As the capital of Spain, Madrid holds a prominent position as a cultural, economic and political hub in Europe. Its rich history, vibrant arts scene, world-renowned culinary offerings as well as its many corporate head offices and financial institutions attract a diverse range of visitors, including both leisure travellers and business professionals. Additionally, Madrid's strategic location within Spain and its well-connected transportation infrastructure, including its international airport and high-speed rail services, facilitate easy access for both domestic and international travellers. The city's tourism sector, which was heavily impacted by the COVID-19 pandemic, experienced a gradual recovery from the latter half of 2021, buoyed by successful vaccination campaigns and the easing of travel restrictions both domestically and internationally.

Sources: European Cities Tourism, INE, Airports Council International, AENA

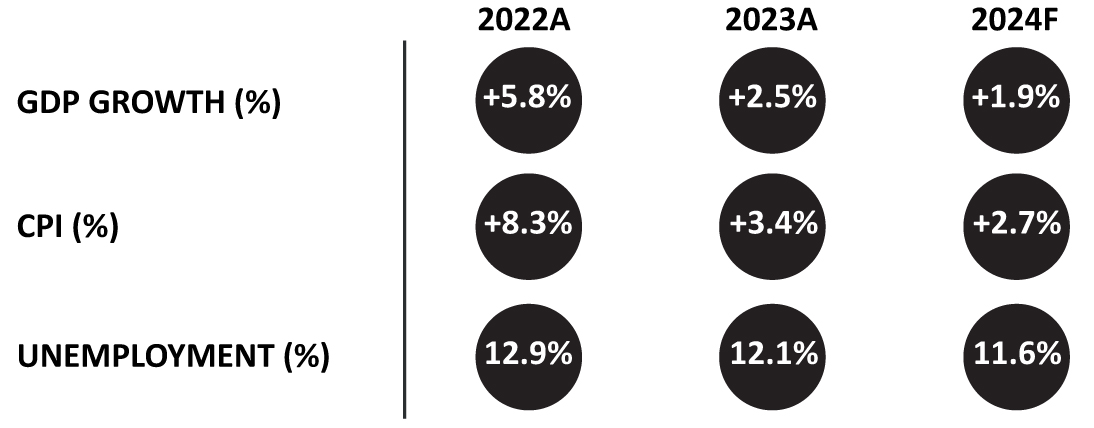

Economic Indicators – Spain

Source: IMF

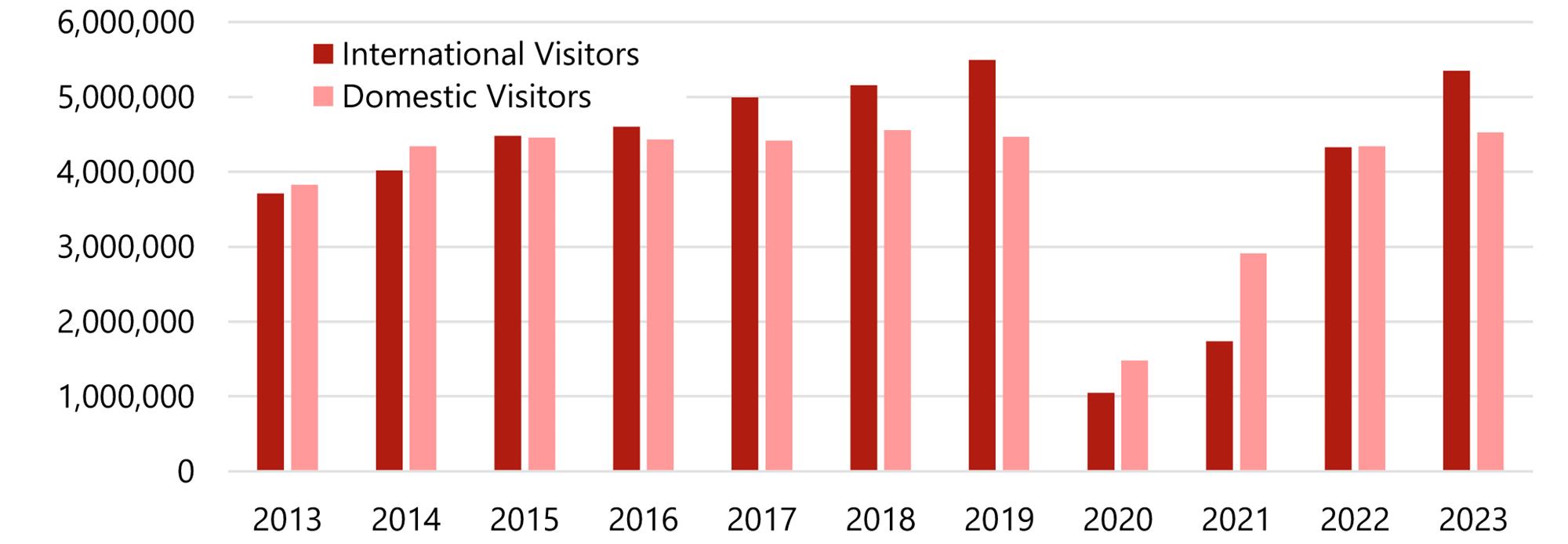

Tourism Demand

The total number of visitors to Madrid recorded a healthy compound annual growth rate (CAGR) of 2.7% from 2013 to 2023. While the share of domestic and international visitors was relatively equal in 2013, domestic demand started to stagnate thereafter, as international demand went from strength to strength, mainly driven by the USA, Italy, France and the UK. The COVID-19 pandemic significantly impacted the tourism industry with severe international travel restrictions. Domestic visitation started to recover in 2021 and, with the eventual easing of travel restrictions, international visitation progressively recovered and reached 97% of 2019 levels in 2023, leading to total visitation in 2023 being almost as high as the record levels of 2019. The number of bednights followed the same trend as visitation figures, with more than 20 million bednights recorded in 2023. As significant events generated demand in 2024, such as Taylor Swift's only Spanish show and the World Rugby Sevens Series Grand Final, the city is expected to maintain this momentum with the Spanish Formula 1 Grand Prix starting from the 2026 season and other sporting events expected at the newly renovated Bernabeu Stadium ensuring quite a positive outlook for the hospitality industry.

International Visitation Leads the Recovery

Source: INE

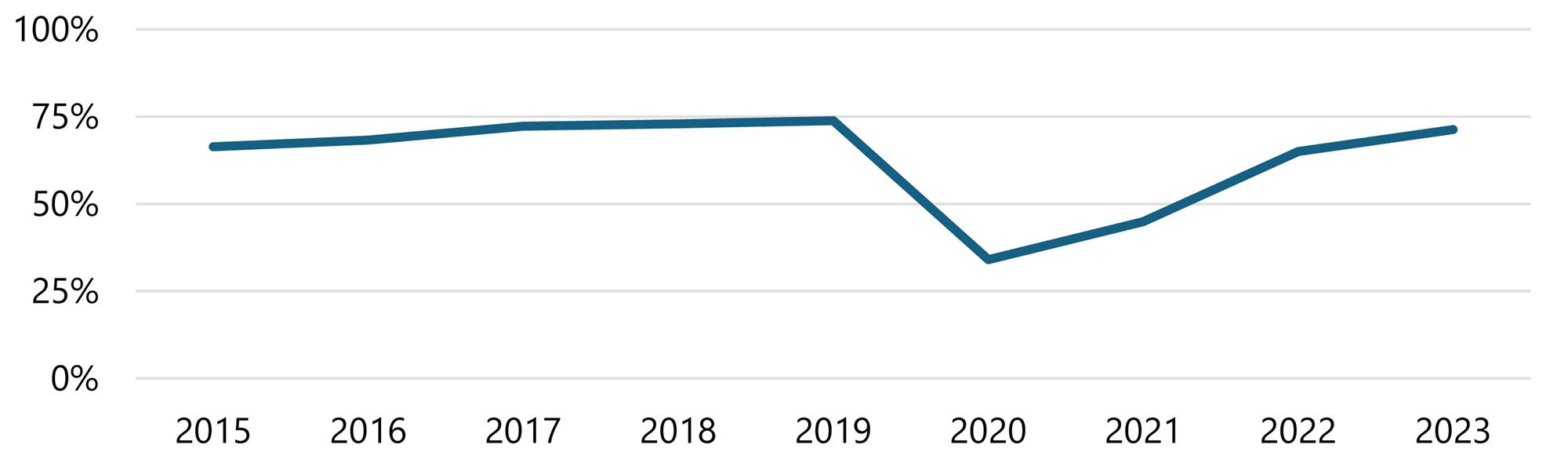

Hotel Performance

With the noticeable rise in international visitation from 2017, occupancy levels in Madrid increased from the mid-60s to the low 70s, while average rate recorded a 5.2% CAGR between 2015 and 2019. Hotel performances were heavily impacted by the pandemic in 2020 and 2021, and they started to return to normal from Q2 2022 onwards, with rates seemingly growing with inflation.

Occupancy Returns to Pre-Pandemic Levels

Source: INE

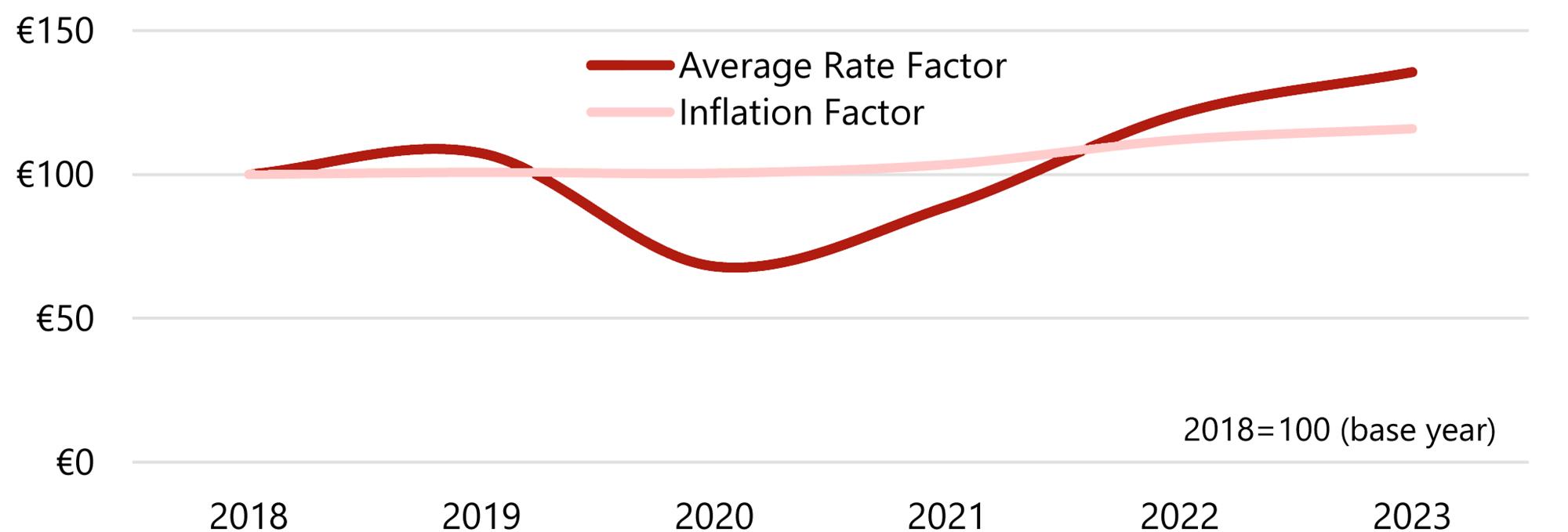

In 2023, with occupancy levels nearly matching those achieved in 2019, average rate observed a real growth of 10% over 2019, equivalent to 26% in nominal terms. According to our research, the average rate of the previously existing stock grew by an average of 16-18% over 2019. The balance of the growth in the Madrid hotel market can primarily be explained by the openings of a handful of very high-end luxury properties. These openings included the 201-room Four Seasons (January 2020), the 194-room Madrid EDITION (February 2022) and the 139-room JW Marriott (March 2023). Furthermore, the 153-room Mandarin Oriental, which closed in 2018 for a three-year renovation, reopened in April 2021 and, in October 2021, the 154-room Villa Magna reopened under the Rosewood brand after extensive refurbishment.

Luxury Hotel Openings Boost Average Rates

Source: INE

Hotel Supply

Madrid’s hotel room supply experienced continuous growth from 2013 to 2023, recording a CAGR of 1.1%. The proportion of independent hotels represented about 54% of the available hotels and 40% of the room stock in 2023. While the number of independent hotels has remained relatively stable in the last ten years or so, branded hotels have steadily increased their share of the market. The upper tier of the market has observed the biggest increases in number, either through new openings or upgrading of existing hotels. Hotel performance has improved alongside the gradual refurbishments, branding activity and opening of new supply. The recent openings in the high-end luxury sector mentioned previously have very noticeably enhanced the average rate in the city, and the expectation is that this will allow for the price ceiling of other hotel classes to move up. Other recent notable openings include the 161-room Hard Rock Hotel Madrid (July 2021), the 174-room Thompson Madrid (September 2022) which is the first of the brand by Hyatt to open in Europe, the 330-room The Social Hub Madrid (September 2022) and the 130-room UMusic Hotel (January 2023). Furthermore, three hotels totalling nearly 600 rooms have opened recently within a five-kilometre radius of the airport, increasing the local supply by 12%.

Madrid has a pipeline of around 2,300 rooms entering the market in the next four years, representing 5% of the current supply. More than 50% of these new rooms are reported to be under construction. We note that the pipeline is mostly driven by independent properties, accounting for 75% of the proposed hotel rooms. Approximately 20% of the pipeline is long-stay apartments, which will represent a 10% increase of the existing supply in this category, indicating the changing landscape of travel and accommodation preferences following the pandemic.

Hotel Pipeline

Source: HVS Research

Investment Market

In 2023, Madrid took third place after Paris and London in terms of transaction volumes thanks to ADIA’s acquisition of a portfolio including six hotels in the city. However, in 2022, Madrid came in second place, with the sale of some trophy assets including the Hotel Selenta Princesa, the Villa Magna and the Bless Madrid.

Madrid is amongst the cities in Europe that has observed the highest increases in hotel value in the last ten years. The dynamism and the performance improvements in the market give confidence to investors and attest to the liquidity of the market. For the latest value trends, please refer to our 2024 European Hotel Valuation Index.

Hotel Transactions – Last 12 Months

Source: HVS Research

Outlook

Madrid is expected to continue its recovery and solidify its position as a leading global destination for leisure and business travellers alike. The growing appeal of the city was supported by the opening of a string of luxury properties under well-known brands, as well as a number of trendy hotels. Demand responded favourably by elevating the average rate performance in the city and breaching the average rate ceiling. The capital of Spain is proving that its strong economic fundamentals, coupled with ongoing efforts to promote tourism, underscore its long-term potential as a top-tier city for hotel development and investment opportunities.

Value Trends 2023 vs 2022

Source: HVS Research

0 Comments

Success

It will be displayed once approved by an administrator.

Thank you.

Error