Berlin, Germany’s largest city with a population exceeding 3.7 million, is a vibrant hub of culture, innovation and diversity. Renowned for its top universities, dynamic sports events, world-class museums and captivating arts scene, Berlin offers a rich tapestry of experiences. With residents of 190 different nationalities, Berlin embraces inclusivity and creativity, making it a truly cosmopolitan destination.

Source: HVS Research

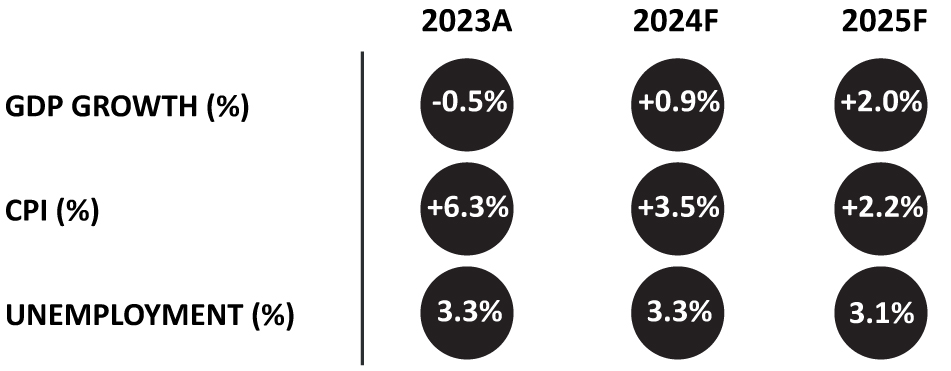

Economic Indicators – Germany

Source: IMF

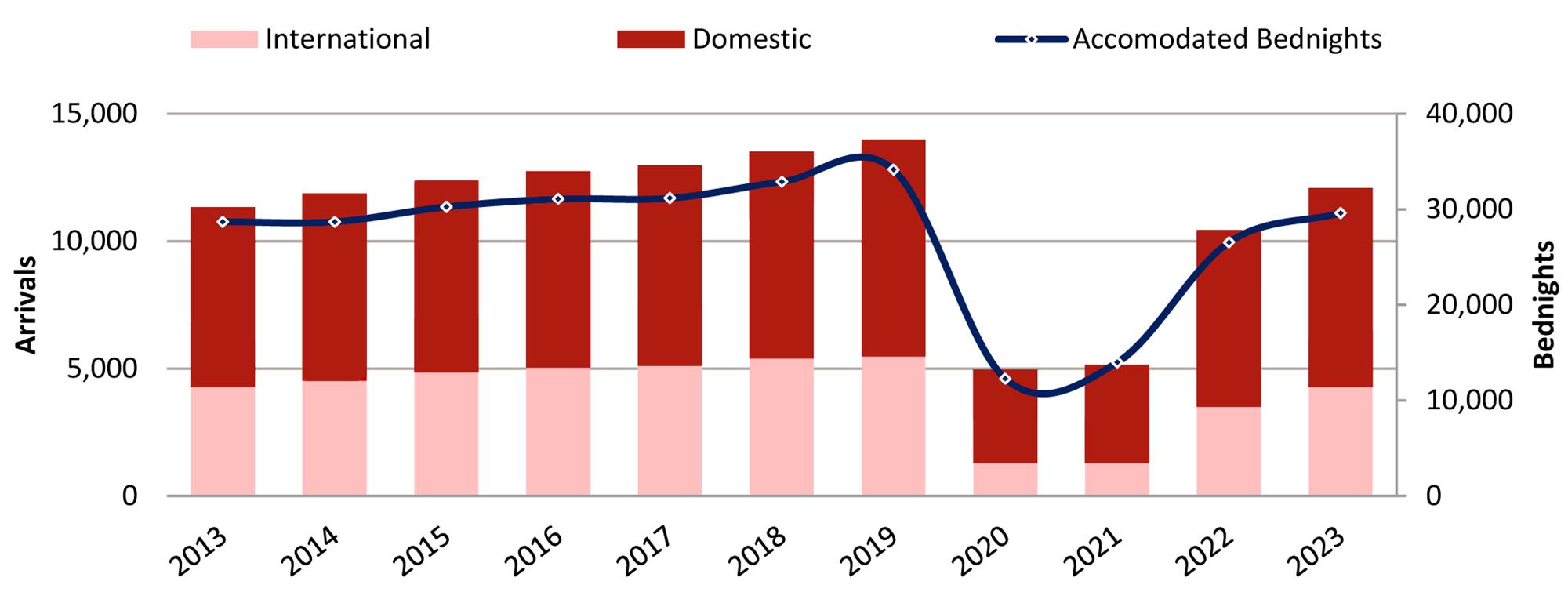

Tourism Demand

As a business, leisure and meetings destination, there are many reasons to visit Berlin. Its economy is led by the service, technology and creative sectors, strengthened by the city’s emphasis on research and development.

For more than a decade, Berlin has ranked within the top 10 international association congresses, as per the ICCA. This sector has lost some momentum since COVID-19 and is taking longer to recover than business and leisure. However, a number of large events are planned in 2024, especially in the fields of medicine and science. Furthermore, the IFA trade show (electronics) will be celebrating its 100th year in September, with 180,000+ delegates expected over the five-day event.

Overall, leisure demand has led the recovery. Berlin has the fundamentals to draw a globally diverse mix of shoppers, gastronomes and art and nightlife enthusiasts. The capital is often cited amongst the best destination city breaks in the world.

In 2023, domestic demand remained the most important source market with 60% of overnight stays. Following the pandemic, the strongest international source countries are once again the UK and the USA. Demand from the Netherlands has already returned to pre-COVID levels, while demand from countries such as Spain and Italy has been growing more slowly, currently at less than 60% of that observed in 2019. One particularly strong contributor in 2023 was Poland, with 42% more bednights recorded than in 2019.

Post-pandemic, 2022 visitation recovered to around 75% of historical levels, which further increased to 87% in 2023, in line with accommodated bednight volumes. The length of stay has remained stable at around 2.5 days.

Visitation and Accommodated Bednights

Source: Visit Berlin

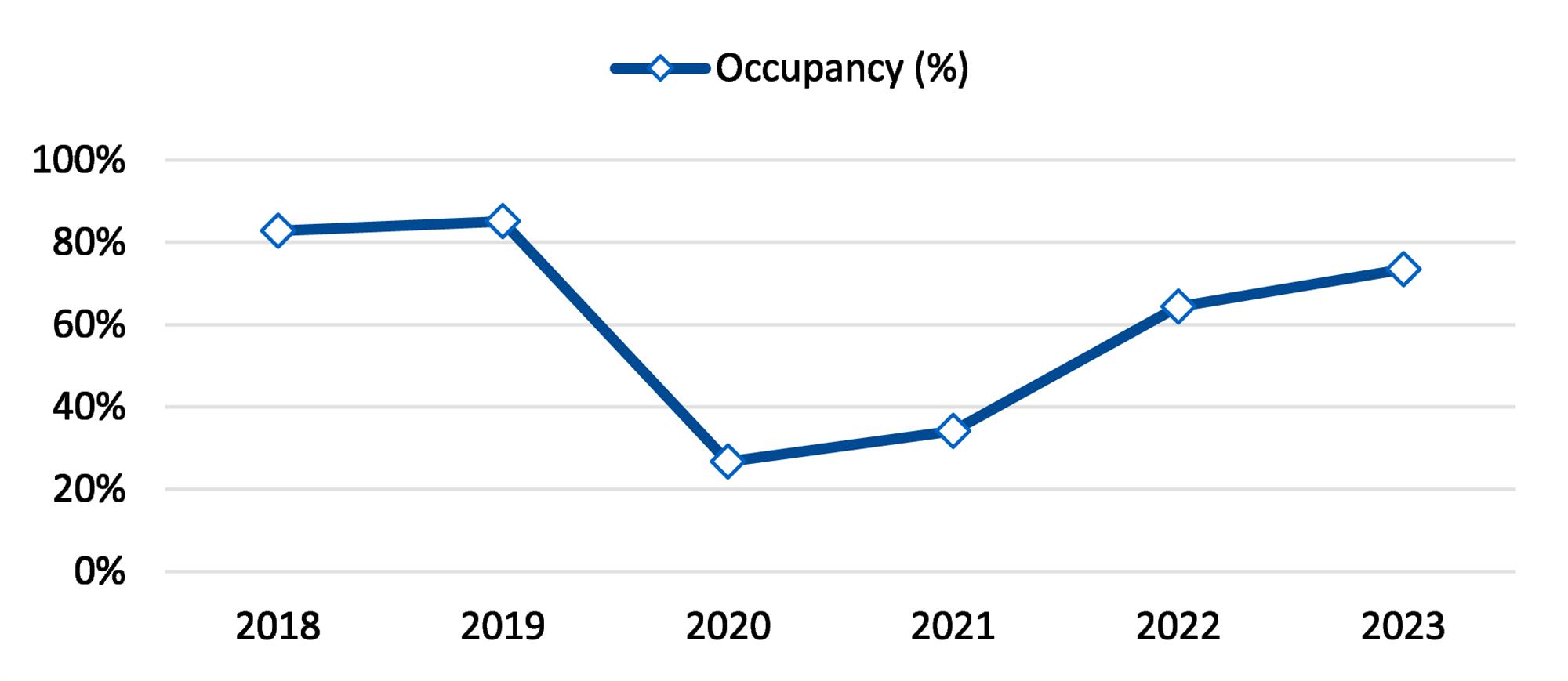

Hotel Performance

Occupancy: Owing to a varied demand base, hotel performance in Berlin has historically been strong. With levels ranging from the low to mid 80s, 2018 and 2019 had some record-high occupancies. Following performance declines due to the pandemic, the market started to recover in 2022, when occupancy rebounded to 75% of its pre-pandemic level. This positive trend continued into 2023 with Berlin’s hotel demand returning to around 85% of its historical volume.

Occupancy is Still Recovering

Sources: HVS Research

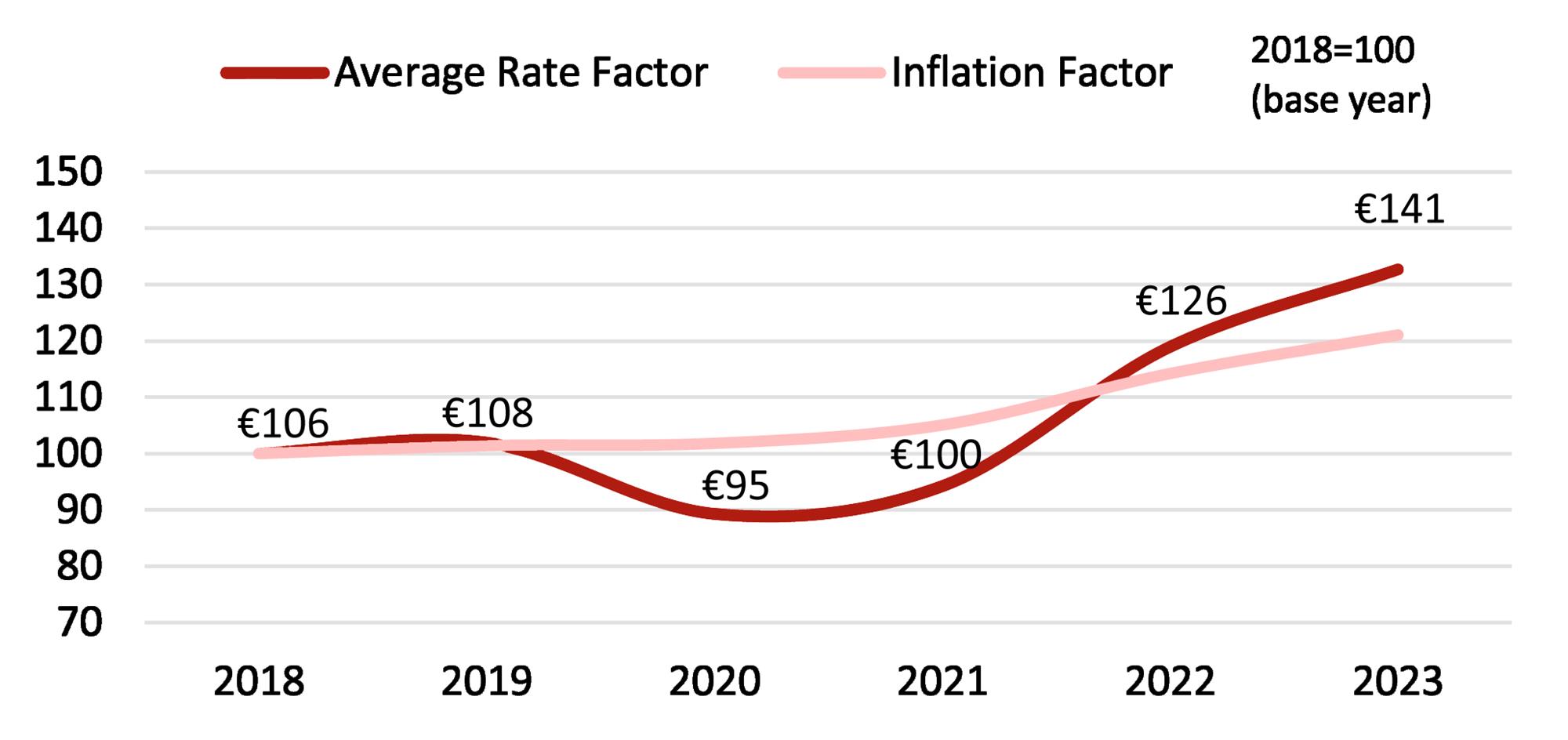

ADR: Berlin recorded average rates of around €105-110 before the pandemic. Having dropped significantly in 2020 and 2021, rates began to benefit from significant above-inflationary growth in 2022 and 2023. As such, the 2023 average rate represented a 30% premium over 2019 in nominal terms – some 10% higher than inflation during the period.

Average Rate Grew Above Inflation

Sources: HVS Research

RevPAR: Owing to hotel demand and average rates growing stronger than inflation, Berlin’s RevPAR improved significantly in 2023, surpassing 2019 by 12% in nominal terms. In real terms, however, it remained more than 5% below the historical level, mostly due to occupancy not having fully recovered.

Hotel Supply

Berlin’s hotel room supply increased at a moderate pace between 2013 and 2023, recording a compound annual growth rate (CAGR) of 1.0%. In 2023, there were 640 hotels in Berlin and more than 69,500 rooms. Over the years, the number of properties has decreased, while the average hotel size has increased. In fact, nearly 7% of Berlin’s hotels have more than 300 rooms and represent almost 30% of the city’s inventory.

The city’s hotel pipeline is relatively strong. If all the hotels announced for the next four years are realised, they would equate to around 4,800 rooms, which represents 6.8% of the existing hotel room supply, or a CAGR of 2.2%. Nearly 2,000 of these rooms (14 hotels) are reported to currently be under construction. More than half of the proposed hotel room inventory consists of midscale and upper midscale hotels, whilst economy hotel rooms represent nearly 35% of the pipeline. Around half of the pipeline’s room inventory is expected to be branded. Notable hotels currently being constructed include the 198-room Zleep Hotel Berlin Airport (opening in August 2024), the 158-room niu Pax Schonefeld (December 2024), the 278-room prizeotel Berlin-City (January 2025) and the 168-room Hampton by Hilton Potsdam Babelsberg (May 2025).

Hotel Pipeline

Sources: HVS Research

Investment Market

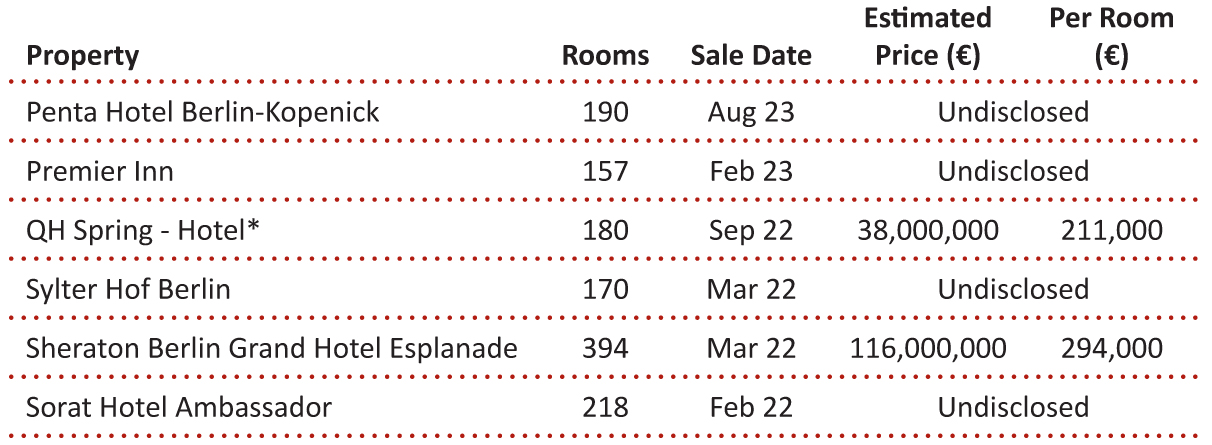

In 2022, Berlin’s hotel transactional activity was rather limited, with the market recording just four hotel transactions. These included the sale of the 218-room Sorat Hotel Ambassador and the 170-room former Sylter Hof Berlin (both sold for undisclosed amounts), as well as the 394-room Sheraton Berlin Grand Hotel Esplanade for €116 million (€294,000 per room) and the 180-room QH Spring Hotel, which sold as part of a portfolio for an allocated price of €38 million (€211,000 per room). In 2023, transactional activity in Berlin’s hotel market decreased even further and there were only two hotel transactions: the sale of the 157-room Premier Inn (bought by Premier Inn Group) and the 190-room Penta Hotel Berlin-Kopenick (purchased by Leonardo Hotels), both for undisclosed prices.

As per our European Hotel Valuation Index, Berlin’s hotel values remained flat in 2023 compared to the previous year; this resulted in values staying around 3% below pre-pandemic levels.

Hotel Transactions – Last 12 Months

*allocated sales price as the asset was sold as part of a portfolio

Sources: HVS Research

Outlook

2024 is set to be an exceptional year for Berlin. The city hosted five matches and the final of the UEFA European Football Championship this summer. Berlin also has a full art and cultural agenda, which includes the celebration of the 35th anniversary of the fall of the Berlin Wall in the autumn, the Casper David Friedrich Festival to mark the 250th anniversary of the birth of the Romantic landscape painter and the 50th BMW Berlin Marathon in September. In addition, the 100th IFA exhibit mentioned earlier is but one example of the meeting segment finding new life. While we expect the hotel pipeline to put some pressure on the recovery of the city, its prospects remain promising, driven by its distinctive character, as it strategically leverages its cultural, economic and conference appeal. Berlin’s favourable outlook suggests future recovery and steady expansion, supported by its stable position as a pivotal hub across various sectors.

Value Trends 2023 vs 2022

Sources: HVS Research