The impact of the COVID-19 pandemic on the timeshare industry was significant; however, industry leaders are optimistic that the recovery is underway and that the recovery timeline may be relatively short.

The impact of the COVID-19 pandemic on the timeshare industry was significant; however, industry leaders are optimistic that the recovery is underway and that the recovery timeline may be relatively short.HVS reviewed the 2020 year-end annual reports of four public timeshare companies: Hilton Grand Vacations, Marriott Vacations Worldwide, Travel + Leisure Co. (formerly Wyndham Destinations), and Bluegreen Vacations. Our research revealed that timeshare interval sales in 2020 ranged from 39.5% to 59.3% of timeshare interval sales achieved in 2019. The overall average penetration of the 2019 sales volume achieved in 2020 for the four public timeshare companies was 45.7%.

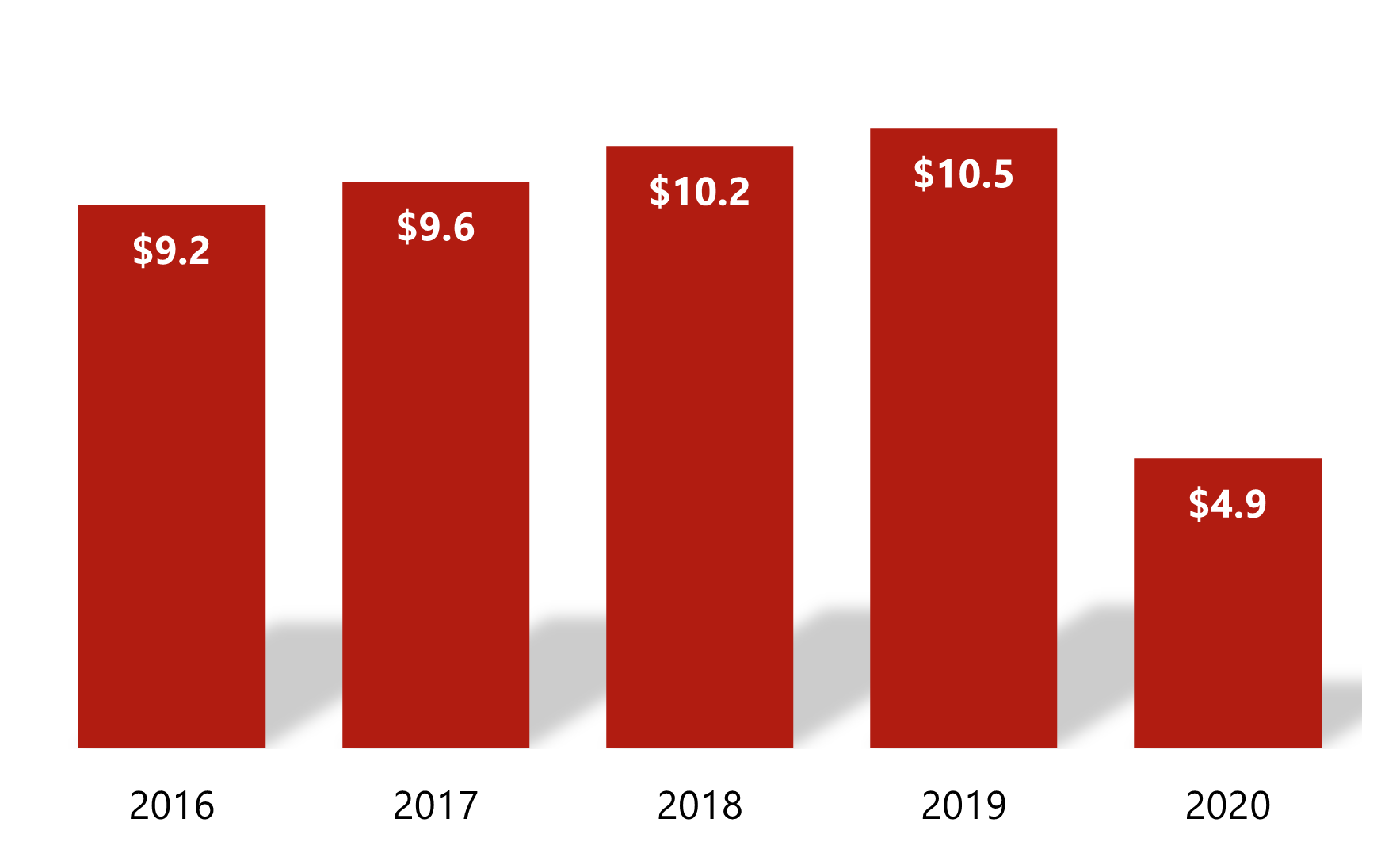

ARDA International Foundation (AIF) is a timeshare research and education group that completes annual surveys of the industry. Based on the results of AIF’s 2021 State of the Industry survey, annual timeshare sales achieved in 2020 totaled approximately $4.9 billion, which represents 47% of the timeshare sales volume achieved in 2019 ($10.5 billion). The annual timeshare sales performance estimated by AIF for the past five calendar years is illustrated in the following table.

Historical Sales (Billions)

Source: AIF

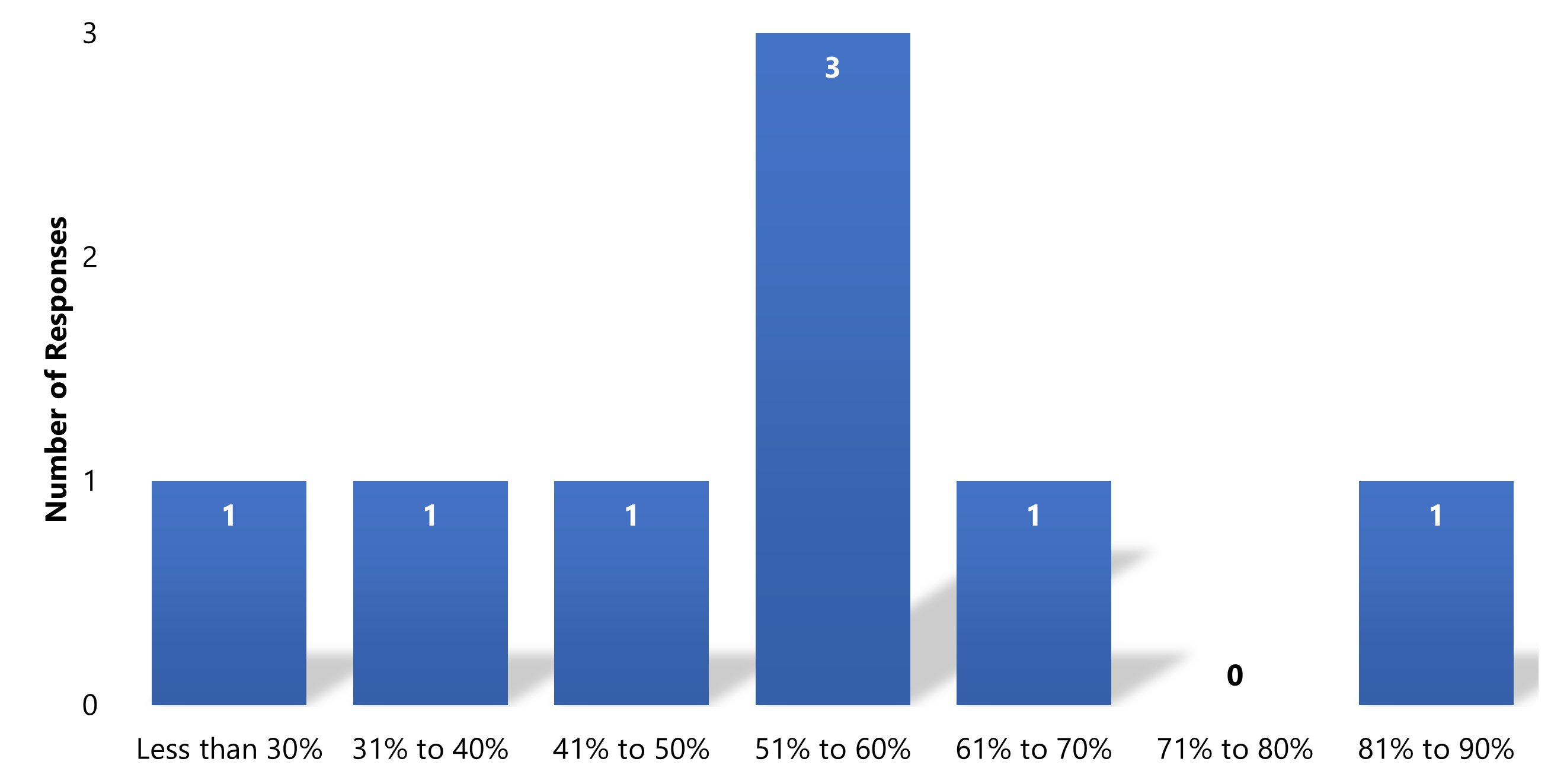

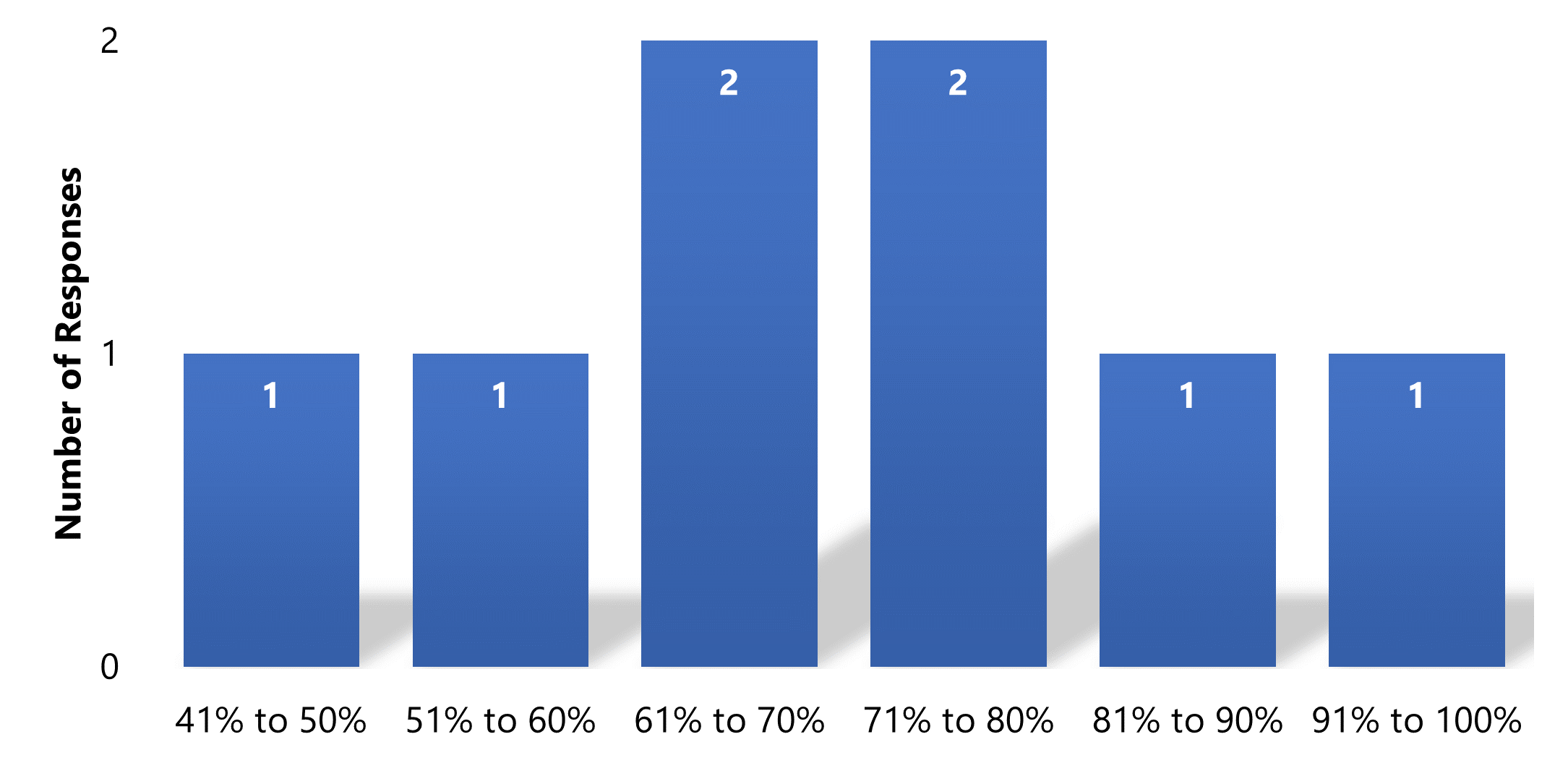

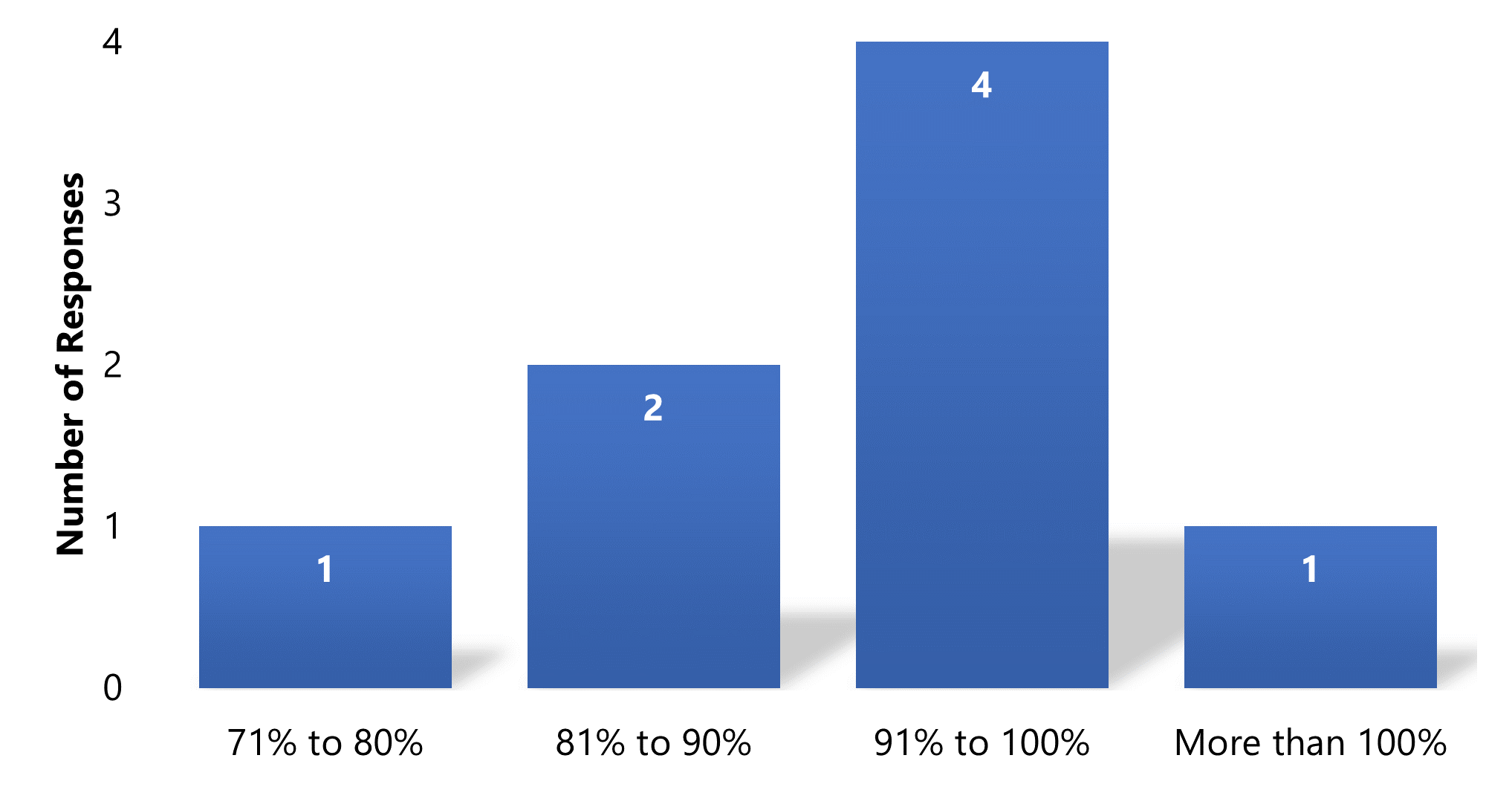

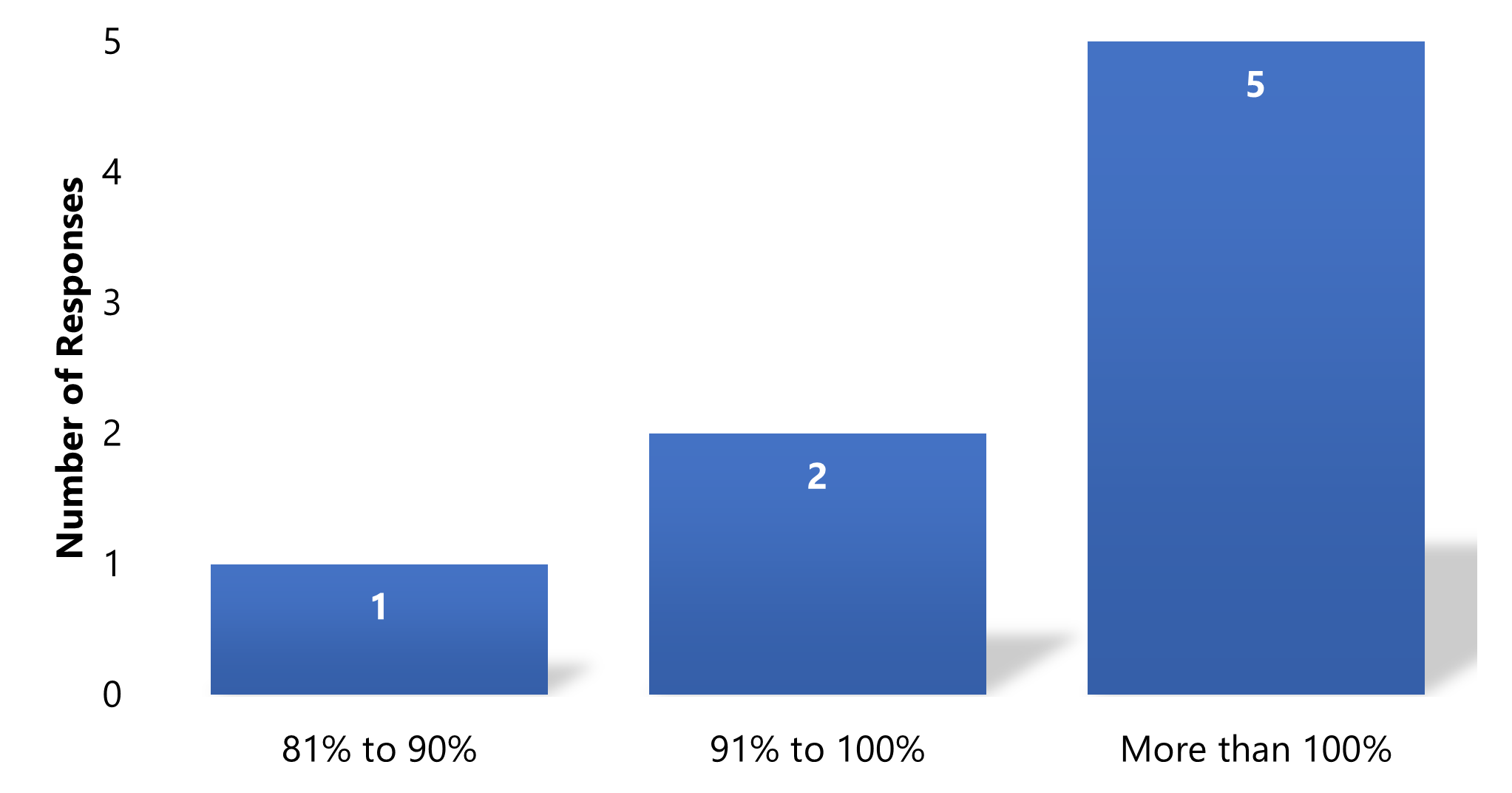

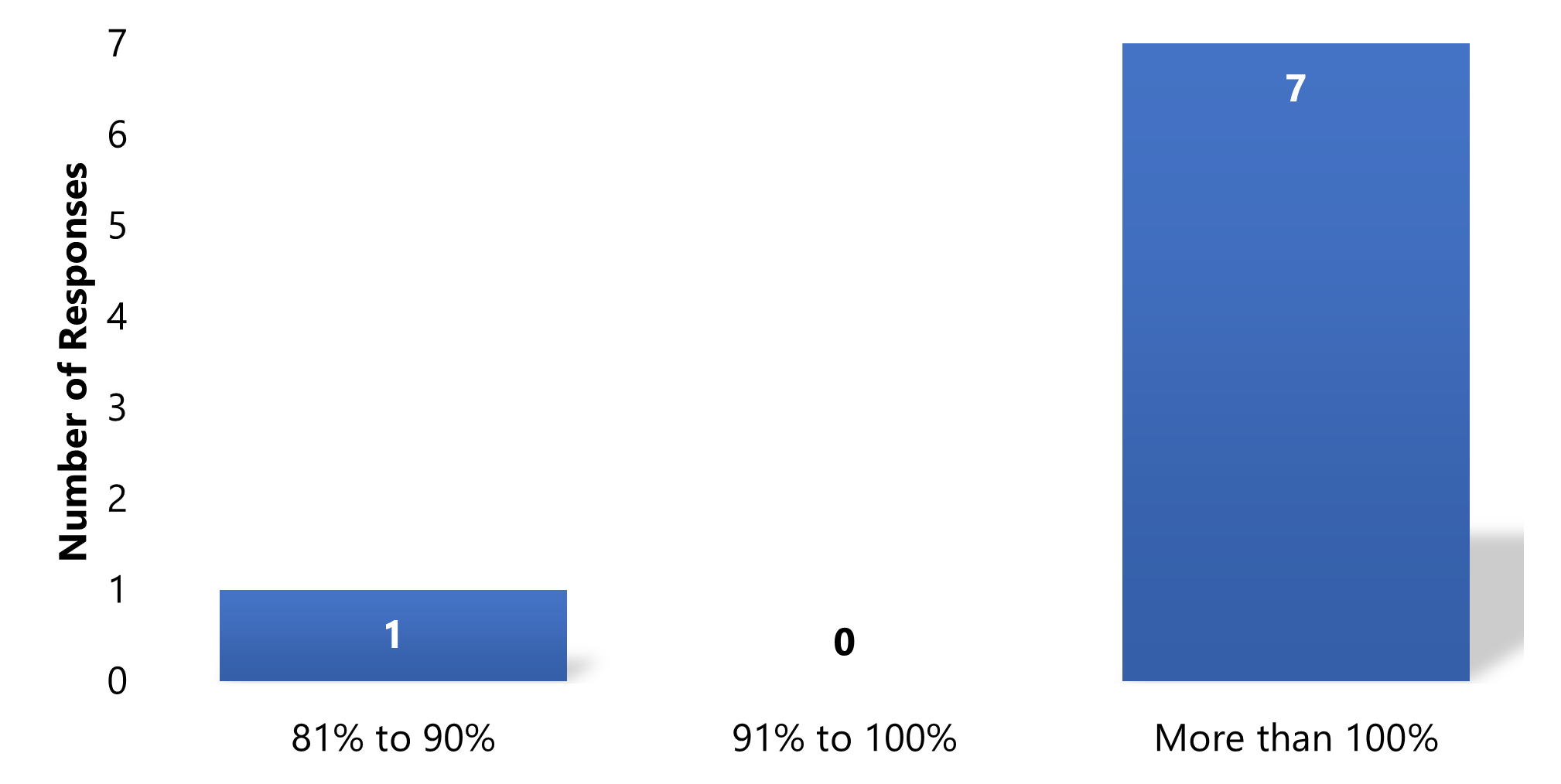

HVS Shared Ownership Services conducted a survey of the top 16 national and regional timeshare companies to measure the impact of COVID-19 in 2020 and gauge the industry’s outlook for recovery. The survey response rate was 50% (eight respondents). Typically, eight respondents would not be enough for a survey; however, given the small size of the timeshare industry, we believe the responses are informative and illustrate how a sizable portion of the industry views the timeline for recovery. The results of the survey are shown in the following tables.

Gross Timeshare Sales in 2020 as a Percentage of the Gross Timeshare Sales in 2019

Gross Timeshare Sales in 2021 as a Percentage of the Gross Timeshare Sales in 2019

We have observed that regional markets are achieving strong performance thus far in 2021 and, in some cases, are already exceeding 2019 levels. Timeshare resorts in destination markets, such as Orlando and Las Vegas, are lagging the performance of regional markets; however, these markets are realizing a steady recovery with a notable uptick in recent months. In particular, Las Vegas is experiencing tremendous recent growth in tourism, with a reported month-over-month increase in visitors of 44.8% in March 2021 and air-passenger traffic almost doubling in 2021 from January (1,505,622) to April (2,906,866).[1]

Gross Timeshare Sales in 2022 as a Percentage of the Gross Timeshare Sales in 2019

Gross Timeshare Sales in 2023 as a Percentage of the Gross Timeshare Sales in 2019

Gross Timeshare Sales in 2024 as a Percentage of the Gross Timeshare Sales in 2019

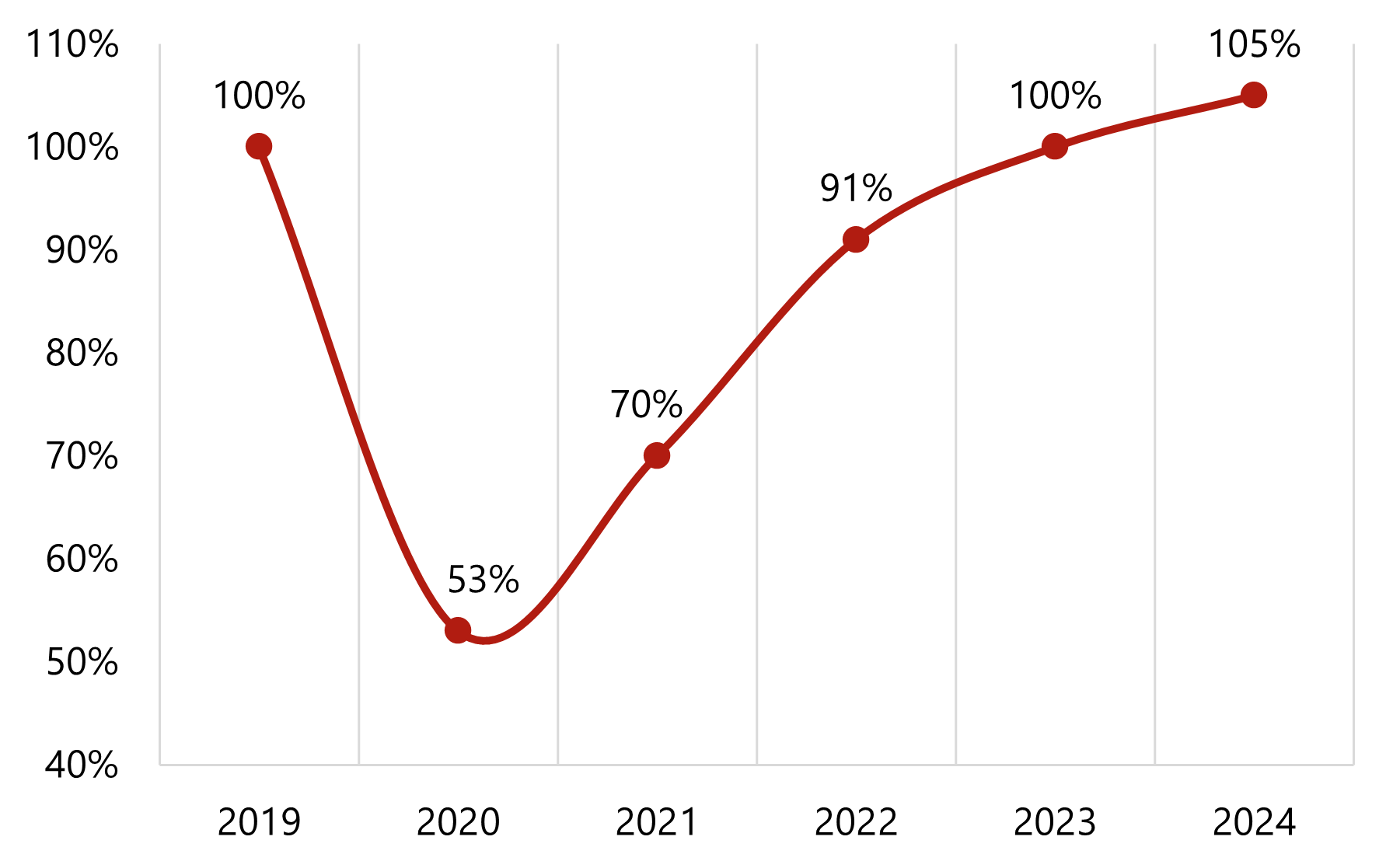

Based on our review of the survey responses and utilizing the gross timeshare sales volume achieved in 2019 as the base year, HVS Shared Ownership Services has projected the recovery timeline for the timeshare industry in the following graph, with expectation of a full recovery in 2023 or 2024.

HVS Projection of the Timeshare Industry Recovery (2019 Base Year)

Sales Volume as a Percentage of 2019 Sales

Sales Volume as a Percentage of 2019 Sales

Source: HVS Shared Ownership Services

In our opinion, the timeshare sector is well positioned to lead the travel industry out of the crisis. The typical timeshare unit features kitchens, as well as washing machines and dryers, and the larger size of timeshare units (compared to hotel rooms) reduces the guest’s reliance on common amenities and inherently accommodates social distancing. Furthermore, timeshare is focused on the leisure demand segment, which insulates the industry from business and group travel trends; these segments are generally expected to lag in the recovery.

Overall, HVS Shared Ownership is optimistic about the recovery of the timeshare industry. We continue to watch the factors affecting the industry, and our consulting and valuation engagements allow us to keep our finger on the pulse of the industry.

[1] Las Vegas Convention & Visitors Authority, April 2021 Executive Summary

About Gary L. Johnson

Gary Johnson is the Senior Vice President and oversees HVS' Shared Ownership Consulting division, specializing in hotel and shared ownership asset advisory. He has appraised and/or consulted on more than 300 hotels, vacation ownership resorts, and mixed-use developments located in more than 20 states and ten countries. In addition to expertise in valuation and consulting of all types of hotel products, Gary has significant expertise in shared ownership real estate, including private residence clubs, fractional properties and timeshare resorts. Contact Gary at +1 (305) 525-8702 or [email protected].

0 Comments

Success

It will be displayed once approved by an administrator.

Thank you.

Error