Transactions in the Asia Pacific

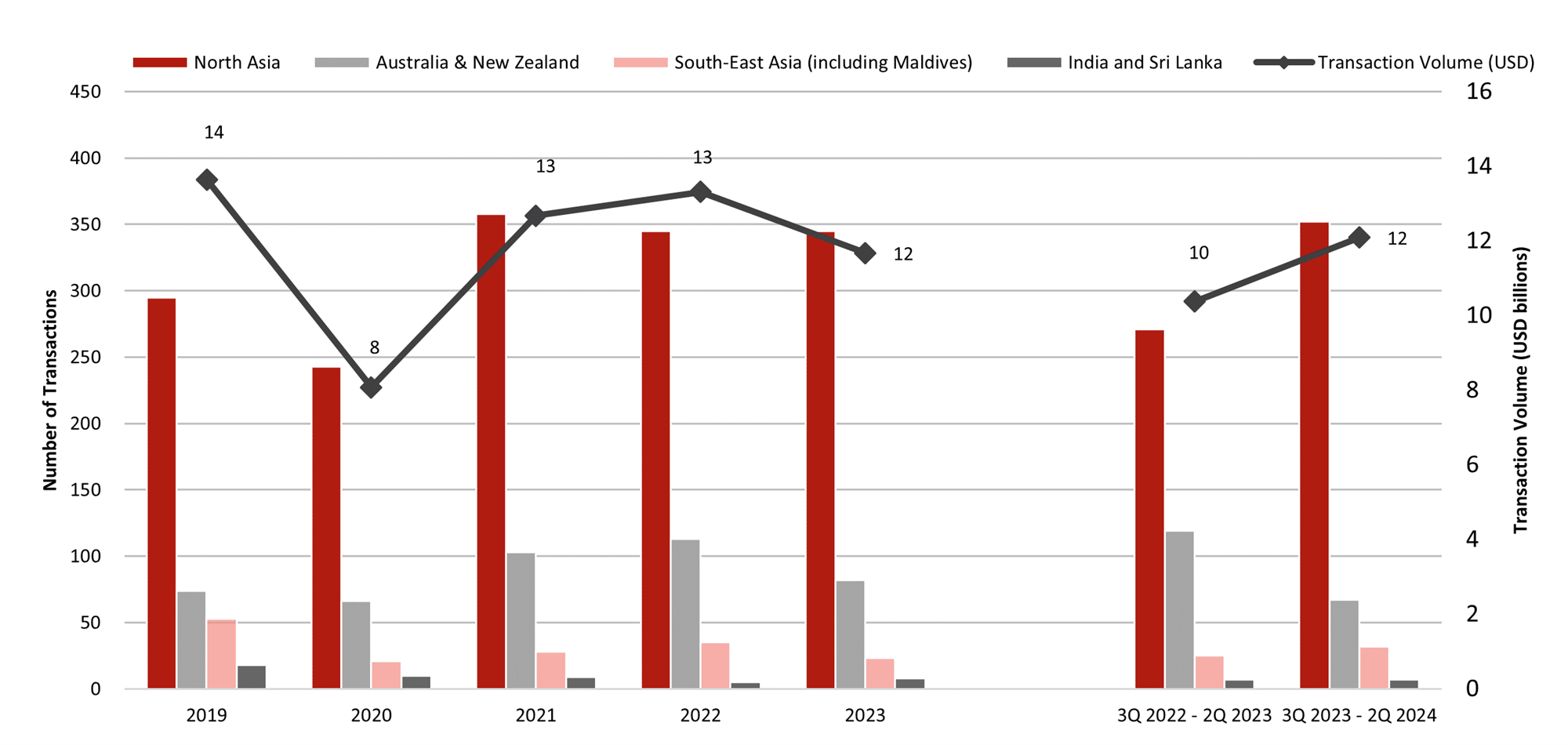

In 2023, hotel transaction volume in the Asia Pacific recorded approximately USD11.7 billion, a 12% decrease from USD13.3 billion from the previous year. The decline in transaction activity can be attributed to the high interest environment, buyer and seller price expectation gap, and a lack of suitable or available hospitality assets in the market. Australasia (Australia and New Zealand), as well as Southeast Asia, observed decreases of 20% and 56% in transaction volume, respectively. However, the trailing 12 months have shown positive signs, with total transaction volume recording a 17% increase, reaching approximately USD12.1 billion. This is fueled by the resurgence in travel demand and strong investor appetite for hotel assets. As the US Federal Reserve begins its easing cycle, the market may continue to see increased transaction activity in the coming year.

Transaction History in the Asia Pacific (2019 - 2Q 2024)

Source: HVS Research

*Please note mentions of "transaction values" pertain to the transaction volume based on relevant stake/interest as of the mentioned date

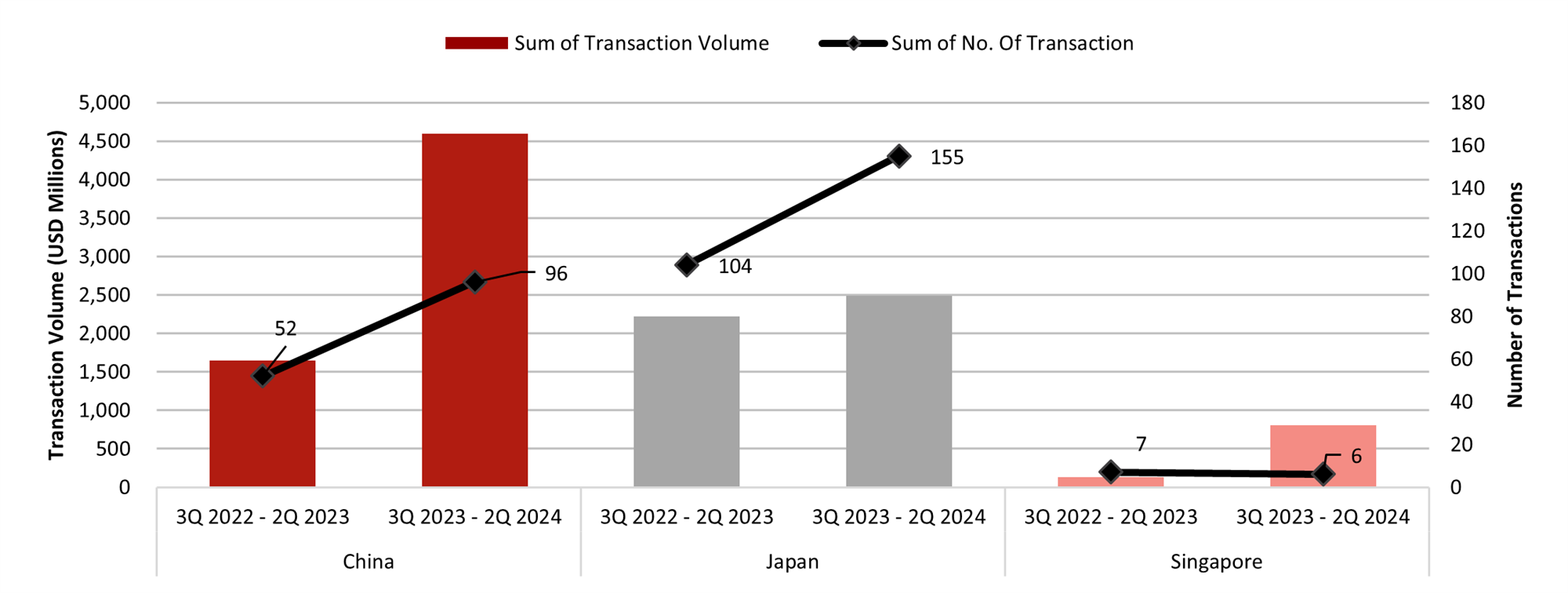

Top Three Most Active Markets (3Q 2023 to 2Q 2024)

Both transaction activity, measured by the number of completed transactions, and transaction volume for hospitality assets have increased over the last four quarters (3Q2023 – 2Q2024) in China, Japan and Singapore. In particular, China recorded a 180% increase in transaction volume compared to the same period last year, reflecting a recovery in the hospitality real estate market, with the majority of support coming from domestic investors. Japan has attracted strong international investor appetite due to robust tourism demand, a weak currency, and low interest rates. Singapore's hotel market has also proven its resilience during the pandemic, supported by a stable and well-established macroeconomic and political environment.

Transaction Volume in Top Three Most Active Markets (3Q 2022- 2Q 2024)

Source: HVS Research

*Please note mentions of "transaction values" pertain to the transaction volume based on relevant stake/interest as of the mentioned date

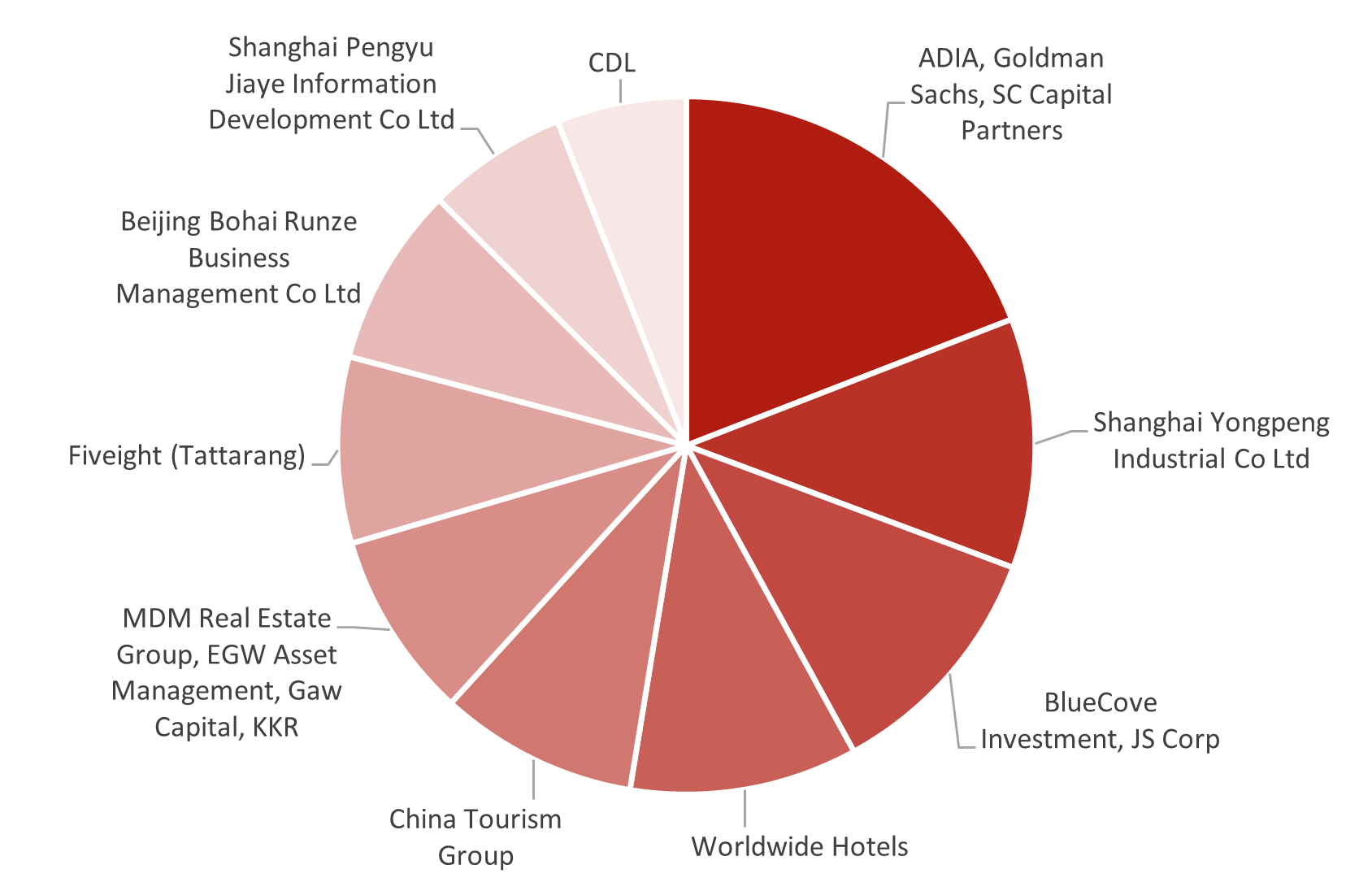

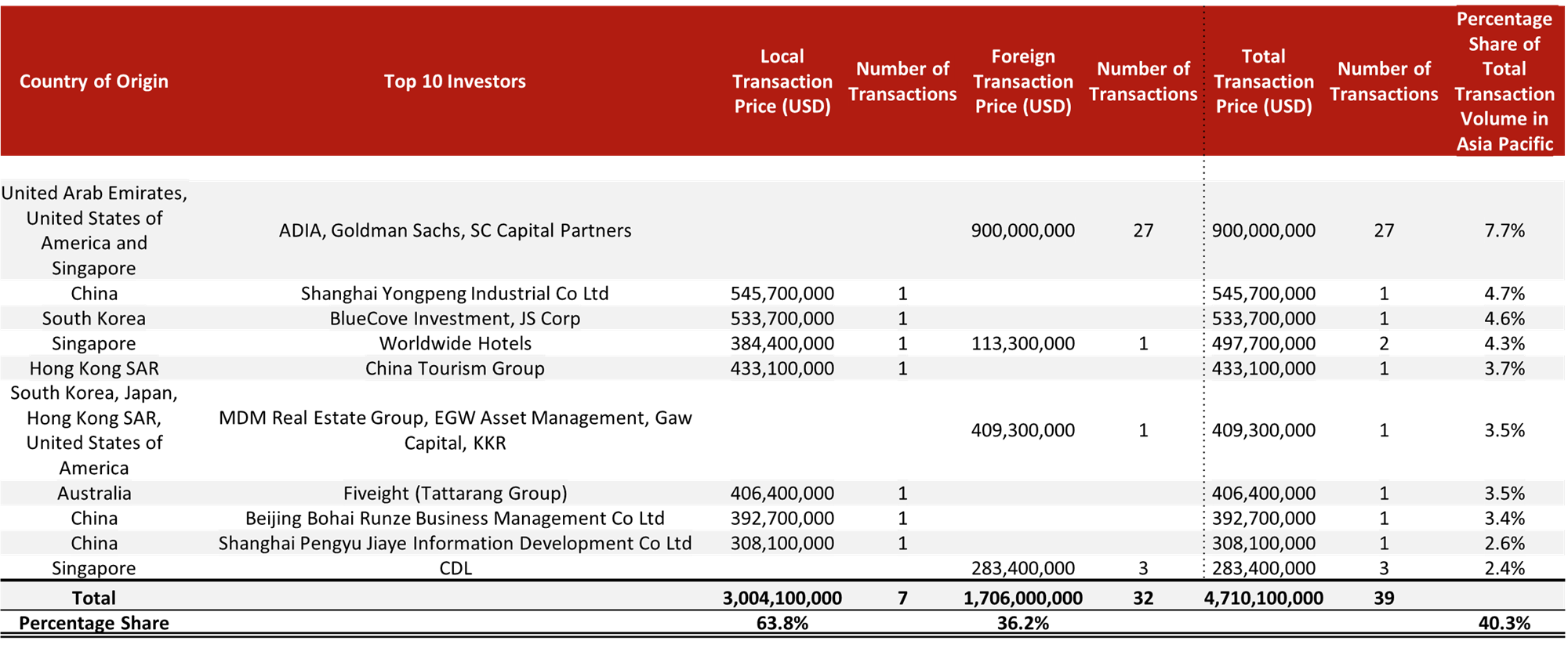

Major Investors in the Asia Pacific

In 2023, transaction activity from the top ten investors in the Asia Pacific accounted for approximately USD4.7 billion or 40% of total transaction volume.

In 2023, we have observed a mix of local and foreign investments, partially contributed by the depreciation of local currency against USD. In terms of the transaction activity by the number of transactions, the consortium formed by UAE-based ADIA, US-based Goldman Sachs, and Singapore-based SC Capital Partners tops the list with the 27-property Daiwa House portfolio deals in Japan, while Japan-based Polaris Holdings recorded 14 with the Red Planet Hotel portfolio deals. Australia-based Salter Brothers took over the third place with the acquisition of 13 properties in Australia.

Top Ten Investors

Source: HVS Research

*Please note mentions of "transaction values" pertain to the transaction volume based on relevant stake/interest as of the mentioned date

Hotel Performance in the Asia Pacific (2024)

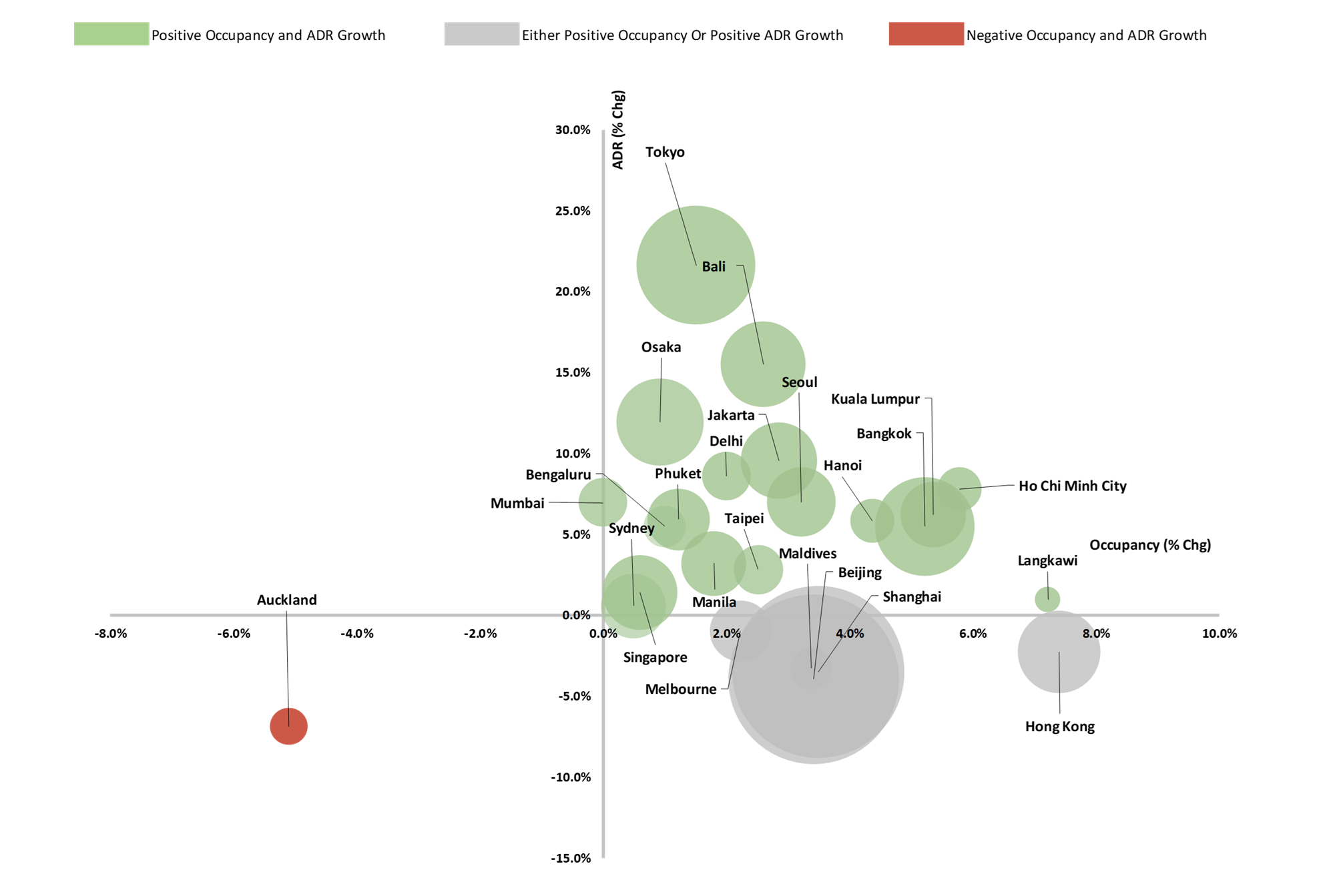

Overall hotel performance across the tracked markets in 2024 is anticipated to continue its recovery. While most markets have not yet reached pre-Covid levels of tourist arrivals, the surge in travel demand has greatly improved market-wide occupancy compared to 2023. ADR has also continued to improve, benefiting from the strong USD and the revenge travel trend. Looking ahead, market occupancy is expected to continue improving, as outbound travel from China has not yet recovered to pre-Covid levels, and air traffic capacity remains restricted by a lack of manpower and aircraft. Markets that saw a significant surge in ADR over the past two years, such as Singapore, the Maldives, and Australia, have observed a more stabilized ADR trend while still gradually recovering in occupancy.

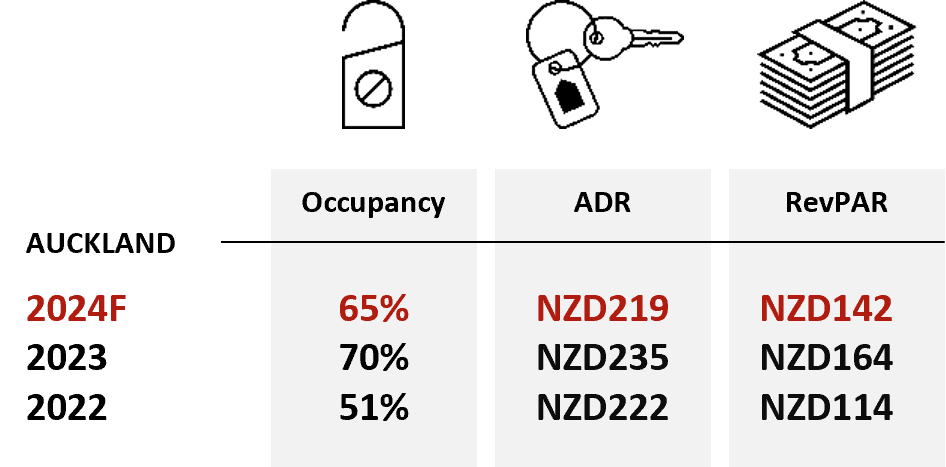

The top five market growth in hotel performances are Tokyo, Bali, Ho Chi Minh City, Kuala Lumpur and Jakarta. In general, hotel performance in Asia Pacific is forecasted to continue its growth trajectory in 2024. Auckland market is expected to register a notable decline in hotel performance metrics due to lower domestic demand, lack of major events and increased hotel supply.

Hotel Performance in the Asia Pacific (2024)

Source: HVS Research

Australia

Key Points

- Tourism contributed 9.8% of GDP in 2023 (AUD252.2 Bn), an increase of 17% from AUD216.1 Bn in 2022, achieving 84% of 2019’s tourism contribution

- 1.7% Real GDP growth is expected in 2024

- 7.2 million international tourist arrivals were recorded in 2023

Highlights

Infrastructure Projects

- AUD5.3 billion for new Western Sydney Airport, to be operational by 2026 for international, domestic and freight

- AUD13.0 billion Melbourne Airport Rail Link to connect to entire Victoria state by 2029

- AUD3.0 billion Melbourne Airport expansion project, featuring a third runway that is expected to be completed by 2031

- AUD65.0 billion expansion of Sydney’s city train network by 2032

- AUD125.0 billion Suburban Rail Loop which will link Melbourne’s Frankston Line to the Werribee Line, providing a key connection through Melbourne Airport by 2053

Notable Transactions

- 300-key Esplanade Hotel Fremantle acquired for AUD116.5 million (AUD388.3k/key) in Jul 2024

- 140-key InterContinental Sydney Double Bay acquired for AUD215.0 million (AUD1.5m/key) in Feb 2024

- 416-key Sofitel Brisbane Central acquired for AUD177.7 million (AUD427.2k/key) in Dec 2023

Notable Upcoming Hotel Openings in Sydney and Melbourne (2024)

- lyf Bondi Junction Sydney, 197-key

- Veriu Macquarie Park, 184-key

Demand

In 2023, total visitor arrivals reached 18.2 million, marking an 87.6% increase from 9.7 million recorded in 2022. International arrivals saw a remarkable 94.6% growth, jumping from 3.7 million in 2022 to 7.2 million in 2023. YTD Jul 2024 data shows a 21% rise in international arrivals from YTD Jul 2023, underscoring a strong recovery in global travel Australia continues to attract international visitors, with the top five source markets in 2023 being New Zealand (17.3%), USA (9.3%), United Kingdom (8.4%), China (7.6%) and India (5.6%).

Supply

*Include non-branded hotels

Source: HVS Research

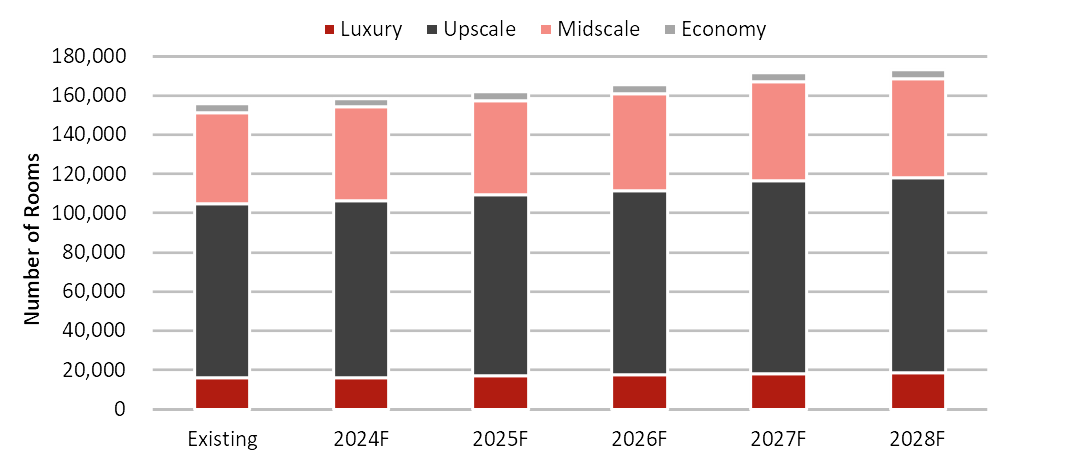

HVS has noted that there will be 108 additional hotels with approximately 17,508 keys by 2028; 19 properties with a total of approximately 2,788 rooms will open by the end of 2024.

Hotel Pipeline (2024 - 2028)

*Exclude non-branded hotels

Source: HVS Research

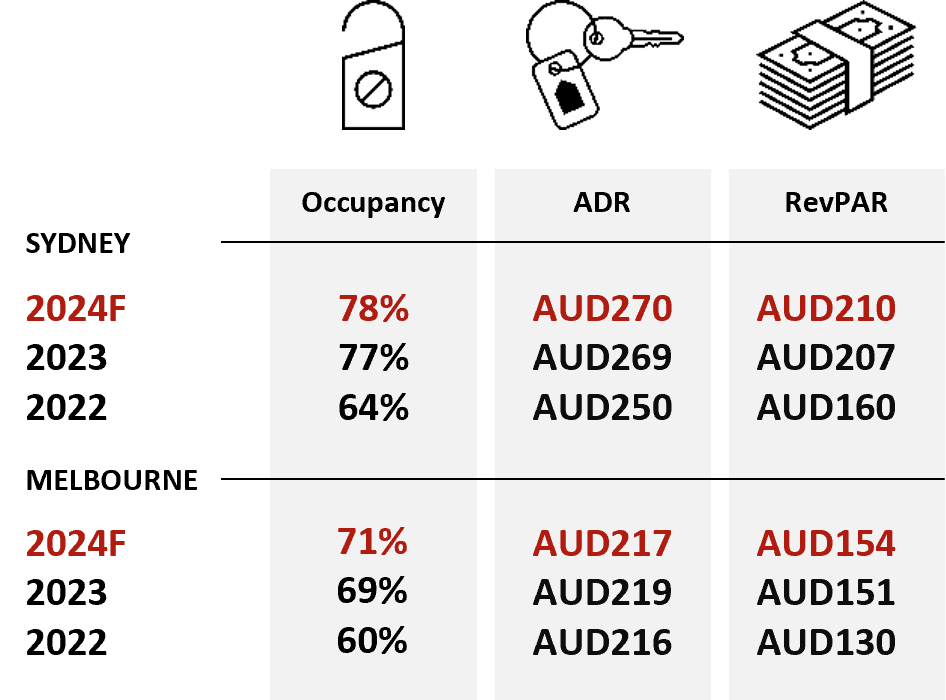

Hotel Performance

Source: HVS Research

As of YTD Aug 2024, Sydney demonstrated strong hotel performance with an increase in occupancy rates (+1.5 percentage points (p.p)), ADR (+2.4%) and RevPAR (+4.4%) as compared to the same time last year. While ADR has decreased by 1.6% in Melbourne, an increase in occupancy rates (+2.5% p.p) translates to an overall growth in RevPAR (2.1%). The ongoing recovery of international travel likely contributed to the increase in metrics while Melbourne might be facing increased competition among hotels leading to downward pressure on rates.

Transactions

From 2019 to YTD Aug 2024, New South Wales (NSW) recorded the highest transaction value followed by Victoria and Queensland. NSW and Victoria, home to Sydney and Melbourne, attract significant investment while Queensland benefits from popular destinations such as Cairns and Gold Coast. High transaction volumes in these states are fueled by thriving tourism and major urban centers.

.png)

Source: HVS Research

China

Key Points

- Tourism contributed 7.3% of GDP in 2023 (RMB9.2 Tn), an increase of 135% from RMB3.9 Tn in 2022, achieving 75.9% of 2019’s tourism contribution

- 4.7% Real GDP growth expected in 2024

- 82.0 million international visitor arrivals recorded in 2023

Highlights

Infrastructure Projects

- RMB57.1 billion China-Central Asia railway to be completed by 2025

- RMB2.0 billion investment plan for cultural and tourism infrastructure by 2027

- RMB35.7 billion Thailand-China railway to be completed by 2028

Notable Transactions

- 82-key Bvlgari Hotel Shanghai sold for RMB2.4 billion (RMB29.6m/key)in Jun 2024

- 185-key Frasers Suites Top Glory Shanghai sold for RMB4.0 billion (RMB21.6m/key) in Nov 2023

- 550-key Westin Beijing Chaoyang sold for RMB2.9 billion (RMB5.2m/key) in Nov 2023

Notable Upcoming Hotel Openings in Beijing and Shanghai (2024)

Top 3 Largest Inventory

- Traders Shanghai Hongqiao Airport, 520-key

- Monogram Shanghai Jingan, 404-key

- Hilton Shanghai Greater Hongqiao, 340-key

Demand

In 2023, China reopened to international tourism, welcoming 82.0 million visitors after three years of border closures. This marks a recovery to more than half of 2019 levels, with international arrivals expected to continue recovering to 2019’s figures, supported by a new visa-free policy for 15 countries which began in Jul 2024 until the end of December 2025. Domestic travel remains dominant, with 4.89 billion recorded domestic travel arrivals in 2023, reaching 81% of 2019 figures. Overall, both international and domestic tourism in China is showing strong signs of recovery.

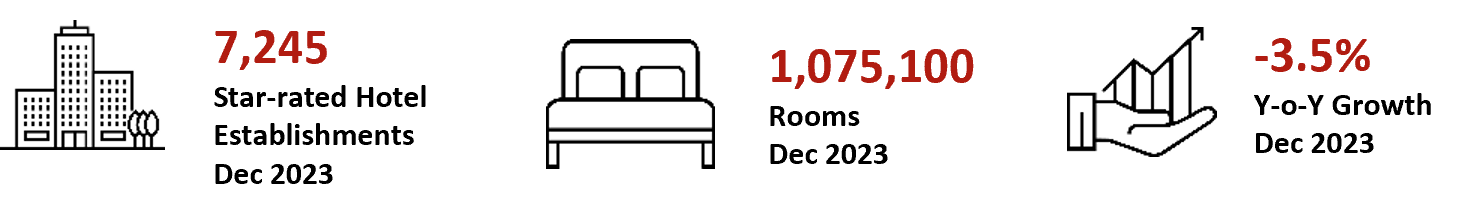

Supply

Source: Ministry of Culture and Tourism of the People’s Republic of China

HVS has noted that going forward, there will be 2,097 additional hotels with approximately 387,712 keys in China by 2028; 259 hotels with approximately 48,737 keys in China will be opened by the end of 2024.

Hotel Pipeline (2024 - 2028)

*Exclude non-branded hotels

Source: HVS Research

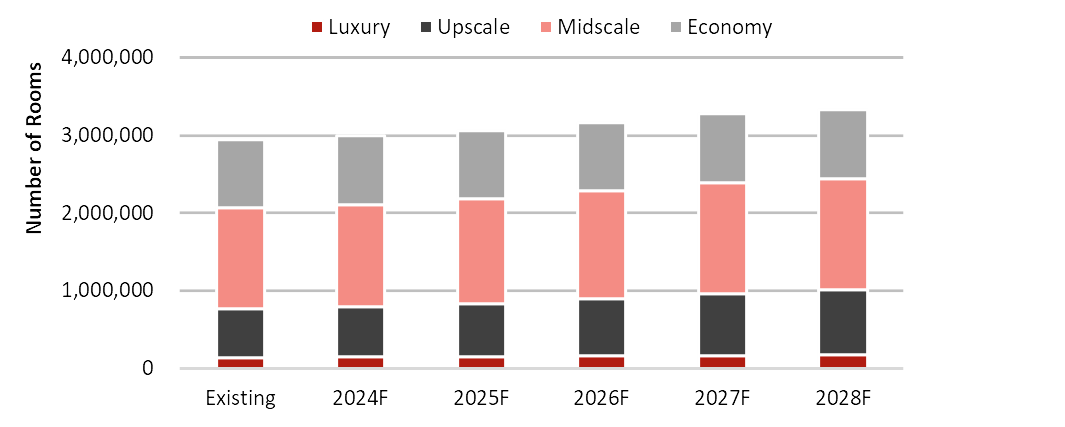

Hotel Performance

Source: HVS Research

As of YTD Aug 2024, Beijing shows an increase in occupancy rate (+3.0 p.p.), a decrease in ADR (-2.7%) and an increase in RevPAR (+1.4%) over the same period last year. Shanghai follows a similar pattern, where occupancy increased by 1.6 p.p., ADR decreased by 2.1% and RevPAR increased by 0.1%. Both markets have shown a remarkable recovery with occupancy rates back to pre-pandemic levels and room rates at 87% of pre-pandemic levels.

Transactions

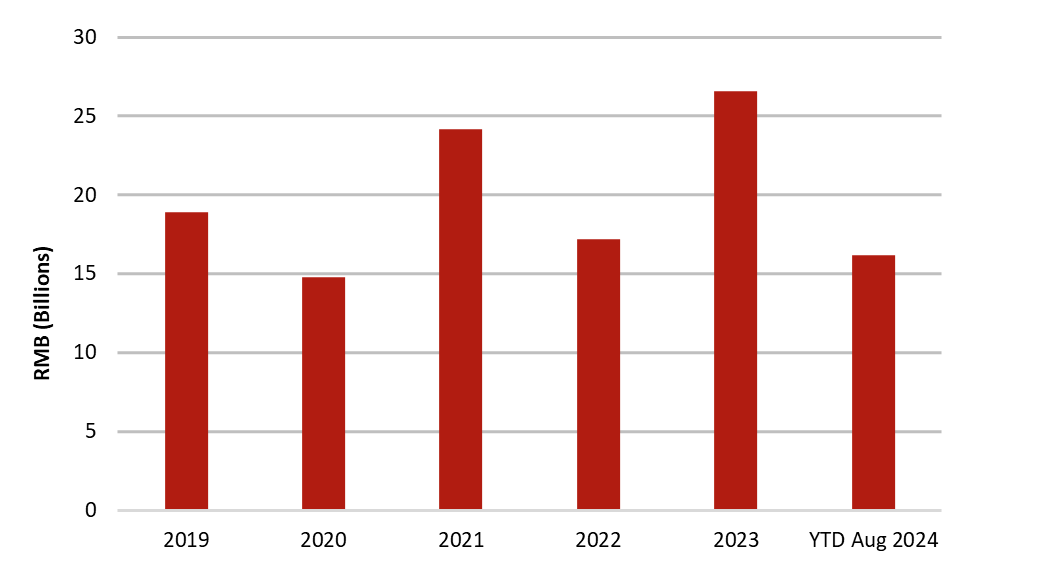

In 2023, the highest number of transactions and transaction volume was recorded, with 97 deals taking place, totaling approximately RMB 26.5 billion – due in part to numerous transactions of branded hotels. YTD Aug 2024 transaction value is 85.6% of 2019’s figure. With a third of the year remaining, 2024 can reasonably be expected to exceed 2019 levels. Overall, market sentiment towards investing in hotels in China remains positive.

Source: HVS Research

Hong Kong

Key Points

- Tourism contributed 9.8% of GDP in 2023 (HKD293.1 Bn), an increase of 99.2% from HKD147.1 Bn in 2022, achieving 80.1% of 2019’s tourism contribution

- 3.2% Real GDP growth is expected in 2024

- 34.0 million international tourist arrivals were recorded in 2023

Highlights

Infrastructure Projects

- HKD110.0 billion Railway Network Expansions by 2030 for extensions of the Tung Chung Line, Tuen Mun South Line, and development of Northern Link and Hung Shiu Kiu Station

- HKD40.0 billion upgrade by 2030 for Hong Kong International Airport Expansion project. The expanded airport is expected to feature the 350,000 square metre SKYCITY automated car parks, autonomous transportation systems, air cargo logistics, and related supporting facilities.

- Plans are underway for the development of the northern regions of Hong Kong to transform the area into a metropolis for work and living with close socio-economic collaboration between Hong Kong and Shenzhen.

Notable Transactions

- 86-key Hillwood House Hotel Tsim Sha Tsui acquired for HKD1.0 billion (HKD11.6m/key) in May 2024

- 56-key The Sheung Wan by Ovolo acquired for HKD320.0 million (HKD5.7m/key) in Jan 2024

- 132-key Butterfly on Victoria acquired for HKD468.0 million (HKD3.5m/key) in Jun 2023

Notable Upcoming Hotel Openings in Hong Kong (2024)

- Metropark Hotel Hung Hom, 536-key

Demand

Hong Kong received a 5,524% increase in international visitor arrivals in 2023 at approximately 34.0 million compared to 2022 at approximately 605,000. Hong Kong’s top source market is China, which represents 78.7% of all arrivals to Hong Kong in 2023. With the recovery of inbound tourism from China and the revenge travel phenomena, Hong Kong’s tourism industry has rebounded significantly. This increased demand is expected to continue as Chinese outbound travel continues to fully recover and global travel demands continue propelling the global tourism industry. This is further evidenced by both short-haul excluding Mainland China and long-haul arrivals to Hong Kong recording 103.6% and 92.1% increases respectively; while new markets comprising of India, Russia, Netherlands, Vietnam, and the Gulf Cooperation Council registering a strong 151.4% growth YTD Jun 2024 compared to YTD Jun 2023. Although, given China’s recent economic slowdowns, a more modest growth trajectory compared to 2023 is expected.

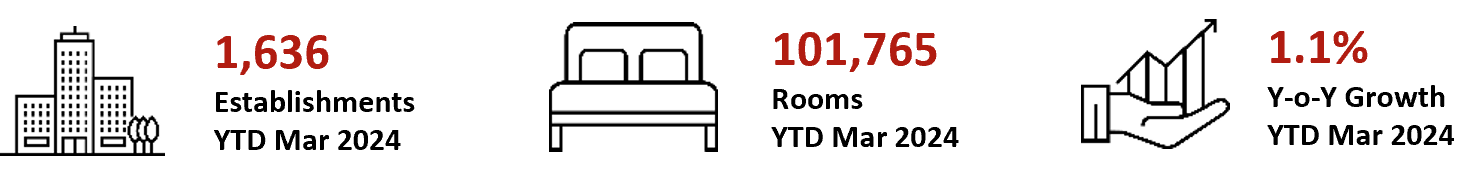

Supply

*Include non-branded hotels and guesthouse

Source: Hong Kong Tourism Board

HVS has noted that there will be four additional hotels with approximately 1,521 keys in Hong Kong by 2028; two hotels with approximately 909 keys will be opened by the end of 2024.

Hotel Pipeline (2024 - 2028)

.png)

*Exclude non-branded hotels

Source: HVS Research

Hotel Performance

Source: Hong Kong Tourism Board and HVS Research

YTD Aug 2024 hotel performance for Hong Kong compared to YTD Aug 2023 shows a strong recovery in occupancy rates (+4.8 p.p), a slight decrease in ADR (-1.3%) and an overall increase in RevPAR (+5.0%). As China’s economic growth has slowed, modest growth is expected for Hong Kong’s hotels as well due to its dependence on Chinese travel.

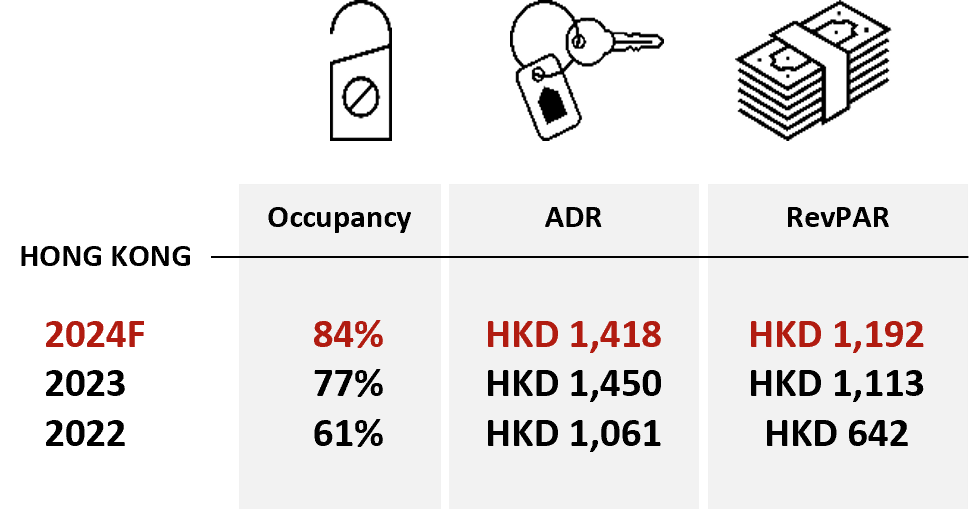

Transactions

Deal frequency was lower in 2023 compared to 2022, but the average transacted value was higher at HKD4.3 million per key in 2023 compared to HKD3.8 million in 2022. YTD Aug 2024 shows an average transacted value of HKD4.7 million per key. Coupled with an increase in the number of transactions, investor sentiments for Hong Kong can taken as positive going forward.

Source: HVS Research

India

.jpg)

Key Points

- Tourism contributed 6.5% of GDP in 2023 (INR19,130 Bn), an increase of 22% from INR15,688 Bn in 2022, and 10% higher than 2019's tourism contribution to GDP

- 7.2% GDP growth is expected in 2024

- 9.2 million international tourist arrivals were recorded in 2023

Highlights

Infrastructure Projects

- The National Infrastructure Pipeline with a projected infrastructure investment of around INR111 trillion (~USD1.5 trillion) during FY2020 - 2025 is underway

- As of 25 September 2024, 1,987 projects are under development

- Number of airports expected to increase from 148 in 2023 to 300 by 2047

Notable Transactions

- 150-key The Golden Palms Resorts and Spa acquired for an undisclosed sum in Jul 2024

- 158-key Courtyard by Marriott Aravali Resort acquired for USD38.0 million (240.5k/key) in Mar 2024

- 275-key hotel in Bengaluru acquired for an undisclosed sum in Jul 2023

Notable Upcoming Hotel Openings in New Delhi, Mumbai, and Bengaluru (2024)

- Holiday Inn Express & Suites Mumbai Powai, 160-key

Demand

The Indian travel industry charted an impressive course of recovery and growth in 2023, buoyed by strong demand from domestic as well as inbound tourism. While revenge travel gradually declined, the leisure segment experienced sustained growth, driven by evolving traveler preferences and a rising interest in unique experiential travel. Inbound tourism displayed promising signs of recovery, with 9.2 million foreign tourist arrivals during the year, marking a remarkable 49% year-on-year growth and just 16% short of 2019 levels.

Supply

Source: HVS Research

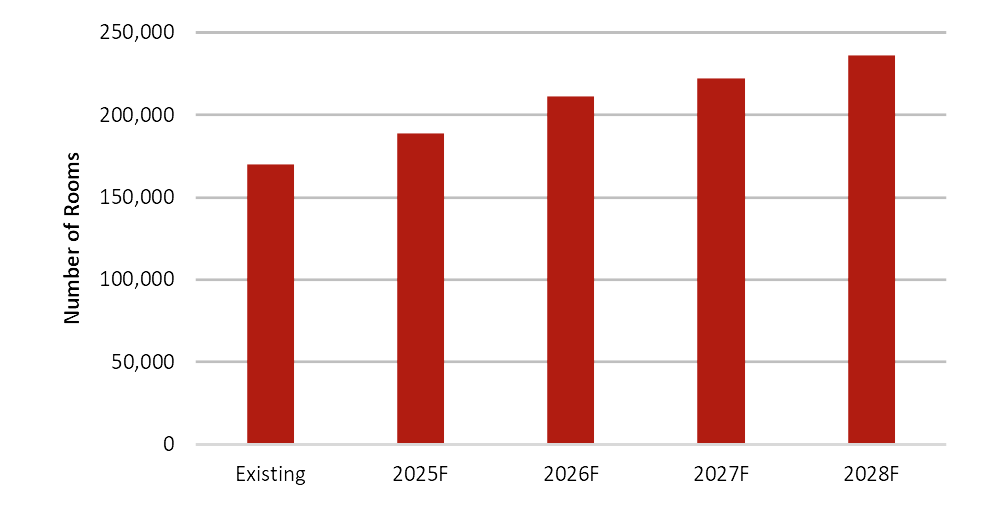

As per HVS estimates, nearly 66,000 additional branded keys will be added to the supply in India by 2028, of which over 18,000 keys are expected to enter the market in 2025. Hoteliers are increasing their focus on leisure destinations, and Tier 3 & 4 cities, due to the significant potential of domestic tourism.

Hotel Pipeline (2024 - 2028)

*Excludes non-branded supply

Source: HVS Research

Hotel Performance

.png)

Source: HVS Research

The resurgence of corporate travel, large-ticket conferences, events and high-profile weddings has fueled the recovery in commercial markets. New Delhi’s hotel occupancy rate increased by 4 percentage points in YTD Aug 2024, while occupancy in Mumbai and Bengaluru remained range-bound to the previous year. New Delhi’s room rates during the period increased by 8%, while room rates in Mumbai and Bengaluru increased by 7% and 4%, respectively.

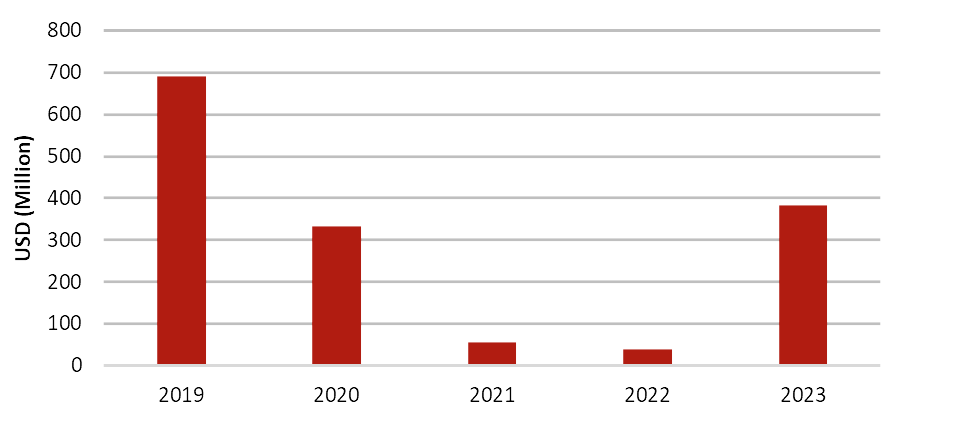

Transactions

In 2023, the hotel investment landscape showed signs of robust recovery, reaching a transaction value upwards of USD382 million across 24 properties. This marked a notable increase from the previous year, reflecting renewed confidence in the hospitality sector, with the momentum continuing into 2024.

Source: HVS Research

Indonesia

Key Points

- Tourism contributed 4.8% of GDP in 2023 (IDR1,007.8 Tn), an increase of 29.5% from IDR778.2 Tn in 2022, achieving 95.9% of 2019’s tourism contribution

- 5.1% Real GDP growth is expected in 2024

- 11.7 million international tourist arrivals were recorded in 2023

Highlights

Infrastructure Projects

- IDR48.0 trillion, memorandum of understanding signed on July 2024 with Eagle Hills from the United Arab Emirates (UAE) for extensive investments in developing hotel properties, airport areas, and tourism destination ecosystems with a key focus on improving Soekarno-Hatta International Airport in Jakarta

- IDR14.0 trillion, development is underway for the Paramount theme park in Bali with an expected completion date of 2025

- IDR324.0 trillion Bali Urban Rail project to be completed in four phases, with the first two phases set to finish in 2031

Notable Transactions

- 50% interest in the 126-key Nawa Resort in Bali was acquired for IDR112.2 billion reflecting the hotel value at IDR224.5 billion (IDR1.8b/key) in Jan 2024

- 160-key BATIQA Hotel Palembang was acquired for IDR51.0 billion (IDR318.8m/key) in Oct 2023

Notable Upcoming Hotel Openings in Bali and Jakarta (2024)

Top 3 Largest Inventory

- New World Grand Bali Resort, 416-key

- Shangri-La The Majnusa Dua Bali, 337-key

- Parkroyal Jakarta, 162-key

Demand

In 2023, international arrivals had a y-o-y increase of 113%. Malaysia remained as the top source market in 2023, contributing 16% to international arrivals. Other top source markets include Australia (12%), Singapore (12%), China(7%), and Timor Leste(6%). YTD Jun 2024 shows a 21% increase in international arrivals from YTD Jun 2023, which is a sign of optimism regarding global travel demand for Indonesia. Overnight hotel guests also show robust recovery with a 17% and 250% growth rate in 2023 for domestic and international guests, respectively. Full recovery for Indonesia’s tourism can reasonably be expected to occur in the coming years.

Supply

*Include non-branded hotels

Source: Statistics Indonesia

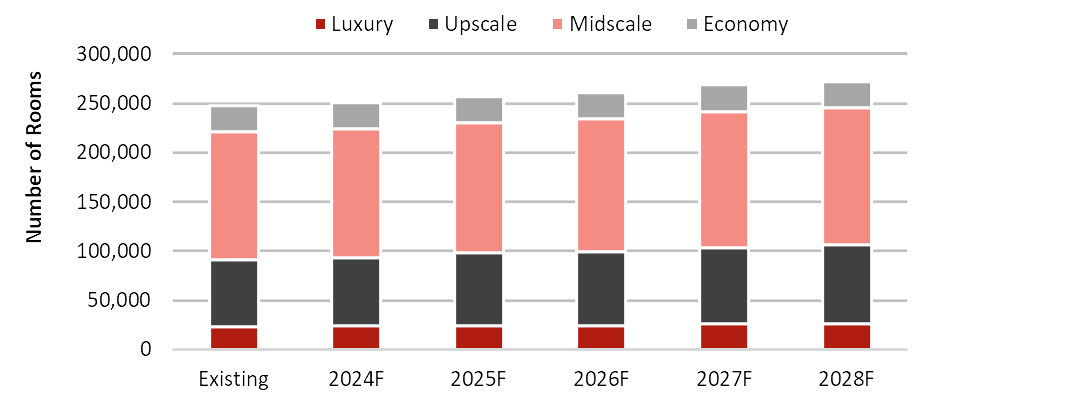

HVS has noted that there will be 144 additional hotels with approximately 24,687 keys in Indonesia by 2028; 19 hotels with approximately 3,044 keys will be opened by the end of 2024.

Hotel Pipeline (2024 - 2028)

*Exclude non-branded hotels

Source: HVS Research

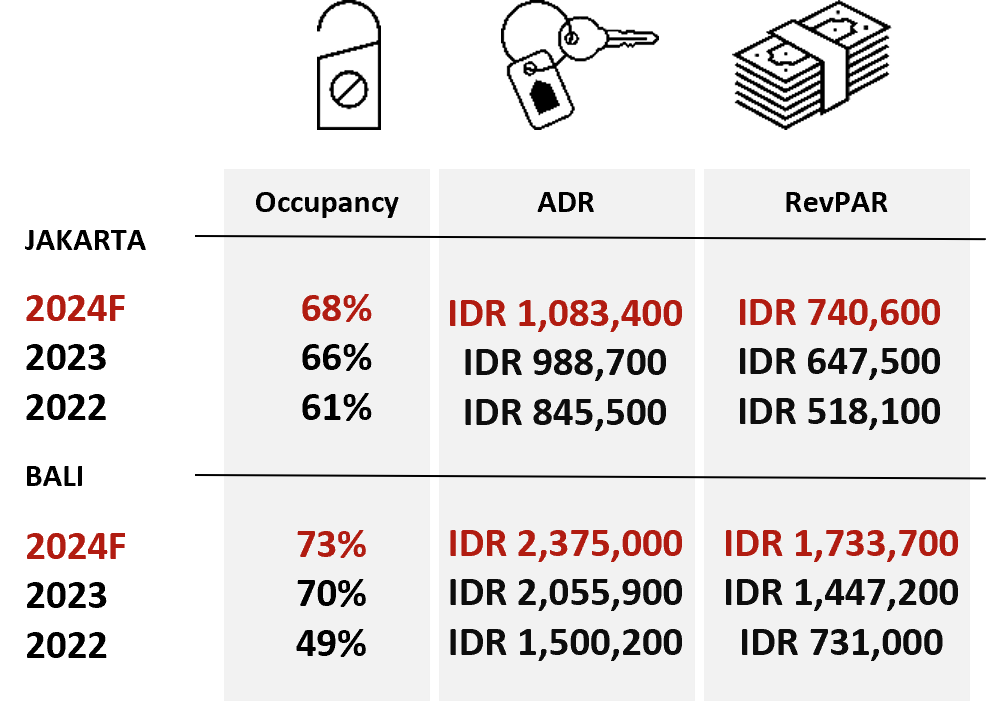

Hotel Performance

Source: HVS Research

YTD Aug 2024 hotel performance for Jakarta has shown improvements for occupancy rates (+3.6 p.p), ADR (+11.2%) and ADR (+17.8%) from the same time last year. Bali also shows similar improvement in occupancy rates (+3.5 p.p), ADR (+15.7%) and RevPAR (+21.5%). Recovering domestic travel to Jakarta and a global increase in demand for Bali from newer key source markets such as Russia will continue to spur growth for hotels in these two markets.

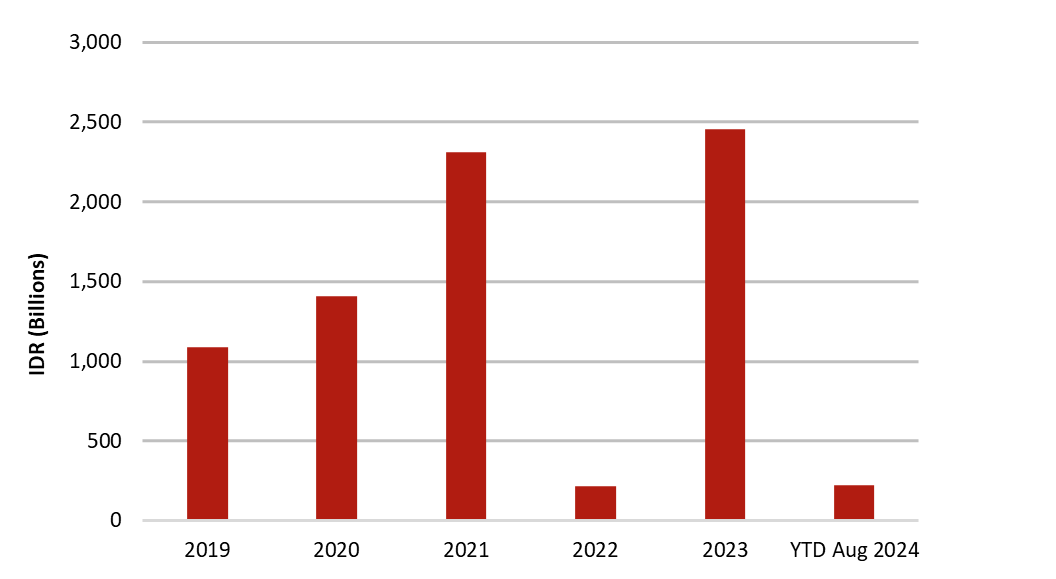

Transactions

2023 recorded the highest transaction value of IDR2.45 trillion from three transactions. There were two transactions in YTD Aug 2024, both were independent hotels. Nawa Resort was sold for IDR224.45 billion, and the Grand Zuri Pematangsiantar was sold for an undisclosed sum.

Transaction Value Recorded by Year (2019 - YTD Aug 2024)

Source: HVS Research

Japan

Key Points

- Tourism contributed 7.1% of GDP in 2023 (JPY41.8 Bn), an increase of 34.4% from JPY31.1 Bn in 2022, achieving 99% of 2019’s tourism contribution

- 0.5% Real GDP growth expected in 2024

- 25.1 million international tourist arrivals were recorded in 2023

Highlights

Infrastructure Projects

- JPY81.0 billion public transport improvement works for Osaka Metro Chuo Line to Yumeshima Station at Osaka by 2025

- JPY165.0 billion development for Osaka Kansai Expo by 2025

- Osaka’s JPY1.1 trillion casino-centered integrated resort by 2030

- JPY900.0 billion redevelopment of former Tsujiki Fish Market by 2032

- JPY500.0 billion development of new subway lines in Tokyo by 2040

Notable Transactions

- 1,052-key Hilton Fukuoka Seahawk acquired for JPY70.0 billion (JPY66.5 million/key) in Aug 2024

- 735-key Hoshino Resorts Risonare Tomamu & The Tower acquired for JPY27.9 billion (JPY38.0 million/key) in Jun 2024

- 436-key OMO7 Osaka acquired for JPY29.0 billion (JPY66.5 million/key) in Jun 2024

Notable Upcoming Hotel Openings in Tokyo & Osaka (2024)

Top 3 Largest Inventory

- APA Hotel & Resort Osaka Namba Station Tower, 2055-key

- KOKO Hotel Osaka Japan Bridge Namba, 255-key

- YOTEL Tokyo Ginza, 244-key

Demand

In 2023, total international arrivals reached 25.1 million, marking 54.1% increase from 3.8 million recorded in 2022. YTD Jul 2024 data shows a 61.7% rise in international arrivals from the same time last year, underscoring a strong recovery in global travel. The surge in visitors to Japan has brought attention to the issue of overtourism. To mitigate the impact, authorities plan to introduce precautionary guidelines by the end of this year. One key strategy involves encouraging tourists to explore lesser-known prefectures, rather than concentrating solely on popular destinations like Tokyo, Osaka, and Kyoto.

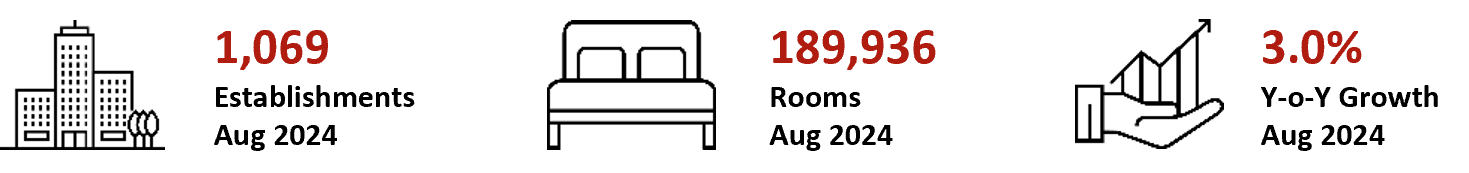

Supply

*Include non-branded hotels

Source: HVS Research

HVS has noted that there will be 88 additional hotels with approximately 15,641 keys by 2028; 9 properties with a total of approximately 3,437 rooms will open by the end of 2024.

Hotel Pipeline (2024 - 2028)

.png)

*Exclude non-branded hotels

Source: HVS Research

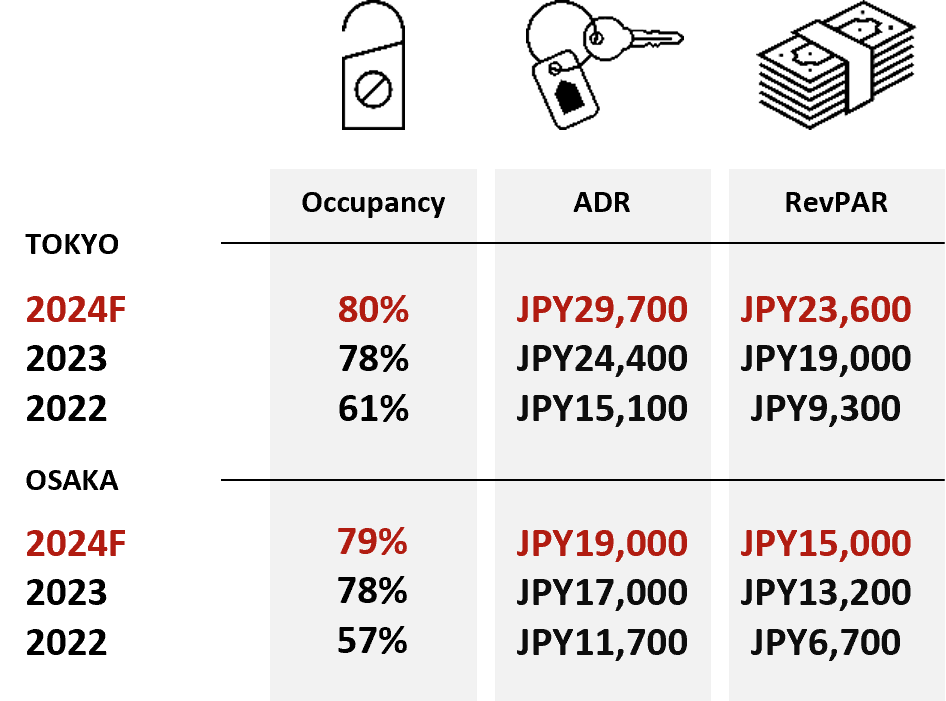

Hotel Performance

Source: HVS Research

As of YTD Aug 2024, Tokyo demonstrated strong hotel performance with an increase in occupancy rates (+2.2 p.p.), ADR (+24.4%) and RevPAR (+27.9%) as compared to the same time last year. Similarly, Osaka registered an increase in occupancy rates (+1.5 p.p), ADR (+13.3%) and RevPAR (+15.5%). As one of the last major economies to lift travel restrictions, pent-up demand from international visitors has driven a sharp increase in visitor numbers. This rebound is further amplified by the weakened yen.

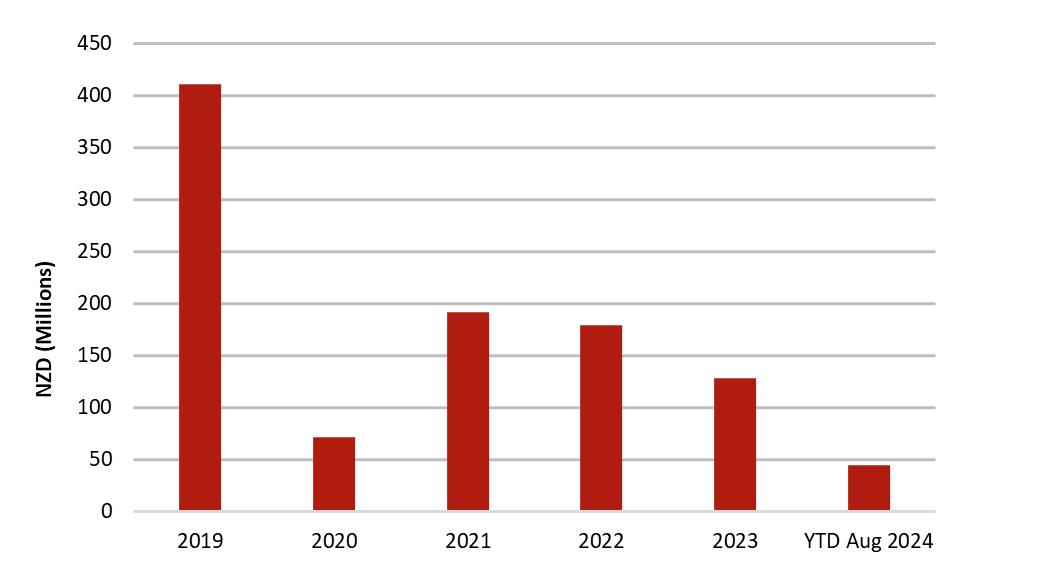

Transactions

2023 recorded the highest transaction value of JPY404 billion with 61 transactions. The surge in transaction volume and the number of transactions signifies the country’s successful recovery from the pandemic. Additionally, the weakening of the yen has played a pivotal role in this uptick as it has made investments more appealing, especially to foreign buyers.

Transaction Value Recorded by Year (2019 - YTD Aug 2024)

.png)

Source: HVS Research

Malaysia

Key Points

- Tourism contributed 8.6% of GDP in 2023 (MYR157 Bn), an increase of 97.8% from MYR79.4 Bn in 2022, achieving 80.2% of 2019’s tourism contribution

- 4.4% Real GDP growth expected in 2024

- 20.1 million international tourist arrivals recorded in 2023

Highlights

Infrastructure Projects

- MYR10.0 billion four-kilometre Singapore – Johor Bahru Rapid Transit System Link project expected to complete by end 2026

- MYR1.5 billion expansion of Penang Airport to be completed by 2028

- MYR10.5 billion light rail transit line in Penang to be completed by 2030

Notable Transactions

- 284-key Courtyard by Marriott Melaka transacted for MYR160 million (MYR563k/key) in Jul 2024

- 150-key W Hotel Kuala Lumpur transacted for MYR270 million (MYR1.8m/key) in Mar 2024

- 199-key Courtyard by Marriott Penang transacted for MYR165 million (MYR829k/key) in Jan 2024

Notable Upcoming Hotel Openings in Kuala Lumpur and Langkawi (2024)

- 8 Conlay Kempinski Hotel Kuala Lumpur, 560-key

- Park Hyatt Kuala Lumpur, 252-key

Demand

Malaysia’s tourist arrivals doubled in 2023 at 20.1 million when compared to 2022 at 10.1 million thanks in large part to the removal of travel restrictions globally, and within Malaysian states themselves. YTD Jun 2024 also records a 28.9% increase in arrivals at 11.8 million compared to YTD Jun 2023 at 9.2 million. This indicates that demand for Malaysia as a tourist destination is strong, propelling a growth in the industry and would lead to carry-on effects for hotel occupancy rates as well. The top source markets as of Jun 2024 for international travellers to Malaysia are Singapore (36.2%), Indonesia (15.1%) and China (12.3%). Domestic travel also saw a 24.6% year-on-year growth in 2023.

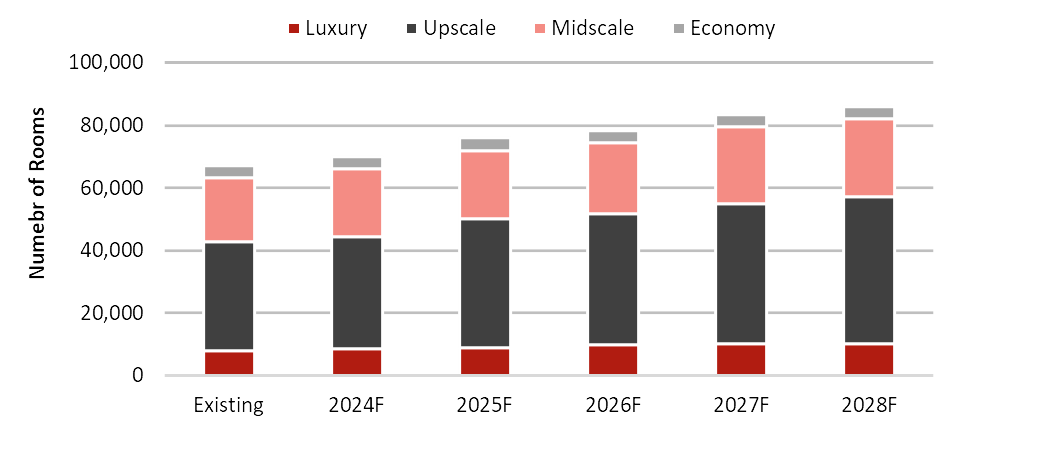

Supply

*Include non-branded hotels

Source: HVS Research

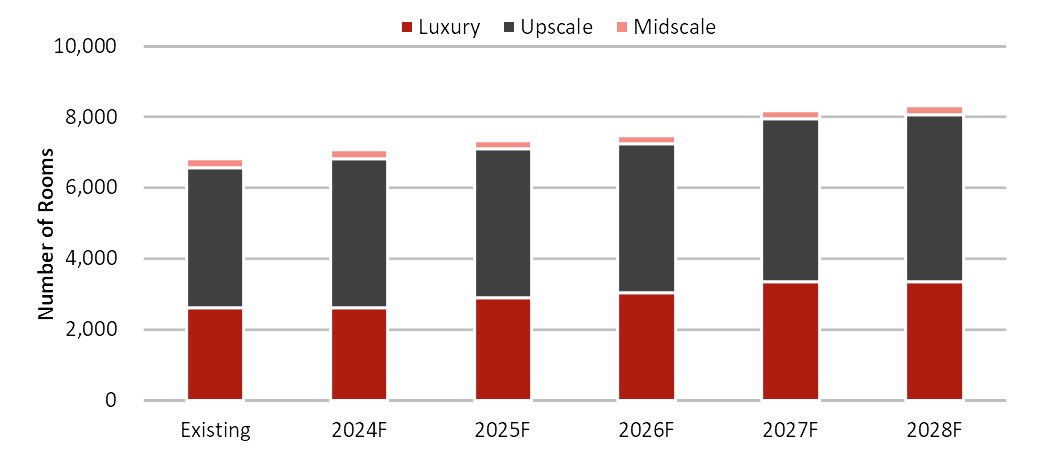

HVS has noted that going forward, there will be 64 additional hotels with approximately 18,832 keys in Malaysia by 2028; 13 properties with a total of approximately 2,850 rooms is expected to open by the end of 2024.

Hotel Pipeline (2024 - 2028)

*Exclude non-branded hotels

Source: HVS Research

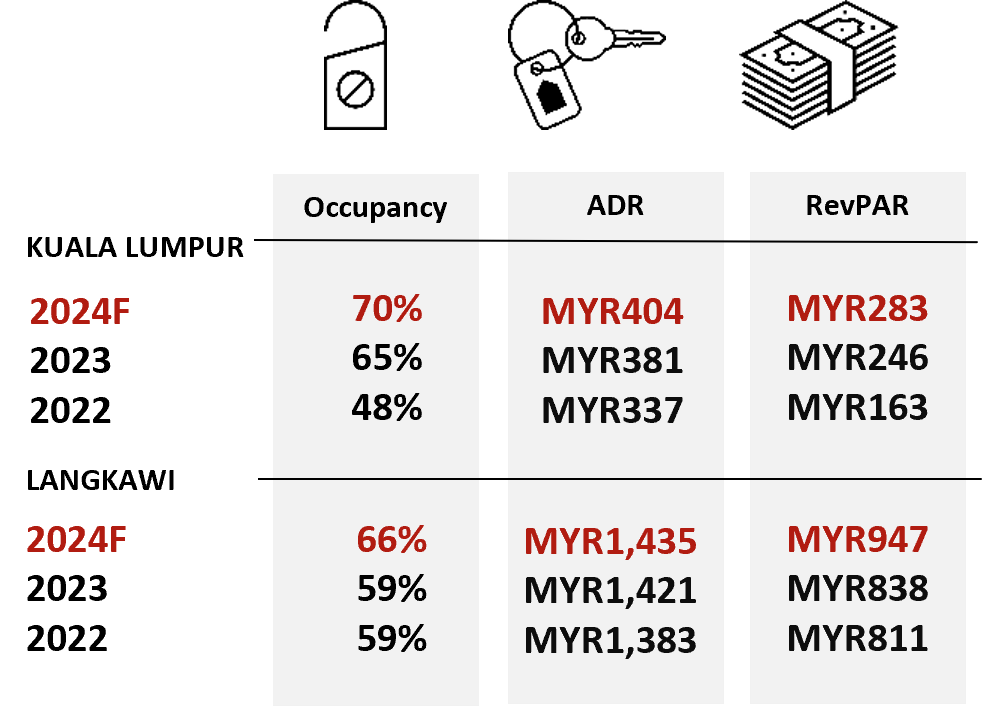

Hotel Performance

Source: HVS Research

As of YTD Aug 2024, Kuala Lumpur showed improvement in hotel performance metrics across occupancy rates (+5.9 p.p.), ADR (+7.8%), and RevPAR (+17.8%) as compared to the same time last year. Since the pandemic until now, Langkawi has displayed a robust recovery with stable and continuous increases in RevPAR year over year. Stronger performances for both markets are expected in 2024; Langkawi in particular due to growing global demand for resort destinations.

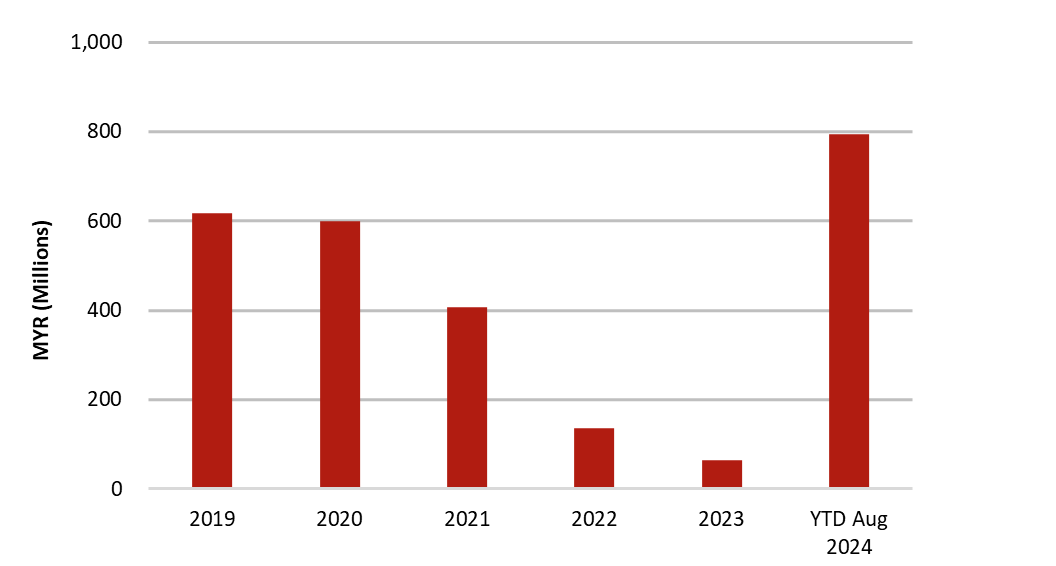

Transactions

YTD Aug 2024 records the highest transaction value in the time period of 2019 to YTD Aug 2024 at MYR795 million. The reason for this is the sale of multiple branded hotels in the year. This increase in recorded transaction value reflects the positive market sentiment towards investing in hospitality assets given the rapidly recovering tourism industry.

Transaction Value Recorded by Year (2019 - YTD Aug 2024)

Source: HVS Research

Maldives

Key Points

- Tourism contributed 58.9% of GDP in 2023 (USD 4.2 Bn), an increase of 10.6% from USD3.8 Bn in 2022, surpassing 2019’s tourism contribution by 34.5%

- 5.2% Real GDP growth is expected in 2024

- 1.9 million international tourist arrivals were recorded in 2023

Highlights

Infrastructure Projects

- USD137.0 million redevelopment of Hanimaadhoo International Airport to be completed by 2025

- USD29.0 million expansion of Gan International Airport expected to be completed by 2025

- USD500.0 million construction of Thilamale Bridge to be completed by 2026

- Multibillion expansion of Velana International Airport expected to be completed by 2050

- USD80.0 million reclamation and shore protection project in Addu city

Notable Transactions

- 120-key Amari Havodda Maldives acquired for USD60.0 million (USD500.0k/key) in Jul 2023

Notable Upcoming Resort Openings in the Maldives (2024)

- Centara Mirage Lagoon Maldives, 145-key

- dusitD2 Feydhoo, 110-key

Demand

In 2023, international arrivals recorded a 12.1% increase from 1.7 to 1.9 million arrivals from 2022. YTD Jun 2024 data shows a 9.2% increase in international arrivals from YTD Jun 2023. The robust growth in tourist arrivals underscores the Maldives’ resilience and ongoing appeal as a top travel destination. In 2023, the top three source markets of Maldives were Russia and India with 14.4% and China with 10% but YTD Jun 2024 data shows that India has contributed only 6% of total visitors, a huge dip from 14.4% which could be attributed to increasing political tensions between Maldives and India.

Supply

*Include non-branded hotels

Source: The Maldives Ministry of Tourism

HVS has noted that there will be 14 additional hotels with approximately 1,498 keys in the Maldives by 2028. This includes two properties with a total of approximately 245 rooms which will open by the end of 2024.

Hotel Pipeline (2024 - 2028)

*Exclude non-branded hotels

Source: HVS Research

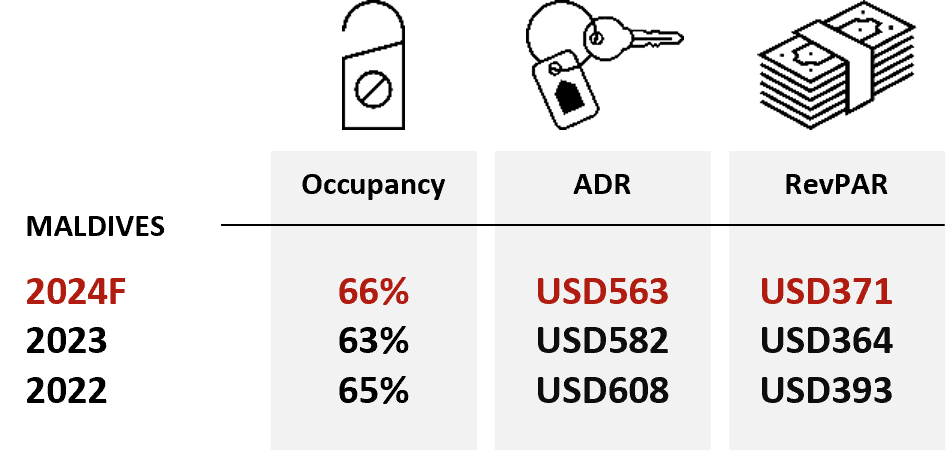

Resort Performance

Source: HVS Research

As of YTD Aug 2024, Maldives experienced an increase in occupancy rate (+1.8 p.p) and RevPAR (+0.2%) but a decrease in ADR (-2.5%) as compared to 2023. The slight increase in occupancy and decline in ADR could be due to hotels pursuing a pricing strategy to match guesthouse pricing as visitors are opting for less expensive accommodation.

Transactions

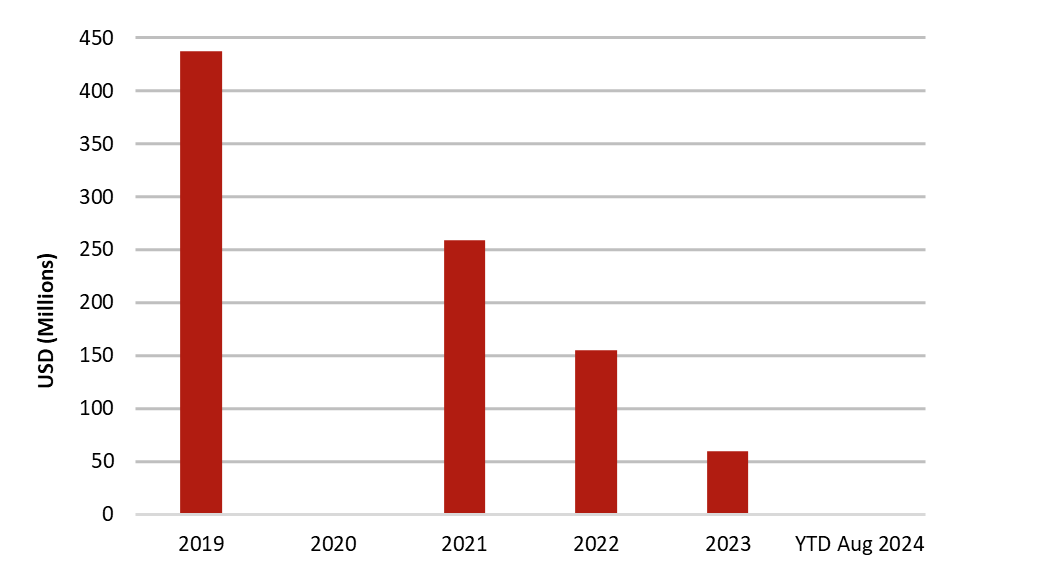

In the past five years, 2019 recorded the highest transaction value and number of transactions, amounting to USD437.5 million from five transactions. Against the backdrop of high interest rates and macroeconomic uncertainties, hotel investment activity in Maldives has slowed. As of YTD Aug 2024, there is no transaction.

Transaction Value Recorded by Year (2019 - YTD Aug 2024)

Source: HVS Research

New Zealand

Key Points

- Tourism contributed 9.1% of GDP in 2023 (NZD46 Bn), an increase of 16.1% from NZD39.6 Bn in 2022, achieving 90% of 2019’s tourism contribution

- 1.0% Real GDP growth is expected in 2024

- 3.0 million international tourist arrivals were recorded in 2023

Highlights

Infrastructure Projects

- NZD3.9 billion Auckland Airport Expansion with new domestic terminal by 2028/29

- NZD600.0 million over-station development above Auckland’s City Rail Link station

- NZD750.0 million convention centre project in Auckland’s CBD by Dec 2027

Notable Transactions

- 21-key Moose Lodge Estate acquired for NZD15.2 million (NZD723.8k/key) in Apr 2024

- 25-key Hotel De Brett acquired for NZD21.0 million (NZD840.0k/key) in Jan 2024

- 106-key DoubleTree by Hilton Wellington acquired for NZD40.0 million (NZD377.4k/key) in Sep 2023

Notable Upcoming Hotel Openings in Auckland (2024)

- Hotel Indigo Auckland, 225-key

- TRIBE Auckland Fort Street, 60-key

Demand

In 2023, New Zealand recorded a total of 3.0 million in international tourist arrivals, a 106% rise from 2022, largely driven by post-pandemic travel and the 2023 FIFA Women’s World Cup. By mid-2024, arrivals reached 1.6 million, surpassing the previous year by 300,000. Australia, the USA and the UK remained the top source markets. New Zealand is now focusing on promoting off-peak tourism to distribute visitors throughout the year. In addition, Tourism New Zealand announced a four-year strategy aimed to grow the country’s food and drink tourism sector, encouraging visitors to explore local cuisine all year round.

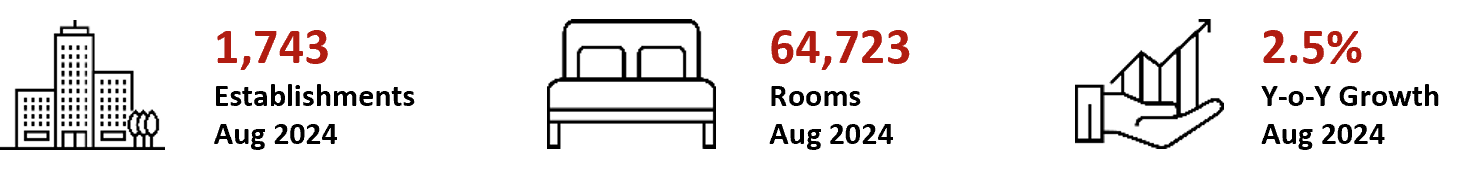

Supply

*Include non-branded hotels

Source: HVS Research

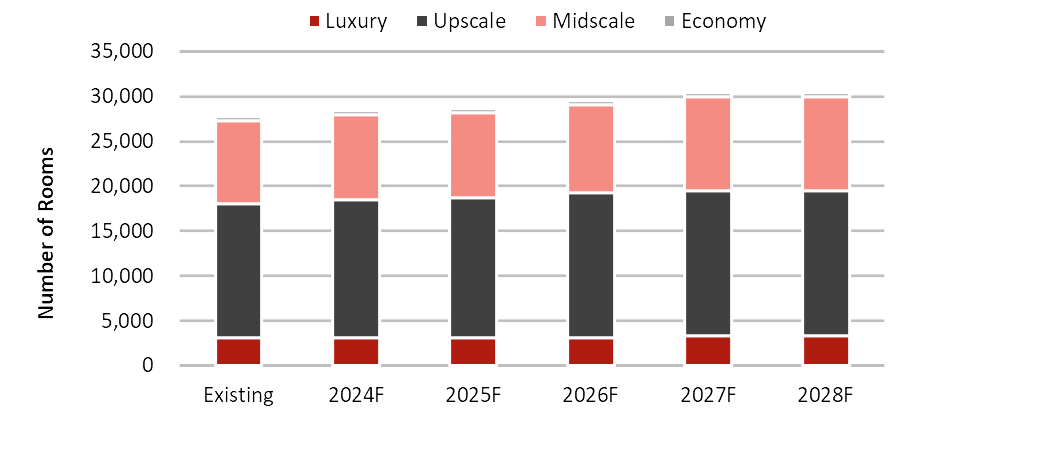

HVS has noted that there will be 15 additional hotels with approximately 2,627 keys in New Zealand by 2028; Four properties with a total of approximately 699 rooms will open by the end of 2024.

Hotel Pipeline (2024 - 2028)

*Exclude non-branded hotels

Source: HVS Research

Hotel Performance

Source: HVS Research

As of YTD Aug 2024, Auckland experienced a decrease in occupancy rate (-4.0 percentage points (p.p)), ADR (-8.0%) and RevPAR (-13.4%) as compared to 2023. The decline across all metrics could be attributed to New Zealand’s off-peak season, typically from Mar to Aug. Additionally, an increase in accommodation supply leads to intensified competition, resulting in lower occupancy and room rates.

Transactions

There were eight transactions recorded in 2023 as compared to two transactions in 2022. However, the transaction volume in 2023 was lower by 28.3% as most transactions were between the range of NZD7 to NZD20 million with the exception of the sale of DoubleTree by Hilton Wellington at NZD40 million. In contrast, 2022 oversaw the sale of Stamford Plaza Auckland at NZD170 million.

Transaction Value Recorded by Year (2019 - YTD Aug 2024)

Source: HVS Research

Philippines

Key Points

- Tourism contributed 17.9% of GDP in 2023 (PHP4.3 Tn), an increase of 83.6% from PHP2.7 Tn in 2022, achieving 86% of 2019’s tourism contribution

- 5.4% Real GDP growth expected in 2024

- 5.5 million international tourist arrivals recorded in 2023

Highlights

Infrastructure Projects

- PHP740.0 billion Bulacan Airport by 2025, backed by San Miguel Corporation

- PHP38.0 billion Malolos-Clark Railway project to be completed by 2025

- PHP2.0 billion Laoag International Airport upgrades to be completed by 2025

Notable Transactions

- 498-key The Peninsula Manila was acquired for PHP319.4 million (PHP641.3k/key) in December 2023

Notable Upcoming Hotel Openings in Manila (2024)

- Somerset Valero Makati, 184-key

Demand

5.45 million visitor arrivals were recorded in the Philippines in 2023, representing just over double the 2022 figure of 2.65 million. The surge in visitor arrivals was spurred by global easing of pandemic-related travel restrictions that were still in place in 2022. The top source markets for the Philippines in 2023 were South Korea at 26.6% of the total share, USA at 16.6%, and Japan at 5.6%. YTD Jul 2024 figures show that Japan has been replaced as the third largest source market by China at 6.2% with South Korea and USA keeping their respective positions with little difference in their share of the market. The source markets experiencing the fastest growth for the Philippines are China, Japan and South Korea which grew 54.0%, 36.9%, and 14.0% respectively when compared to YTD Jul 2023 figures. Domestic travel in 2023 has surpassed 2019 levels, with total arrivals at 99.0% of 2019 levels. 2024 is expected to continue on this trajectory of growth, indicating a full recovery and beyond for the Philippines.

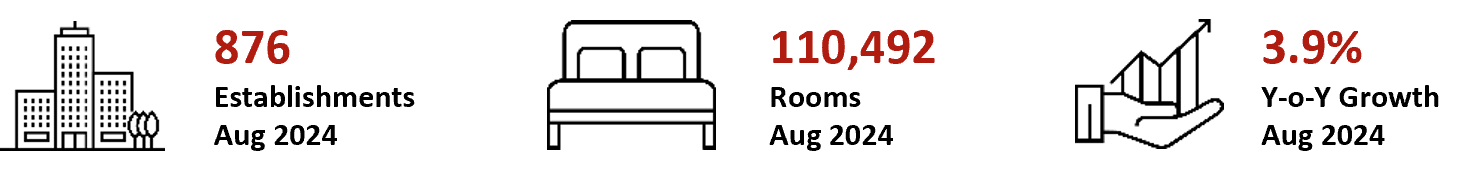

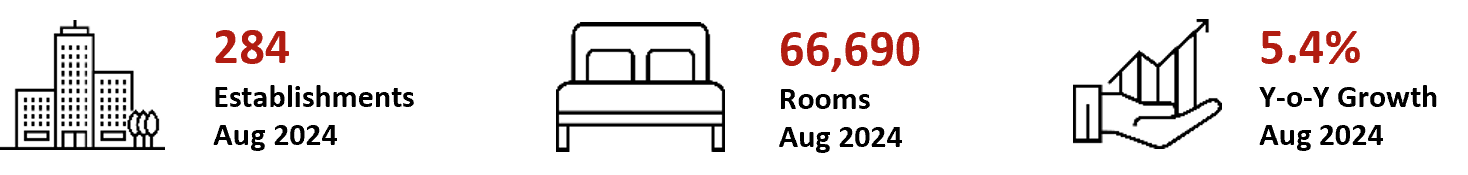

Supply

*Include non-branded hotels

Source: HVS Research

HVS has noted that going forward, there will be an additional 18 hotels amounting to 4,411 keys by 2028 with one 184-key hotel, the Somerset Valero Makati, opening in 2024.

Hotel Pipeline (2024 - 2028)

.png)

*Exclude non-branded hotels

Source: HVS Research

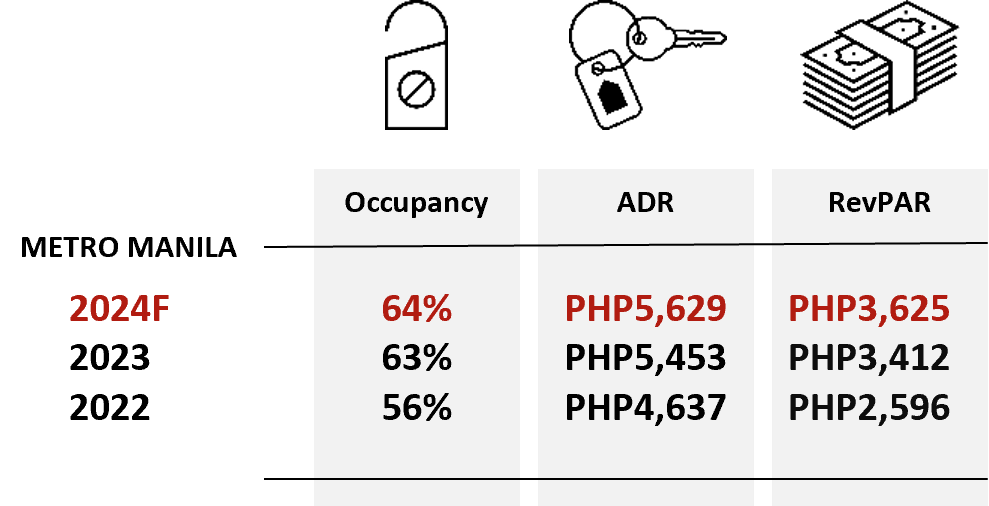

Hotel Performance

Source: HVS Research

YTD Aug 2024 hotel performance for Metro Manila registered a 2.3 p.p. growth in occupancy rates, 1.7% increase in ADR, and a 5.5% improvement in RevPAR compared to same time last year. This growth is expected to continue for Metro Manila as events and business travel to the region is expected to pick up steam, contributing to further growth in tourist arrivals.

Transactions

There have been no transactions as of YTD Aug 2024. Transactions volume in 2023 was a record high, with a portfolio of 14 hotels being acquired for PHP4.4 billion from Red Planet Hotels in 2023. Excluding this large portfolio, 2023 had only one other transaction – The Peninsula Manila was acquired for PHP320 billion in December 2023. This increase in transaction activity exhibits the positive sentiment toward investing in the Philippines’ hospitality industry.

Singapore

Key Points

- Tourism contributed 8.9% of GDP in 2023 (SGD58.4 Bn), an increase of 42.7% from SGD18.3 Bn in 2022, achieving 88% of 2019’s tourism contributions

- 2.4% Real GDP growth is expected in 2024

- 13.6 million international tourist arrivals were recorded in 2023

Highlights

Infrastructure Projects

- Disney Cruise Line is expected to set sail from Singapore Marina Bay Cruise Center in 2025

- Resorts World Sentosa's expansion, adding 700 hotel rooms, a new gateway and updates to Universal Studios, is expected to soft open by late 2025

- New Science Centre Singapore in Jurong Lake District expected to open in 2027

- Porsche Experience Centre located next to Changi Exhibition Centre to open in 2027

- Marina Bay Sands to complete its fourth tower by Jul 2029

- Expected completion of the Cross Island Line (CRL) MRT Line by 2030

- Construction of Changi Airport Terminal 5 will begin in 2025 and is expected to be operational by mid-2030s

Notable Transactions

- 313-key Capri by Fraser Changi City acquired for SGD170.0 million (SGD543.1k/key) in May 2024

- 134-key Hotel Telegraph Singapore acquired for SGD180.0 million (SGD1.3m/key) in May 2024

- 308-key Hotel G Singapore acquired for SGD238.0 million(SGD772.7k/key) in Jan 2024

Notable Upcoming Hotel Openings in Singapore (2024)

- The Standard Singapore, 143-key

- Raffles Sentosa Resort & Spa, 62-key

Demand

In 2023, visitor arrivals recorded a y-o-y increase of 115.8%. YTD Jun 2024 observed 8.2 million arrivals, a 31.2% increase compared to the same period in 2023.

In 2023, the top five source markets were Indonesia (16%), China (10%), Australia (8%), India (8%), and Malaysia (7%). Compared to 2022, while Indonesia, Australia, India, and Malaysia remained part of the top source markets, Philippines is no longer top 5 contributor to Singapore’s international arrivals. Instead, China has re-emerged as the 2nd top source markets.

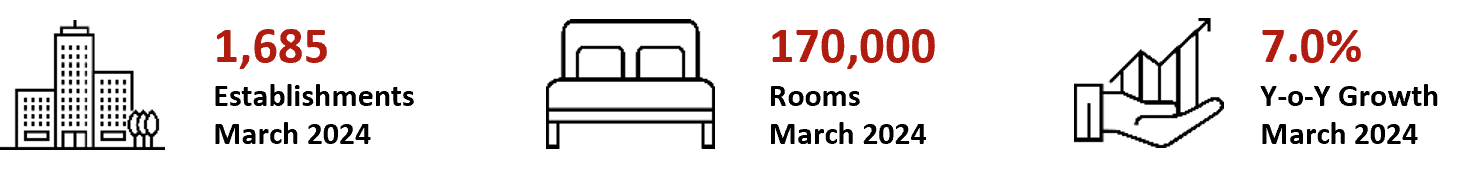

Supply

*Include non-branded hotels

Source: Singapore Tourism Board

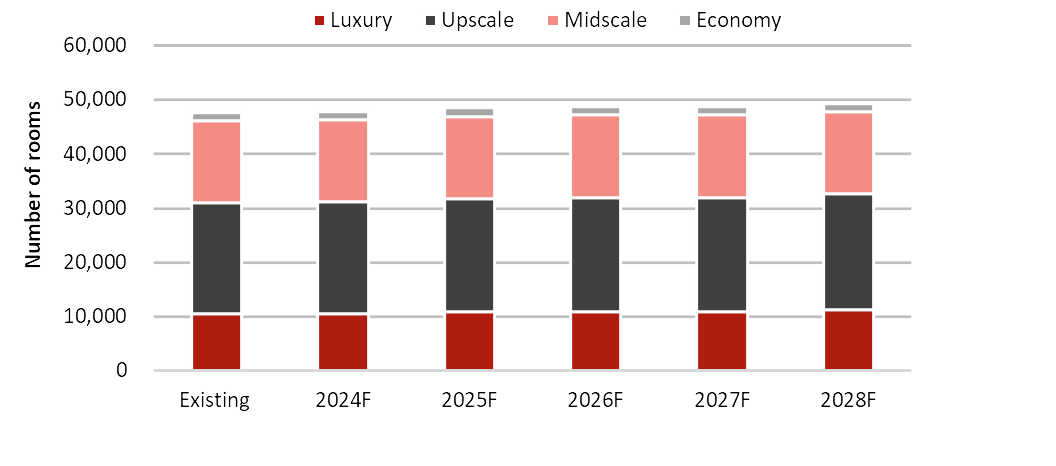

HVS notes that there will be 9 additional hotels with 1,677 keys in Singapore by 2028, including two hotels with 205 keys opening in 2024.

Hotel Pipeline (2024 - 2028)

*Exclude non-branded hotels

Source: HVS Research

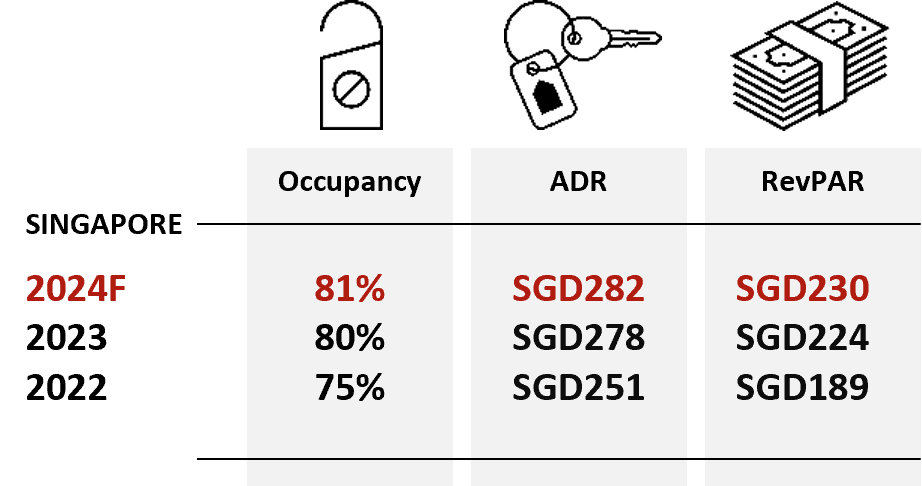

Hotel Performance

Source: HVS Research

In YTD Aug 2024, occupancy saw a slight drop of 0.2 p.p., while ADR saw a marginal increase of 2.2%, resulting a 1.9% increase for RevPAR as compared to the same time last year.

This may suggest that the market's recovery from COVID-19 has reached a mature stage. Moving forward, with key events in 2H2024, such as the F1 Singapore Grand Prix, Singapore is expected to sustain its growth.

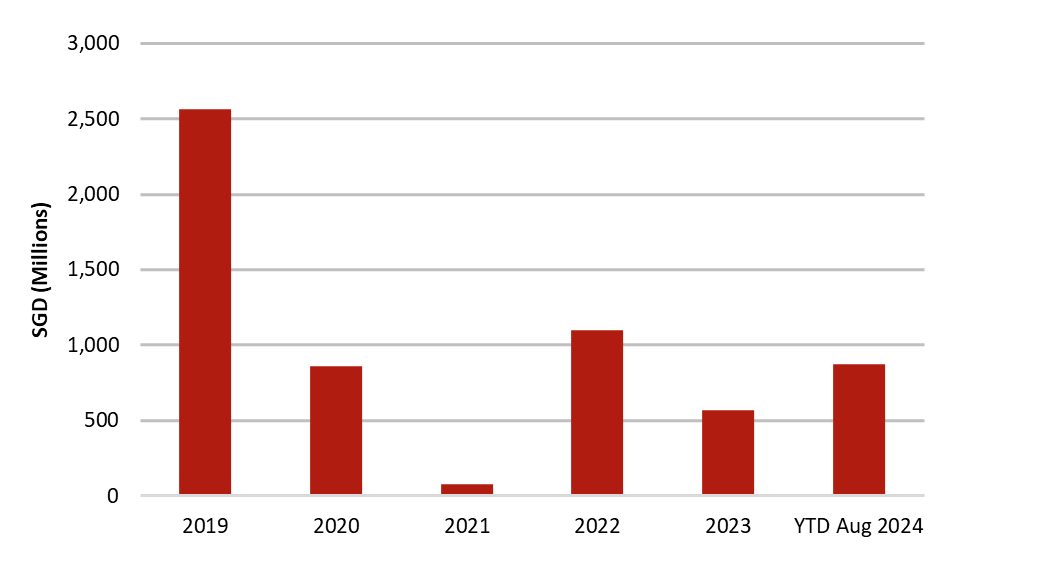

Transactions

In the past five years, while 2019 recorded the highest transaction value, 2022 recorded the highest number of hotel transactions.

- In 2019, ten hotels were transacted at SGD2.57 billion.

- In 2022, 14 hotels were transacted for a total of SGD1.10 billion.

In YTD Aug 2024, there were five hotel transactions for a total of SGD548 million.

Transaction Value Recorded by Year (2019 - YTD Aug 2024)

Source: HVS Research

South Korea

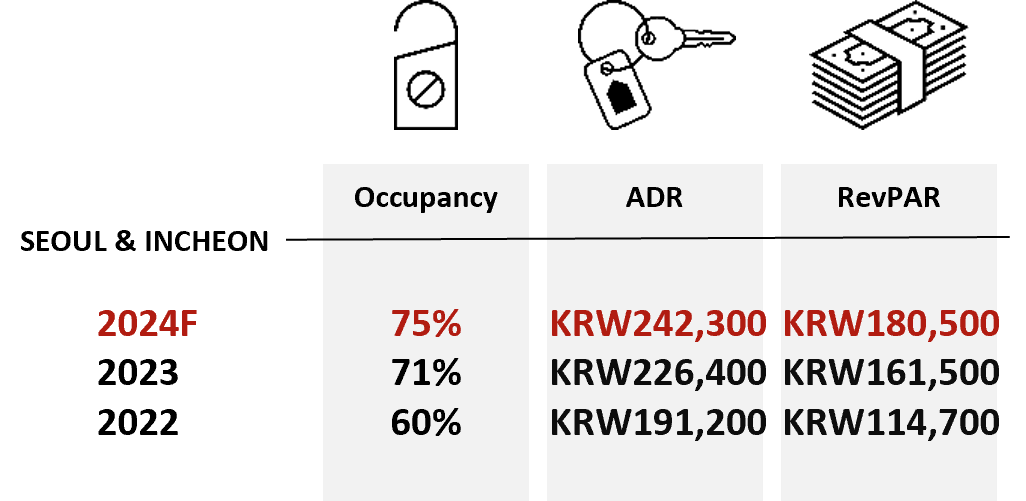

Key Points

- Tourism contributed 3.8% of GDP (KRW84.7 Tn) in 2023, an increase of 18.2% from KRW76.7 Tn in 2022, achieving 94% of 2019’s tourism contribution

- 2.6% Real GDP growth is expected in 2024

- 11.0 million international tourist arrivals were recorded in 2023

Highlights

Infrastructure Projects

- KRW4.8 trillion development on Incheon International Airport Expansion by end of 2024

- KRW13.5 trillion construction of major roads and railways including Seoul-Sejong Expressway by 2024

- KRW4.1 trillion expansion of New Jeju International Airport by 2025

Notable Transactions

- 434-key Conrad Seoul Hotel transacted at KRW400 billion (KRW921.7 m/key) in Aug 2024

- 50% interest in 120-key Hotel Prima Seoul acquired for KRW232 billion, reflecting the hotel value at KRW464 billion (KRW3.9b/key) in May 2024

- 576-key Tmark Grand Hotel Myeongdong, transacted at KRW228 billion (KRW396.2m/key) in Mar 2024

No hotel openings in the rest of 2024

Demand

In 2023, international arrivals recorded a 245% increase, from 3.2 million in 2022 to more than 11.0 million in 2023. Japan rose to the top source market, accounting for 23.4% of the total international arrivals. Benefited by the Jeju visa-free scheme, China has also quickly rebounded to second place, accounting for 20.4% of the total inbound travellers. United States came to the third place and contributed 14.8%. The South Korean government has been releasing various tourism schemes, including waiving visa fees for countries such as China, Vietnam, and Indonesia to stimulate the tourism industry. As of YTD July 2024, international arrivals to South Korea reached 9.1 million, already exceeding 80% of the total number recorded in 2023.

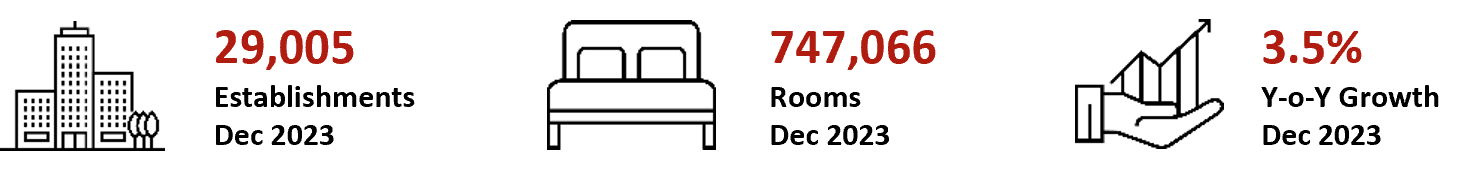

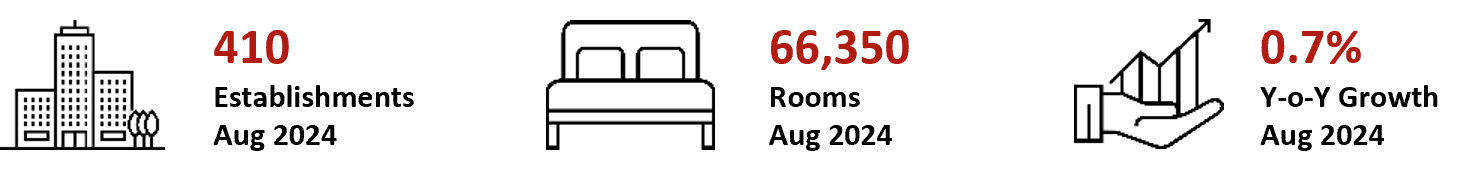

Supply

.png)

*Include non-branded hotels

Source: HVS Research

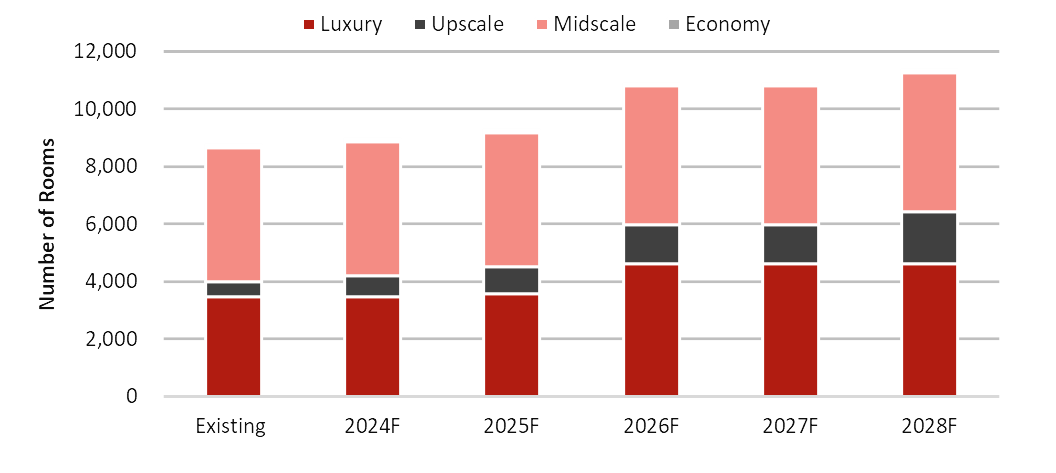

HVS has noted that there will be 34 additional hotels with approximately 7,956 keys in South Korea by 2028; two properties with a total of approximately 487 rooms will open by the end of 2024.

Hotel Pipeline (2024 - 2028)

*Exclude non-branded hotels

Source: HVS Research

Hotel Performance

Source: HVS Research

As of YTD August 2024, occupancy in Seoul and Incheon experienced an increase of 3.9 p.p, and an increase in room rates of 8.6%; with RevPAR increased by 14.7%. Seoul and Incheon witnessed the highest RevPAR in 2023 since 2018. The increase in inbound tourists and limited hotel supply has boosted hotel performance.

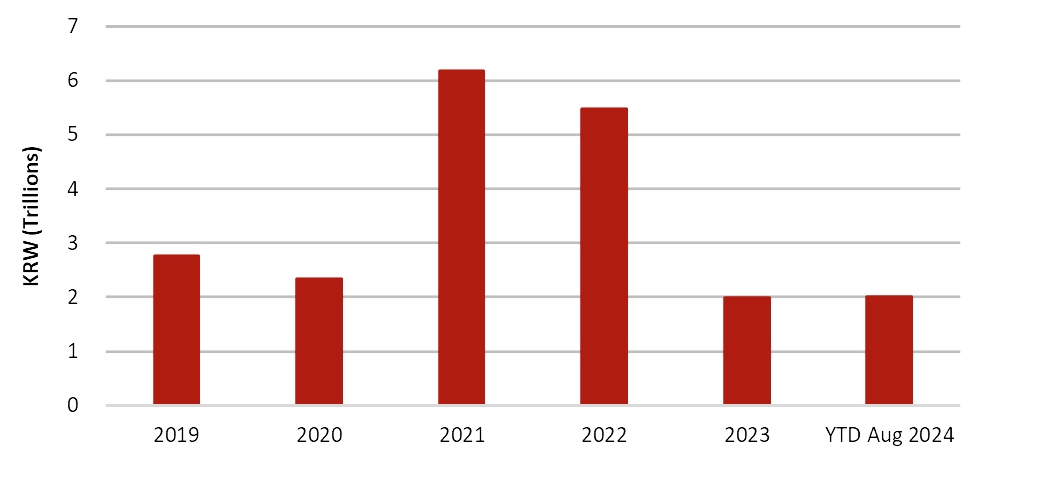

Transactions

South Korea, particularly Seoul, has registered a high level of investment activity in recent years. Transaction values peaked in 2021 at approximately KRW 6 trillion. While 2023 saw a dip in transaction volume, YTD August 2024 data shows 49 transactions with a total volume of approximately KRW 2.0 trillion, exceeding the 2023 total.

Source: HVS Research

Taiwan

Key Points

- Tourism contributed 4.2% of GDP in 2023 (NTD988 Bn), an increase of 44.4% from NTD303.8 Bn in 2022, achieving 80% of 2019’s tourism contributions

- 3.3% Real GDP growth expected in 2024

- 6.5 million international tourist arrivals recorded in 2023

Highlights

Infrastructure Projects

- NTD45.0 billion Taiwan Taoyuan International Airport Terminal 3 is expected to complete construction by 2025 and operational by 2026

- NTD55.4 billion High Speed Railway Extension from Kaohsiung City to Pingtung City by 2029

- Taiwan plans to open 18 representative offices and seven Taiwan Tourism Information Centers worldwide by 2025 to boost international visitors

Notable Transactions

- 42-key An Ho Hotel in Taipei was transacted at NTD919 million (NTD21.9m/key) in Feb 2024

- 138-key Guide Hotel in Hsinchu City was transacted at NTD2.3 billion (NTD16.5m/key) in Dec 2023

- 33-key Li Xin Motel in Kaohsiung was transacted at NTD1.2 billion (NTD36.4m/key) in May 2023

No hotel openings for the rest of 2024

Demand

In 2023, Taiwan's tourism sector experienced a strong recovery, with 6.5 million international visitors, marking a 624% increase compared to 2022. This growth momentum continued into YTD July 2024, with 4.4 million visitors, an 35% rise compared to the same period in 2023. Taiwan continues to be a popular destination, with its top three source markets in 2023 coming from North Asia: Hong Kong & Macao (18%), Japan (14%), and South Korea (11%). The United States and Singapore followed, contributing 7% and 8% of total arrivals, respectively.

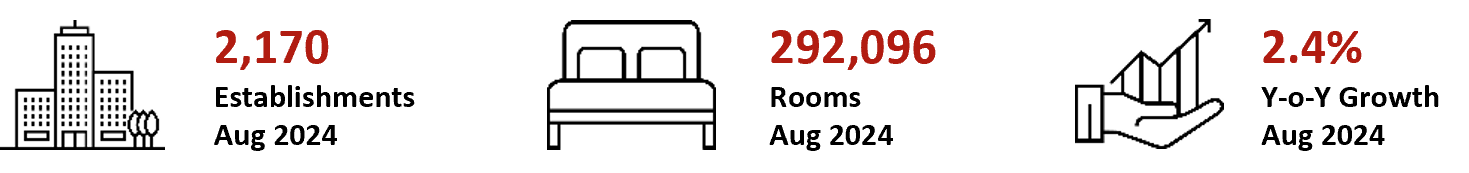

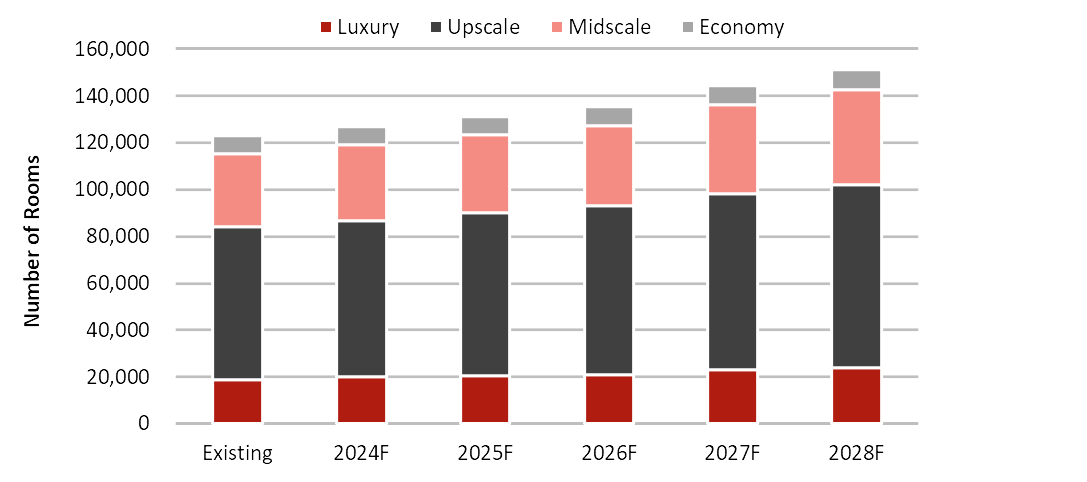

Supply

*Include non-branded hotels

Source: HVS Research

HVS has noted that going forward, there will be 16 additional branded hotels with approximately 2,605 keys in Taiwan by 2028; one hotel with approximately 211 rooms will open by the end of 2024.

Hotel Pipeline (2024 - 2028)

*Exclude non-branded hotels

Source: HVS Research

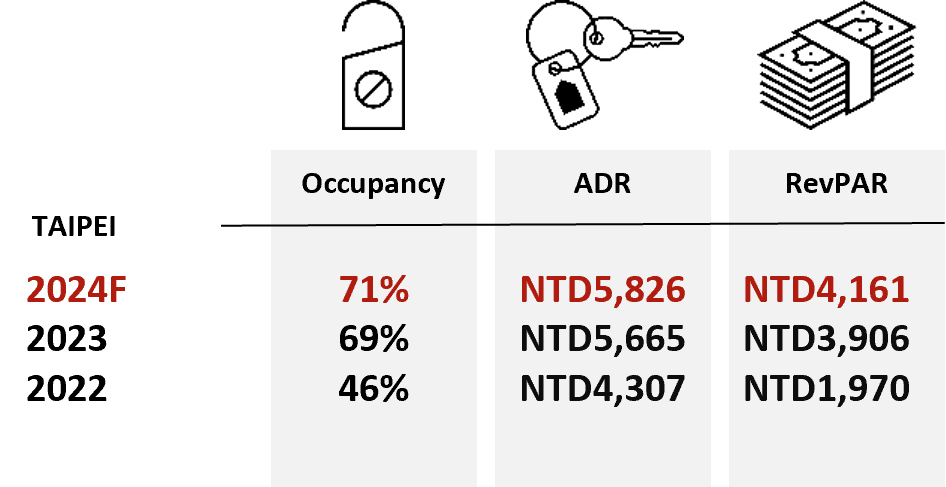

Hotel Performance

Source: HVS Research

As of YTD Aug 2024, hotel occupancy in Taipei has increased 3.9 p.p. y-o-y. Similarly, ADR increased by 3.6%, which has resulted in an increase in RevPAR by 9.6%. Taiwan’s tourism market continues to demonstrate growth and a steady recovery from the pandemic.

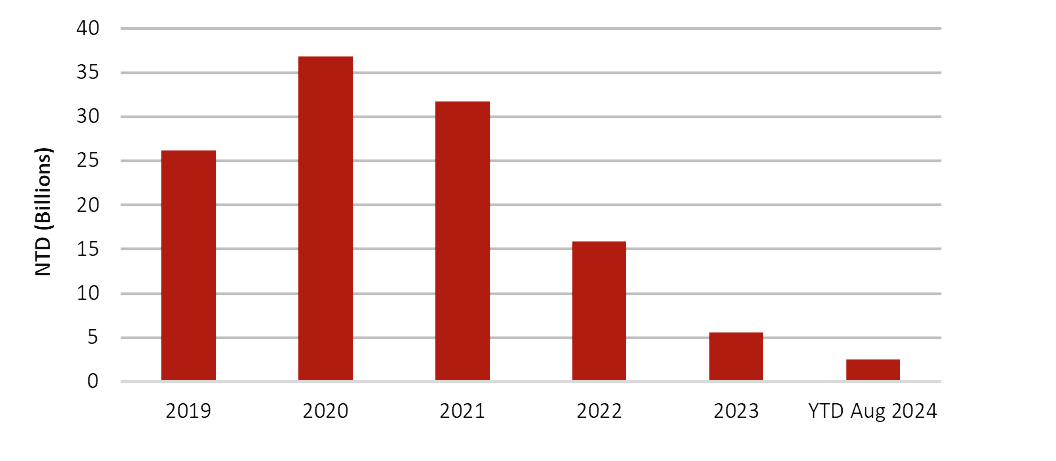

Transactions

Transaction value in Taiwan in YTD Aug 2024 is historically low compared to the past years, where the highest record was at NTD36.8 billion in 2020. Recent Investment activities were mainly transacted outside of Taipei, with only three transactions in Taipei in 2023 and one in YTD Aug 2024.

Source: HVS Research

Thailand

Key Points

- Tourism contributed 10.4% of GDP in 2023, (THB1.9 Tn) an increase of 59.4% from THB1.2 Tn in 2022, achieving 71% of 2019’s tourism contribution

- 2.5% Real GDP growth expected in 2024

- 28.4 million international tourist arrivals recorded in 2023

Highlights

Infrastructure Projects

- THB346.5 billion Thailand-China Railway Project which connects Bangkok with the Laos-China railway by 2028

- THB6.2 billion upgrade of Phuket International Airport by 2029

- THB36.8 billion expansion of Don Mueang Airport at Bangkok by 2029

- THB80.0 billion to develop Phuket’s second airport by 2031

- THB159.0 billion expansion of Suvarnabhumi Airport at Bangkok by 2035

Notable Transactions

- 285-key The Evason Phuket Resort acquired for THB1.5 billion (THB5.2m/key) in Jun 2024

- 56% interest in 123-key Dhara Dhevi (resort) at Chiang Mai acquired for THB1.3 billion, reflecting the hotel value at THB2.4 billion (THB19.3m/key) in May 2024

- 248-key Beehive Boutique Hotel Phuket acquired for THB481.8 million (THB1.9m/key) in Sep 2023

Notable Upcoming Hotel Openings in Bangkok and Phuket (2024)

Top 3 Largest Inventory

- Grande Centre Point Lumpini Bangkok, 512-key

- Ramada Phuket, 426-key

- The Ritz-Carlton Bangkok, 260-key

Demand

In 2023, Thailand experienced a 136% surge in international arrivals, growing from 12 to 28.4 million compared to the previous year. By Aug 2024, arrivals had increased by an additional 8.7% year-on-year. The top three source markets were Malaysia (22.9%), China (17.5%) and the Republic of Korea (8.2%). In addition, domestic arrivals also increased from 19.4 million in 2022 to 20.0 million in 2023. To boost off-season tourism, the government has introduced new tax incentives for businesses and leisure travellers, effective until Nov 2024. Since 15 Jul, Thailand has allowed visa-free entry for visitors from 93 countries and territories, up from 57.

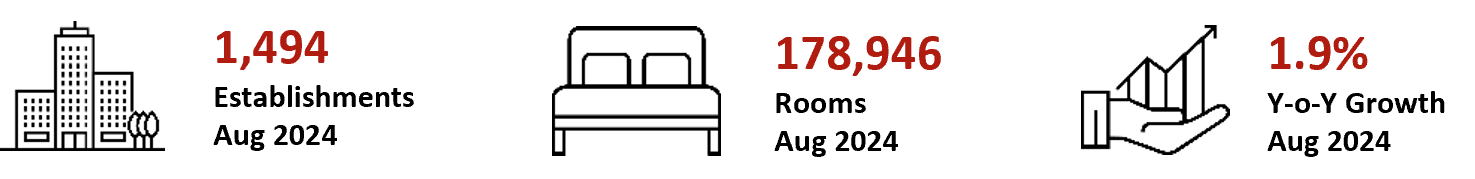

Supply

*Include non-branded hotels

Source: HVS Research

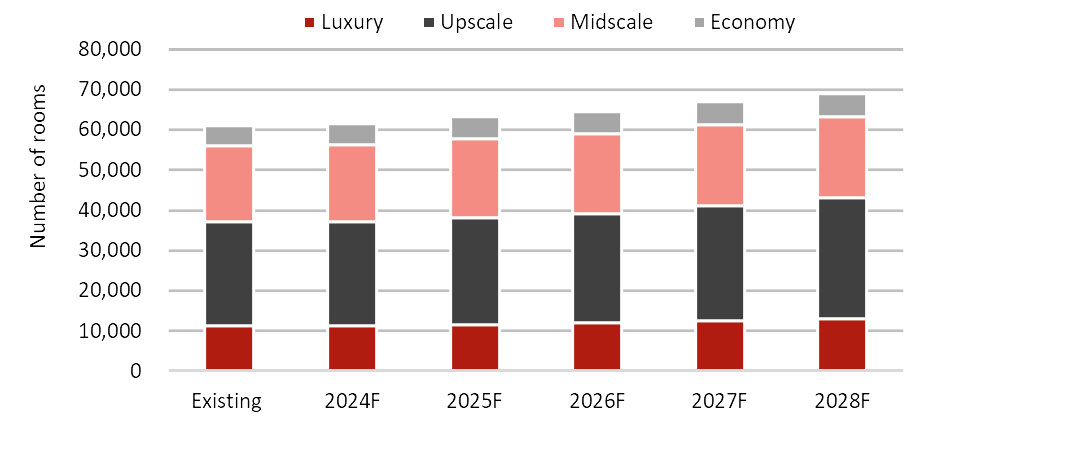

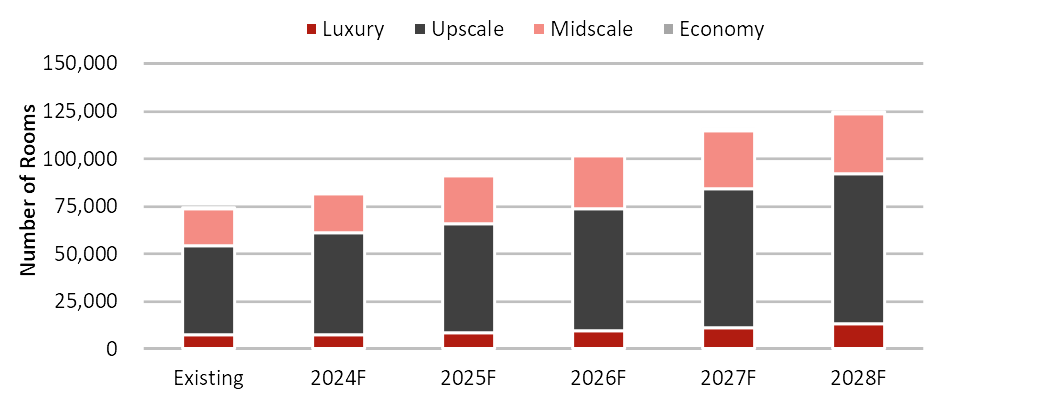

HVS has noted that going forward, there will be 114 additional hotels with approximately 28,116 keys in Thailand by 2028; 18 properties with a total of approximately 3,874 rooms will open by the end of 2024.

Hotel Pipeline (2024 - 2028)

*Exclude non-branded hotels

Source: HVS Research

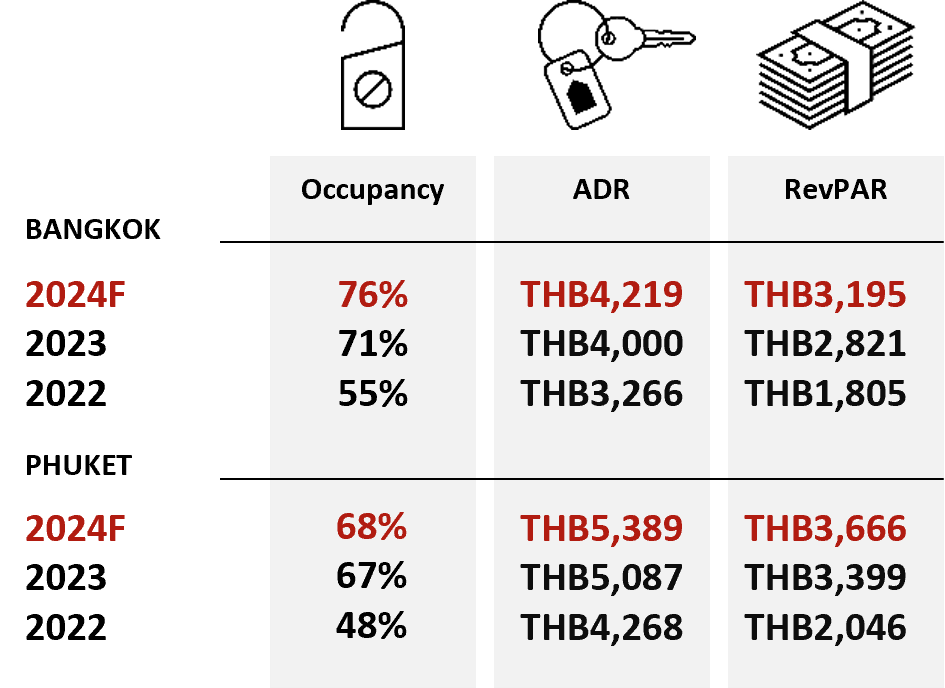

Hotel Performance

Source: HVS Research

As of YTD Aug 2024, Bangkok demonstrated strong hotel performance with an increase in occupancy rates (+4.8 percentage points (p.p)), ADR (+5.7%), and RevPAR (+12.9%) as compared to the same time last year. Phuket’s occupancy rates, ADR, and RevPAR have also increased by 3.2 p.p, 9.2% and 14.3%, respectively. RevPAR in Bangkok and Phuket have exceeded pre-pandemic levels.

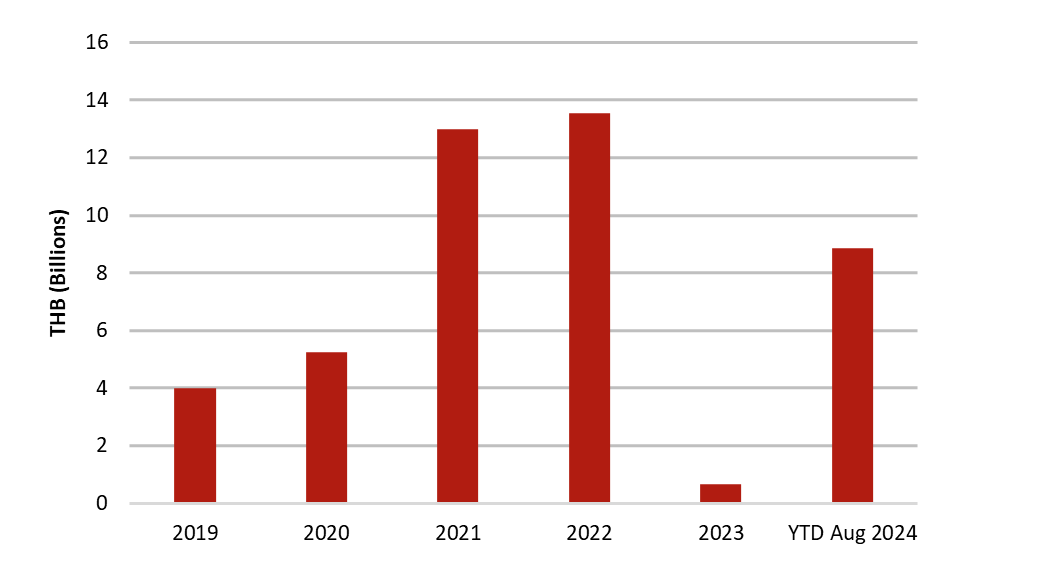

Transactions

There were eight transactions in 2023 however six transaction sales remained undisclosed. This resulted in a decline in the transaction volume recorded in 2023. YTD Aug 2024 recorded seven transactions with a total of THB8.8 billion. In addition, The Lamai Samui at Ko Samui and KROMO Thailand at Bangkok were acquired for an undisclosed sum.

Source: HVS Research

Vietnam

Key Points

- Tourism contributed 6.8% of GDP in 2023 (VND682.6 Tn) an increase of 29.5% from VND525.4 Tn in 2022, achieving 99.8% of 2019’s tourism contribution

- 6.3% Real GDP growth expected in 2024

- 12.6 million international tourist arrivals recorded in 2023

Highlights

Infrastructure Projects

- VND11.0 trillion construction of domestic terminal at Ho Chi Minh’s Tan Son Nhat International Airport by first quarter of 2025

- VND4.7 trillion expansion of Hanoi’s Noi Bai International Airport by end of 2025

- VND4.9 trillion investment for public transportation network enhancement by 2030

- VND11.0 trillion construction of Vietnam’s North-South expressway to China

Notable Transactions

- 223-key Hilton Da Nang acquired for VND544.2 billion (VND2.4b/key) in Sep 2023

- 175-key Capri by Fraser Ho Chi Minh acquired for VND490.9 billion (VND2.8b/key) in Jun 2023

- 140-key ibis Saigon South acquired for VND280.5 billion (VND2.0b/key) in Jun 2023

Notable Upcoming Hotel Openings in Hanoi and HCMC (2024)

- AVANI Ho Chi Minh City Hotel, 217-key

- Hotel Indigo Saigon The City, 150-key

Demand

In 2023, international arrivals recorded a 266% increase, from 3.4 to 12.6 million arrivals from 2022. YTD Jul 2024 data shows a 51% increase in international arrivals from YTD Jul 2023. The top three source markets in 2023 include Republic of Korea (28.5%), China (13.8%) and Taiwan (6.8%). The expansion of flight routes from China to Vietnam has significantly boosted the number of Chinese tourists visiting Vietnam, evident in a 200% surge compared to YTD Jul 2023 figures. Additionally, the frequent promotion by the Ministry of Culture, Sports and Tourism in tourism events held in various countries has helped to increase visitors.

Supply

*Include non-branded hotel

Source: HVS Research

HVS has noted that moving forward, there will be 151 additional hotels with approximately 50,311 keys in Vietnam by 2028; 22 hotels with approximately 8,302 keys will be opened by the end of 2024.

Hotel Pipeline (2024 - 2028)

*Exclude non-branded hotels

Source: HVS Research

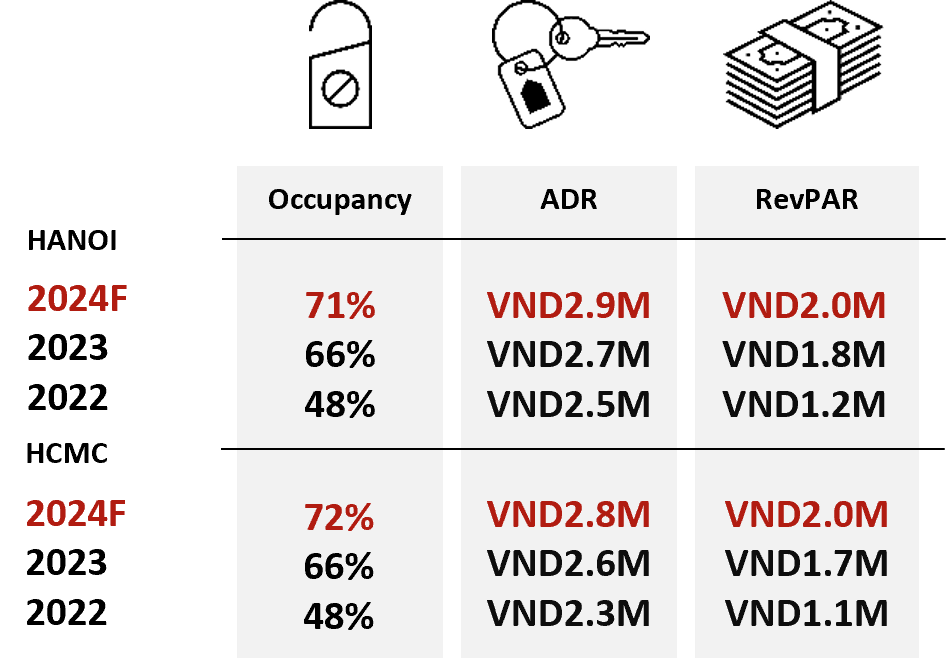

Hotel Performance

Source: HVS Research

As of YTD Aug 2024, Hanoi demonstrated strong hotel performance with an increase in occupancy rates (+5.1 p.p), ADR (+7.6%) and RevPAR (+16.6%) as compared to the same time last year. Ho Chi Minh’s occupancy rates, ADR, and RevPAR have also increased by 6.6 p.p, 8.6% and 20.1% respectively. The growth in both cities can be attributed to the return of Chinese tourists. In particular, for Ho Chi Minh City, it is also due to the undersupply of hotels, driving strong demand for available accommodations.

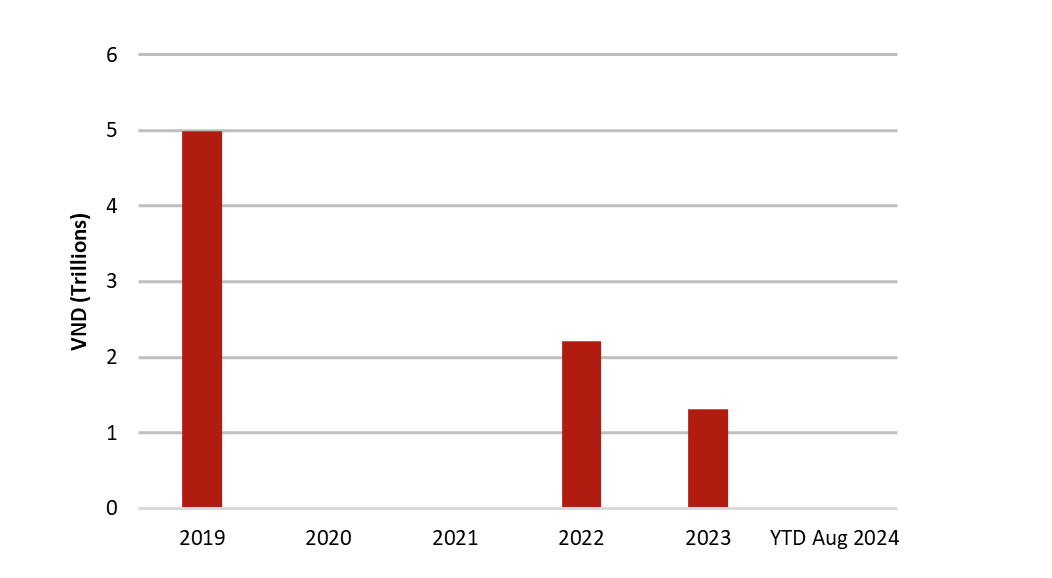

Transactions

There were three transactions in 2023 for Hilton Da Nang at VND544.2 billion, ibis Saigon South at VND280.5 billion and Capri by Fraser Ho Chi Minh at VND490.9 billion. Hotel investment activity is muted due to the government clamp down on corruption and a new president taking office in 2024. Despite limited transactions, the hotel market in Vietnam remains promising due to hotel growth opportunities and infrastructure developments.

Transaction Value Recorded by Year (2019 - YTD Aug 2024)

Source: HVS Research

Notable contributions were made by:

For Asia Pacific: Henrich Huang, Chariss Kok, Jay Low, Isaac Ko, Mildred Sim, and Temuujin Chiam.

For India: Mandeep S Lamba, Akash Datta, and Dipti Mohan

0 Comments

Success

It will be displayed once approved by an administrator.

Thank you.

Error