Introduction

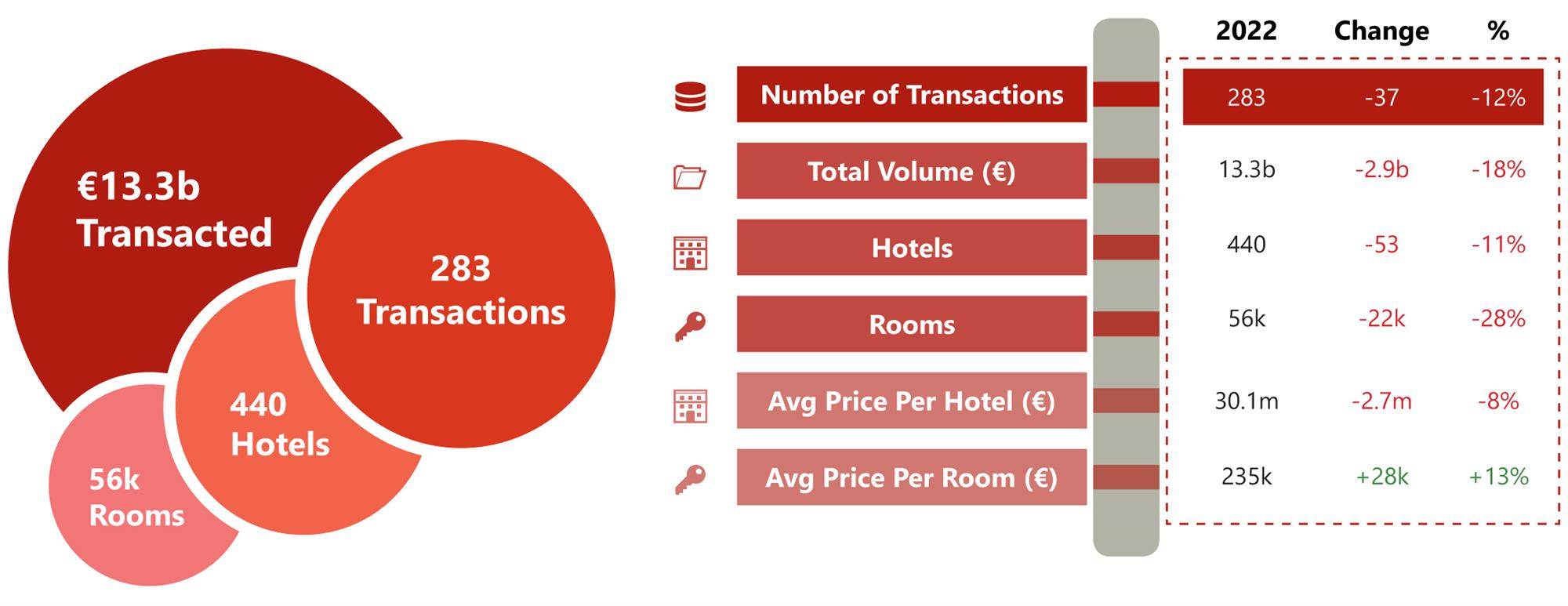

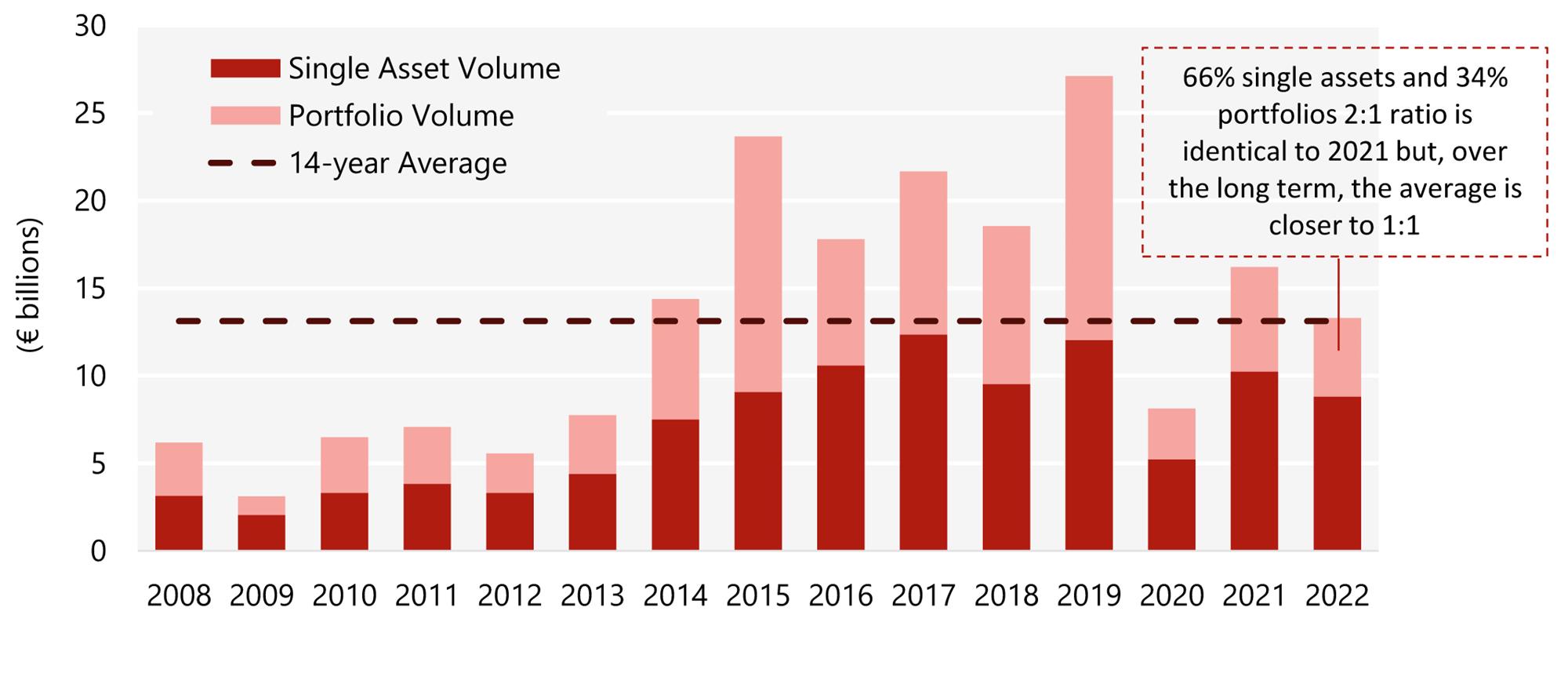

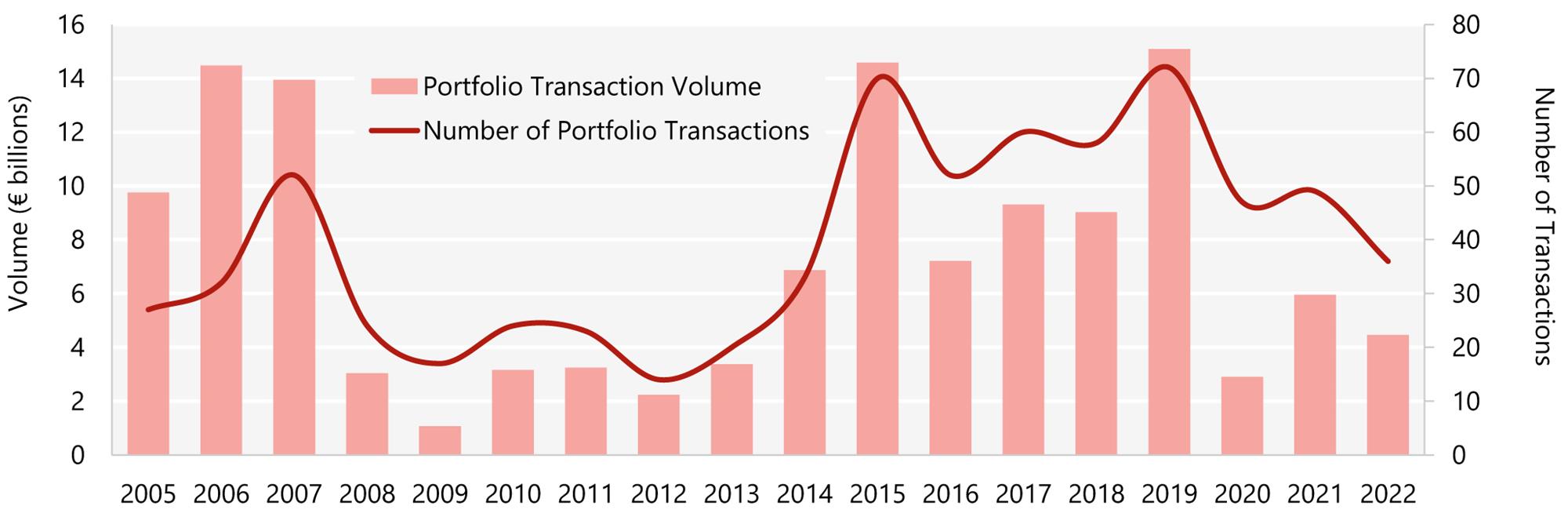

The post-COVID era was expected to have been a story of strong recovery in the hotel investment market. However, the Russian invasion of Ukraine in February 2022, which fueled huge increases in energy and food prices, overall inflation and therefore interest rates, resulted in a mixed picture for hotel transactions for the year. Although still reaching €13.3 billion, total volume in 2022 fell short of 2021 by 18%, with 37 fewer transactions. Prices per room achieved higher levels on average than in 2021, led by significant price increases in portfolio transactions.

Total Transaction Volume

Source: HVS – London Office

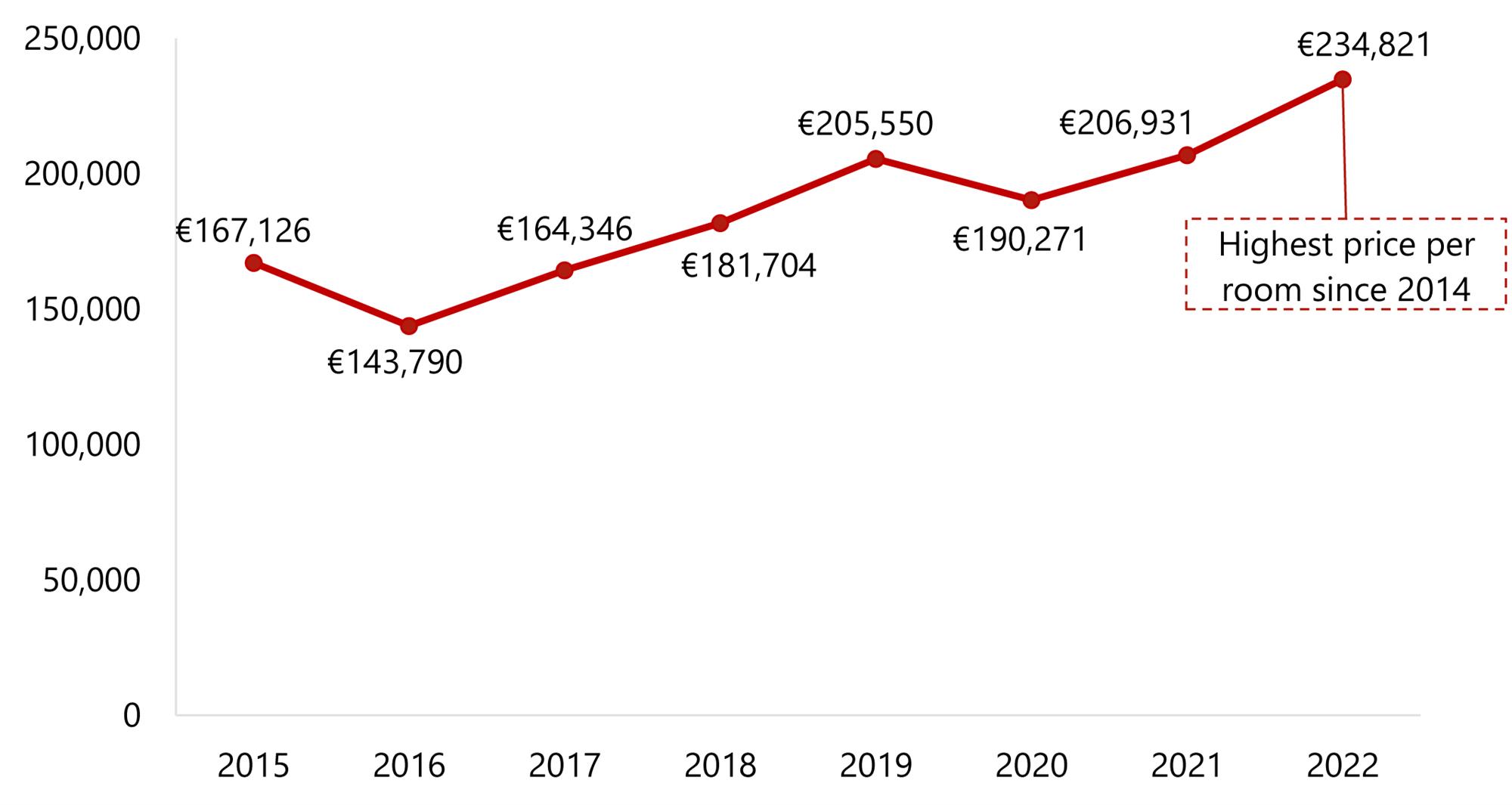

Pricing & Deal Size

- The average price per room was €235,000 in 2022, an increase of 13% over 2021;

- Hotels that transacted in 2022 had an average of 128 rooms, which is lower than in 2021 (-19%).

Source: HVS – London Office

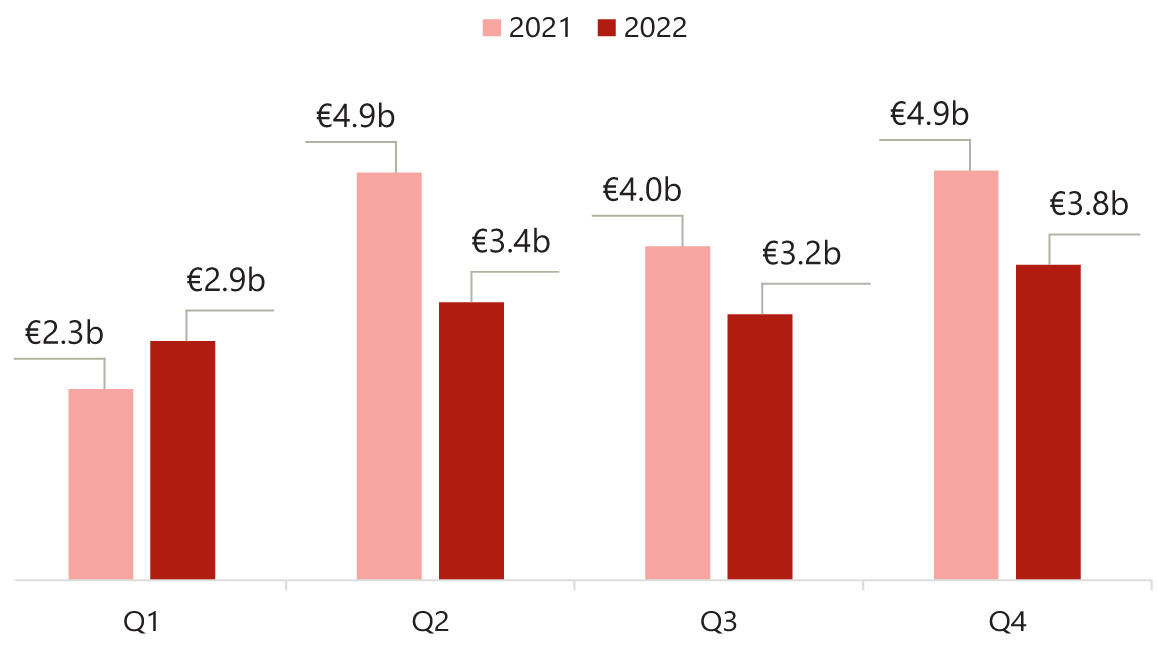

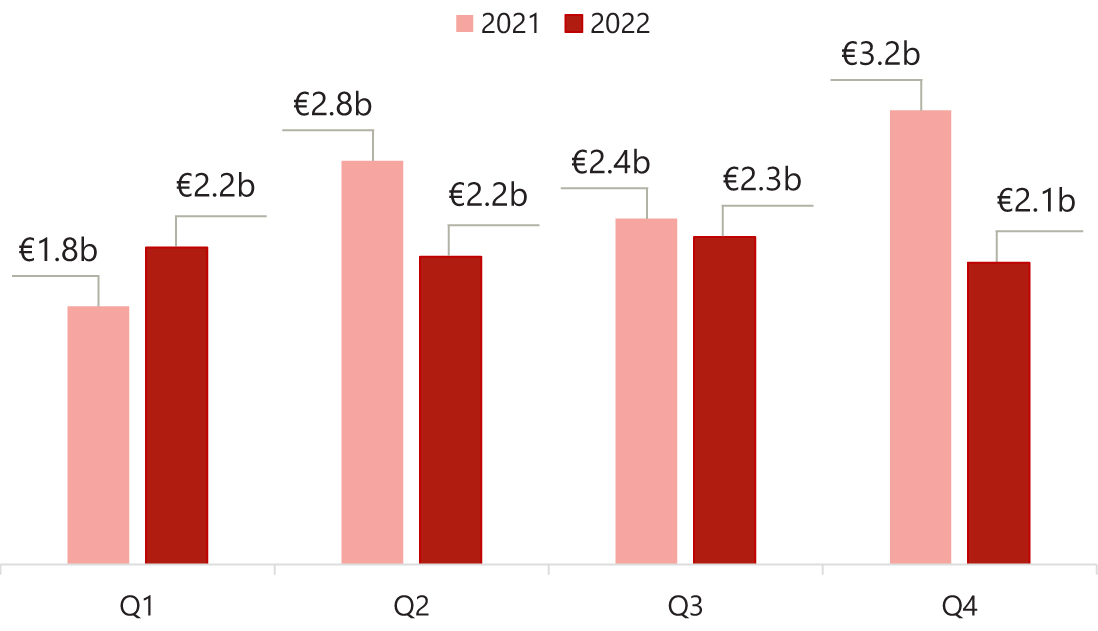

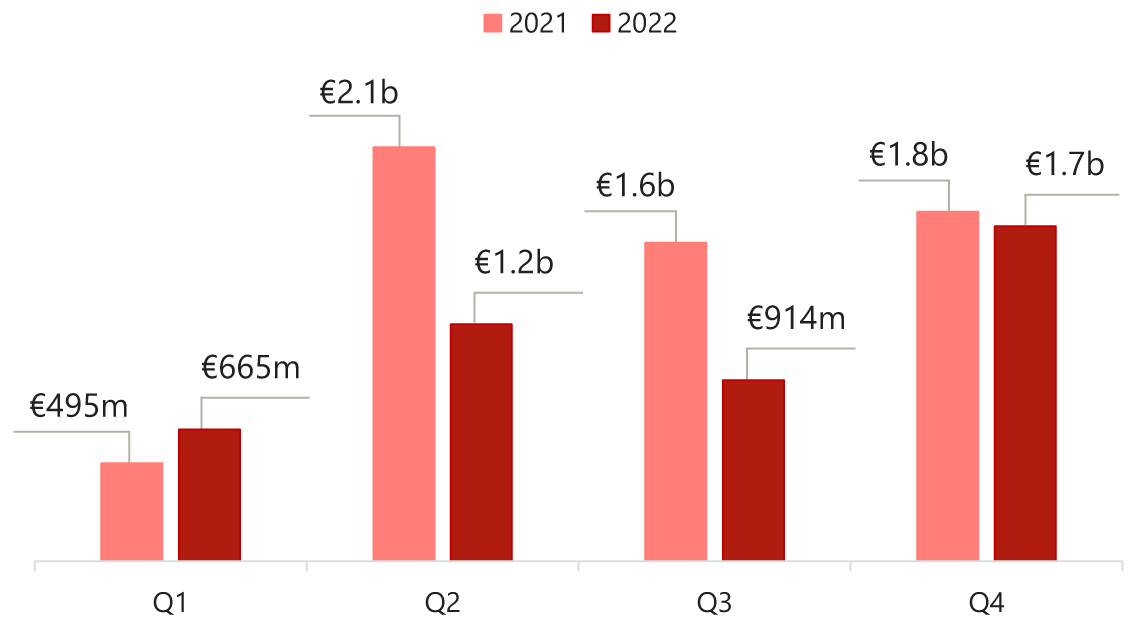

Seasonality

- Deal volume was strongest towards the end of the year, with Q4 being the year’s strongest quarter of activity (as is often the case);

- Deal activity outpaced 2021 between February and April and in August and September.

Source: HVS – London Office

|

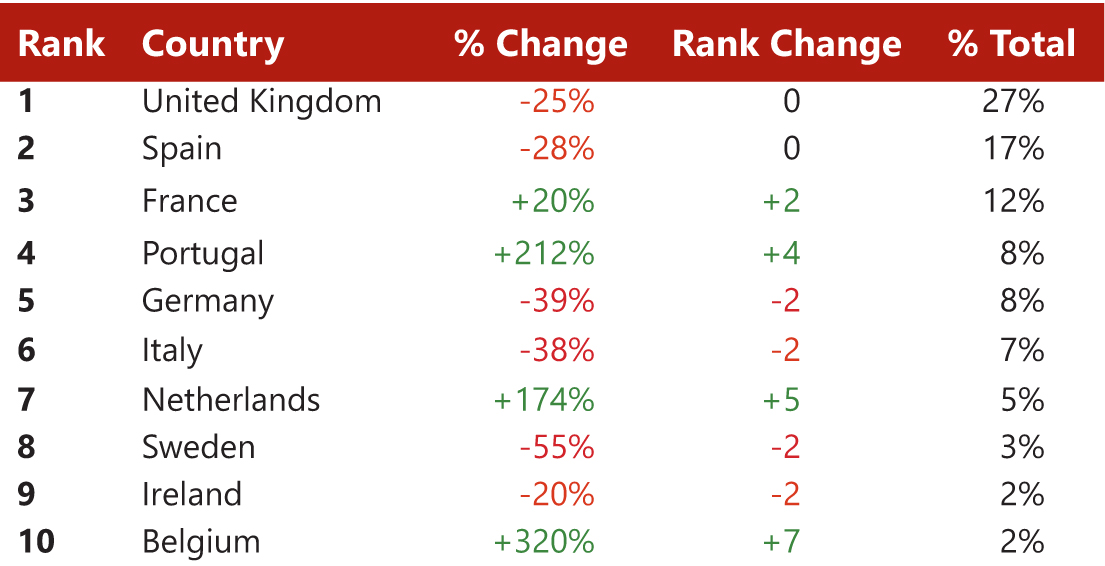

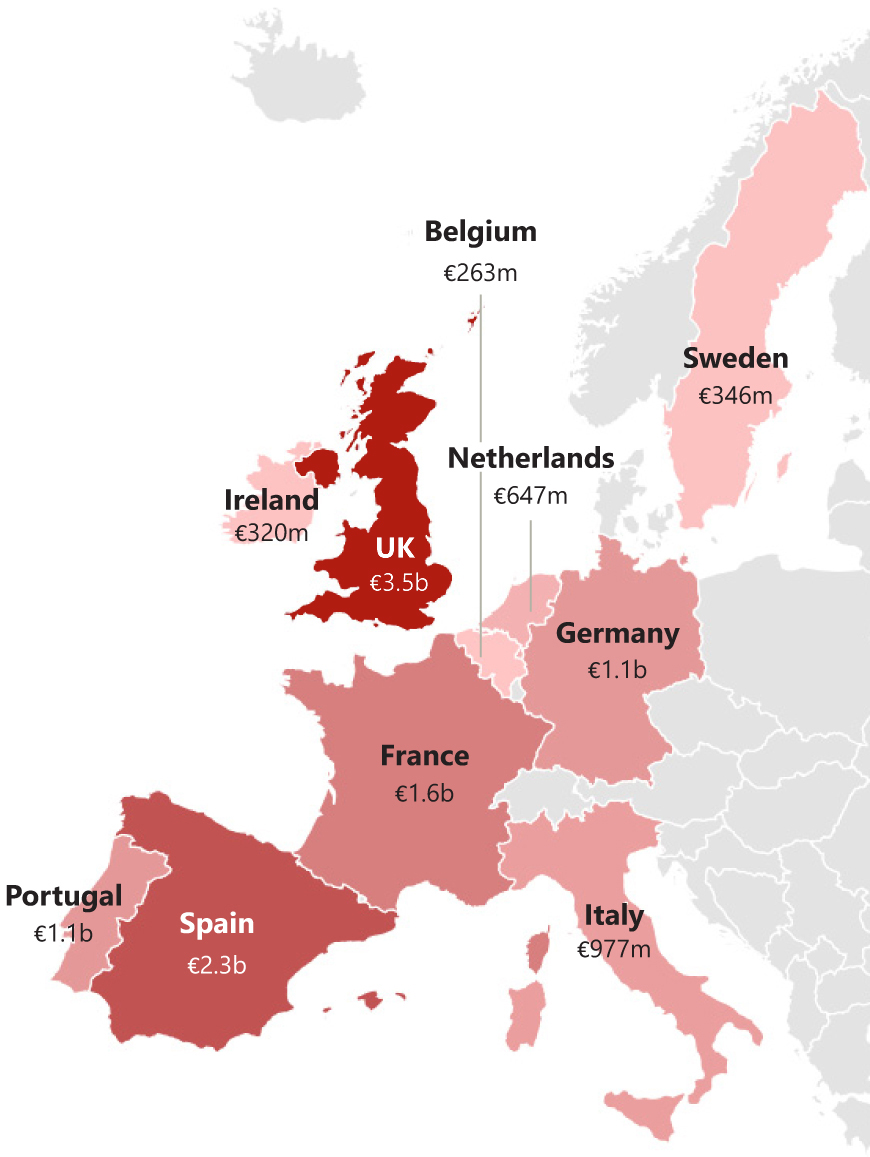

Chart 4: Top Countries – Total Asset Activity By Volume (€) |

|

|

|

|

Source: HVS – London Office |

|

Source: HVS – London Office

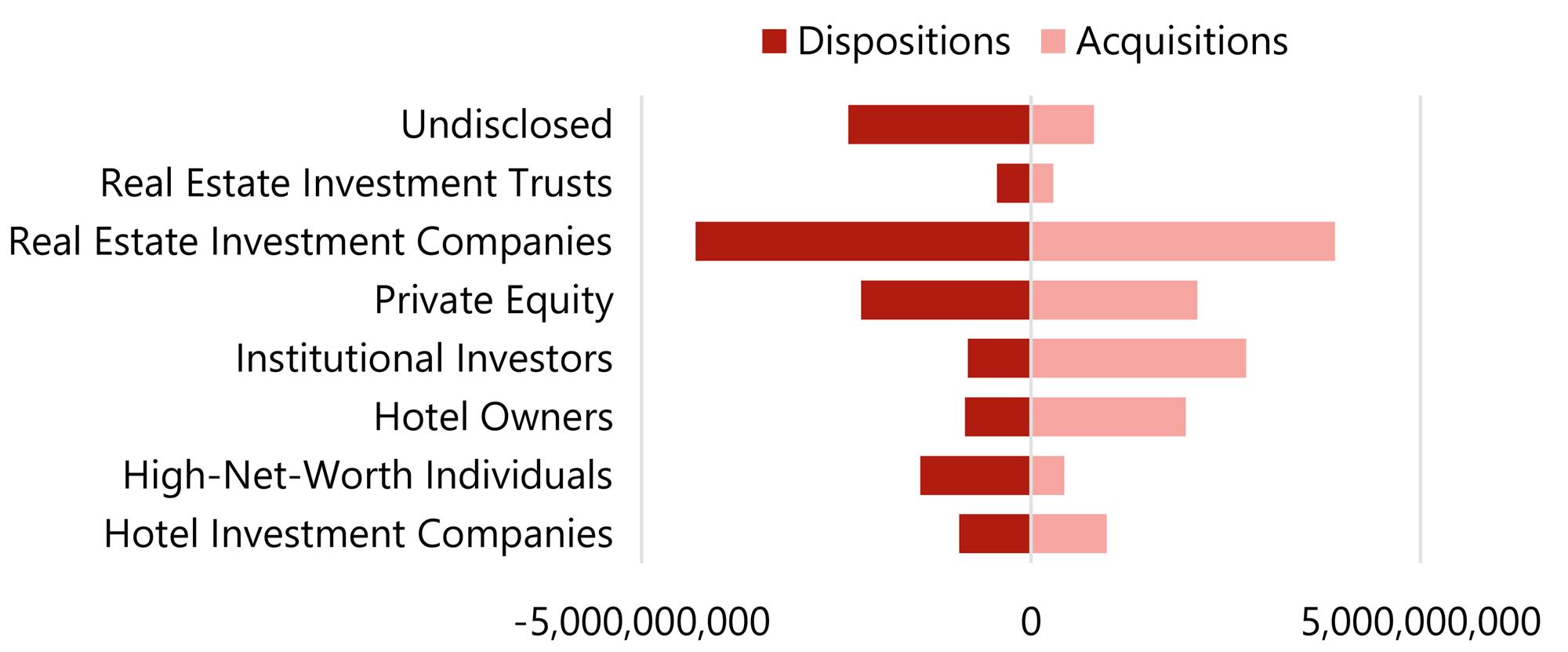

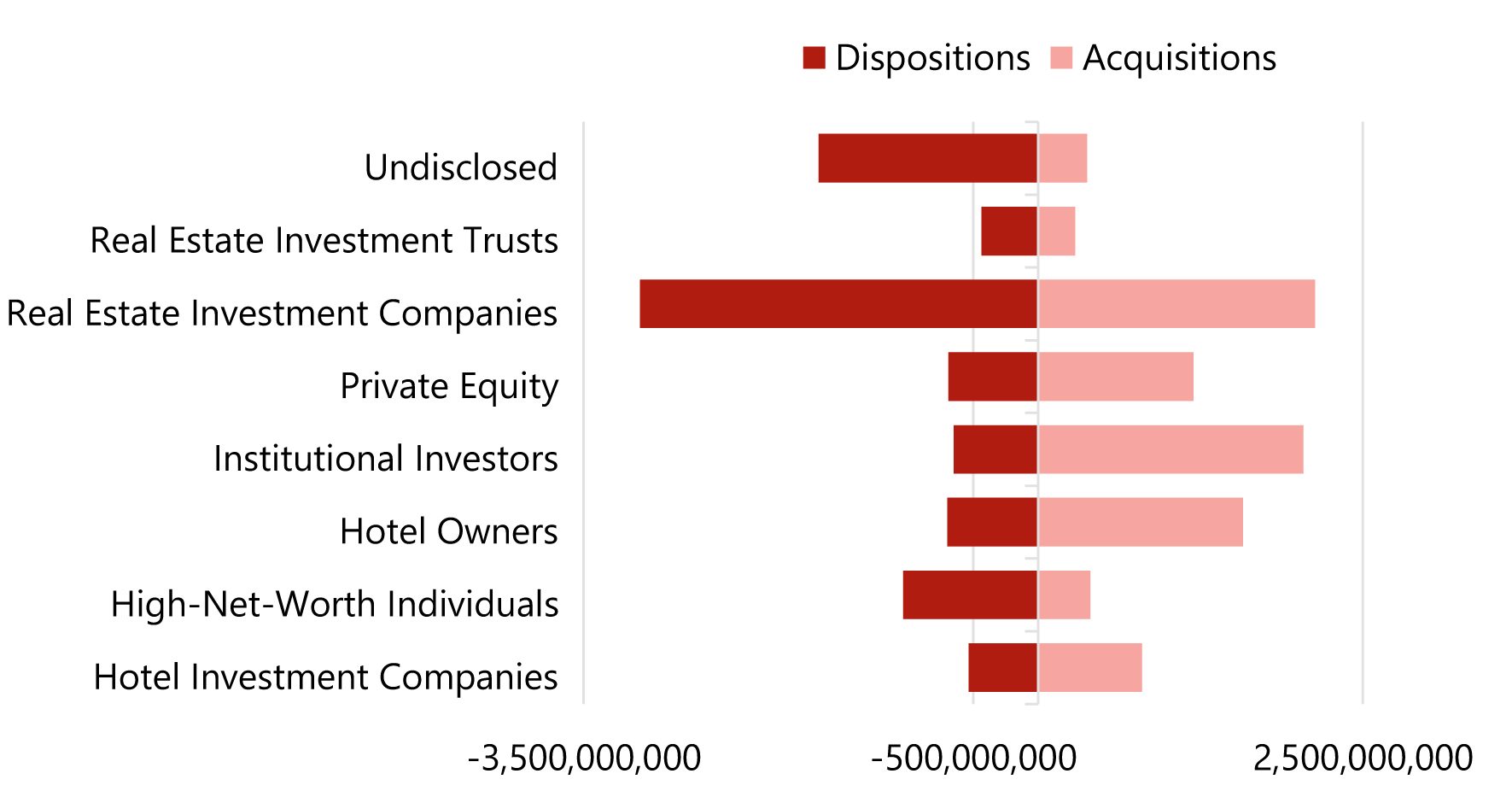

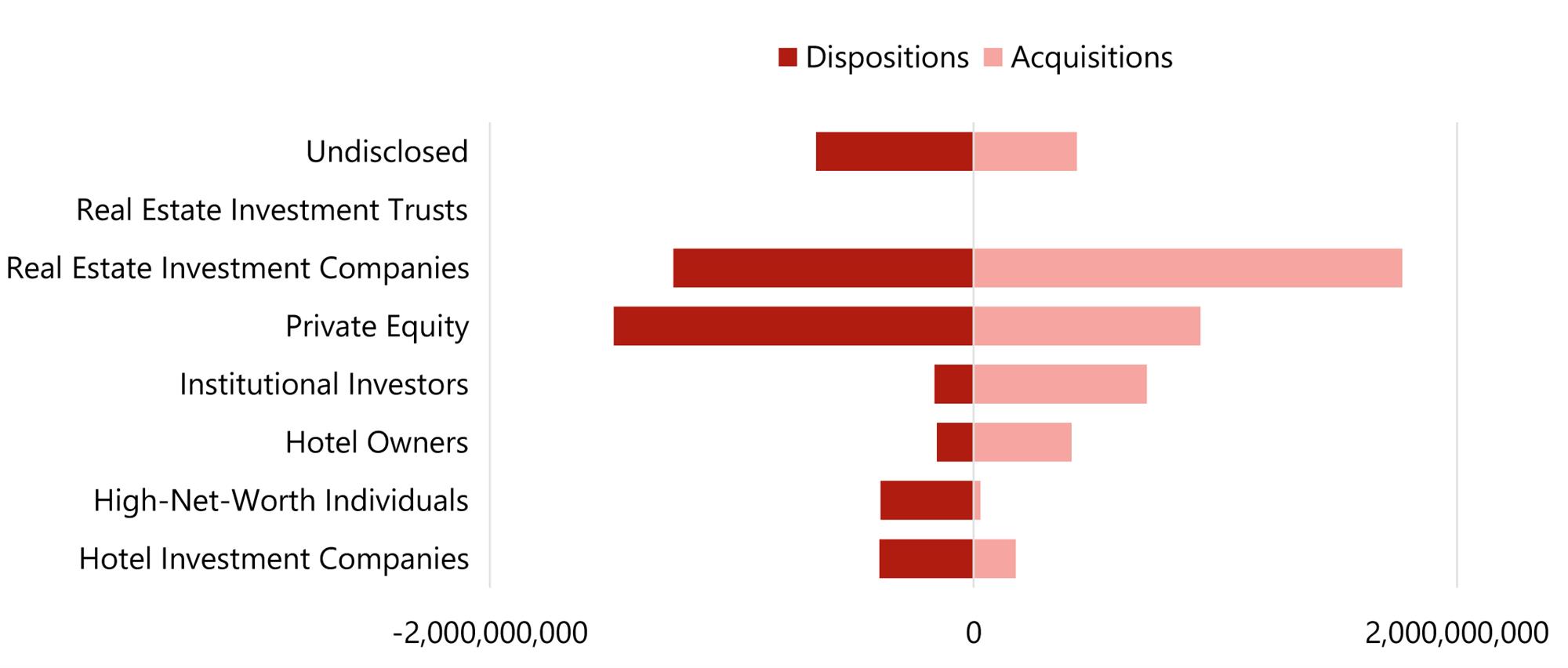

Activity by Investor Type

- Real Estate Investment Companies were the most active investors in 2022, being both the largest buyers and the largest sellers of hotels by volume. Private Equity firms were the second-most-active sellers, with Institutional Investors being the second-most-active buyers;

- Institutional Investors were also the largest net buyers in 2022, acquiring €2.0 billion more than they sold. The largest net sellers were Undisclosed, with more than €2.3 billion in disposals, followed by High-Net-Worth Individuals with €1.4 billion in disposals, as shown in Chart 7;

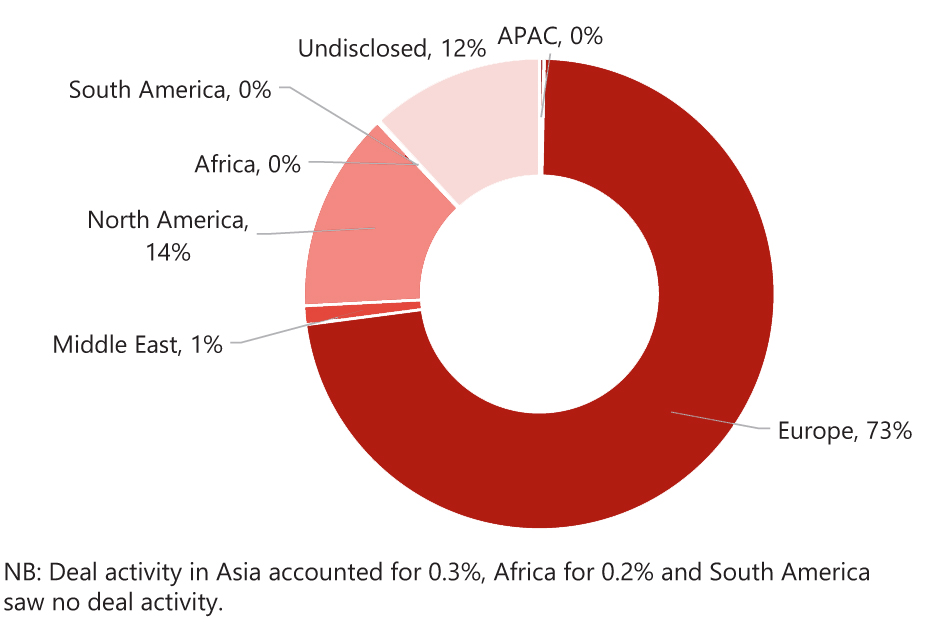

- As shown in Chart 6, European groups accounted for 73% of total hotel transactions in 2022.

Source: HVS – London Office

Source: HVS – London Office

Source: HVS – London Office

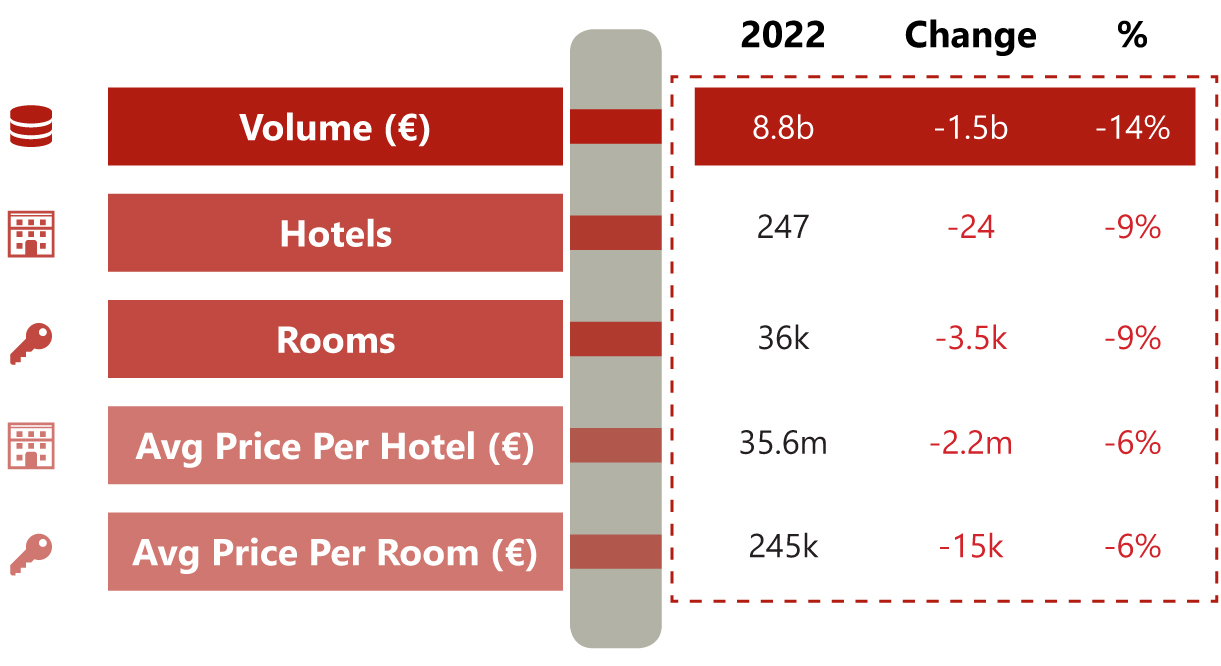

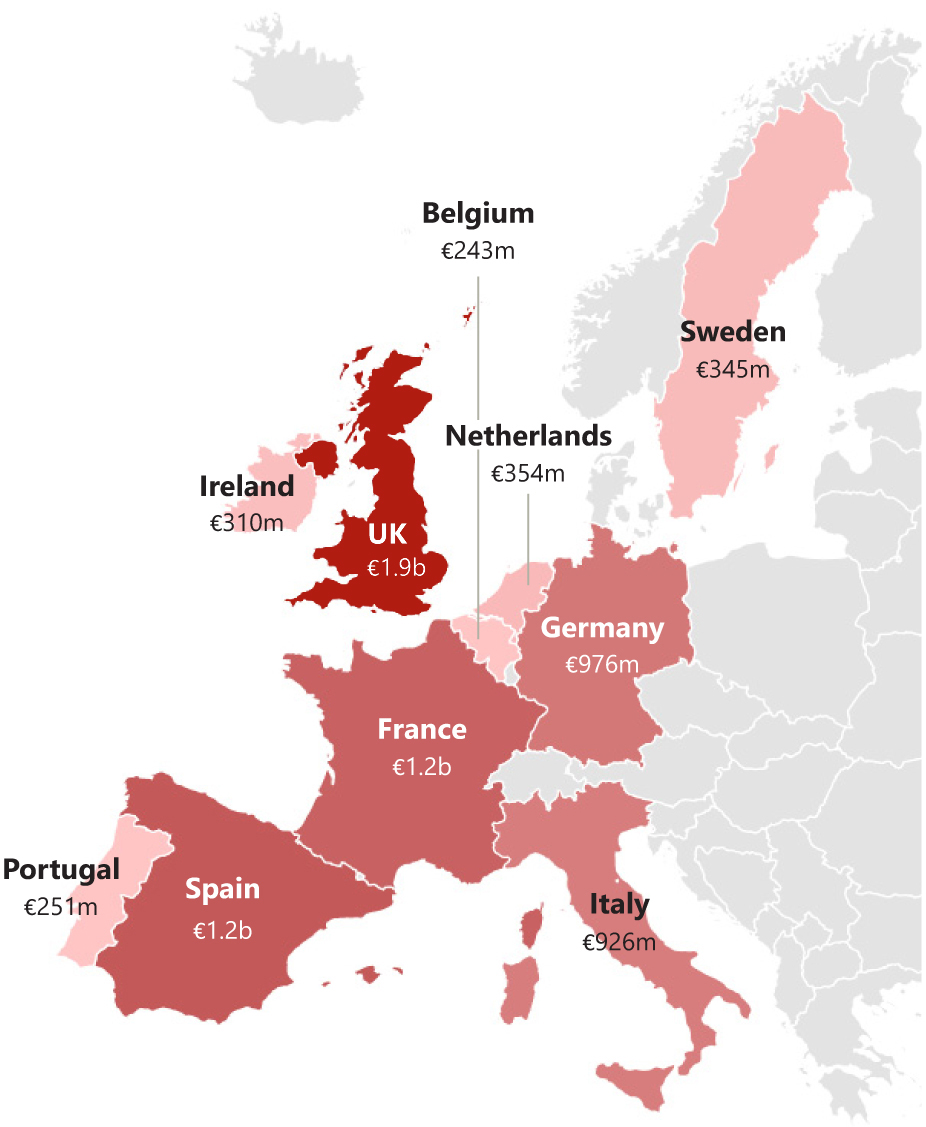

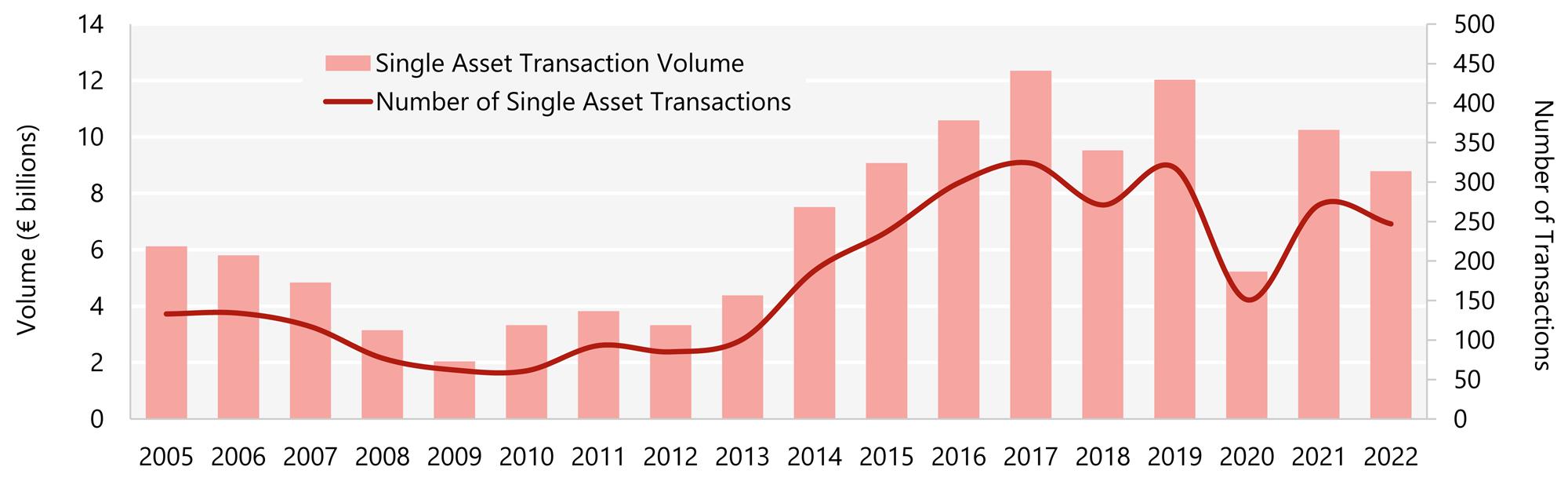

Single Assets

Single asset transaction activity[1] declined in 2022, as investors held onto properties owing to their rapidly increasing top-line performance, with RevPAR exceeding 2019 levels in many cases.

- Single asset transaction volume in 2022 totalled €8.8 billion, falling short of 2021 volumes by 14%;

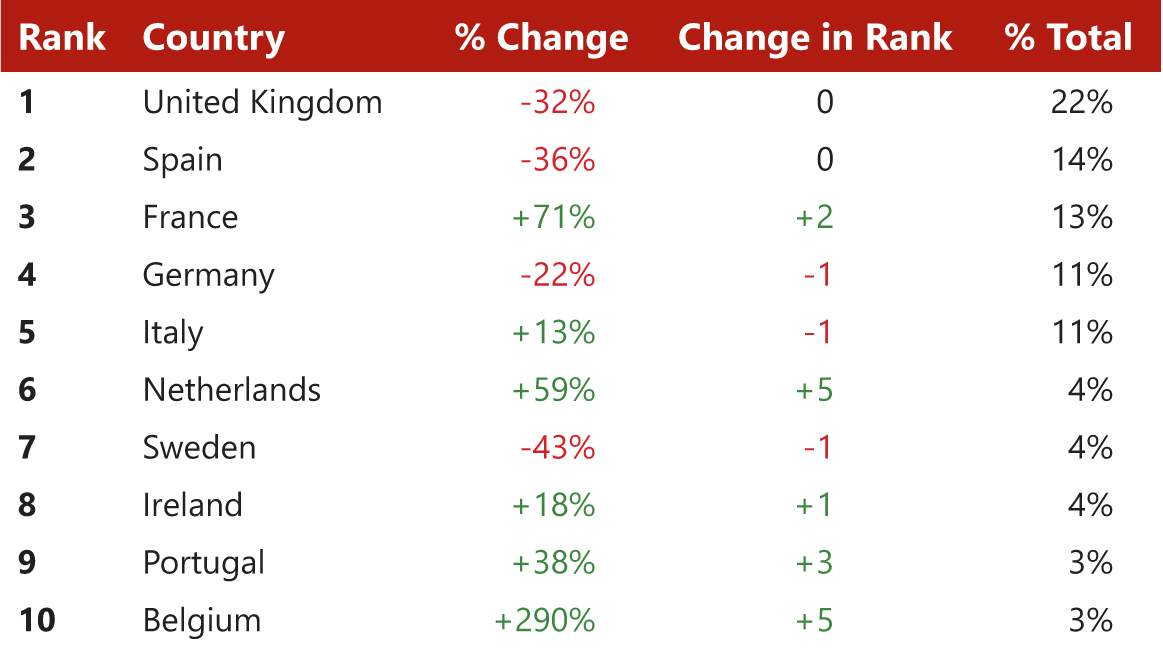

- The UK retained its crown as the most liquid market in Europe, and Spain solidified its position as the second most sought-after investment market in Europe;

- The year had some clear winners, with France moving up into third place (as shown in Chart 9) and edging past Germany, which had been consistently the second-most liquid European market pre-pandemic;

- Collectively, the top three markets in Europe this year accounted for 50% of the entire single asset volume.

|

Chart 9: Single Asset Top Countries Breakdown By Volume (€)

|

|

|

|

|

Source: HVS – London Office |

|

Source: HVS – London Office

Source: HVS – London Office

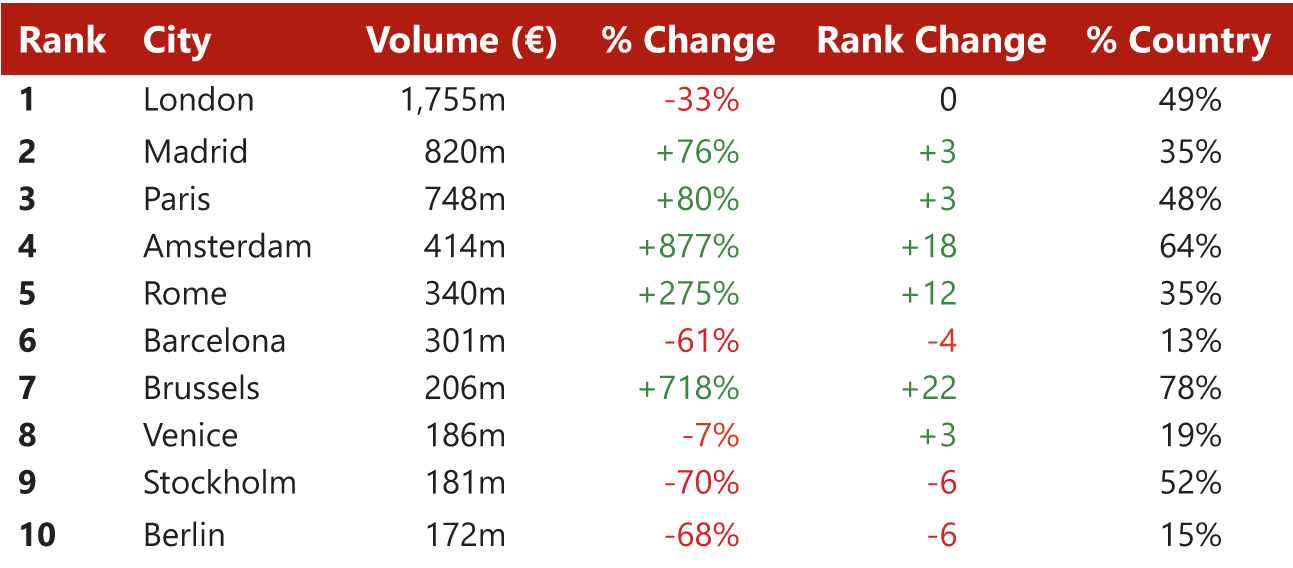

Investment Volume by City

Some major European cities attracted substantially more investor attention than they did in 2021, contributing to their respective countries’ growth in 2022:

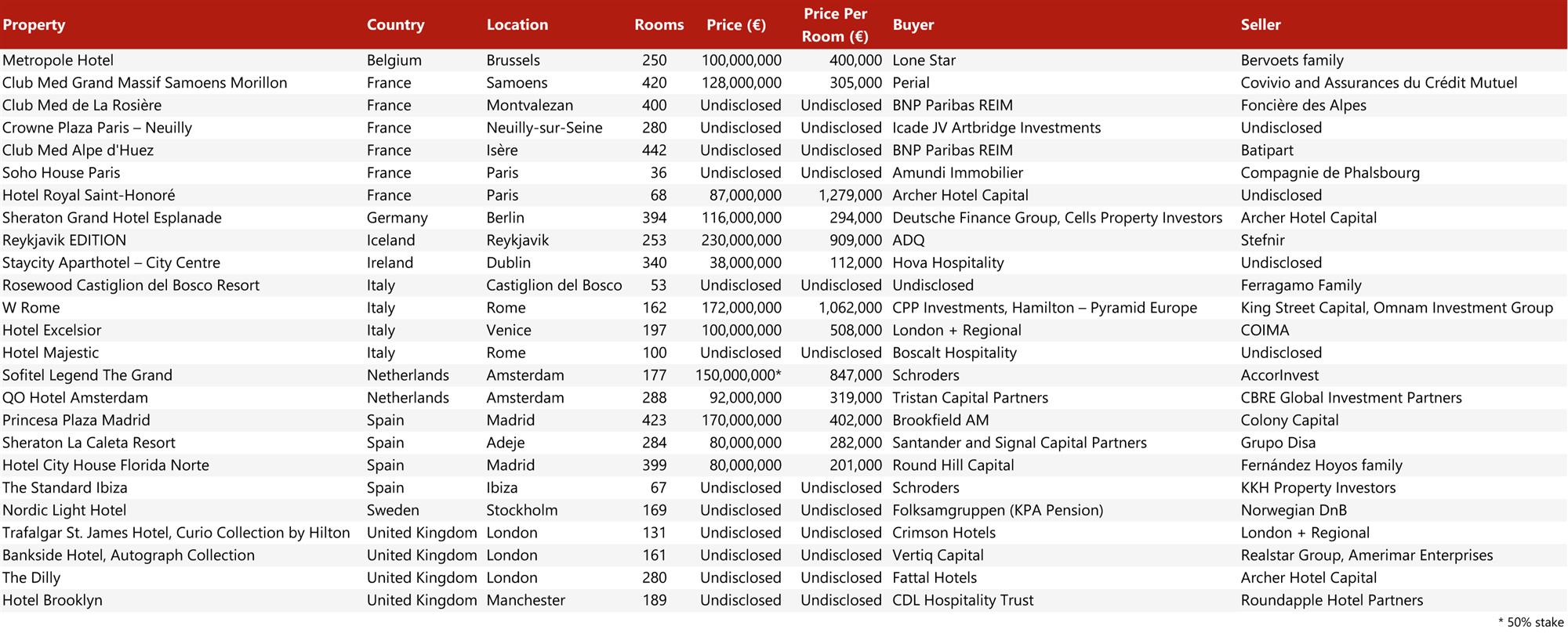

- Madrid climbed to second place, behind London, with a total volume of €498 million (a 23% increase on 2021), with deals such as the hotel Princesa Plaza Madrid. Paris, where volume increased by an impressive 49%, rising from sixth place in 2021, followed Madrid in third place;

- Italy’s single asset hotel prices recorded an average of €560,000 per room (+60%), which was driven by several high-profile acquisitions, including the Rosewood Castiglion del Bosco resort in Tuscany. Rome, in particular, saw a volume increase of 883% versus 2021, including the transaction of the W Rome, lifting the Eternal City to the fourth-highest transaction volume of any European city in 2022;

- Both Amsterdam and Brussels returned as top investment markets in 2022, recording the fifth- and sixth-highest single asset volumes of any European city in 2022, respectively.

Investor Type

- Institutional investors were 2022’s largest net buyers of single assets at €1.4 billion (as shown in Chart 12), further increasing their investment appetite compared to 2021 (net €1 billion);

- The biggest percentage shifts came from High-Net-Worth Individuals who were much more active in 2022 compared to 2021, with 75% more acquisitions and 197% more disposals of single assets;

- Real Estate Investment Companies were the largest net sellers in 2022, recording €863 million in net sales, followed by High-Net-Worth Individuals, who disposed of €633 million more in assets than they acquired.

Source: HVS – London Office

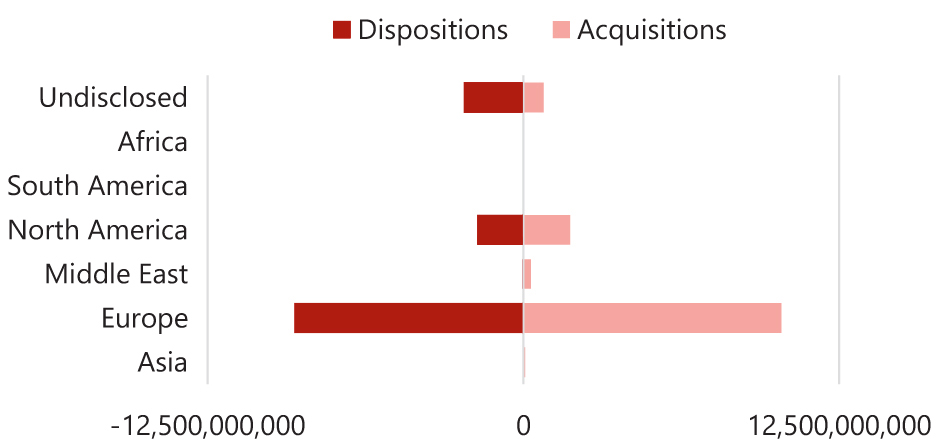

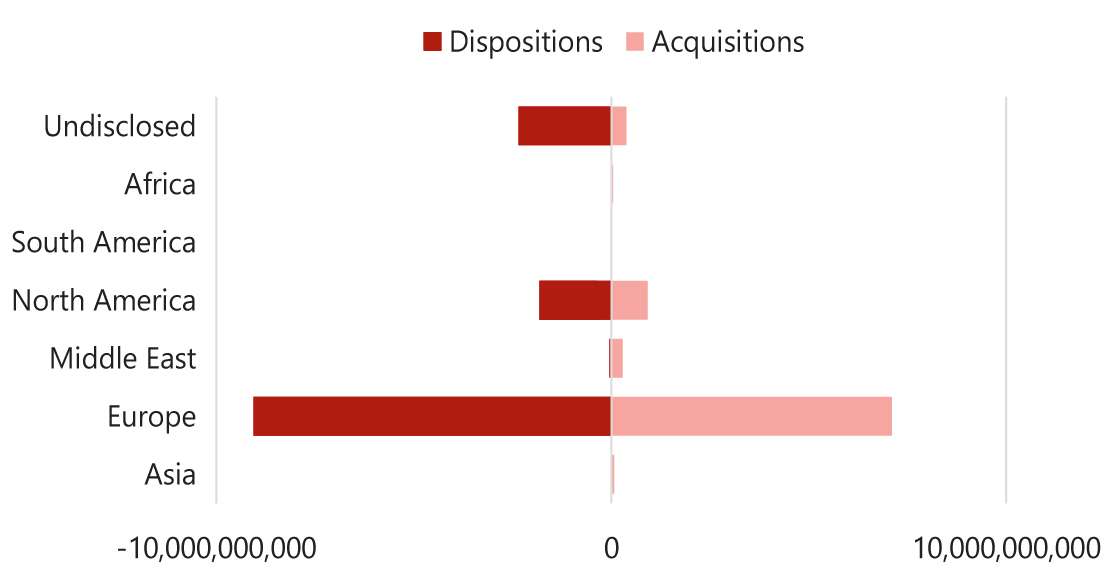

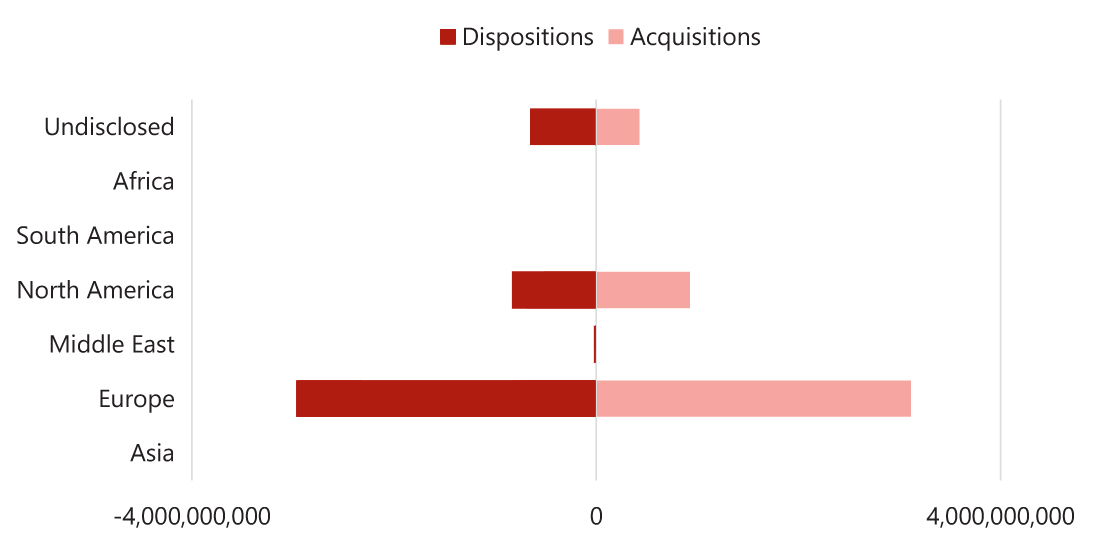

Capital by Continent

- European buyers accounted for more than 76% of all transactions, increasing by 9 percentage points compared to 2021, resulting in net acquisitions of €1.1 billion for the year;

- North American investors came in at 13% of Europe’s total transaction volume;

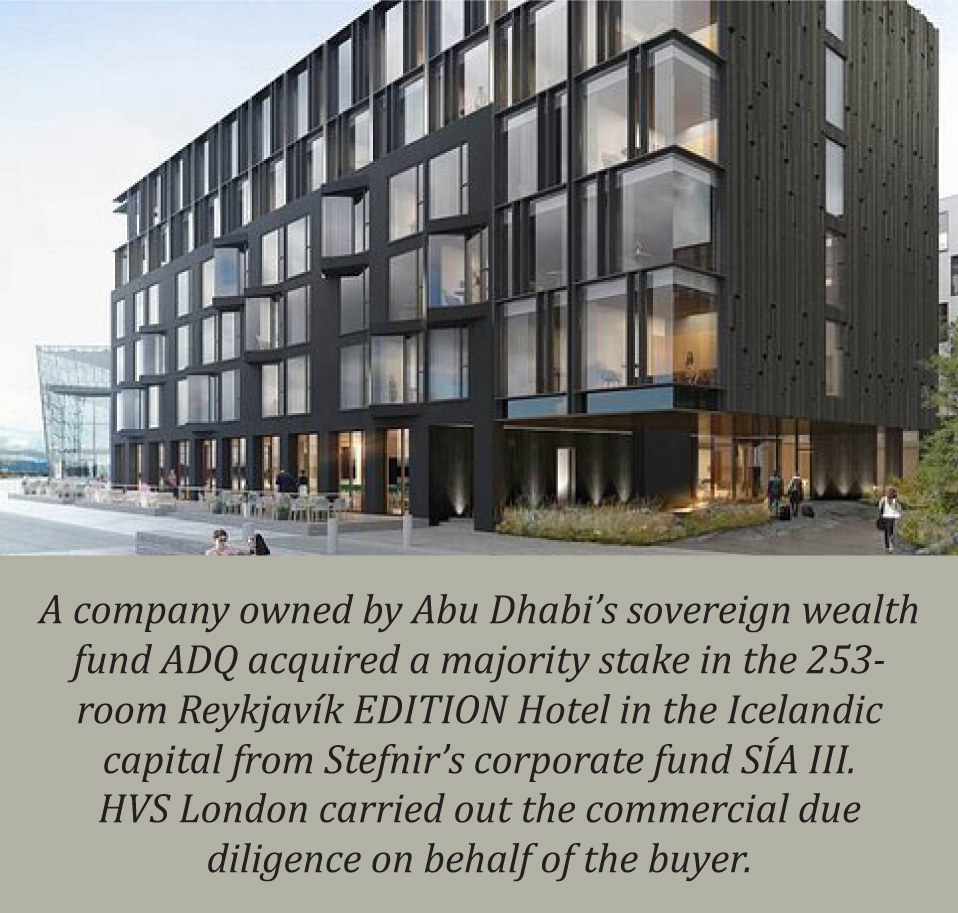

- Middle Eastern investors, who were largely dormant in Europe in the previous two years, returned with one of Europe’s most high-profile acquisitions of 2022 – The Reykjavik EDITION in Iceland.

Source: HVS – London Office

|

|

Notable Single Asset Transactions

Presented below is a selection of single asset transactions that occurred over the course of 2022. To request an expanded list of transactions, please contact [email protected].

Source: HVS – London Office

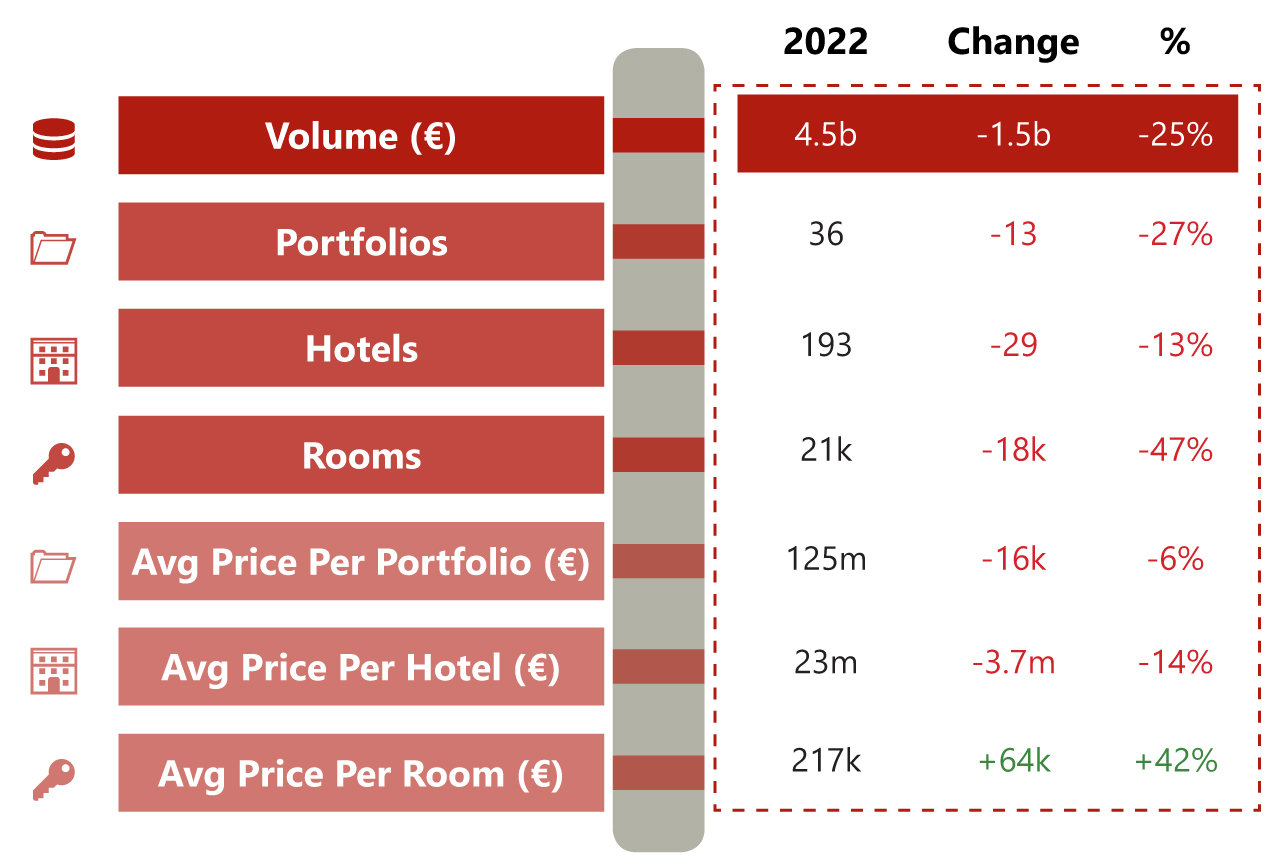

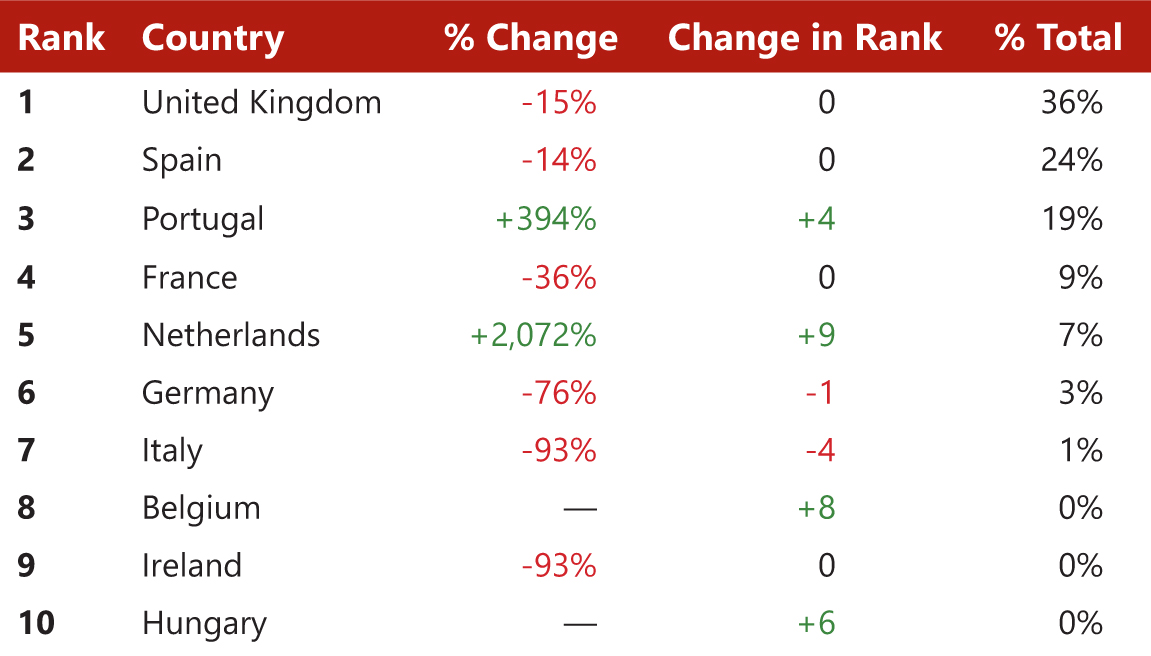

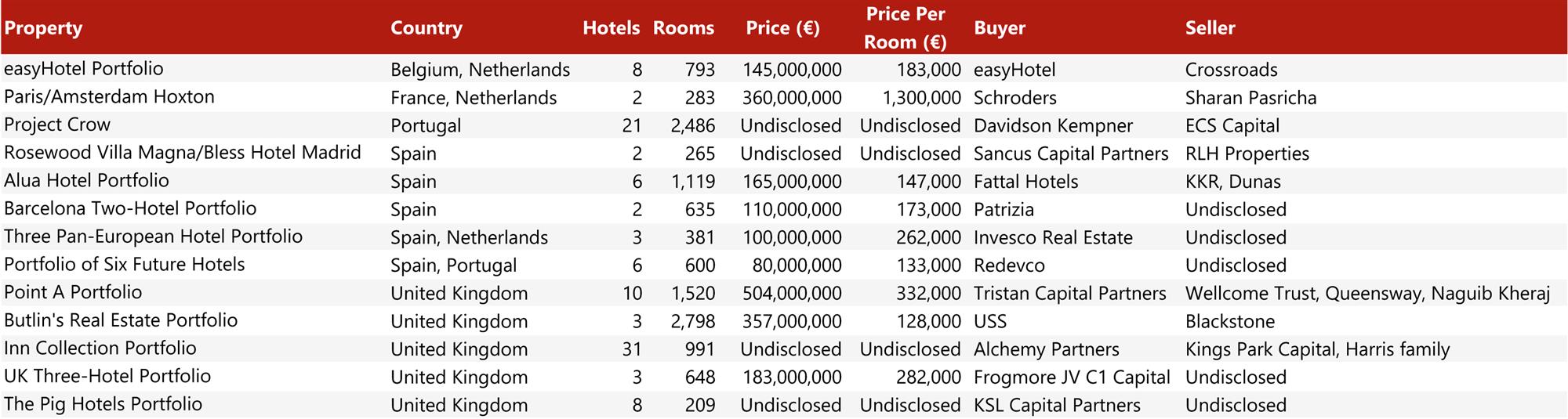

Portfolio Assets

As with single assets, portfolio sales declined in 2022. Although the average price per room for portfolios was 42% higher than in 2021, around 47% fewer rooms transacted, resulting in an overall decline in volume. Several of the largest portfolio deals took place in the UK, including Alchemy’s acquisition of Inn Collection, KSL’s acquisition of the Pig Hotels, Tristan’s acquisition of Point A and USS’s acquisition of Butlin’s.

Volume

- Portfolio transaction volume in 2022 was €4.5 billion, falling short of 2021 volumes by 25% and amounting to the second-lowest level of the last decade;

- While 2022 started off strongly, with a slightly higher volume than Q1 2021, transaction activity declined by 43% in Q2 and Q3, compared to the previous year, as investors grappled with rising inflation and, particularly, interest rates;

- In Q4, volumes were close to 2021 levels, with 38% of the year’s total volume occurring in Q4.

Source: HVS – London Office

Source: HVS – London Office

|

Chart 17: Portfolio – Top Countries Breakdown By Volume (€)

|

|

|

|

|

Source: HVS – London Office |

|

Cities

- London retained its standing as the most liquid city market in Europe, contributing €560 million (£468 million) towards portfolio transactions, although this was 53% less than in 2021. London hotels accounted for 35% of total UK portfolio transactions, compared to 62% in 2021;

- Madrid saw the second-highest volume, largely bolstered by the sale of the Rosewood and BLESS hotels by RLH Properties. Collectively, Madrid and Barcelona accounted for 11% of all portfolio transactions, with their volume increasing by 78% over 2021;

- Paris and Amsterdam saw the third- and fourth-highest portfolio volumes at €287 million and €171 million respectively;

- In keeping with 2021, major German cities were very limited in terms of portfolio volume, at roughly €100 million.

Investor Type

- Real Estate Investment Companies and Private Equity firms accounted for 61% of all portfolio activity in 2022;

- Hotel Owners were significantly less active than the year before, accounting for only 6% of total volume, as compared with 30% in 2021;

- Institutional Investors and Real Estate Investment Companies were net buyers, at roughly €500 million of net purchases each, while Private Equity firms disposed of a net €500 million more than they acquired, as seen in Chart 18.

Source: HVS – London Office

Investor Location

- Europeans accounted for 68% of deal activity, with North American firms accounting for 20%;

- Middle Eastern and Asian buyers were noticeably absent in 2022.

Source: HVS – London Office

Notable Portfolio Transactions

Presented below is a selection of portfolio transactions that occurred over the course of 2022. To request an expanded list of transactions, please contact [email protected].

Source: HVS – London Office

Conclusion and Outlook

As a year expected to show further strong recovery from the depressed levels of investment activity during COVID, 2022 did not transpire as expected. However, this was driven solely by the impact of global geo-political and macroeconomic factors. Although only 18% lower than 2021 with €13.3 billion in hotel investment volume, 2022 was still 51% behind 2019 levels.

The year started strongly, with initial activity outpacing Q1 2021, but the economic implications of Russia’s invasion of Ukraine put a very significant dampener on investment activity for the rest of the year. By Q2, prevailing market headwinds had slowed deal activity below the 2021 pace. Substantial interest rate rises and reduced lender activity hindered deal flow, while rising operating costs, brought on by double-digit inflation and staffing shortages, impacted profit forecasts. Hotel trading was, however, generally well supported by strong top-line growth that reaped the benefits of saved disposable income during the pandemic and very strong demand for leisure travel. This helped many hotels to absorb the substantial increases in wages and, particularly, energy costs that occurred during the year.

However, in the transactions market, the bid-ask gap widened significantly throughout the year, with most buyers hunting for distressed deals that were few and far between, and most sellers being unprepared to sell at such levels and with very limited pressure from their lenders to do so. By Q3 and particularly Q4, many investors had put new acquisitions on hold while they reassessed values and waited for some degree of clarity as to how high interest rates were likely to reach, and how likely it was that major economies may enter recession in 2023. As is often the case, Q4 in 2022 still finished as the strongest quarter in the year, but this was mainly due to investors meeting annual investment targets, as well as some early indicators that interest rates were likely to peak at a level lower than initially feared.

Looking ahead, although recent pressures on the banking system are certainly raising some concerns, economic outlooks are otherwise generally improving, and hotel trading fundamentals remain solid in many markets. Strong top-line performance in many destinations, coupled with further recovery prospects in most markets, suggest a positive outlook and equally help soften pressures felt on profit margins, reducing distressed situations. The leisure-led post-COVID recovery is now broadening to other segments, with further strong recovery expected for business travel and conferences. Inflationary pressure will continue to impact operating costs this year, though at clearly decreasing levels that are still expected to be largely offset by higher revenue levels. The effects of the Ukraine conflict will still be felt, especially in neighbouring countries; however, it seems that many investors feel that this war may go on for quite some time and that, in the meantime, life and business activity elsewhere needs to go on. For transaction activity, there is still plenty of capital chasing high-quality opportunities, with southern Europe and key gateway cities in particular remaining highly sought-after.

The substantial tightening of monetary policy since Q2 last year has clearly started to rein in inflation, which is now expected to fall to around 2.5% in 2024 (in advanced economies). Furthermore, the IMF now expects that, once inflation is tamed, interest rates in advanced economies may return to pre-pandemic levels. As inflation reduces, pricing expectations will change, reducing some of the bid-ask spread in the market. Access to financing through high-street lenders remains subdued, at levels similar to those experienced during the pandemic. However, alternative financing options are on the rise, servicing some of the demand in the sector. While the macroeconomic situation is not where it was pre-pandemic, 2022 demonstrated that hotels are much better positioned to adapt to surging inflation than most other asset classes are. Although clearly aided by pent-up demand post-pandemic, very strong RevPAR growth has also indicated how quickly hotel operators can react in times of high inflation and increasing operating costs. With trading fundamentals remaining strong and inflation having peaked, investor demand, especially for prime and quality assets, of which Europe has many, remains high.

0 Comments

Success

It will be displayed once approved by an administrator.

Thank you.

Error