The most consistent issue HVS Brokerage & Advisory has encountered during transactions is whether a group is budgeting sufficient capital for prospective asset acquisitions that require PIP renovations. An incorrect estimate means buyer groups must increase their capitalizations or request a price reduction on a dollar-for-dollar basis relative to their cost increases. This ultimately changes many metrics late in acquisition processes and lowers IRRs because any extra capital is drawn entirely from equity and not a blend of equity and debt. Recent observations are detailed below. The lesson is that accurate PIP estimating is vital in successfully acquiring hotels today.

The most consistent issue HVS Brokerage & Advisory has encountered during transactions is whether a group is budgeting sufficient capital for prospective asset acquisitions that require PIP renovations. An incorrect estimate means buyer groups must increase their capitalizations or request a price reduction on a dollar-for-dollar basis relative to their cost increases. This ultimately changes many metrics late in acquisition processes and lowers IRRs because any extra capital is drawn entirely from equity and not a blend of equity and debt. Recent observations are detailed below. The lesson is that accurate PIP estimating is vital in successfully acquiring hotels today.

PIP Costs Are Increasing

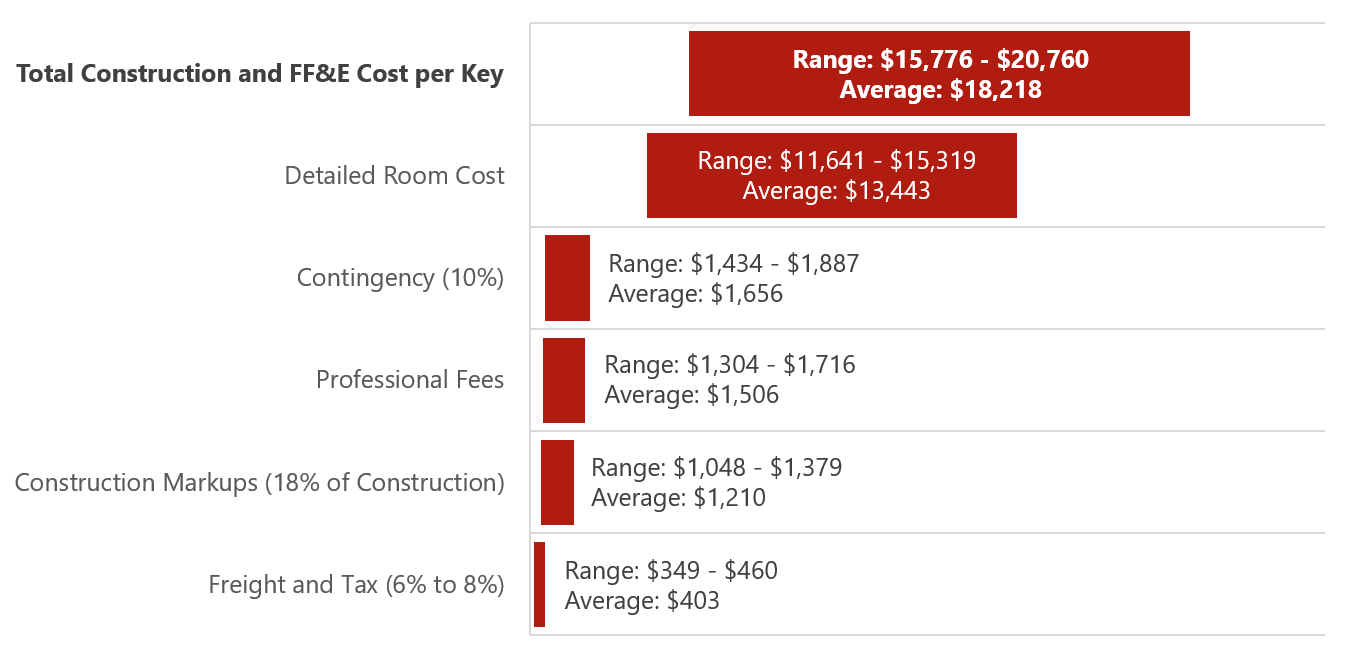

HVS is seeing PIP costs for select-service assets increasing quickly, requiring many groups to adjust their return expectations deep into the acquisition underwriting process. According to the JN+A and HVS Design Hotel Cost Estimating Guide for 2019, the detailed cost average expense per room for a hotel guestroom renovation is $18,218. Depending on the brand and quality level of the asset, these figures can also be higher. In addition, the construction cost component of PIPs is increasing rapidly as a result of the tight labor market. This can further raise the cost per room. Finally, we are anecdotally hearing about long lead times for the receipt of furniture and other components, potentially adding logistics costs to PIPs.Greater Complexity of PIPs Is Making PIP Estimating, Though Difficult, More Important

Due to new brand standards that contain numerous detailed improvements, PIPs are not as easily estimable as they once were. When many HVS professionals began in the industry 15 to 20 years ago, trusted renovation requirements metrics existed when acquiring an asset. However, due to today’s sophisticated brand standards and an overall improvement in quality and consistency in the hotel industry, using a “go to” rule, such as estimating that all select-service hotel renovations will be $10,000 per room, is very risky. As one can see from the table below, the range among PIPs is great. This places significant importance on having an accurate estimate of a PIP for an acquisition transaction.

Source: JN+A and HVS Design

Strategies to Overcome PIP Increases

With the increase in PIP costs and complexity, HVS recommends two strategies when selling an asset. The first is ordering a PIP inspection from the brand and making it available to buyers at the outset of the sale process. This enables buyers to be as informed as possible and avoids later obstacles in the purchase process. It is also important to keep in mind that brand PIP inspectors are very busy, so it is essential to schedule inspections as soon as the decision is made to sell an asset. The second strategy is to determine the renovation expense estimate an interested buyer had made. If a buyer provides a reasonable estimate, this can increase the likelihood that the buyer can complete the transaction.In conclusion, sellers can take various steps to mitigate issues related to renovations during a sale process. While there can be intricate challenges with current sale PIPs, new estimating tools also exist to assist a seller. If you have further questions regarding renovations and sales processes, please reach out to the HVS Brokerage & Advisory team.

HVS Brokerage & Advisory works in all major national markets, with multiple brokerage offices in cities such as Denver, CO; Atlanta, GA; and Houston and Dallas, TX. Eric Guerrero with HVS Brokerage & Advisory can also utilize HVS’s significant data resources to discuss any asset you may be evaluating for sale, transition, or recapitalization.

About Eric Guerrero

Eric Guerrero is a Senior Managing Director and a Partner at HVS, leading the firm’s Brokerage & Advisory division in the United States. With over a decade of investment sales experience, he has participated in hundreds of hotel transactions with an aggregate value of over $800 million across the nation. Eric has advised both private investors and institutional clients and has managed hotel transactions of all classes and sizes, from independent, $1-million, limited-service hotels to $50-million, select-service portfolios across multiple states. Contact Eric at (713) 955-0012 or [email protected].

0 Comments

Success

It will be displayed once approved by an administrator.

Thank you.

Error