Once an old-school beach destination peppered with mom & pop motels, softened zoning restrictions welcomed high-rise condominium towers in the early 2000s, transforming the area into a collegiate Spring Break haven. The mid-2010s hailed the entrance of a new marketing strategy and the area’s first nationally branded hotels, in addition to legislation prohibiting alcohol consumption on the beaches, once more evolving the market identity to one of a family-friendly destination. It was also during these years that the market bore witness to the housing bubble burst and economic downturn of the Great Recession, the Deepwater Horizon Oil Spill, and Hurricane Michael, followed by the COVID-19 pandemic in 2020; nevertheless, it persisted.

Once an old-school beach destination peppered with mom & pop motels, softened zoning restrictions welcomed high-rise condominium towers in the early 2000s, transforming the area into a collegiate Spring Break haven. The mid-2010s hailed the entrance of a new marketing strategy and the area’s first nationally branded hotels, in addition to legislation prohibiting alcohol consumption on the beaches, once more evolving the market identity to one of a family-friendly destination. It was also during these years that the market bore witness to the housing bubble burst and economic downturn of the Great Recession, the Deepwater Horizon Oil Spill, and Hurricane Michael, followed by the COVID-19 pandemic in 2020; nevertheless, it persisted.

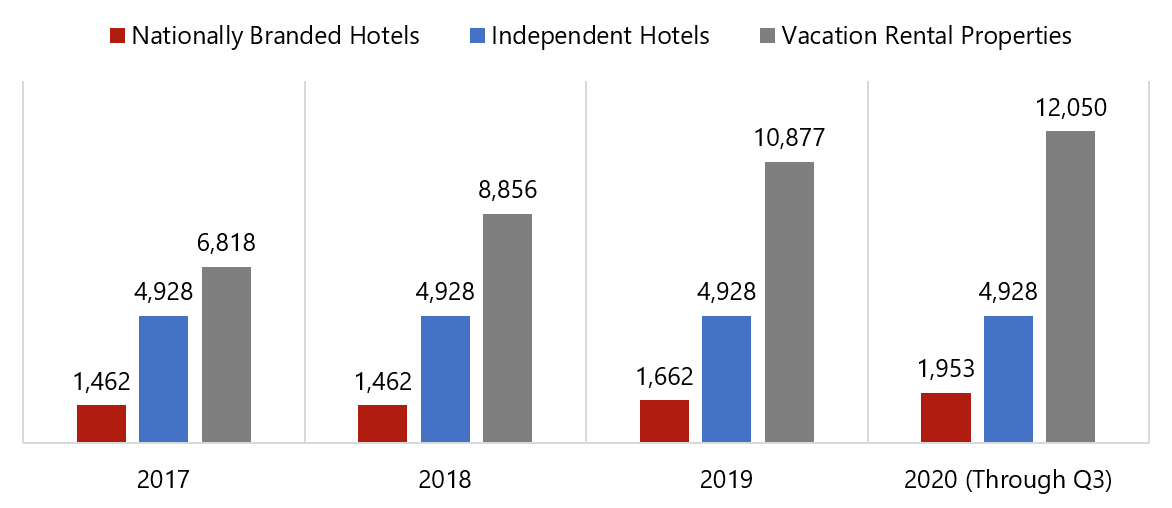

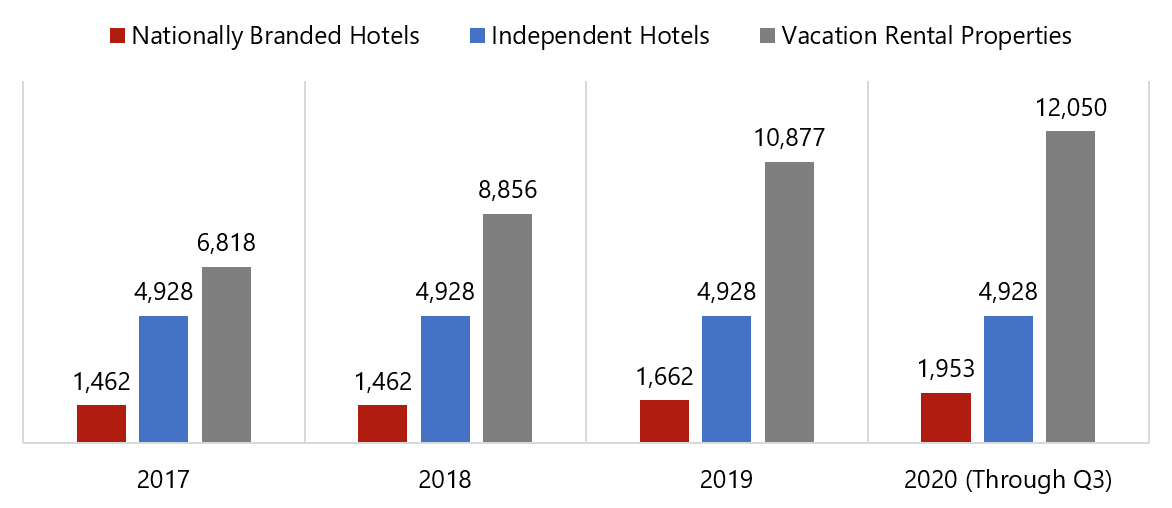

At the turn of the 21st century, Panama City Beach experienced a condominium boom that created thousands of vacation rental units, and while these high-rise towers replaced the area’s traditional beach motels, they failed to fill the gap in mid-range, short-term lodging. Although more nationally branded hotels have entered the market in recent years, as illustrated in the chart below,[1] the area’s lodging product continues to be heavily weighted toward independent properties, condominiums, and long-term vacation rentals rather than traditional hotel models.

Room Supply by Type of Accommodations

Source: STR and AirDNA

Source: STR and AirDNA

Panama City Beach’s prime feeder markets are within a half-day’s drive, providing ample opportunity for weekend stayovers. However, this type of travel is stifled by length-of-stay requirements required by most condominiums and vacation rentals, with a seven-day minimum typical during the peak season. With most working Americans allotted just ten days of vacation per year,[2] and with most Americans not using their allotted days,[3] the traditional week-long vacation is no longer feasible. Futhermore, the inconsistent product of independent condominium and vacation rental properties result in complicated real estate structures, unused amenities, and a lack of design and personality. Traditional hotel models with streamlined costs, sophisticated distribution channels, loyalty programs, and simplified organizational structures allow for a higher-end product, a transparent booking experience, and no length-of-stay restrictions that are more appropriate for this market’s modern visitors.

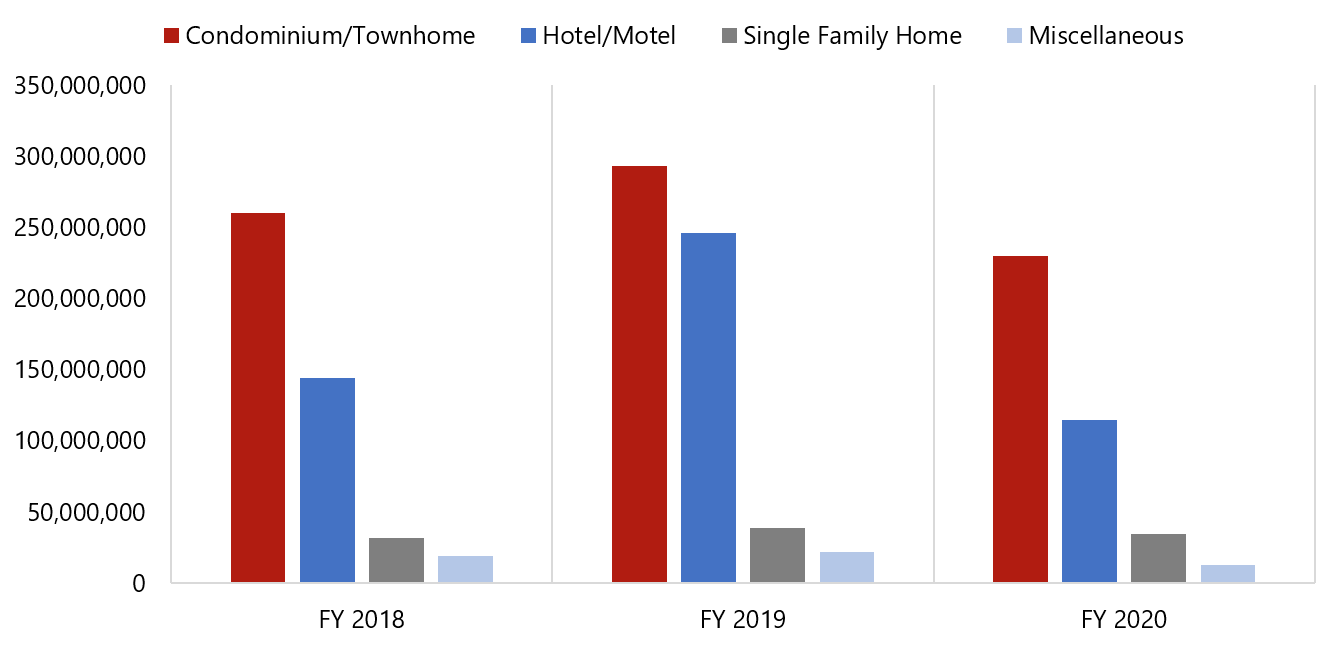

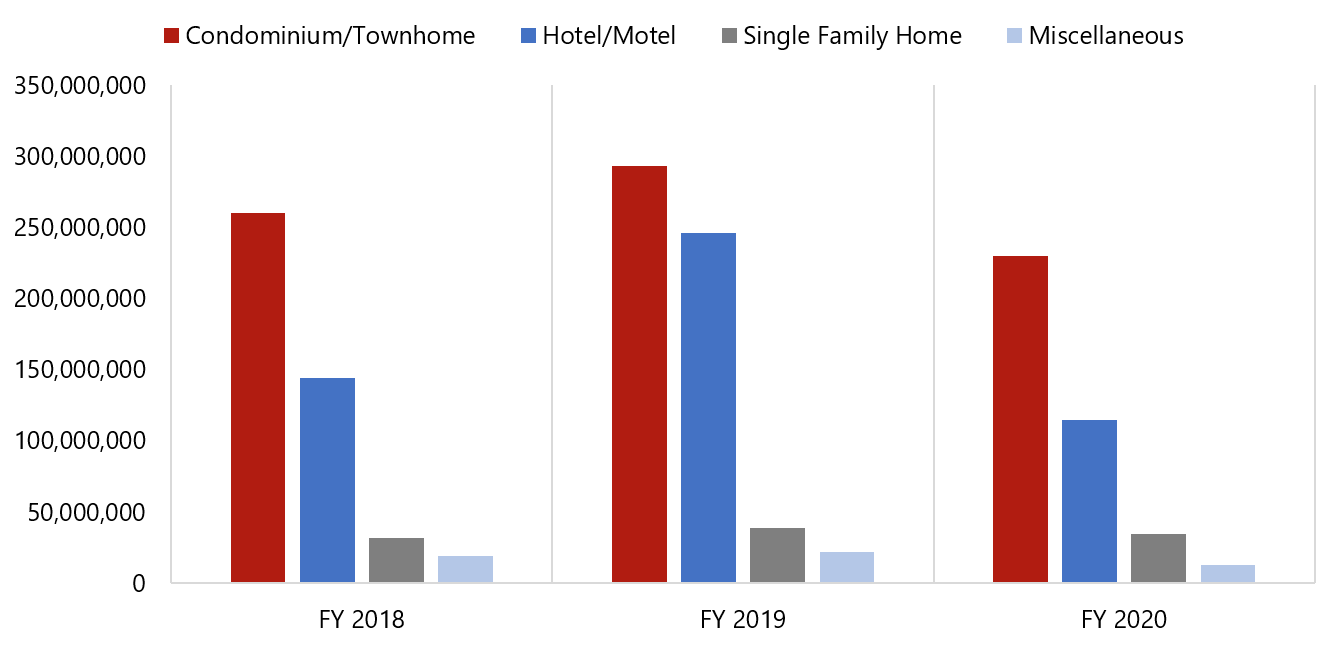

Furthermore, an examination of the city’s collection of tourist development tax, also known as bed tax, gives evidence to consumer’s changing preference in lodging in this market. In 2019, revenue growth in the hotel/motel category significantly outpaced revenue increases in both the condominium and single-family home rental categories. Conversely, a sharp decline in revenues generated by all rental types, particularly in the hotel/motel category, in 2020 was likely due to changes in consumer preferences related to the COVID-19 pandemic and the need for social distancing.

Annual Gross Receipts of Bed Taxes by Property Type

Source: Bay County Tourist Development Tax Reporting

Source: Bay County Tourist Development Tax Reporting

*Fiscal year reported from October through September

**Miscellaneous property types include campgrounds, apartments, duplex/multifamily, and timeshare properties

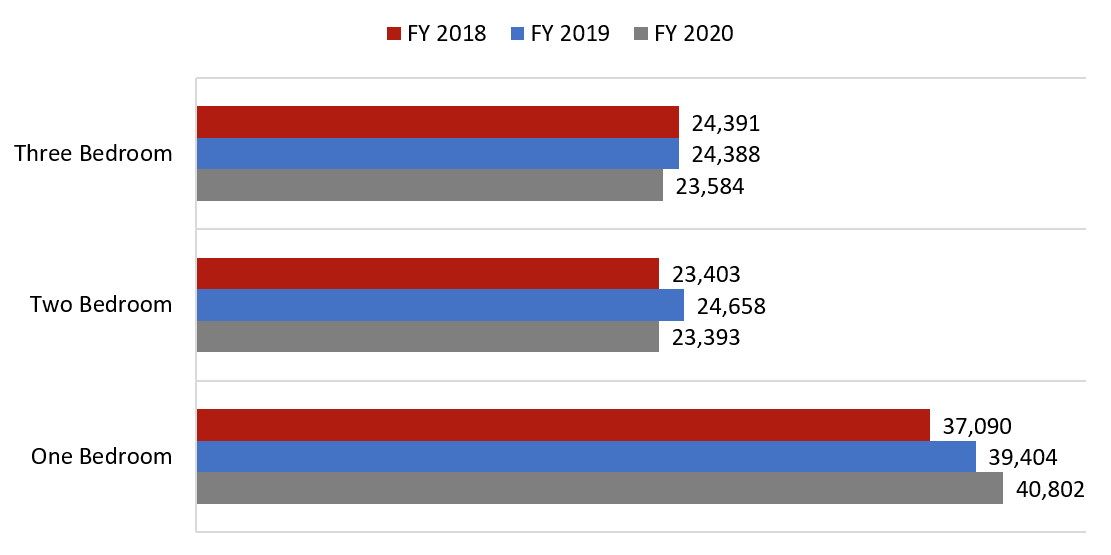

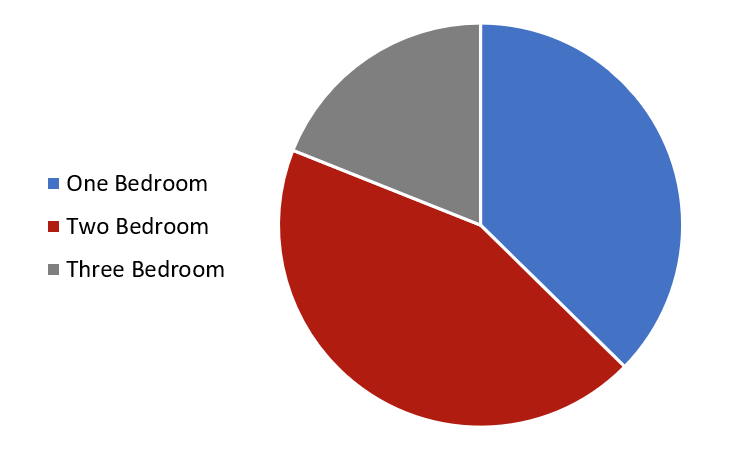

However, this current trend is likely not a permanent one, as consumers in this market have historically elected to rent one-bedroom units at a much higher frequency than two- and three-bedroom units. As such, increases in revenues collected from traditional hotel models are, once again, anticipated to outpace increases in revenues collected from condominium rentals and single-family home rentals in the near term.

*Fiscal year reported from October through September

**Miscellaneous property types include campgrounds, apartments, duplex/multifamily, and timeshare properties

Implied Annual Average Revenue per Bedroom

Source: Bay County Tourist Development Tax Reporting

FY 2020 Distribution by Unit Type

This need for a change in lodging supply is also spurred by the area’s change in demand generators. While tourism is the primary driver of lodging demand in Panama City Beach, with over 17 million tourists visiting the area annually,[4] the market contains numerous other demand generators that attract commercial, government and military, and group travelers, as well.

Destination sport-related entities, like the recently constructed Panama City Beach Sports Complex, are supporting a substantial rise in the growth of sports tourism, with the youth sports industry predicted to climb to $77.5 billion worldwide by 2026.[5] The Panama City Beach Sports Complex encompasses 210 acres, houses 13 multi-purpose fields, and hosts facilities that target seven different sports. While several events in 2020 were canceled due to travel restrictions related to the COVID-19 pandemic, the complex is anticipating booking 45 events, attracting an estimated 45,000 players, to the market in the next year.[6]

Following significant damage from Hurricane Michael in late 2018, the Tyndall Air Force Base received $3 billion in redevelopment financing from Congress, representing the largest military construction project that the U.S. government has approved to date. Reconstruction is expected to create 4,000 to 5,000 jobs locally while the base is rebuilt over an aggressive five-year period, targeting 2023 for completion. This redevelopment is anticipated to position the base as a premier, technologically advanced, state-of-the-art asset for the U.S. Air Force, ensuring its long-term viability.

In May 2018, St. Joe, Minto Communities, and Margaritaville announced their partnership and intention to brand its active adult community as Latitude Margaritaville Watersound. The lifestyle brand, which broke ground in at its Panama City Beach location in 2020, has been highly successful in the active adult community space at its Daytona and Hilton Head developments. The Latitude Margaritaville Watersound is in the heart of St. Joe’s Bay-Walton Sector Plan and includes approximately 3,500 homes and resort-style amenities for the 55-plus community. The sales center and models are projected to open in early 2021.[7]

The market’s rebranding as a family-friendly destination, a major departure from its prior Spring Break moniker, continues to have a positive impact on the area and has ignited confidence in key stakeholders. While the market experienced some demand loss while fortifying its new reputation, the loss has been largely mitigated. Panama City Beach’s current “Make It Yours” marketing strategy focuses on growing awareness of the total Panama City Beach experience, particularly in off-peak months, by inviting families, couples, winter residents, and weekend travelers to engage in beach, food, and entertainment activities, including special events. Visit Panama City Beach has been successful in driving demand by targeting alternate sources of business, and this demand growth is anticipated in the future.

Despite economic hardships spurred by environmental, microbiological, and financial disasters, both occupancy and average rate at traditional model hotels in this market have grown substantially since 2010, with double-digit growth reported in 2018 and 2019 as a result of hurricane-related demand and successful marketing strategies by local tourism agencies. While a sharp occupancy decline occurred in March and April 2020 because of the COVID-19 pandemic, this drop in demand has already proven to be temporary, as occupancy resurged in the summer months.

Panama City Beach has a multitude of untapped demand sources and a captive audience of travelers seeking traditional hotel accommodations. Given this market’s changing dynamics, it is important for lodging developers to have a focused target audience, as each market segment, be it beachgoers, snowbirds, military personnel, or sports teams, has specific needs and a desired price point. Development prospects may feel risky given the current economic climate; however, this destination market has proved its resiliency, flexibility, and ability to transform in the face of hardship time and time again. Overall, this market is well positioned and prepared for its next wave of growth and is equally prepared to rise above its next test of strength.

[1] Data collected from STR Panama City Beach Participation Model and AirDNA Panama City Beach Reporting

[2] CNBC, “Here’s how many paid vacation days the typical American worker gets.” Retrieved 01/08/2021.

[3] US Travel, “Paid Time Off Trends in the U.S.” Retrieved 01/08/2021.

[4] Bay County Chamber of Commerce, Communities, Panama City Beach

[5] Wintergreen Research, Inc.

[6] WJHG, “Busy year ahead for the Panama City Beach Sports Complex” Retrieved 01/08/2021.

[7] Business Wire, “Minto Communities, Margaritaville Holdings and The St. Joe Company Begin Development for Latitude Margaritaville Watersound” Retrieved 01/08/2021.

About Hannah McManus

Hannah, a Director with HVS Consulting & Valuation, leads the Saint Petersburg, Florida office. Hannah collaborates on and provides thoughtful insights for projects including hotel appraisals, market studies, portfolio valuations, and feasibility studies for proposed hotels, resorts, and mixed-use hospitality assets. A long-time resident of the West Coast Florida region, she offers expertise in leisure-driven and coastal Florida markets with a profound understanding of Florida assets. Hannah’s experience extends beyond Florida across a variety of markets in the Southeast and New England, including engagements in the greater New York City market. Contact Hannah at (410) 967-8879 or [email protected].

0 Comments

Success

It will be displayed once approved by an administrator.

Thank you.

Error