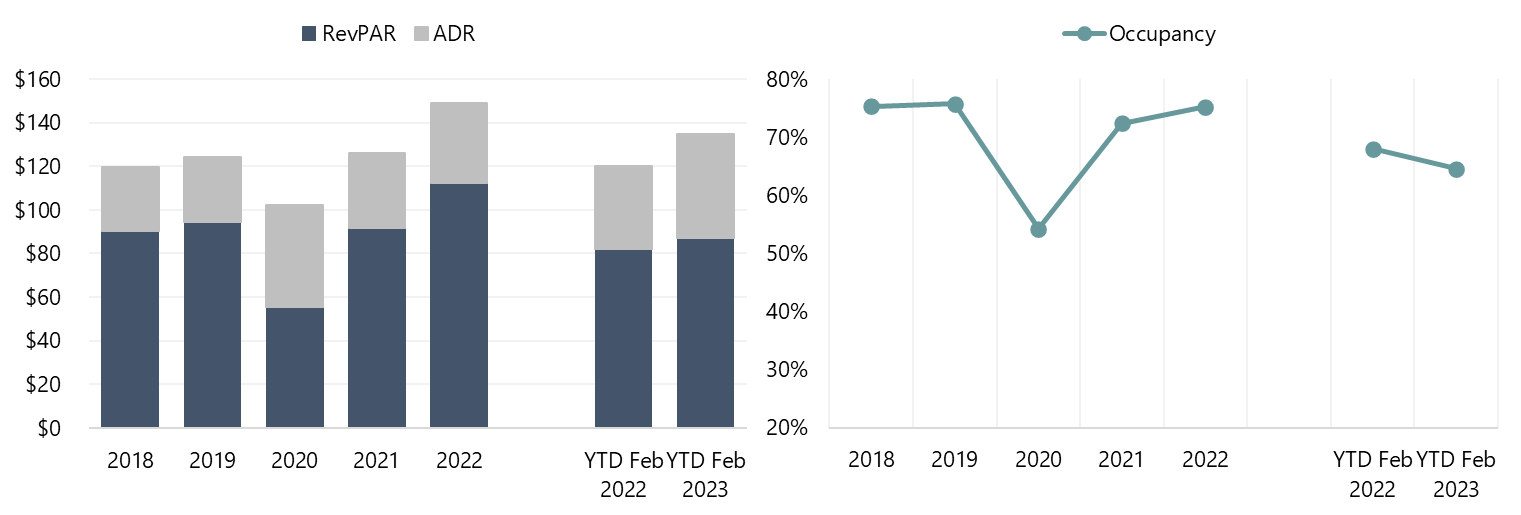

Boise Hotel Metrics

Source: Kalibri Labs

Source: Kalibri Labs

The factors supporting the historical Boise hotel market trends are outlined as follows:

- The downtown core hotel engine roared back to life in 2021, fueled by continued population growth and a relatively quick return of sports groups. ADR performance exceeded historical levels that year, with occupancy remaining slightly below previous peaks as new supply was being absorbed by the market.

- RevPAR continued its upward trajectory through 2022, with an almost 20% year-over-year increase as convention business began to pick up in the association segment that year. The surge of “revenge travel” through the first half of 2022 enabled Downtown Boise hotels to surpass pre-pandemic peaks in both occupancy and ADR.

- With relatively fast absorption of new supply, the key driver of occupied room nights in 2022 was group business, which increased by 22% that year compared to 2019.

- Boise Airport’s expanded routes to domestic markets such as Atlanta, Palm Springs, Santa Ana, Austin, and Chicago contributed to the improving metrics by making Boise more easily accessible. Hotel operators were in a strong position to leverage heightened demand levels and inflationary trends to exert significant pricing power in both the transient and group segments.

- Hoteliers reported that the rise in transient room rates has caused travelers who are being outpriced by the market to move out of Boise into Meridian; however, government per-diem rates increased strongly as well, which prevented an outward migration of this segment.

Boise’s Convention Comeback

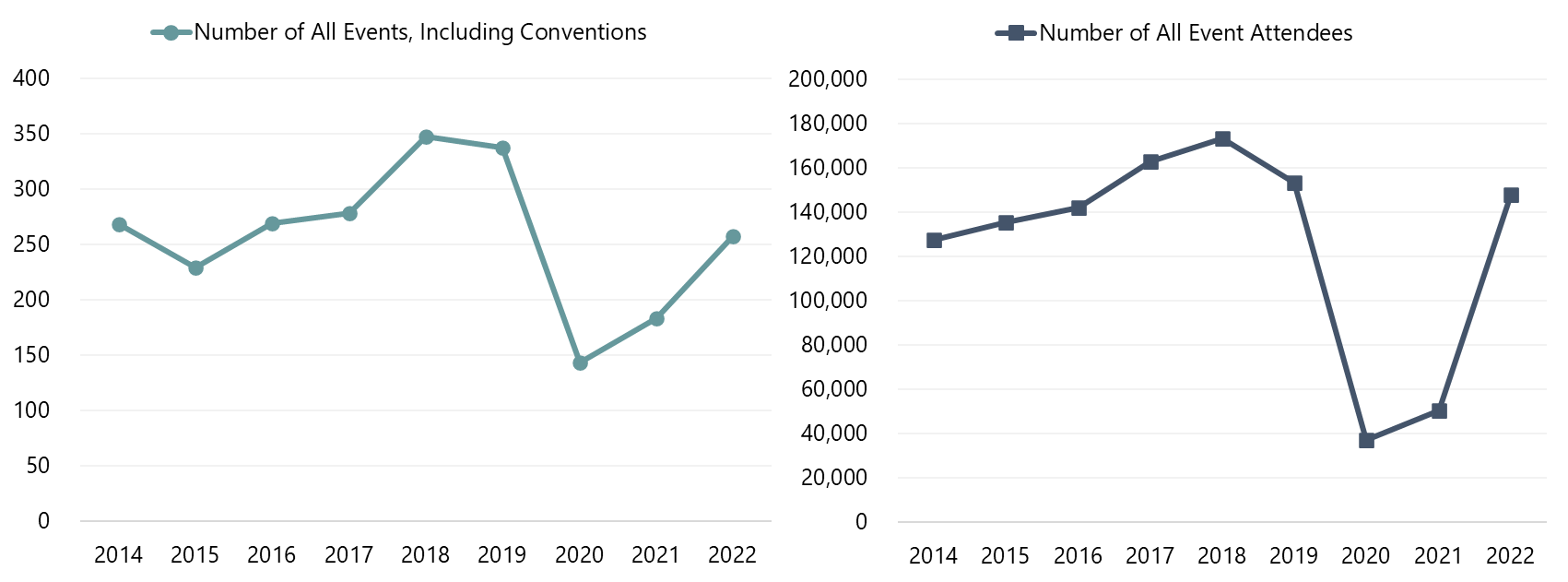

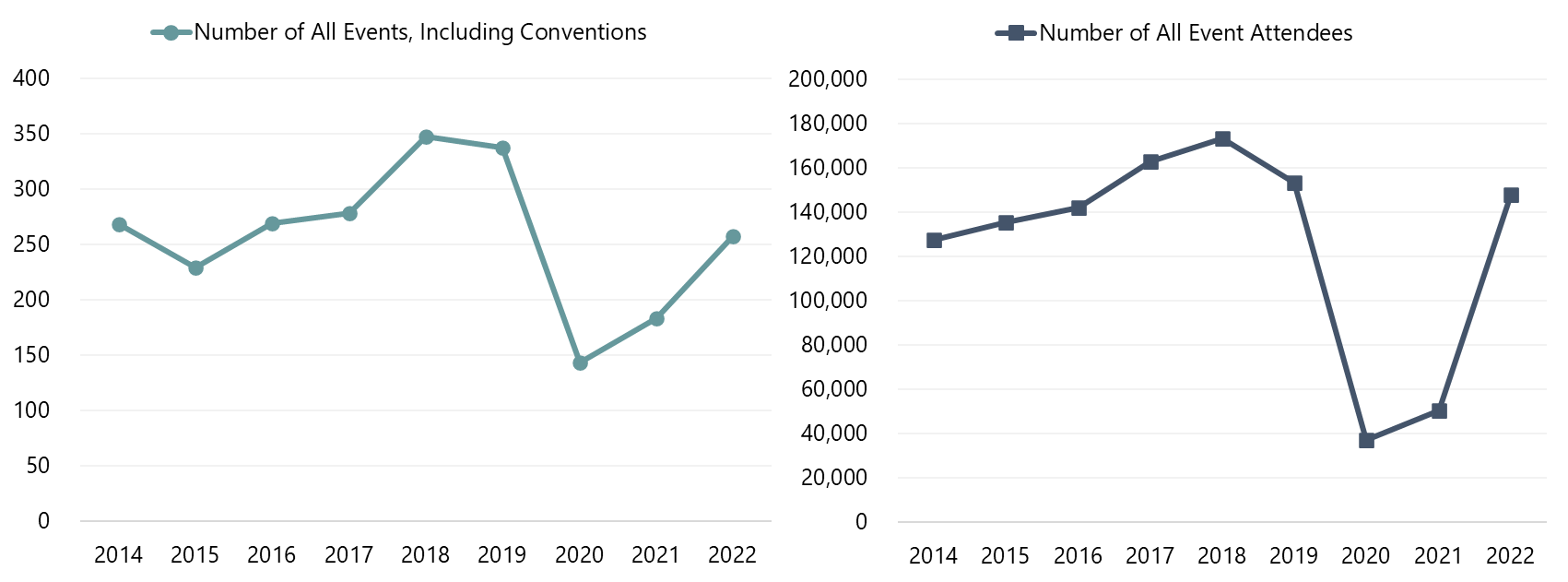

Boise Centre Usage Statistics

Source: Boise Centre

Source: Boise Centre

While not depicted in our charts, in 2022, the number of conventions and the number of convention attendees at the Boise Centre surpassed 2019 levels, as convention events were larger that year. Moreover, due to staffing challenges in 2022, convention booking restrictions were put in place from the beginning of the summer through the end of the year.

Boise does incredibly well within the smaller to midsize group-event segment. However, the lack of a large convention hotel results in lost business opportunities among the larger convention groups. Moreover, 300-to-400-attendee groups generally require room blocks at multiple hotels due to the lack of a large convention hotel, which poses an additional challenge for winning more business. Market participants reported that a 600+-room convention hotel would put Boise on the map for many larger conventions that it currently has to turn away.

Nonetheless, the convention center benefits from a strong demand base and its location in Idaho’s state capital. Moreover, with convention business being slow to resume in major Pacific Northwest destinations following the COVID-19 pandemic, Boise has benefited from groups seeking an alternative to major regional convention markets such as Seattle, Portland, and San Francisco. The city has recorded a notable uptick of first-time conventions and group events to the market in the post-COVID-shutdown period since 2020.

While there is new supply in various development stages in and around Boise, it is important to note that none of the new supply will be convention-oriented in nature. Boise is expected to benefit from the new supply that offers a boutique, luxury product; however, the new hotels are not likely to help the convention center draw larger groups, according to market participants. Nonetheless, the new supply is an additional example of the extraordinary growth underway in the market.

Boise’s Emerging Tech Era and Bright Outlook

Even before the onset of the COVID-19 pandemic, inbound business migration for tech companies from West Coast cities was already a significant component of Boise’s growth outlook. This trend accelerated following the pandemic due to the Treasure Valley’s business-friendly climate, affordable living conditions, and land available for development. Additionally, continued remote work policies for tech companies led to a rise in relocations for tech workers to Boise. Most recently, the large-scale expansion of Micron Technology’s headquarters by 2030 is an additional key aspect of Boise’s thriving future in the tech world. This development alone is anticipated to create an estimated 17,000 new jobs.Based on our conversations with hoteliers in Boise, 2023 is shaping up to be another robust year for area hotels, with no deceleration in sight for the Gem State’s capital as it continues to dominate the regional convention market. Another anticipated bright spot for Boise is the return of the Jaialdi festival in 2025. Anticipated to reach a population of one million people by 2024/25, Boise is poised to rise from a “small city” to a “small yet big convention city,” among other players in the Rocky Mountain region, such as Salt Lake City.

With the continued investor interest in commercial development in Boise, the unceasing popularity of the market for small-to-midsize conventions, and the ongoing growth within the tech sector, the economic outlook for Boise is overwhelmingly positive.

For more information, please contact Eileen Bosworth of HVS Portland or Lauren Reynolds of HVS Salt Lake City.

0 Comments

Success

It will be displayed once approved by an administrator.

Thank you.

Error