Mixed messages abound these days, comprising some bright spots, some not so bright spots, and some challenges. With no coherent theme, the greatest challenge may be developing a forecast for the industry as a whole. But we are undaunted and herewith present our current expectations for the U.S. lodging industry.

Mixed messages abound these days, comprising some bright spots, some not so bright spots, and some challenges. With no coherent theme, the greatest challenge may be developing a forecast for the industry as a whole. But we are undaunted and herewith present our current expectations for the U.S. lodging industry.The recent successive increases in GDP, lower inflation levels, and continued strong job growth paint a positive picture of the U.S. economy, but ongoing international conflicts, the pending election, and uneven economic metrics have resulted in a lack of overall clarity. The specter of a recession remains, although much diminished from the concerns that characterized much of 2023.

The lodging industry is similarly challenged by mixed messages. A review of STR’s monthly occupancy data for the U.S. indicates that the industry experienced a full twelve months of modest occupancy declines beginning in April 2023 and extending through March 2024. Data for April 2024 was positive, but the shift of the Easter holiday from April to March makes it difficult to interpret these results. Was the 2023/24 twelve-month trend a one-year correction? Or is it symptomatic of a longer-term negative trend? The notable variation in results among property types, locations, and demand segments is logical—and consistent with the post-pandemic period thus far—but further obfuscates the issue.

The group demand segment is currently one of the brightest lights of the lodging industry, led by strong convention pace and booking activity. The corporate group sector, particularly small corporate meetings and events, also continues to grow. Business travel is a positive factor, too, as return-to-office trends continue and negotiated rates have increased.

The current slow pace of supply growth is also favorable for existing hotels. The industry is now reaping the benefits of the high construction costs and the limited availability and high cost of financing that have severely constrained new construction starts over the past several years. As a result, most industry participants expect supply growth to be around 1% this year and remain muted for the next several years. However, the industry has learned to recognize these circumstances as opportunities. Thus, HVS expects supply to grow more quickly than current trends suggest. Some markets are also benefiting from increased restrictions on short-term rentals, which reduces competition from these sources. However, the short-term-rental sector continues to affect many markets, particularly as travelers seek lodging alternatives that may be perceived as a better value.

Supported by the above-noted factors, many urban markets are reporting positive results in both occupancy and ADR. Leisure markets are also showing positive trends, but bear watching through the peak summer season, which was somewhat undermined in 2023 by broader concerns about the economy. An imbalance in international travel was also a factor last year, as outbound U.S. travelers outpaced inbound leisure visitors. The inbound statistics are showing some improvement but continue to be impaired by the strong dollar. And the resurgence of the cruise industry is a competitive factor that could also constrain lodging demand.

While the pace of inflation appears to be slowing, room rates remain elevated compared to historical levels, putting increased pressure on disposable incomes. The weak results reported by the economy and midscale hotel sectors reflect these trends, as properties in these categories can be particularly sensitive to broader economic pressures.

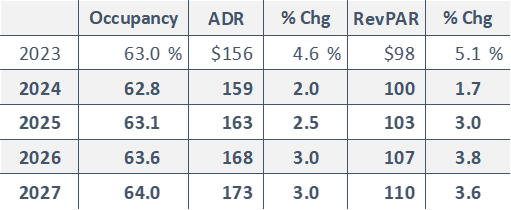

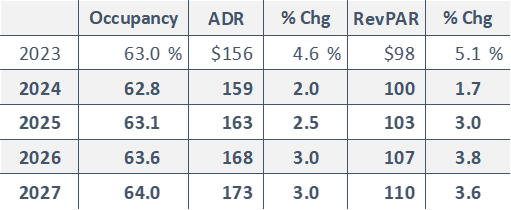

Our latest forecasts are presented below.

Forecast of Lodging Metrics

Source: STR (Historical), HVS (Forecast)

Source: STR (Historical), HVS (Forecast)

Overall, the outlook is modestly positive, with constrained supply growth as the most influential factor. Persistent softness in demand growth may undermine yield management and could prompt some caution in pricing. Nevertheless, ADR growth is expected to remain positive in 2024, supported by continued growth in the higher-priced demand segments. As a result, RevPAR is not expected to keep pace with inflation in 2024 but should surpass inflation in the following three years.

Anne R. Lloyd-Jones, MAI, CRE, is the Director of Consulting & Valuation Services, National Practice Leader at HVS, the premier global hospitality consulting firm. Since joining HVS in 1982, Anne has provided consulting and appraisal services for over 5,000 hotels. Anne’s particular areas of expertise include market studies, feasibility analyses, and appraisals. She is also an expert in the valuation of management and franchise companies, as well as brands. Her experience includes a wide range of property types, including spas and conference centers. She has appeared as an expert witness on numerous occasions, providing testimony and litigation support on matters involving bankruptcy proceedings, civil litigation, and arbitration. For further information, please contact Anne at +1 (914) 772-1570 or [email protected]

0 Comments

Success

It will be displayed once approved by an administrator.

Thank you.

Error