The COVID-19 pandemic has had a severe impact on the Philadelphia lodging market. While the area regained a substantial amount of tourism in 2021, Philadelphia’s lodging market has remained depressed for nearly two years given the limited amount of commercial and group demand.

Demand was healthy in the years prior to the pandemic, with Philadelphia hotels registering occupancy levels in the high 60s to low 70s from 2011 through 2019. Occupied room nights were generated by a mixture of tourists visiting sites and museums or attending sporting events, group and international travelers attending events at the Pennsylvania Convention Center (PCC), and commercial travelers visiting the many healthcare entities and financial firms in the city.

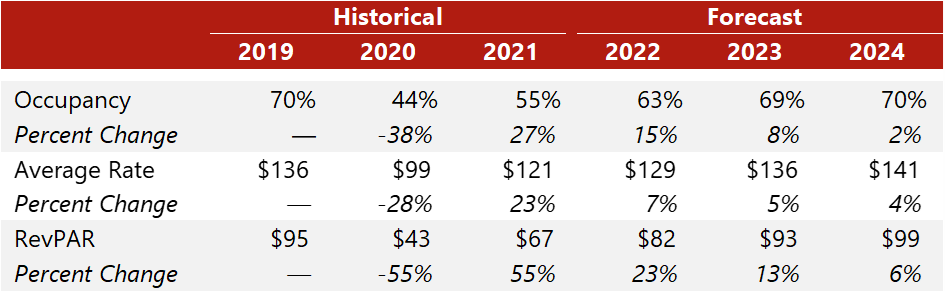

In 2020, following stay-at-home orders and mask mandates by Mayor Jim Kenney, occupancy dropped to 44% from the 2019 benchmark of roughly 70%, reflecting a 26-point decline. Occupancy reached its lowest level in April 2020 at the height of the pandemic. Similarly, ADR decreased roughly 28% from 2019 levels, declining from $136 to $99. On January 27, 2022, the City of Philadelphia reimplemented mask mandates citywide and established a proof-of-vaccination requirement to dine in restaurants given the significant increase in COVID-19 cases related to the Omicron variant. These restrictions were lifted in March 2022.

Philadelphia 2022–2024 Forecast

Source: STR (Historical Years) and HVS (Forecast)

Major factors contributing to the market’s performance during the pandemic and our forecast are summarized as follows:

- Year-end 2021 data illustrate a significant increase in occupancy and a roughly $22 gain in ADR. Recent leisure demand growth and a partial return of commercial demand and meeting/group demand contributed to these upward trends. Occupancy and ADR were initially affected by the Omicron variant in January and February of 2022; however, restrictions were lifted in March, similar to many other primary markets across the nation. Hotel performance has experienced a notable recovery since that time, with travel growing across all demand segments.

- Commercial demand and group business have historically been two of the strongest segments in the Philadelphia market as a result of the strength of the education and healthcare sectors, as well as the presence of a major international airport. According to local brokers, Philadelphia's office tenants are still evaluating the impact of pandemic and have not made permanent decisions to eliminate physical office space while their work-from-home policies remain in effect until the pandemic fully subsides. Many corporations allowed employees to return to work on a hybrid basis, but the emergence of variants shifted work back to remote-only situations several times in the last year. Furthermore, PCC usage statistics for 2020 and 2021 have yet to be released; however, according to convention representatives, nearly 600 events (including 20 citywide events) and roughly 750,000 occupied room nights were lost due to the COVID-19 pandemic. The outlook for the PCC remains optimistic, as over 20 events are on the books for 2022, with nearly 350,000 occupied room nights expected to be generated. The Philadelphia market remains a favorable location to host large-scale events given its proximity to other major markets, the number of available hotel rooms, and the breadth of tourist attractions in the area.

- The city typically attracts tourism demand throughout the year because of Philadelphia's historic importance as the nation's original capital, as well as the popular sporting events held at Citizens Bank Park, Lincoln Financial Field, and the Wells Fargo Center. While many of the tourist attractions and entertainment venues temporarily closed or enacted visitor restrictions because of the COVID-19 pandemic, all of these venues reopened in 2021 after restrictions were lifted and travel levels increased. According to data compiled by the Philadelphia Business Journal, the city hosted 17.6 million visitors in 2019, while in 2020, that number fell to about 7.6 million. Although statistics were not available for 2021, tourism demand is expected to greatly aid the lodging market’s recovery.[1]

- Philadelphia International Airport (PHL), located just south of Downtown Philadelphia, reported record-breaking passenger traffic numbers in 2019 before traffic declined significantly in 2020. American Airlines remains the most prominent airline presence at PHL, and significant capital was spent on the airport prior to the pandemic, including a $200-million runway expansion completed in November 2019. A recovery of passenger traffic has resumed, and 2021 levels reached almost 60% of 2019 levels. Passenger volume should continue to grow as most travel restrictions have been rescinded and economic activity rebounds further; however, airline staffing shortages on a national basis have recently been limiting the number of flights and passenger traffic at PHL.

- Philadelphia is anticipating a record-breaking year for new development and construction in 2022. Over the last decade, the local government has instituted numerous tax incentives to draw new residential, commercial, and hospitality development to the city. More than 90 applications for new developments were received in 2021 to support the over 5% population growth since 2010. Most new developments are located in the Center City and University City neighborhoods, proximate to the finance, education, and healthcare demand generators. Notable developments include One Cathedral Square, The Laurel Rittenhouse, One uCity Square, and other hospitality projects, as detailed below.

- Multiple hotel projects were slated for development before the onset of the pandemic. However, given the uncertainty of the lodging market, a large number of these projects were put on hold or canceled. Recently completed new supply includes the 236-room Canopy by Hilton and the 332-room Hyatt Centric in 2020; the 208-room Live! Casino & Hotel in January 2021; and the 751-room, dual-branded Element by Westin and W Hotel in May and August 2021, respectively. Some smaller, independent hotel developments remain on hold.

Based on our market research, the long-term outlook for this market is optimistic, and we are confident that Philadelphia hotels will return to their pre-pandemic performance levels. The slow return of employees to offices, significant leisure travel to Philadelphia, and numerous citywide events booked for 2022 and beyond contribute to positive outlook for the market.

For more detailed forecasts or to inquire about a specific hotel project, contact Scott Killheffer or Jerod S. Byrd with our Philadelphia team.

[1] Sharon Oliver, Philadelphia Business Journal, "Visits to Greater Philadelphia tourist attractions dropped almost 60% in 2020 amid the pandemic." 05/24/2021. Retrieved 04/28/2022.

0 Comments

Success

It will be displayed once approved by an administrator.

Thank you.

Error