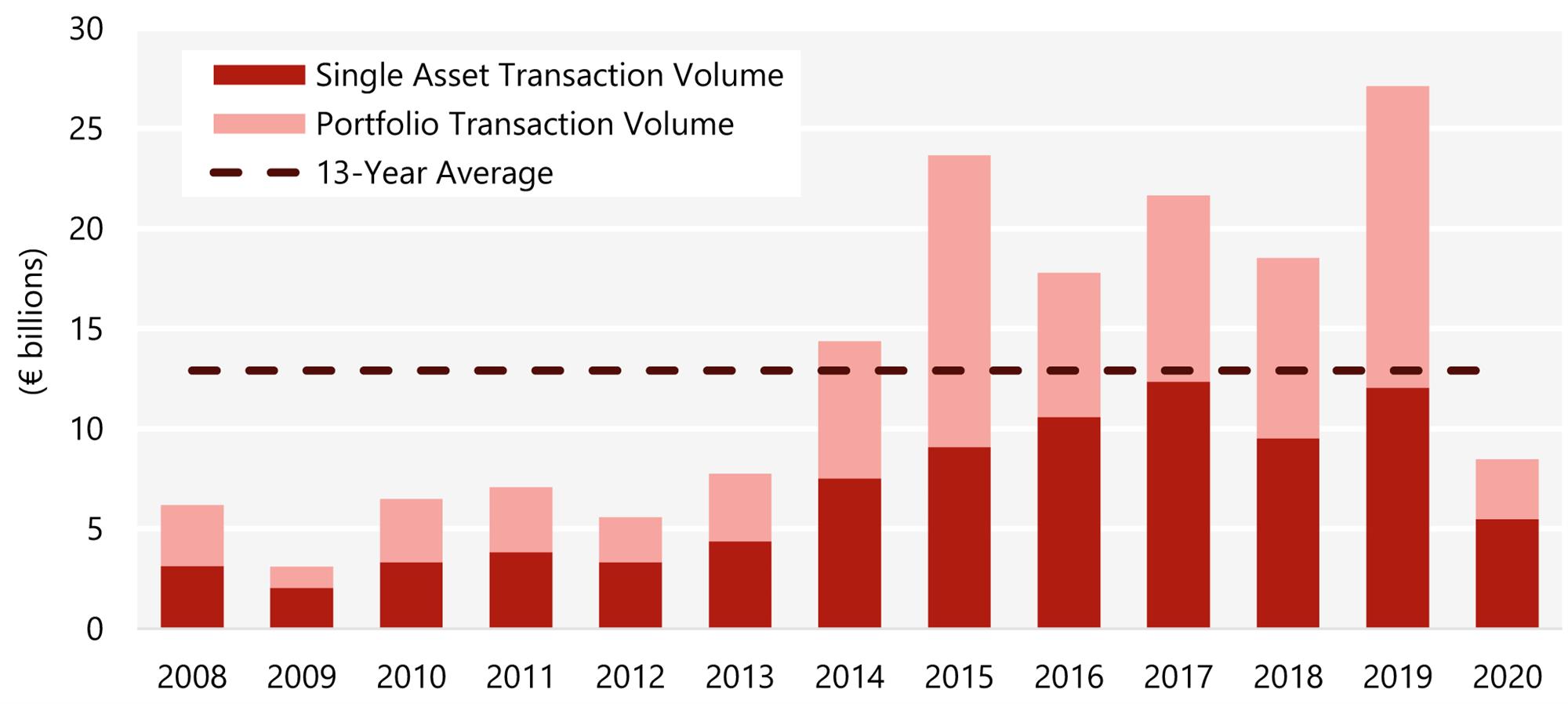

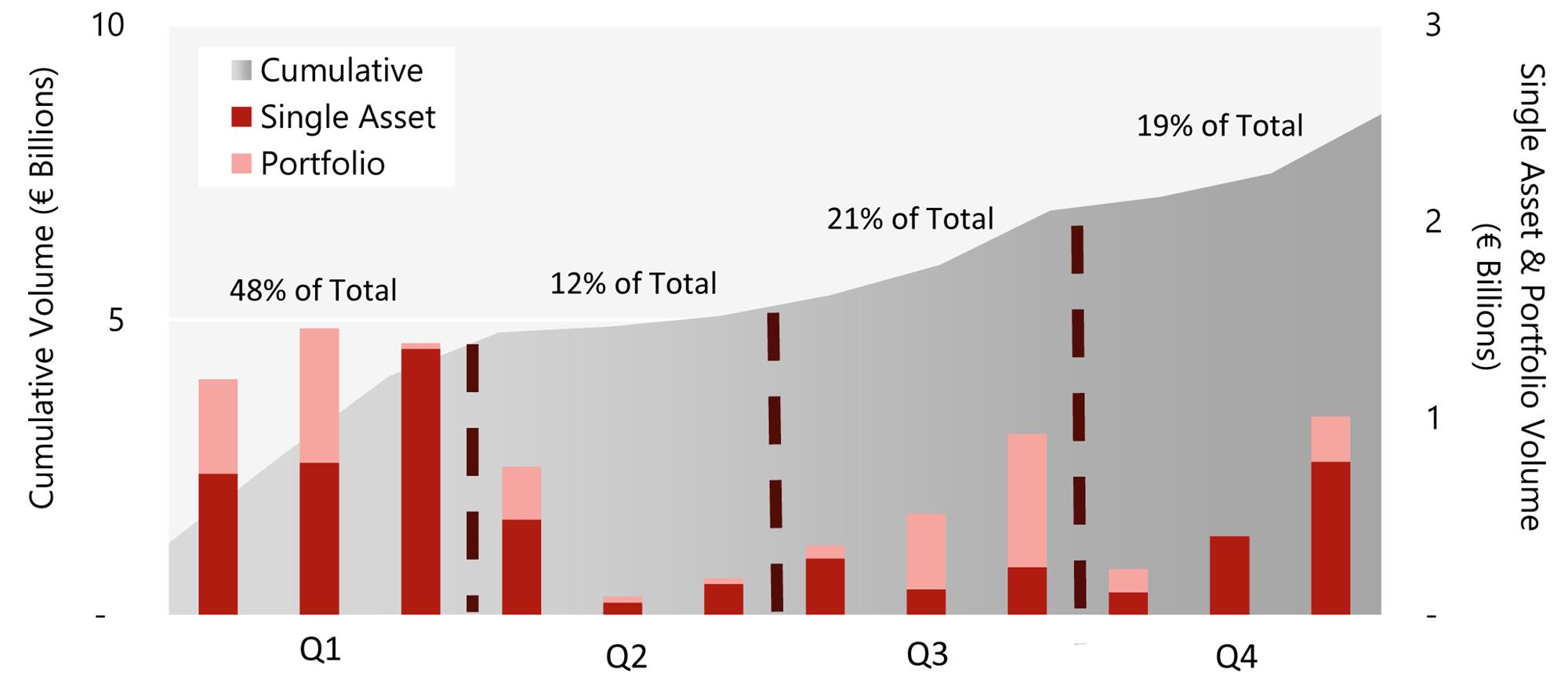

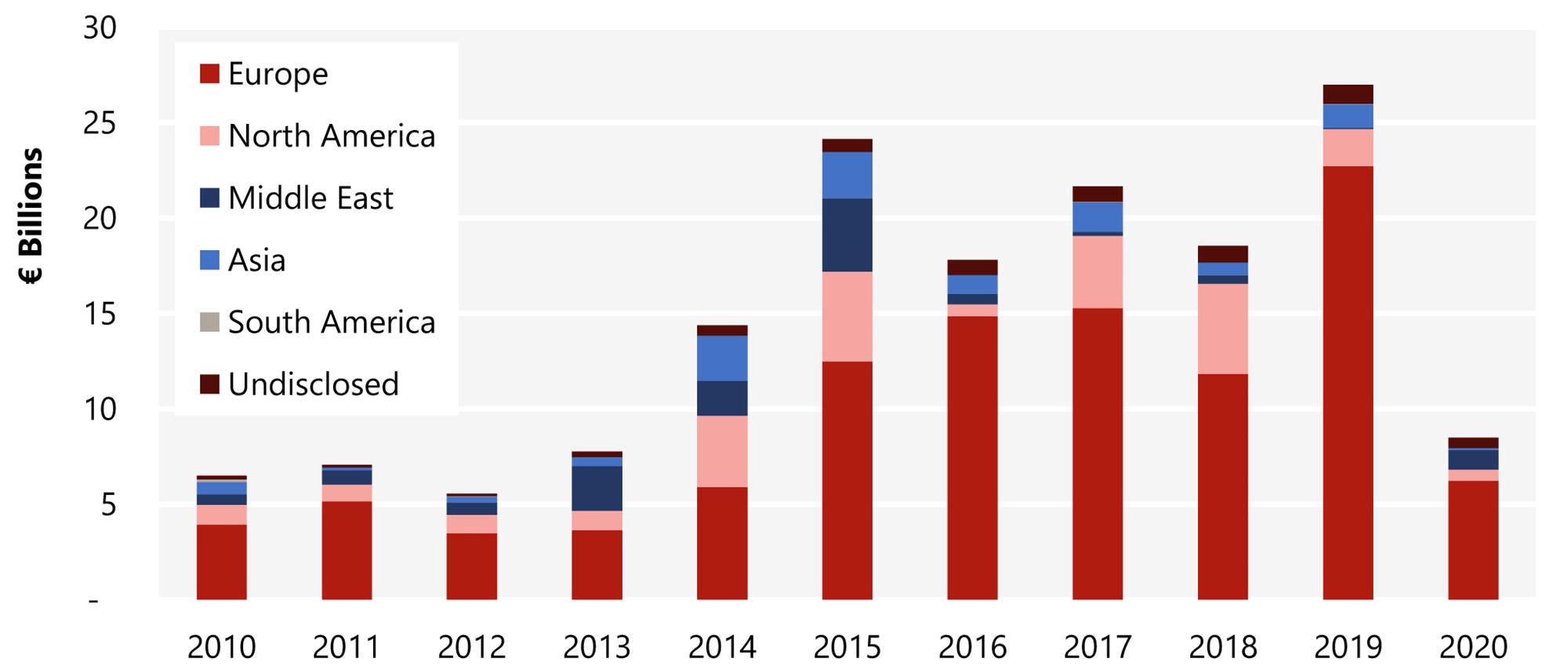

Total European hotel transaction volume reached €8.5 billion[1] in 2020, representing a fall of 69% on 2019 (see Chart 1), which was the previous market peak at €27.1 billion. Even so, 2020 figures remain significantly ahead of those seen in the Global Financial Crisis, with 2009 seeing only €3.1 billion in transaction volume.

Highlights

- 48% of the total 2020 transaction volume occurred in the first three months of the year, primarily representing transactions that were agreed pre-pandemic;

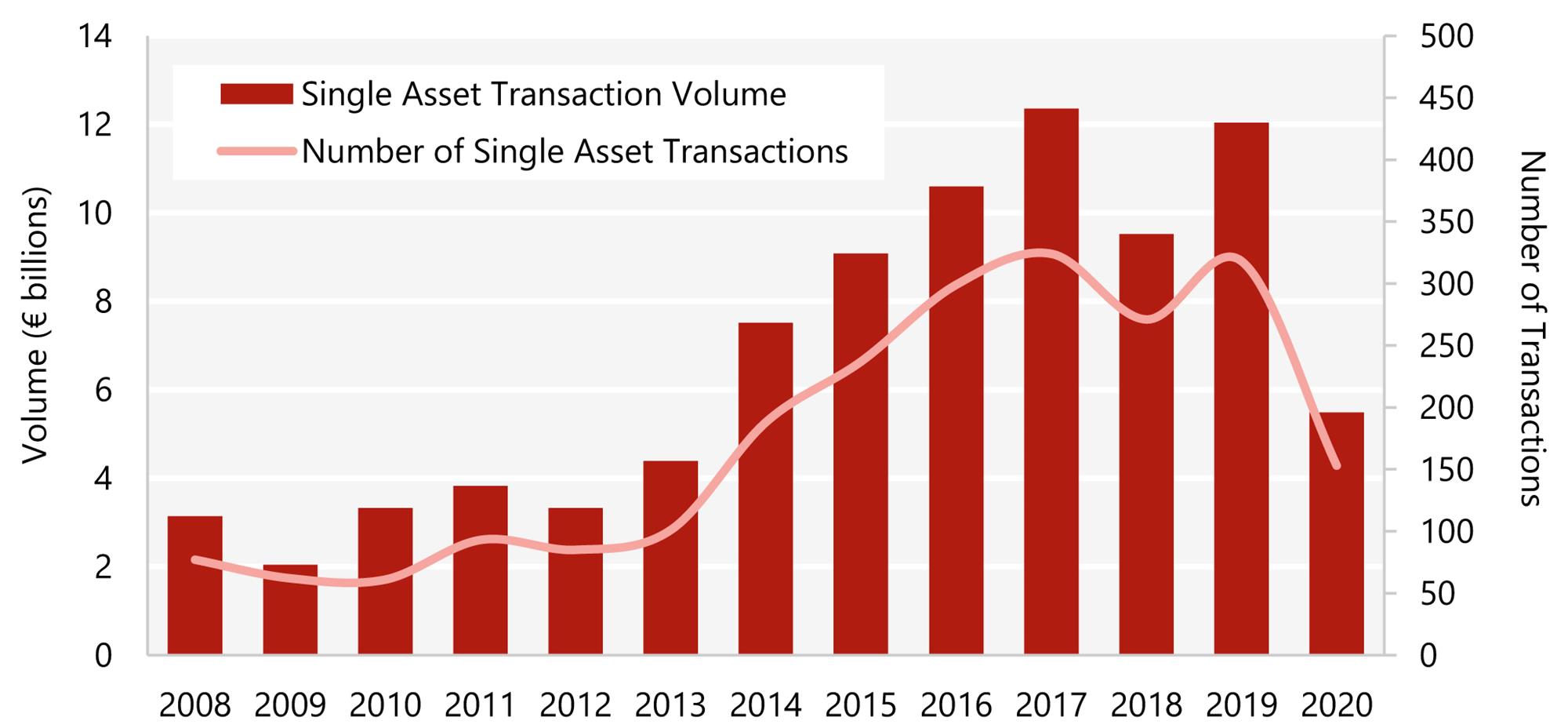

- Single assets accounted for €5.5 billion or 65% of the 2020 total, decreasing 54% from 2019, though significantly above the previous 2009 volume trough of €2.0 billion;

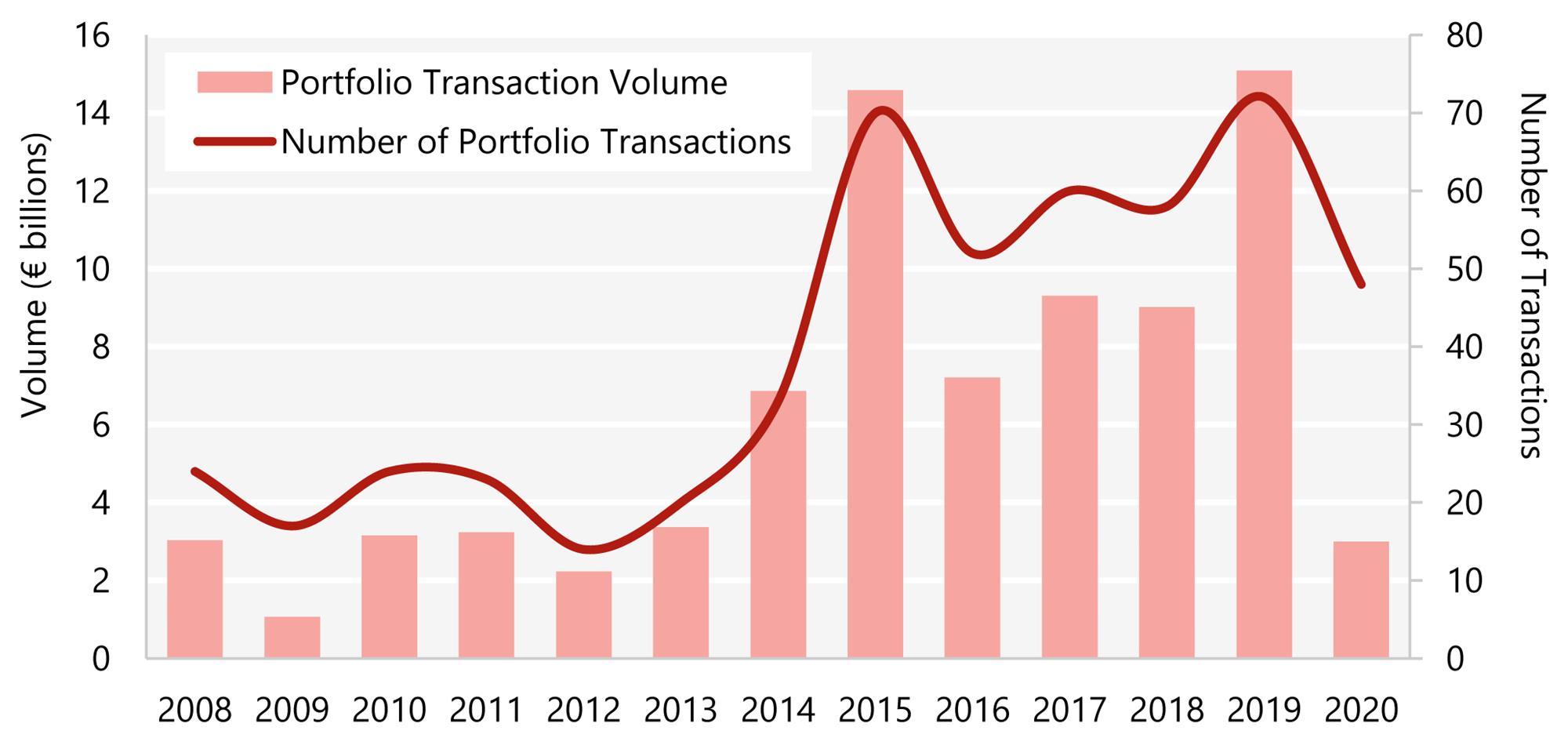

- Portfolio assets transacted at a total volume of some €3.0 billion (35% of the total), decreasing by 80% from 2019, although, again, this was significantly above the previous 2009 volume trough of €1.1 billion;

- This 65:35 split between single asset and portfolio volume for 2020 represented a significant shift in favour of single assets as compared to 2019 (45:55) and was slightly less balanced than the ten-year average split of 55:45. This was mainly due to a significant decrease in high-value portfolio transactions in 2020;

Chart 1: Total Hotel Investment Volume 2008-20

Source: HVS – London Office

- All investor types except High-Net-Worth Individuals posted overall declines in acquisitions. Real Estate Investment Companies contributed the most capital at €2.1 billion (-72% on 2019). The largest net sellers were Hotel Operators, with net disposals of €454 million. REITs were the only category of investors that posted positive net volumes, at €499 million (+1%);

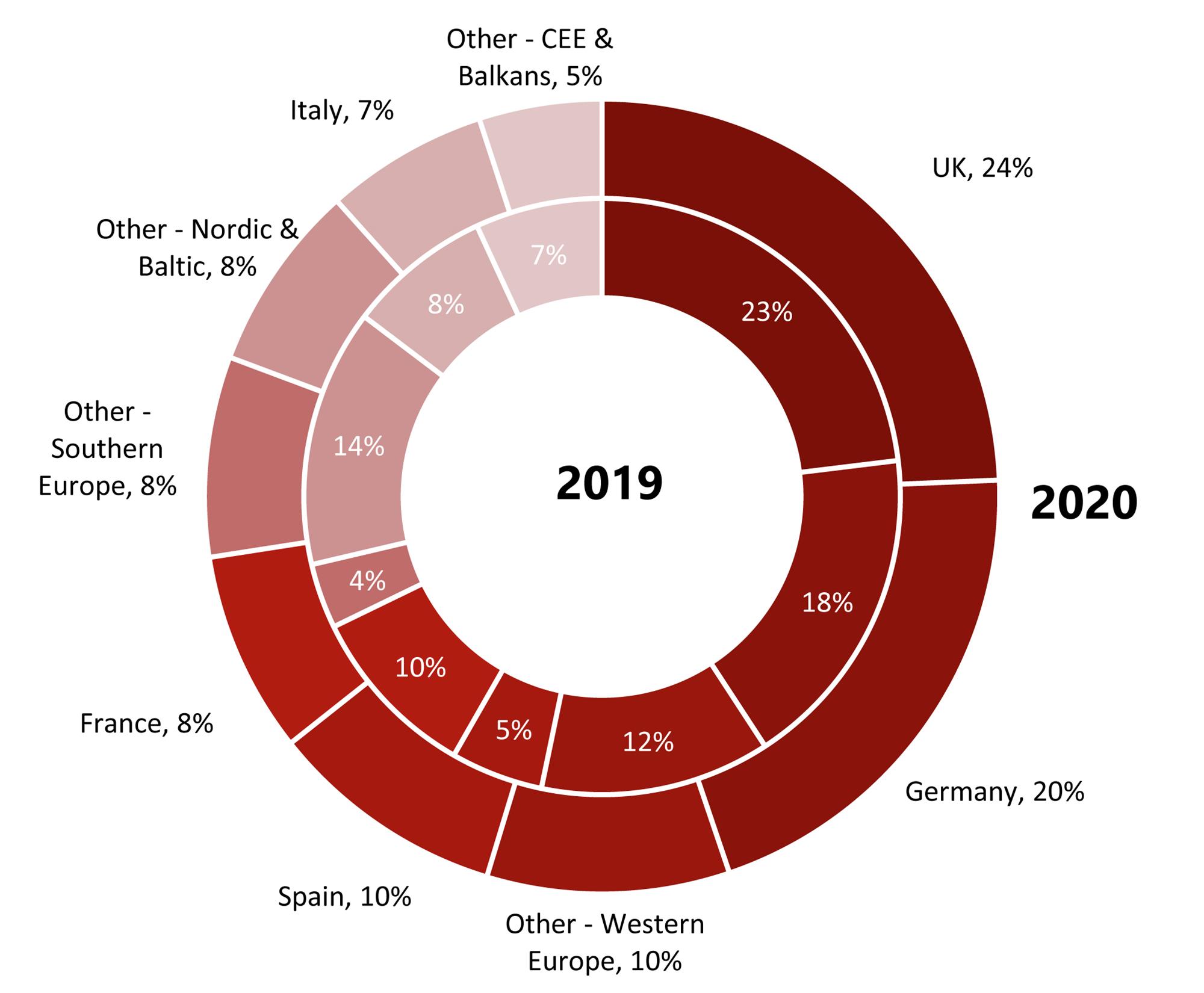

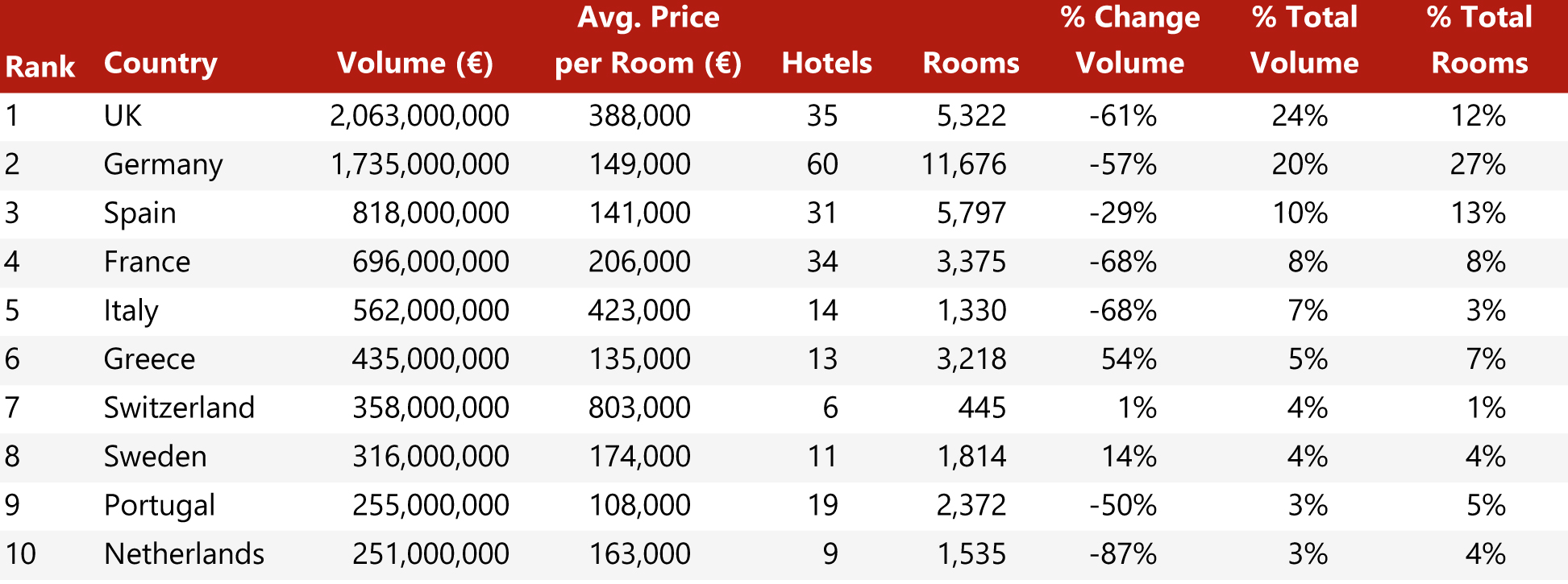

- The UK maintained its leading role within Europe, reaching a transaction volume of €2.1 billion/£1.8 billion, which is a decline of 61% on 2019 (€6.2 billion/£5.5 billion). Germany was not far behind, recording total investment volume of €1.7 billion, a 57% drop on 2019;

- London posted the highest investment volume of any city in Europe at €1.6 billion/£1.4 billion in 2020 (-27% compared to 2019), ahead of Munich at €501 million (+15%), Paris at €312 million (-51%), Berlin at €223 million (+43%) and Rome at €193 million (+3%);

- Moving into 2021, we expect to see the full and substantial effects of the COVID-19 pandemic, with no ‘pre-pandemic’ acquisitions boosting the first half of the year, and then the effects of increasing distressed debt and opportunistic investors vying for footholds ahead of the anticipated European hotel market recovery. In H1 2021, as travel bans and lockdowns remain in effect for many, we expect to see relatively little transaction activity. Following the rollout of vaccination programmes and a collective easing of travel bans, we expect hospitality to begin to recover, although segments such as MICE business and Corporate travellers will lag behind Leisure, with businesses shaped by work-from-home policies and digitalisation adjusting to a post-pandemic world. Furthermore, owing to the economic decline and unemployment generated by COVID-19, many of the negative effects of Brexit that were expected to shape 2020 and 2021 have to quite an extent been masked or resolved, potentially leading to a smoother transition than expected.

Europe in the Face of COVID-19

After a stellar 2019, driven by record-low interest rates, yield compression, the weakening euro and pound in a post-Brexit Europe, and outstanding interest from Asian investors, 2020 was primed to be another great year for the European hospitality market. Investment volume for the months of January and February 2020 reached €2.7 billion, surpassing the 2019 volume by 2.5%. What is more, average sale prices per room over the same period reached €170,000, increasing by 1.8% over 2019, highlighting the increasing appetite for European hotels in early 2020. One point of note is that some of these deals in early 2020 were announced in late 2019 but closed in the first few months of the year.

In late 2019, the COVID-19 virus was discovered in China, causing a national lockdown in early 2020, which restricted virtually all leisure and corporate travel in and out of the country. Asian-centric European hospitality markets suffered immediately from the restrictions, but for most of Europe, business continued as usual.

In mid-March 2020, the virus had spread throughout much of Europe, launching national lockdowns of varying intensities throughout the continent. Major restrictions included largely banning domestic and international travel – including leisure and non-essential business – the closing of many hotels, restaurants, and retail spaces, and government directives for businesses to work from home whenever possible. Naturally, hospitality markets were heavily affected; according to our sister publication, the European Hotel Valuation Index, which explores market-by-market hotel pricing and values, hotel performance during lockdown dropped significantly, with establishments that remained open seeing top-line declines of more than 80%. Following a brief period of reprieve in the summer months, during which some international leisure travel was permitted, European national and regional lockdowns persisted throughout 2020.

Port-Palace Hotel

Source: www.portpalace.net

The overall effect of the pandemic and associated lockdowns was a significant drop in hotel investment volume compared to 2019, with total 2020 volumes reaching €8.5 billion in 2020. Compared to the previous peak (2019), this represents a decline of 69%. As per Chart 1, total European volume has not fallen to these levels since 2013, following the recovery from the Global Financial Crisis and the European Debt Crisis, though 2020 volumes were significantly higher than the previous 2009 trough of €3.1 billion. The total number of transactions in 2020 declined to 291, a fall of 66%. The average sales price per room declined from €206,000 in 2019 to €194,000 in 2020, representing a drop of 6%. The number of rooms per transaction also declined by around 4%. The net effect on transactions was a slight decline in the average sales price per hotel of 9%.

Aside from the significant declines in cash flow, one potential driver for transaction volume declines in 2020 was a distinct lack of available debt financing options. Owing to repayment difficulties brought on by reduced cash flows during lockdown, the EU mandated a moratorium on certain loan payments across Europe, beginning in the summer of 2020. Naturally, banks during the course of 2020 were significantly less motivated to originate new loans or refinance, often reducing acceptable loan-to-value ratios, increasing interest rates, and generally being far more selective when lending to new sponsors. Tightening lending options naturally increases the expected cost of capital for potential acquisitions, shifting the capital stack from debt to equity and increasing the need for mezzanine lending, which some senior lenders are not comfortable with, which in turn may have pushed many fair-weather investors to postpone or terminate ongoing transactions in favour of waiting out the storm.

A total of 291 hotels and more than 44,000 rooms exchanged owners in 2020, of which 153 hotels were as single asset transactions and 138 were sold as part of portfolio deals. The largest amount of capital, by some distance, was poured into the UK, while Germany booked the second highest investment volume. The UK saw some €2.1 billion/£1.8 billion (24% of the total European volume) invested while Germany received €1.7 billion (20% of total volume). In terms of room count, however, Germany transacted 27% of all hotel rooms and 21% of all hotels while 12% of all hotel rooms and 12% of the total number of hotels transacted in the UK.

Single asset transactions declined by 54% in terms of sales volume compared to 2019, whereas portfolio volumes declined by 80%. Overall, 65% of transactions were single asset transactions, compared to the historical ratio of 55:45 single asset versus portfolio.

Chart 2: Regional Share of Transaction Volume 2019-20

Source: HVS – London Office

Some countries with high average prices per room included Switzerland (€674,000), Italy (€447,000) and the UK (€388,000). Each recorded an increase in the average price per room of more than 50%, indicating continued interest in key European markets.

In general, decreased investment demand reflected supressed 2020 cash flows and an uncertain recovery outlook for the next few years. The impact of COVID-19 on average values per room by market is explored in our sister publication, the European Hotel Valuation Index.

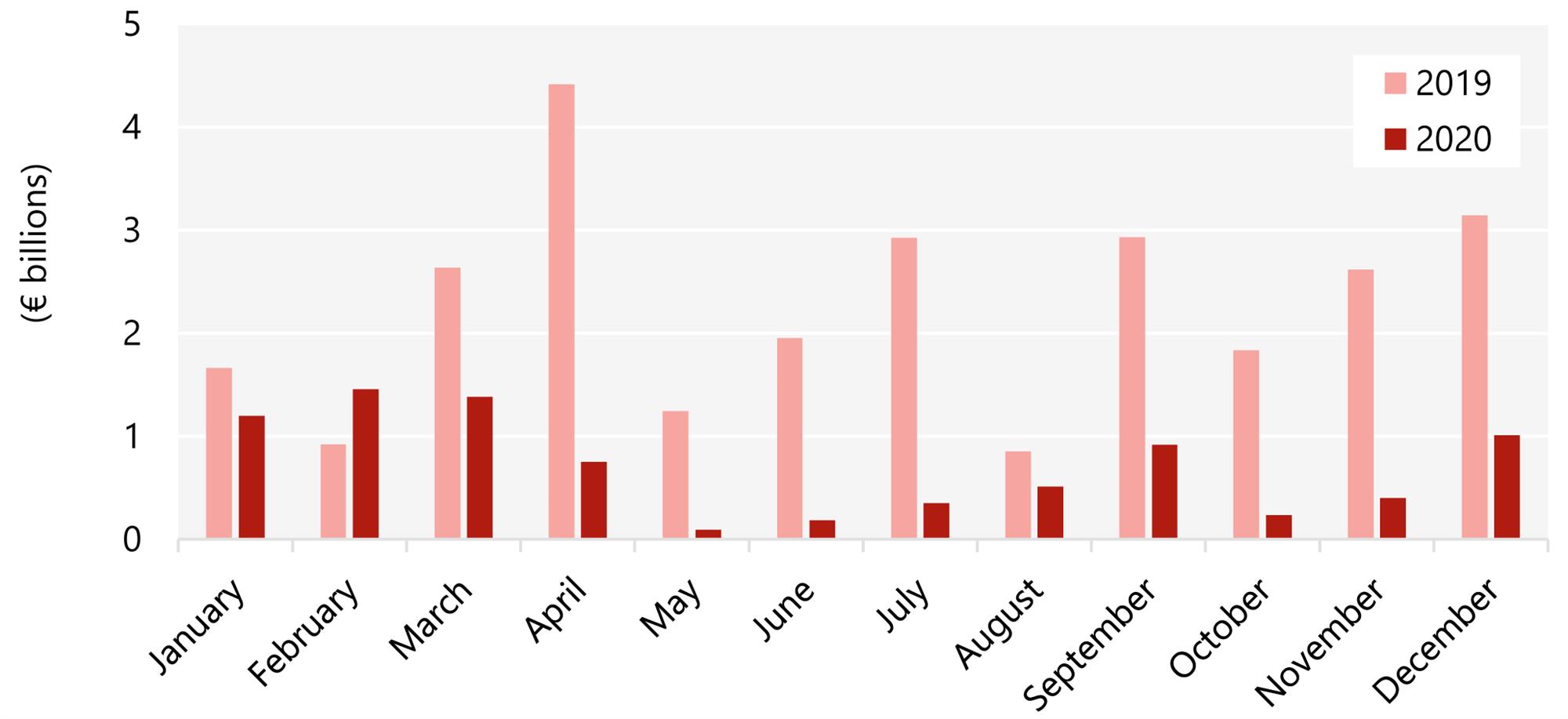

Chart 3: Total Investment Volumes by Month 2019 & 2020

Source: HVS – London Office

Quarterly Activity

In the first quarter of the year, €4.0 billion of European hotels transacted, representing 52% of the year’s single asset transactions and 40% of the portfolio transactions by volume. Compared to 2019, total volume for the quarter fell by 23%, owing in large part to a decline in portfolio transactions, which fell by 58%. Single-asset volume increased by 18% over 2019, partially on account of the sale of The Ritz London.

Following the rise of COVID-19, hotel transactions largely ground to a halt, with minimal activity in Q2 as investors froze deals in favour of letting the dust settle. Q2 investment volume totalled €1.0 billion, a decline of 86% compared to 2019. Portfolio volumes were particularly suppressed, declining by 93% to €332 million, compared to €4.9 billion in 2019. One interesting point of note is that more than three quarters of transactions in 2020 occurred in months with no or softened lockdown restrictions.

Chart 4: Investment Volume in 2020 by Quarter

Source: HVS – London Office

Single Assets

Following a strong 2019, 2020 saw a 54% decline in single asset transaction volumes. The total volume of single assets in 2020, which totalled €5.5 billion, was the lowest transaction volume recorded since 2013. In 2020, a total of 153 hotels (24,000 rooms) changed hands across Europe, 165 hotels fewer than 2019. In addition to fewer deals, transactions in 2020 were on average smaller in both monetary terms and room count. The average number of rooms per property for single asset deals declined by 10% to 156, which is a departure from both 2019 and the ten-year historical average of around 170. Interestingly enough, while the average price per hotel declined by 5%, the average sales price per room was largely static compared to 2019. Overall, single asset transactions in 2020 corresponded to 65% of deals in 2020, representing a large increase in proportion compared to only 44% in 2019.

(If one removes The Ritz London from the dataset, as it is a significant outlier not only within 2020 but compared to all historical hotel transactions, the average sales price per room across single asset transactions would have declined by 15%.)

Chart 5: Single Asset Investment Volume 2007-19

Source: HVS – London Office

Spotlight on the UK

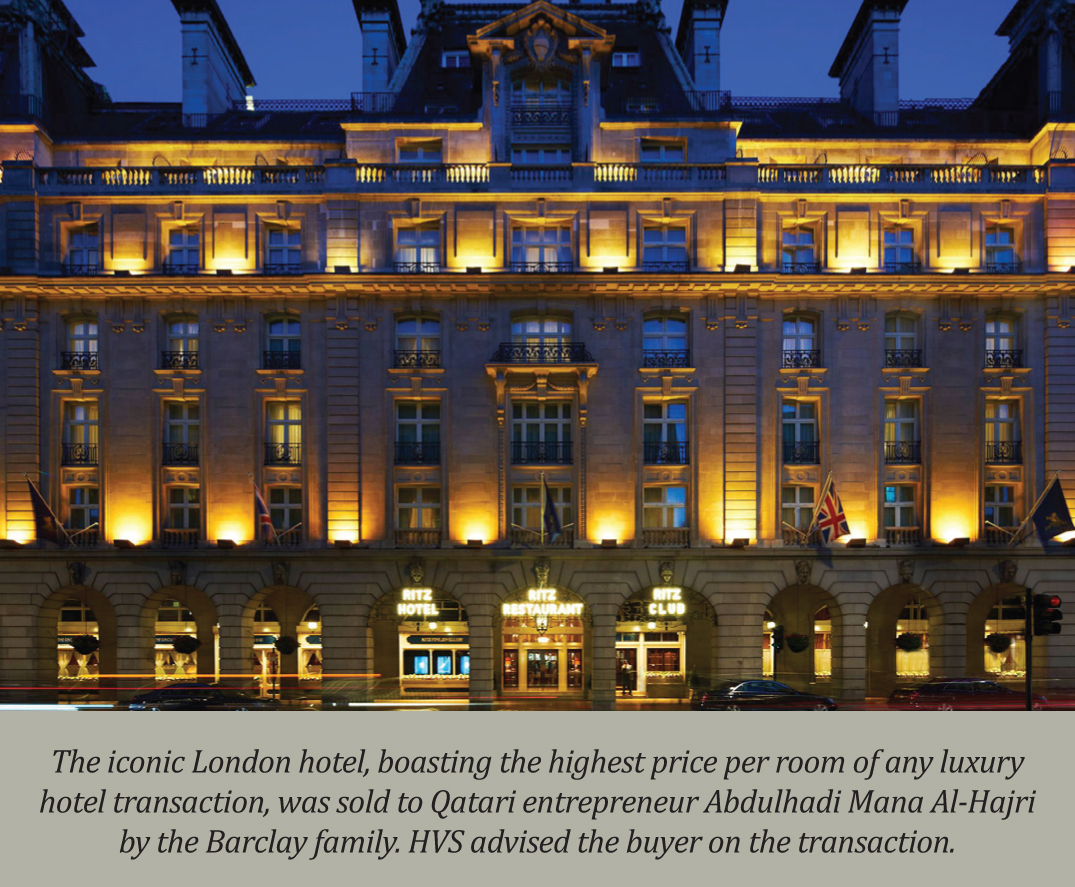

The UK continued to rank highly in terms of total volume, returning to the number one spot and reaching €2.1 billion/£1.8 billion in 2020, despite the 61% decline compared to 2019. The UK suffered the largest decline in nominal total volume of any European country, with a net change of -€3.2 billion compared to 2019. Overall, UK transactions represented 24% of the total European volume, 12% of total hotels sold and 12% of total rooms. Of the UK’s 35 transactions, nearly all were single asset deals, representing 32% of all single asset deals by volume in 2020. Collectively, 5,322 rooms in the UK transacted over the year. In terms of pricing, the UK maintained the fifth-highest average price per room at €388,000/£330,000. This represents a 67% increase in the average price per room and a 75% increase in the average price per hotel, though the figures are skewed by the sale of The Ritz in London, which was the highest price-per-room transaction ever recorded. The property in Mayfair was acquired by the ruler of Qatar’s brother-in-law from the Barclay family and is expected to undergo significant renovation works. HVS advised the buyer on the transaction.

The UK city which saw the most activity in 2020 was unsurprisingly London, which saw a total of €1.6 billion/ £1.4 billion in total volume and 78% of all transactions by volume within the UK, compared to 42% in 2019.

The Ritz London

Source: tr-images.condecdn.net

Spotlight on Germany

Returning to the number two position, Germany reached a total investment volume of €1.7 billion in 2020, decreasing by 57%. In terms of nominal value, Germany’s total volume declined by the second-largest amount of any European country, down €2.3 billion compared to 2019. Overall, German transactions represented 20% of European volume, the second most after the UK; however, German transactions contributed a larger volume of hotels and rooms, at 21% and 27%, nearly double that of the UK. In 2020, 60 hotels and 11,676 rooms transacted in Germany. As was the case in 2019, German transaction volume was once again a story of volume over price, with only the 15th highest average price per room at €149,000.

There was a noticeable change in the geographical disbursement of investments in Germany, with 64% of the total volume occurring in major cities, as compared to 47% in 2019. The cities with the highest investment volume were Munich (€501 million) and Berlin (€223 million), with Frankfurt and Düsseldorf taking a back seat in 2020, declining by 73% and 62%, respectively.

Key acquisitions in Germany include Aroundtown’s acquisition of TLG, including 1,553 rooms for €199 million (€128,000 per room) and Patrizia’s acquisition of 11 B&B hotels (1,145 rooms) from Covivio for €115 million (€100,000 per room). Key single-asset transactions include Eastern Property Holdings’ acquisition of the 304-room Nhow Berlin from Jesta Group.

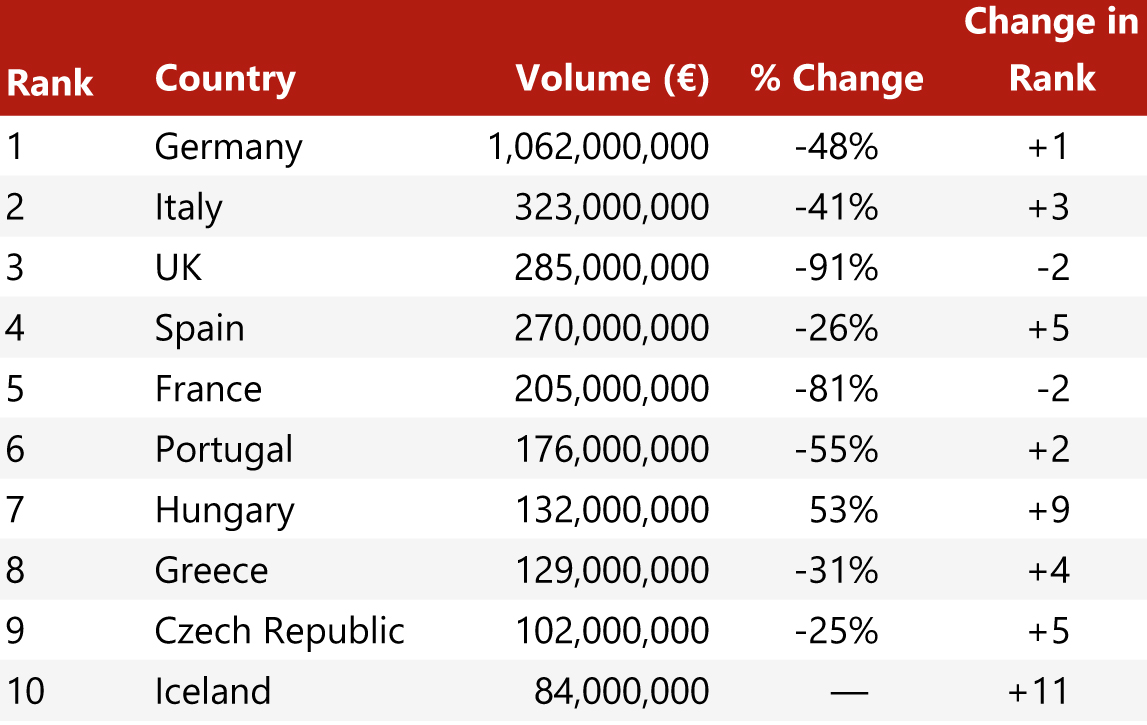

Chart 6: Top Countries by Volume 2020

Source: HVS – London Office

Spotlight on Spain

Spain had the third-highest transaction volume in 2020, with a total volume of €818 million. A total of 31 assets changed hands, representing 5,797 rooms. Compared to 2019, the total volume, number of hotels and number of rooms declined by 29%, 33%, and 26%, respectively. Overall, Spanish transactions accounted for 10% of the total European transaction volume, 11% of hotels and 13% of transacted rooms. The average price per room was €141,000, which is a 6% increase compared to 2019.

Within Spain, the city with the largest volume of transactions was Barcelona, with five transactions and a total volume of €155 million. This represents a 29% increase in volume for the city compared to 2019. The average price per room within the city was €239,000.

Spanish transactions were largely led by portfolios, with notable portfolio acquisitions including Swiss Life’s acquisition of four resort hotels (534 rooms) in the Balearic Islands and Catalonia for €50 million (€94,000 per room) from Elaia Investment; Blantyre Capital’s acquisition of three hotels (934 rooms) in Tenerife from Gema Hoteles; and Apollo Global’s acquisition of two hotels (912 rooms) from Lopesan Grupo.

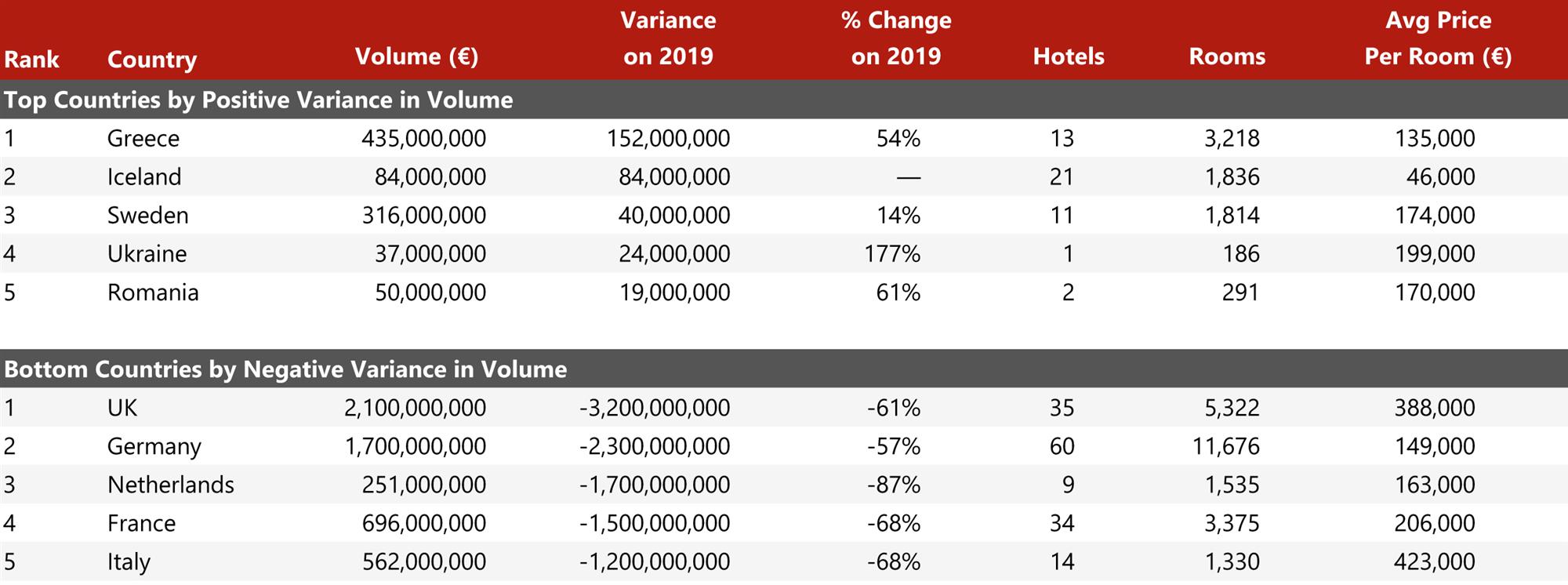

Chart 7: Top and Bottom Countries by Variance in Volume to 2019

Source: HVS – London Office

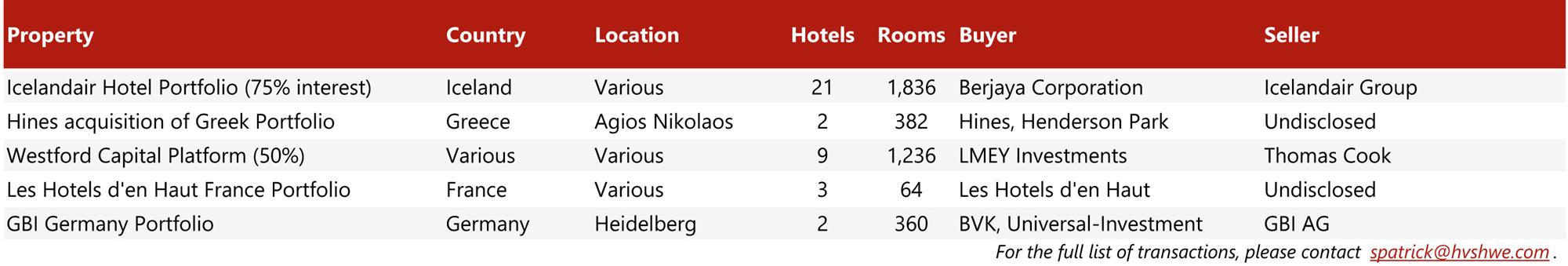

Notable Transactions

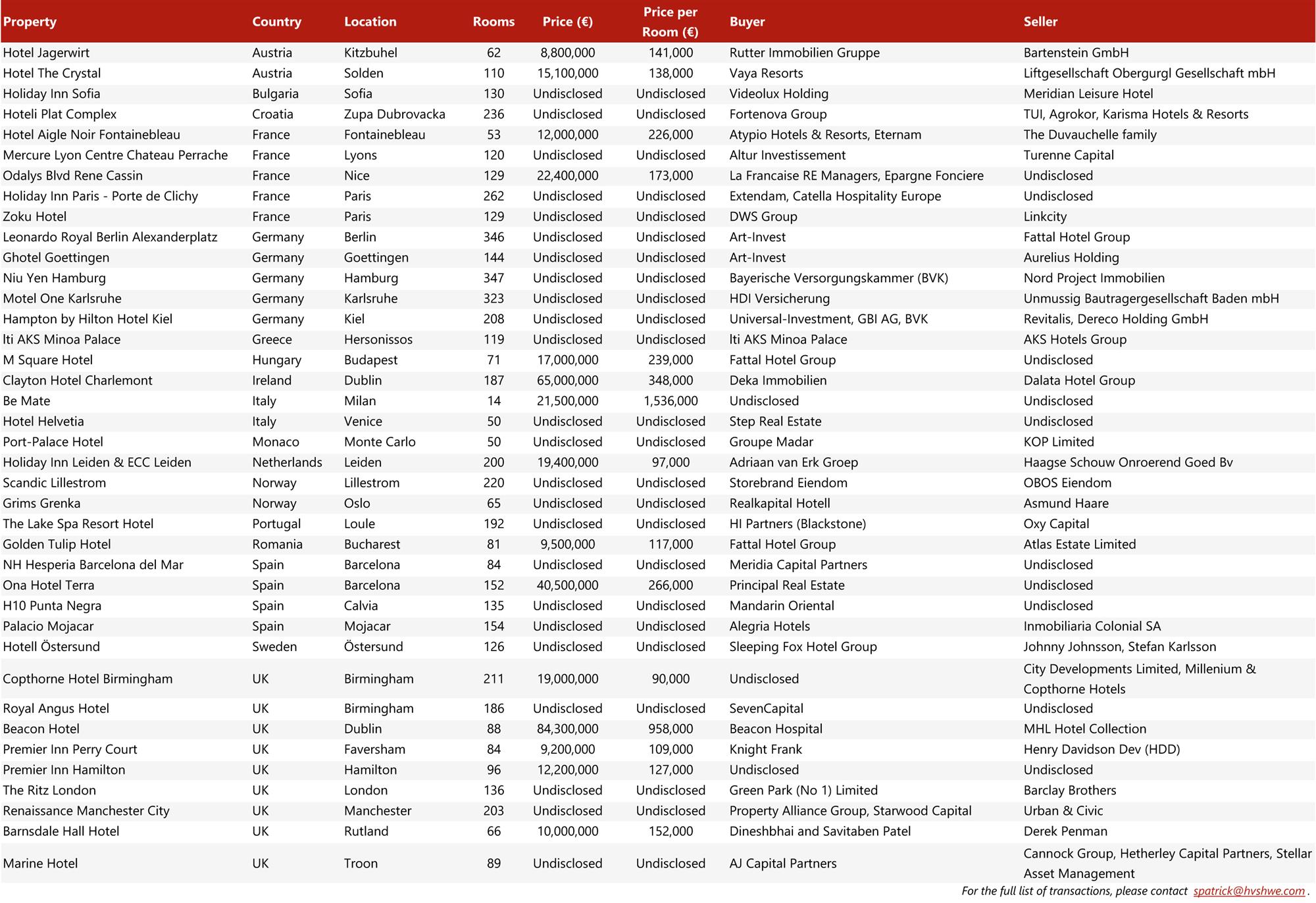

Presented in Charts 8 and 12 are a selection of transactions that occurred over the course of 2020. To access the full list of transactions, please contact [email protected].

Chart 8: Notable European Single Asset Hotel Transactions 2020

Source: HVS – London Office

Portfolios

€3.0 billion of hotel portfolios transacted in 2020, a significant 80% decline compared to the €15.1 billion seen in 2019. In terms of sales volume, 138 hotels changed hands (-74%), representing 19,795 rooms (-74%) across 48 individual transactions. Compared to 2019, 33% fewer transactions occurred, indicating a significant reduction in the average number of hotels per portfolio – from 7.3 on average in 2019 to 2.9 in 2020. In terms of pricing, the average price per room declined by 23% from €197,000 to €152,000, and the average number of rooms per transaction declined from 1,064 in 2019 to 412 in 2020. Overall, the sheer reduction in the number of transactions and hotels transacted significantly reduced the overall volume for 2020. As with single asset transactions, the majority of deals occurred in the first and third quarters of 2020, correlating with periods of time with no or fewer lockdown restrictions in Europe.

Chart 9: Portfolio Investment Volumes 2008-2020

Source: HVS – London Office

The largest portfolio transaction by volume was Covivio’s €573 million (€514,000 per room) acquisition of eight hotels (1,115 rooms) across Europe from Varde Partners. The properties operate under The Dedica Anthology brand. Varde Partners began buying the debt on the company in 2016 through a series of transactions, ultimately acquiring all of the equity in 2017, before disposing of the assets in 2020.

Also of note is Vivion’s acquisition of two London hotels from Sheikh Hamad bin Jassim Al Thani for €285 million/£255 million (€806,000/£720,000 per room). Sheikh Hamad, who served as Qatar’s prime minister from 2007 to 2013, put The Sanderson and St Martins Lane hotels, collectively 354 rooms, up for sale in 2019, before closing the deal with Luxembourg-based Vivion, which is backed by Israeli entrepreneur Amir Dayan. Sheikh Hamad reportedly purchased the two hotels eight years ago for £192 million (£542,000 per room).

Other notable portfolio transactions include Aroundtown’s acquisition of TLG for €198 million (€128,000 per room), Aroundtown’s disposal of four German hotels to Primonial, Palm Invest’s €121 million (84,000 per room) acquisition of 11 Portuguese hotels (1,438 rooms) from Bernardino Gomes Group, and Hines’ and Henderson Park’s €61 million (€87,000 per room) acquisition of three Greek hotels (704 rooms) from Cyan Group.

Holiday Inn London Bloomsbury

Source: hotelmedia.s3.amazonaws.com

Aside from Aroundtown’s acquisition of TLG, several other M&A deals occurred in 2020. In August, LMEY Investments acquired the remaining 50% stake in Thomas Cook’s Westford Capital Platform, giving them full ownership of the platform’s nine hotels and 1,236 rooms around the Mediterranean. In December, AXA acquired Kadans Science Partners, including the future Pullman Brussels Airport, which will have a reported 125 rooms.

While not a real estate deal, Accor and Ennismore announced an all-share merger, bolstering Accor’s brands and market share in the lifestyle hospitality space. Through the deal, Accor took a majority share in a new entity, co-CEO’d with Sharan Pasricha, the founder and CEO of Ennismore. At its inception, the combined entity will comprise 12 brands with 73 hotels in operation and a pipeline of more than 110 additional hotels across 150 destinations. As part of the merger, Accor has announced plans to buy out its partners in sbe, Mama Shelter and 25hours. As of November 2020, Accor’s lifestyle operations represented about 5% of its overall fees and more than 25% of its pipeline fees. The merger is expected to place further emphasis on the growing lifestyle hospitality segment.

Portfolio Investment by Region

Germany surpassed the UK as the most active region in terms of portfolio transactions, recording some €1.1 billion in total volume – see Chart 10. A total of 36 hotels, representing 6,662 rooms, transacted in Germany during 2020. The average price per room was €159,000, representing a 1% decrease in pricing per room for portfolios. Collectively, Germany represented 35% of all portfolio transactions in Europe by volume in 2020, more than double the 14% reached in 2019.

Chart 10: Top Countries by Portfolio Transaction Volume in 2020

Source: HVS – London Office

Italy transacted the second most portfolio assets by volume in 2020 at €323 million, moving up from fifth in 2019. A total of five hotels, representing 546 rooms, transacted in Italy during 2020. The average price per room was €592,000. Collectively, Italy accounted for 11% of all portfolio transactions in Europe.

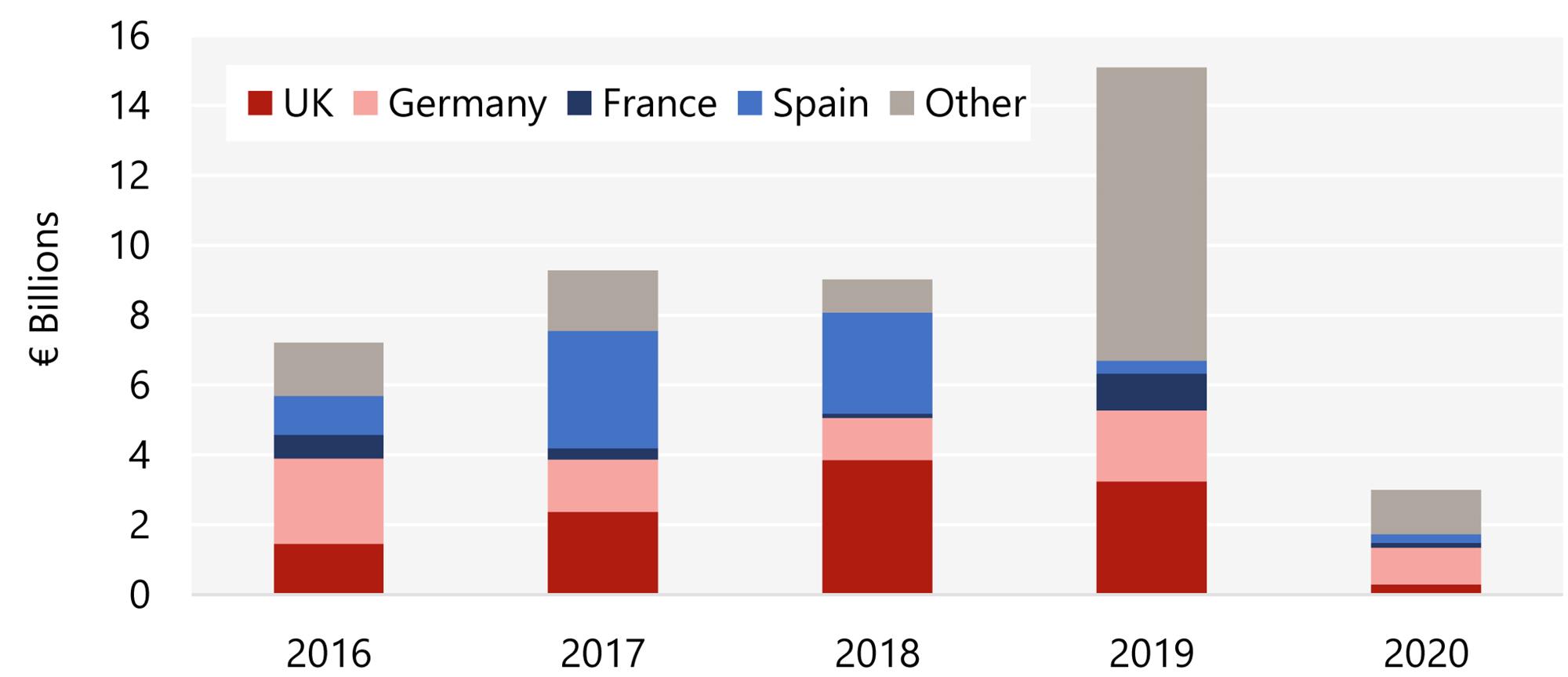

Chart 11: Portfolio Investments by Region 2016-2020

Source: HVS – London Office

The UK, in third place, transacted a single portfolio: the sale of two London hotels to Vivion by Sheikh Hamad bin Jassim Al Thani. The portfolio, containing The Sanderson and St Martins Lane hotels in London, collectively 354 rooms, transacted for €285 million/£255 million (€806,000/£720,000 per room). Compared to 2019, the UK lost its status as a portfolio hotspot, with the total portfolio volume in 2020 declining by 91% from 2019.

Chart 12: Notable European Portfolio Transactions 2020

Source: HVS – London Office

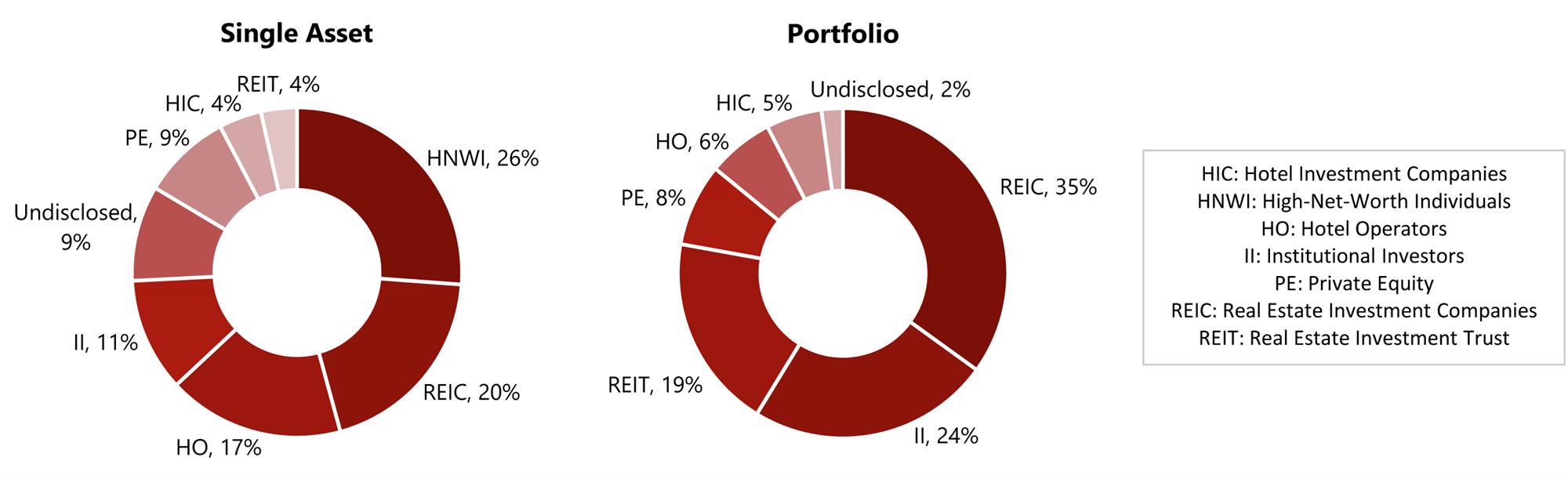

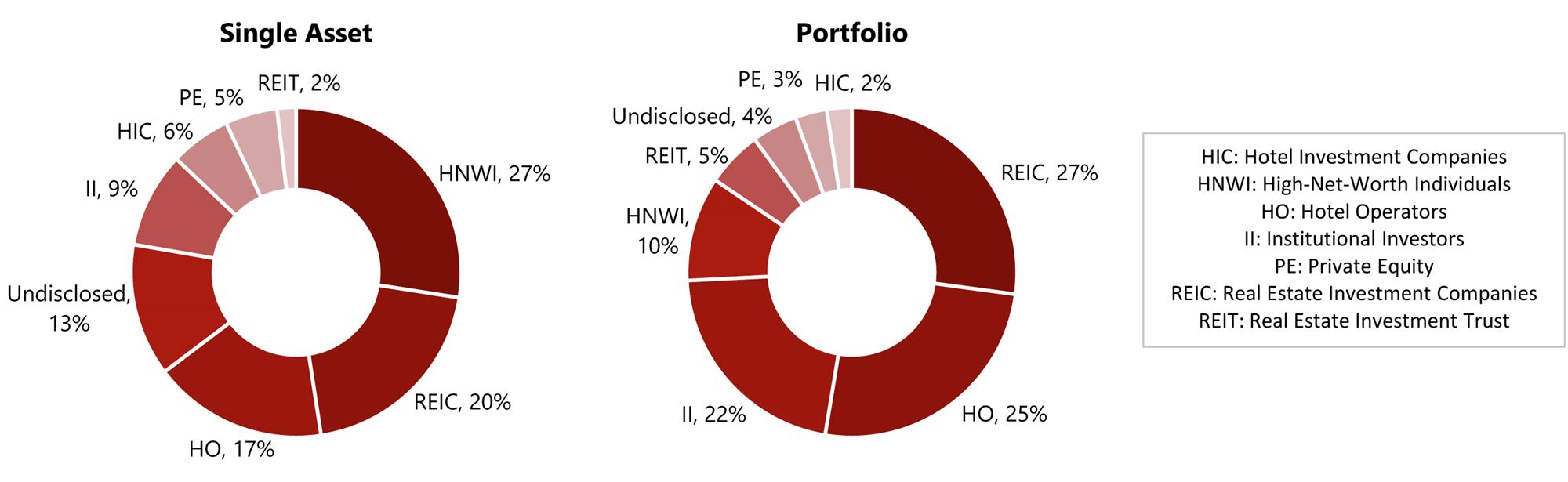

Main Buyers

Real Estate Investment Companies were the largest buyers in 2020, responsible for 25% of all acquisitions, 20% of single asset purchases and a substantial 35% of portfolios. Collectively, they acquired €2.1 billion of assets, despite recording a 72% decrease compared to 2019.

Chart 13: Buyer Types in 2020 – Single Asset Sales Versus Portfolio

Source: HVS – London Office

The only group that saw a positive increase in acquisition volume in 2020 compared to 2019 were High-Net-Worth Individuals, largely skewed by the acquisition of The Ritz in London. All other investment groups saw a decrease in sales volume of more than 50%, except for REITs. With a volume of €765.9 million in acquisitions, their activity declined by only 11% compared to 2019.

In terms of net transaction volume, after deducting disposals, REITs had the highest positive volume at €499 million. The largest net sellers were Hotel Operators and High-Net-Worth Individuals, which disposed of a net €560 million and €379 million, respectively.

Investment by Region

In terms of percentage share of total investments, European investors remained responsible for the largest share of the continent’s total transaction volume in 2020 (€6.2 billion), accounting for 74% of all hotel investments. Investments from Europe saw the largest decrease in overall capital deployed at -€16.5 billion (-73%). Outside of Europe, the Middle East saw a significant increase in capital deployment, accounting for 12% of the overall volume.

Notably absent from the acquisition process were Asian investors, with a nearly 90% decline in total investment volume to €121 million, compared to the €1.2 billion in 2019. Overall, Asian investors accounted for only 1% of the overall transaction volume in 2020. Also significantly diminished were North American investor volumes, which saw a decline from €1.9 billion in 2019 to €570 million (-71%).

Chart 14: Investor Origin by Region 2010-2020

Source: HVS – London Office

Main Sellers

Real Estate Investment Companies were the largest sellers in 2020, responsible for 23% of all sales (20% of single assets and 27% of portfolio transactions). Collectively, they transacted €1.9 billion of sales, representing a 63% decrease compared to 2019. The largest portfolio transactions sold by Real Estate Investment Companies include Aroundtown’s acquisition of TLG for €199 million (€128,000 per room) and Aroundtown’s disposal of four German hotels to Primonial.

Chart 15: Seller Types in 2020 – Single Asset Sales Versus Portfolio

Source: HVS – London Office

The only group that saw a positive increase in sale volume in 2020 compared to 2019 was High-Net-Worth Individuals. All other investment groups except REITs saw a decrease in sales volume of more than 50%.

Notably absent from the sell-side in 2020 were Hotel Investment Companies, Private Equity firms and REITs, which collectively accounted for only 12% of total sales. Interestingly, REITs were the second least affected group in terms of reduction in sale volume, at only -28% compared to 2019.

Conclusion and Outlook

2020 began in the wake of a record-breaking 2019, with the first few months of 2020 staying on-pace or even exceeding 2019 volumes. Concerns of Brexit’s impact on Europe and the UK quickly faded behind the shock of the pandemic following the start of European lockdowns in March 2020. With what was largely a global travel shutdown, transaction volumes ground to a halt, as investors postponed acquisitions in the hope of clearer skies and/or reduced pricing to come.

As the year progressed, it became clear that a return to normality in terms of business, MICE and leisure travel was unlikely to occur in 2020. Even news of vaccine developments in late 2020 was quite quickly stifled by novel virus variants and additional lockdown measures.

Tentative market sentiment and deal-hungry capital investors waited in expectation of a wave of distressed debt creating a chain reaction that might allow for significant discounts on prime assets that had fallen into distress. However, very substantial government assistance and generally supportive banking policies rolled out during 2020 prevented substantial loan defaults and forced sales. Despite droves of cash-flush buyers, asset owners capable of weathering the storm postponed sale processes or refused to provide substantial discounts in the hope of a relatively quick recovery in asset values, noting that fundamentals for the European hotel market remain strong in the medium-to-long term. Furthermore, since significant debt financing allocations earmarked for hospitality were tied up in pre-existing loans, some with postponed or reduced debt service, new originations were scarce. The resultant capital stack for prospective acquisitions required far more equity, resulting in buyers carefully considering the significantly reduced number of acquisition options.

The collective result of these mechanisms was a substantial decline in the 2020 transaction volume of 69% compared to the year before. Transactions that did occur often came at a discount of between 10% and 25% from expected pre-pandemic pricing, with the majority of investments coming from European investors in single-asset deals. Even so, 2020 transaction levels remained well above the last major market reset in 2009.

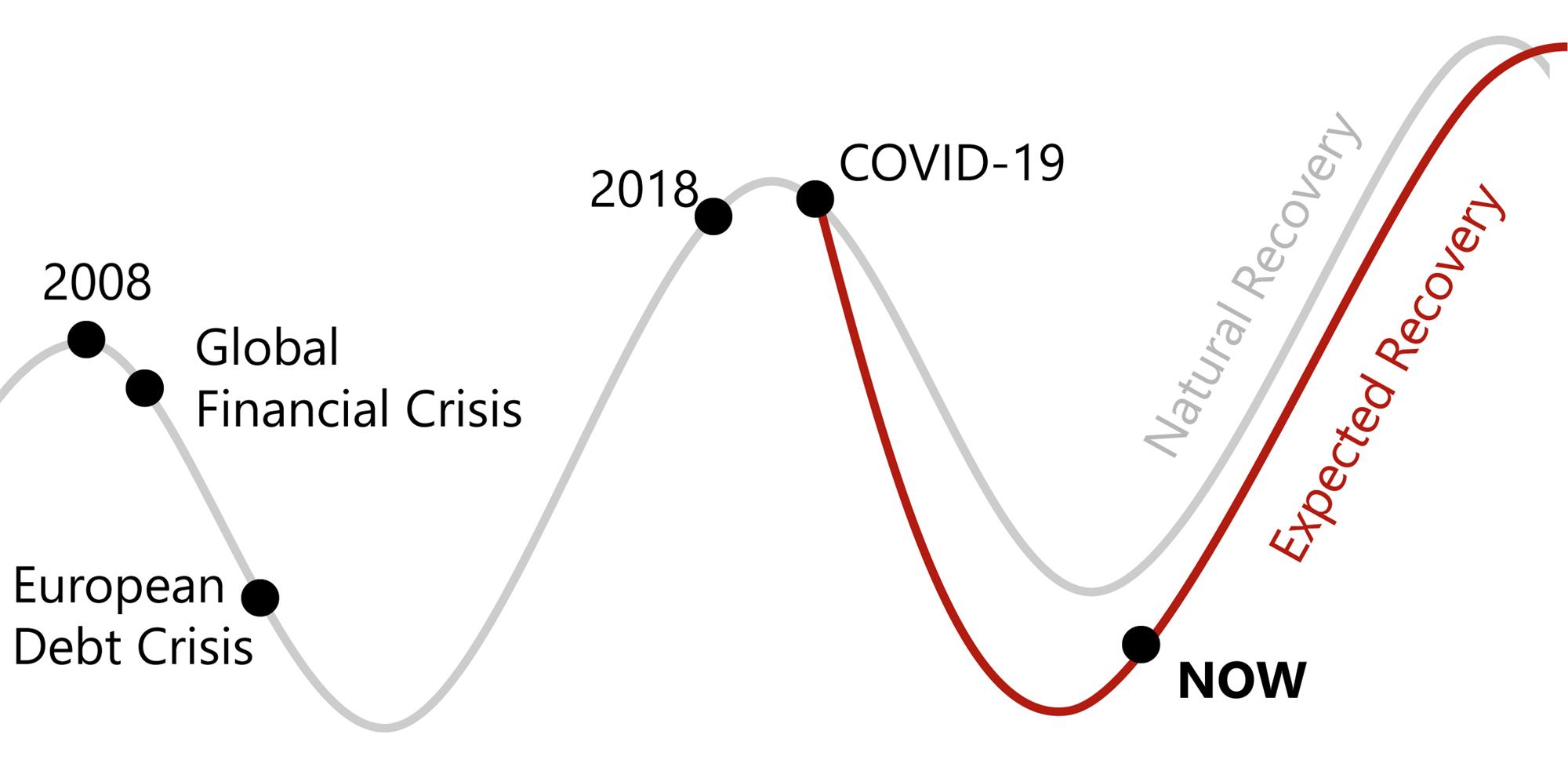

Chart 16: European Economic Cycle Outlook

Source: HVS – London Office

Looking forward, it is clear that recovery is coming. Vaccine rollouts are widespread globally, with prime investor markets such as Israel expecting to vaccinate most of their populations in the coming months. Many countries in Europe are hoping to ease lockdown measures by summer 2021, with various schemes to support a recovery in international travel, although this is tempered somewhat by a slower-than-expected vaccine rollout so far in continental Europe and associated concerns of a potential third wave.

In terms of a return to previous investment volumes, timing is variable. Asian and North American buyers were largely absent from the 2020 European transaction market, despite continued faith in the region. One possible explanation is that it is simply harder to perform the necessary due-diligence to acquire multimillion euro assets from abroad without ‘boots on the ground’. Market sentiment is that there is still very significant capital vying to get ahead of the recovery curve by snapping up well-located hospitality assets in Europe. Continued vaccine rollouts and the eventual opening of international borders is expected to unleash a wave of pent-up leisure demand, as lockdown-stricken Europeans head for warmer climes. While corporate and MICE business is expected to lag behind, particularly as the pandemic has forced digitalisation upon many companies, these segments will return. Furthermore, rising traveller and investor confidence, paired with gradual increases in debt originations, will help to return transaction volumes to their previous levels.

In terms of investment volume expectations for 2021, while this year will not have the initial boost of the pre-pandemic deals that supported investment levels in the early months of 2020, we expect investment activity to increase significantly in the second half of this year. Volume recovery will be more V-shaped than U-shaped, primarily due to many owners trying to hold on longer so as to benefit from recovering pricing before they sell. COVID infection rates still remain high globally, and the vaccine rollout will take time. There is some sentiment that the virus will make a comeback in the winter of 2021 if vaccine distribution falters. Regardless, substantially improving prospects, paired with a level of forced sales as economic support programmes fall away and loans come up for refinancing, should ensure that the second half of 2021 will be significantly stronger than the second half of 2020 in terms of transaction volumes, although the majority of volume recovery is expected to occur in 2022 following completed immunisation programmes, the return of leisure and corporate travel and restored market confidence. There is still a huge weight of capital looking to invest in hotels, and the availability of distressed acquisition opportunities is likely to be significantly less than what was anticipated when the pandemic began, which will support recovery in asset values.

0 Comments

Success

It will be displayed once approved by an administrator.

Thank you.

Error