Introduction

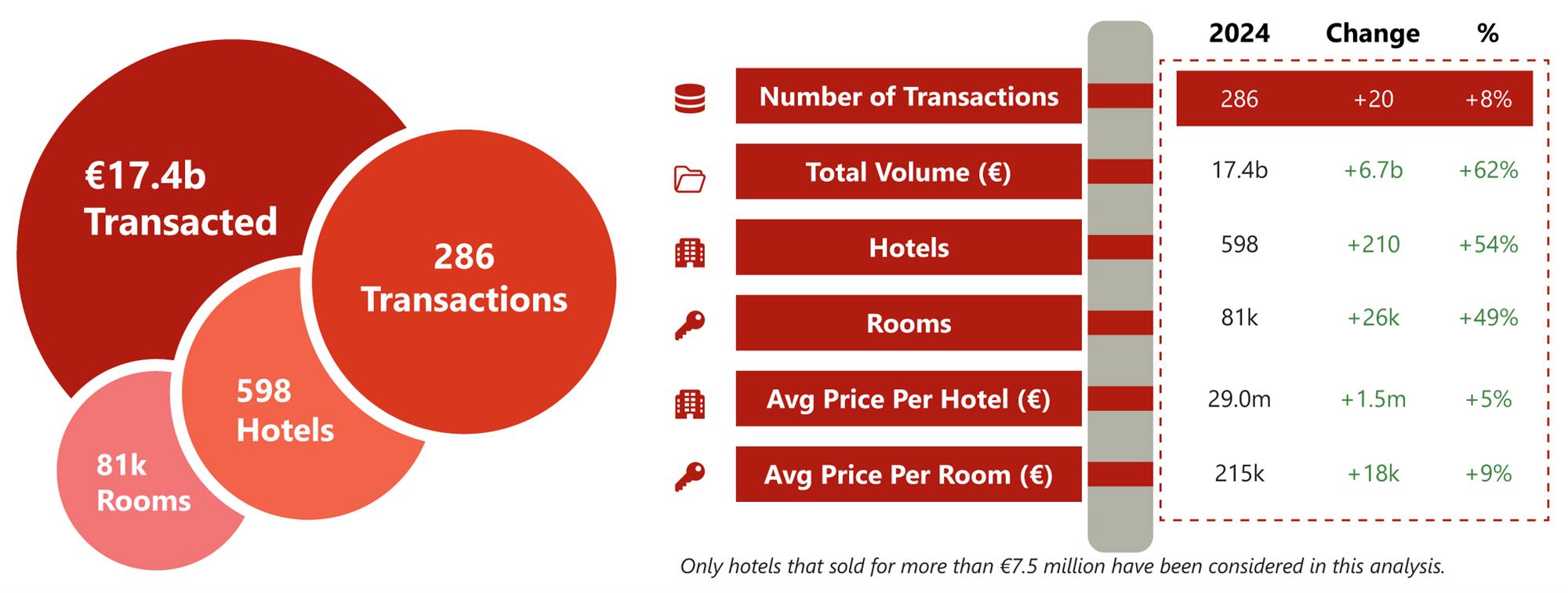

After two years of reduced activity, 2024 marked a turning point for the European hotel investment market, with transaction volume surging 62% year-on-year to reach €17.4 billion[1], the highest level recorded since 2019 (although still being only around two-thirds of the volume recorded in 2019). Easing interest rates, combined with abundant dry powder from Private Equity investors, fuelled a resurgence in deal-making, particularly in portfolio transactions where 2024 volumes were double the level recorded in 2023. Despite geopolitical uncertainties and a year filled with global elections, travel demand remained robust, reinforcing Europe’s status as a global tourism powerhouse and driving further RevPAR growth. With more transactions, higher hotel values and increased investor confidence, 2024 proved to be a year of resurgence, setting the stage for continued momentum in 2025.

Source: HVS – London Office

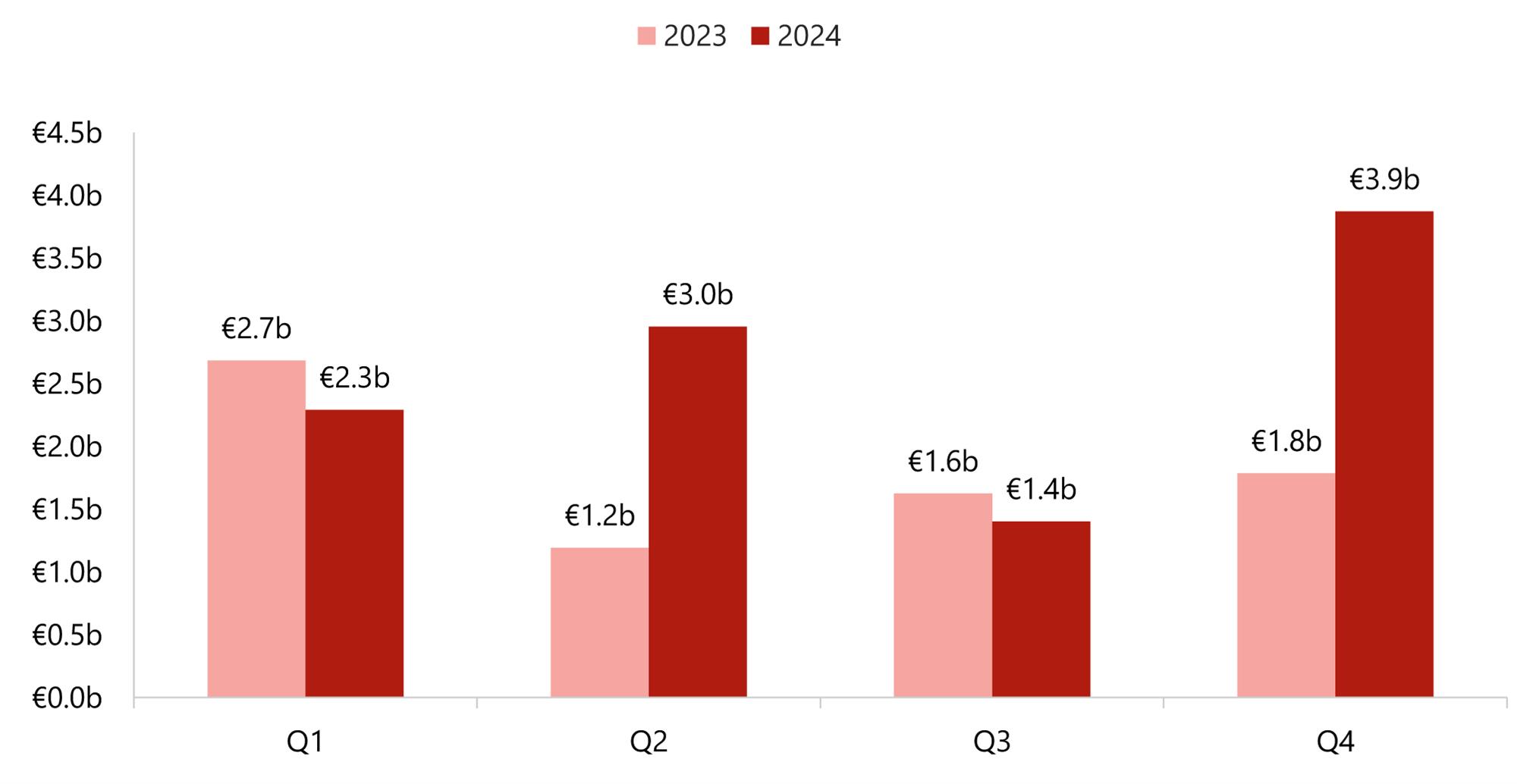

Total Transaction Volume

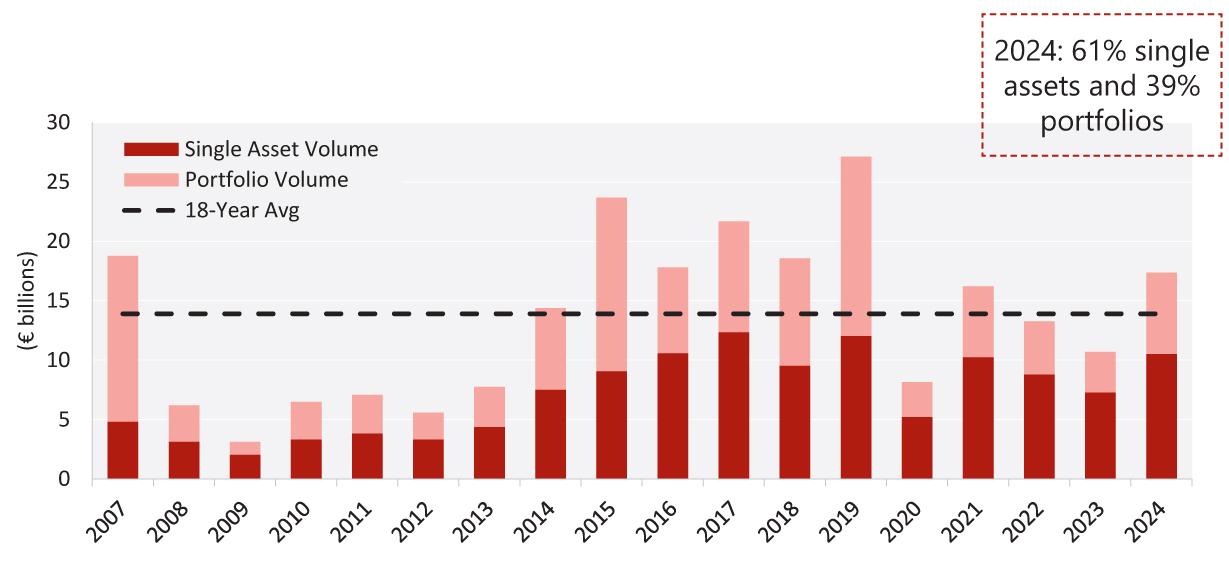

- Total transaction volume in 2024 reached €17.4 billion, the highest level recorded since 2019, and an impressive €6.7 billion increase over 2023, with portfolios making up nearly 40% of the total.

Source: HVS – London Office

Pricing & Deal Size

- The average price per room was €215,300 in 2024, an increase of 9% over 2023 and around 5% higher than in 2019;

- Hotels in 2024 transacted for an average price per hotel of €29 million (a 5% increase over 2023) and had an average of 135 rooms (a 3% decrease over 2023).

Source: HVS – London Office

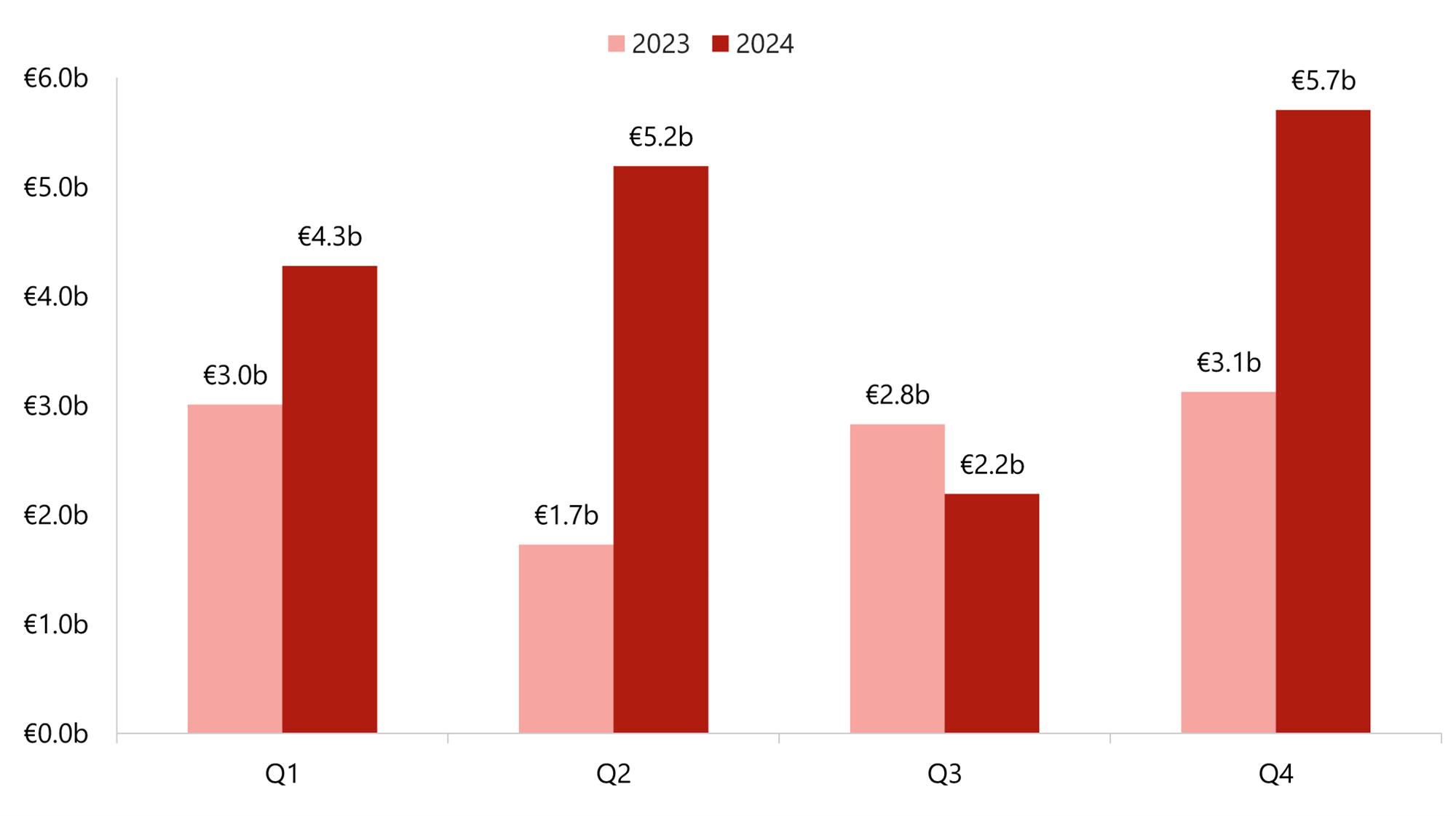

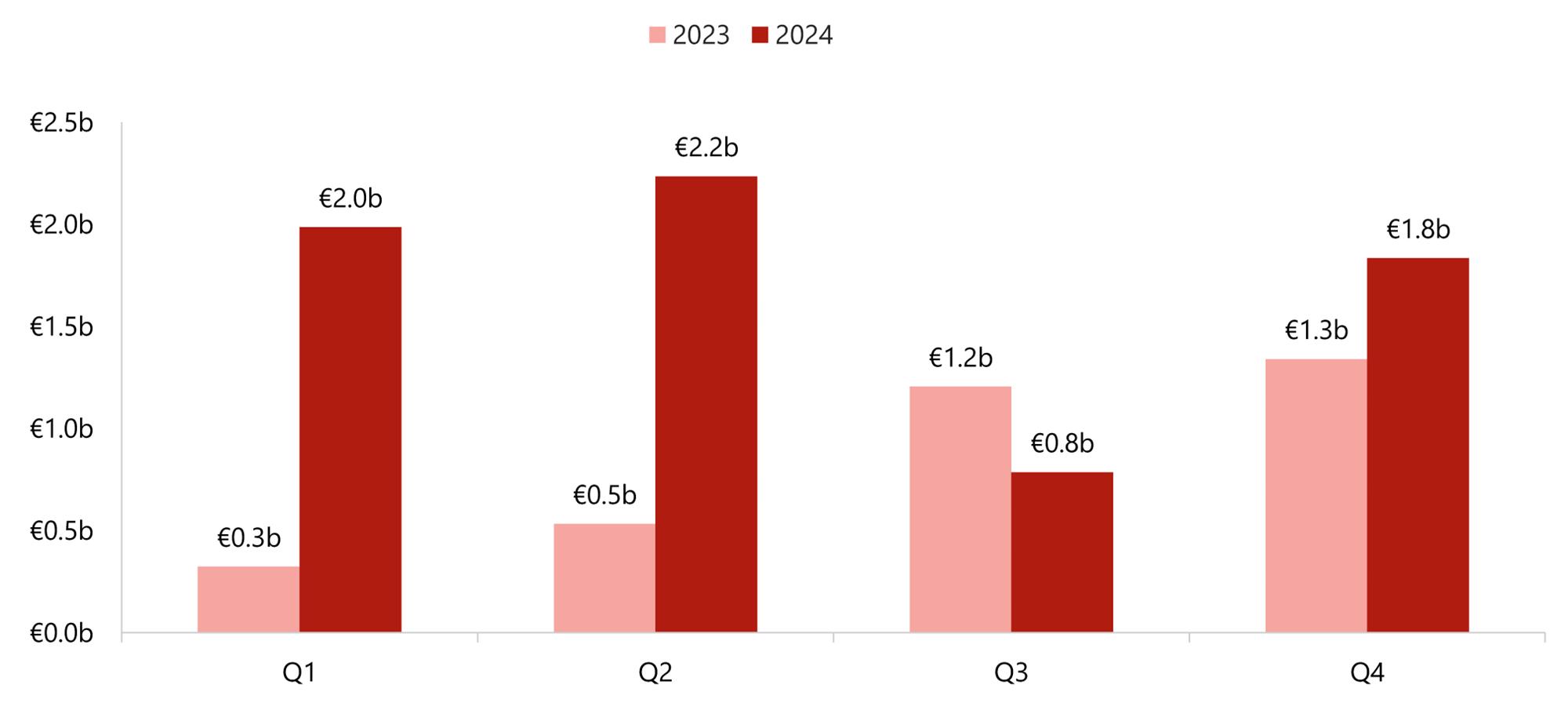

Seasonality

- Unlike most years, transaction volume was higher in the first half of the year in 2024, although the fourth quarter still recorded the highest level of activity (however, only 10% ahead of Q2).

|

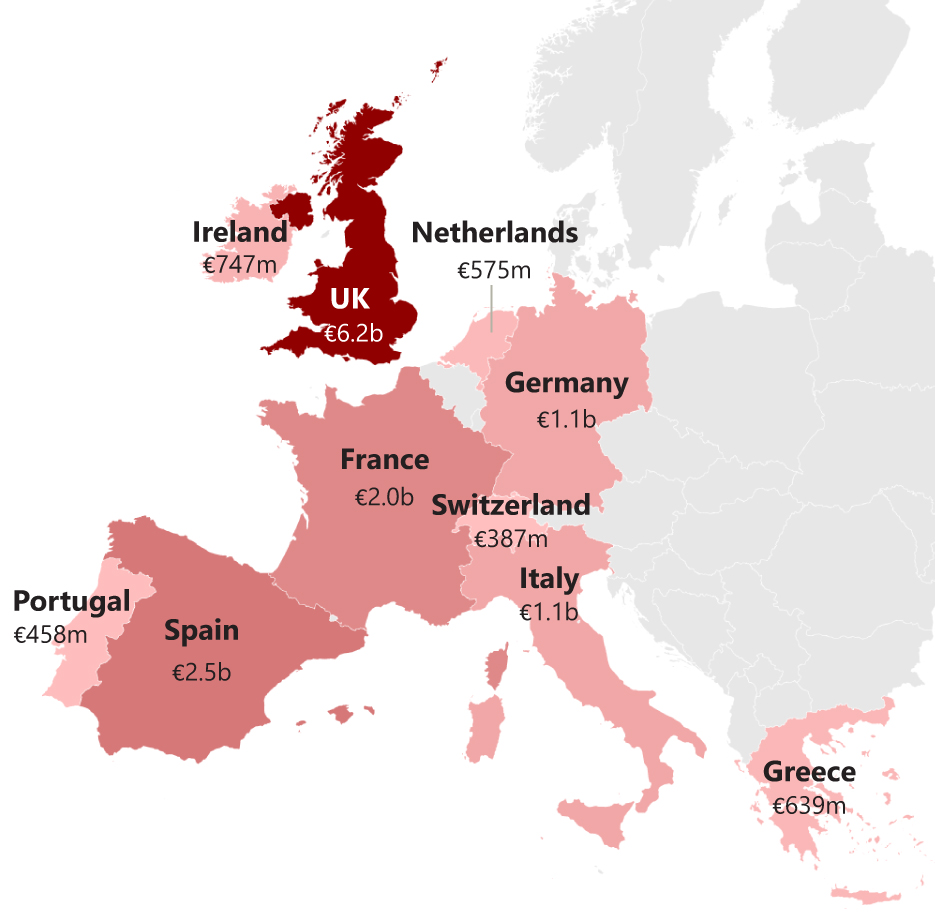

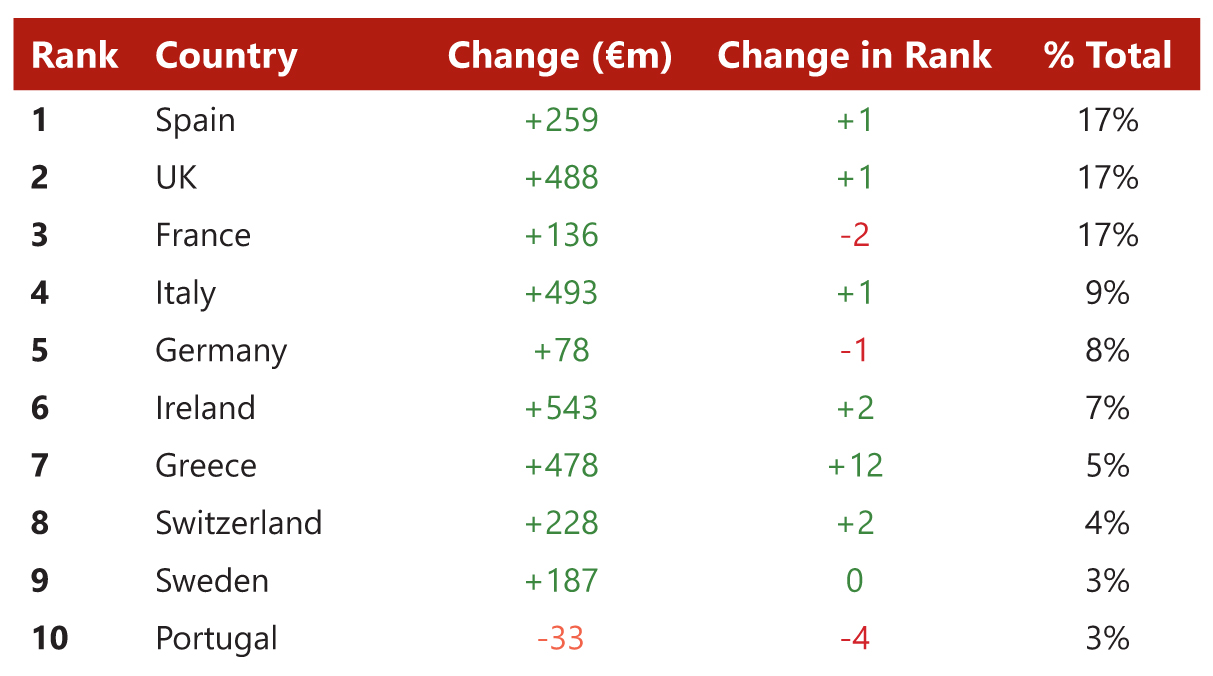

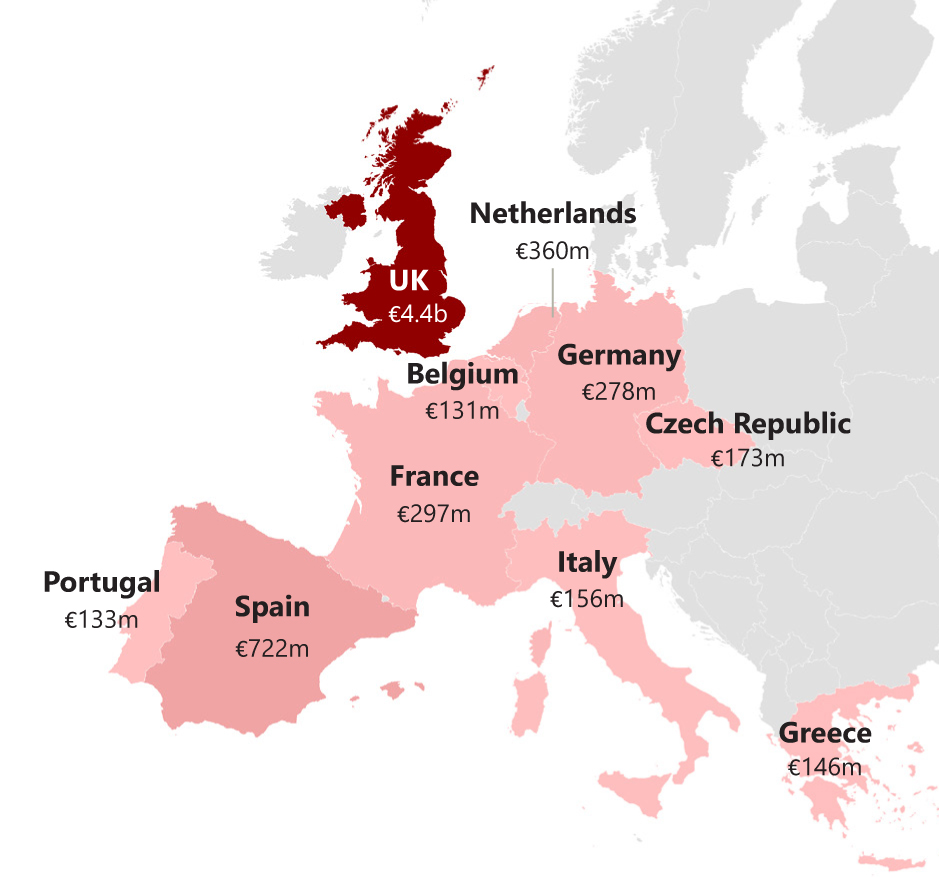

Chart 3: Top Countries (Total Activity By Volume) |

|

|

|

|

Source: HVS – London Office |

|

Source: HVS – London Office

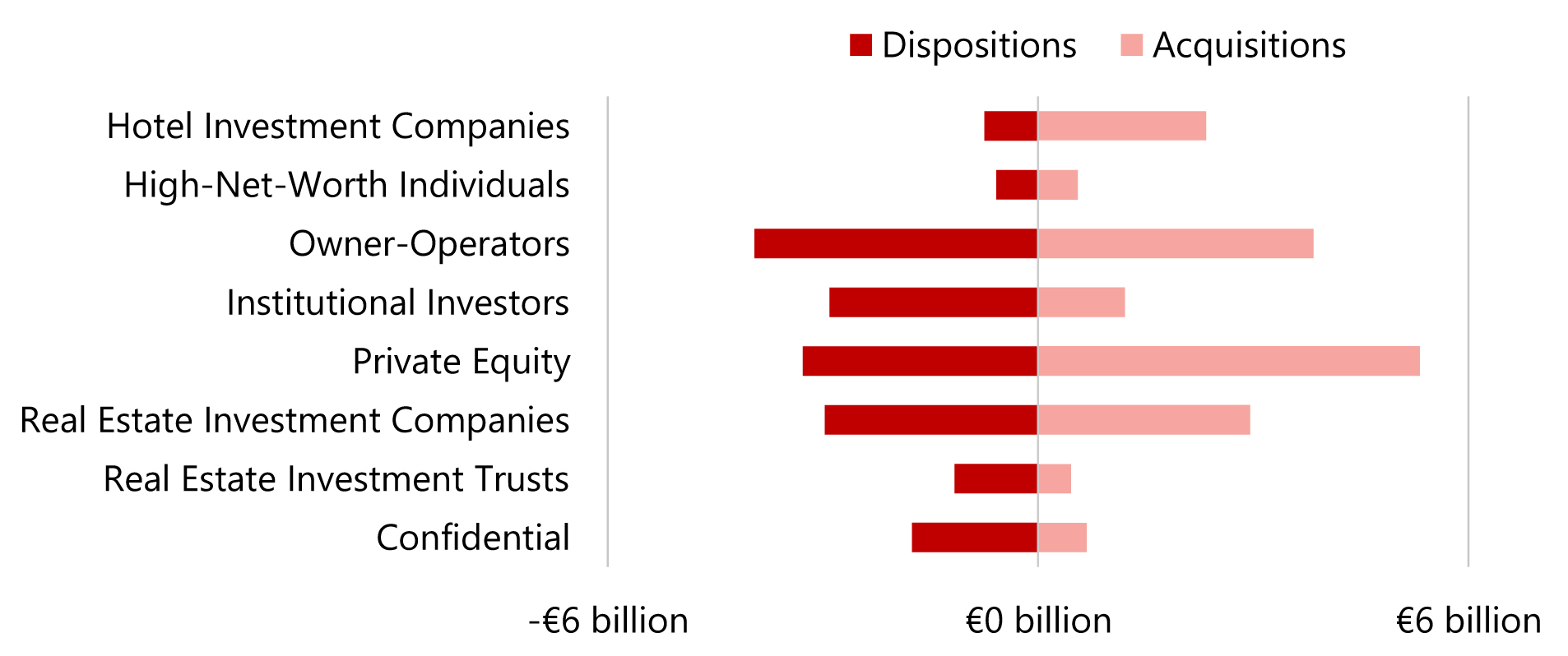

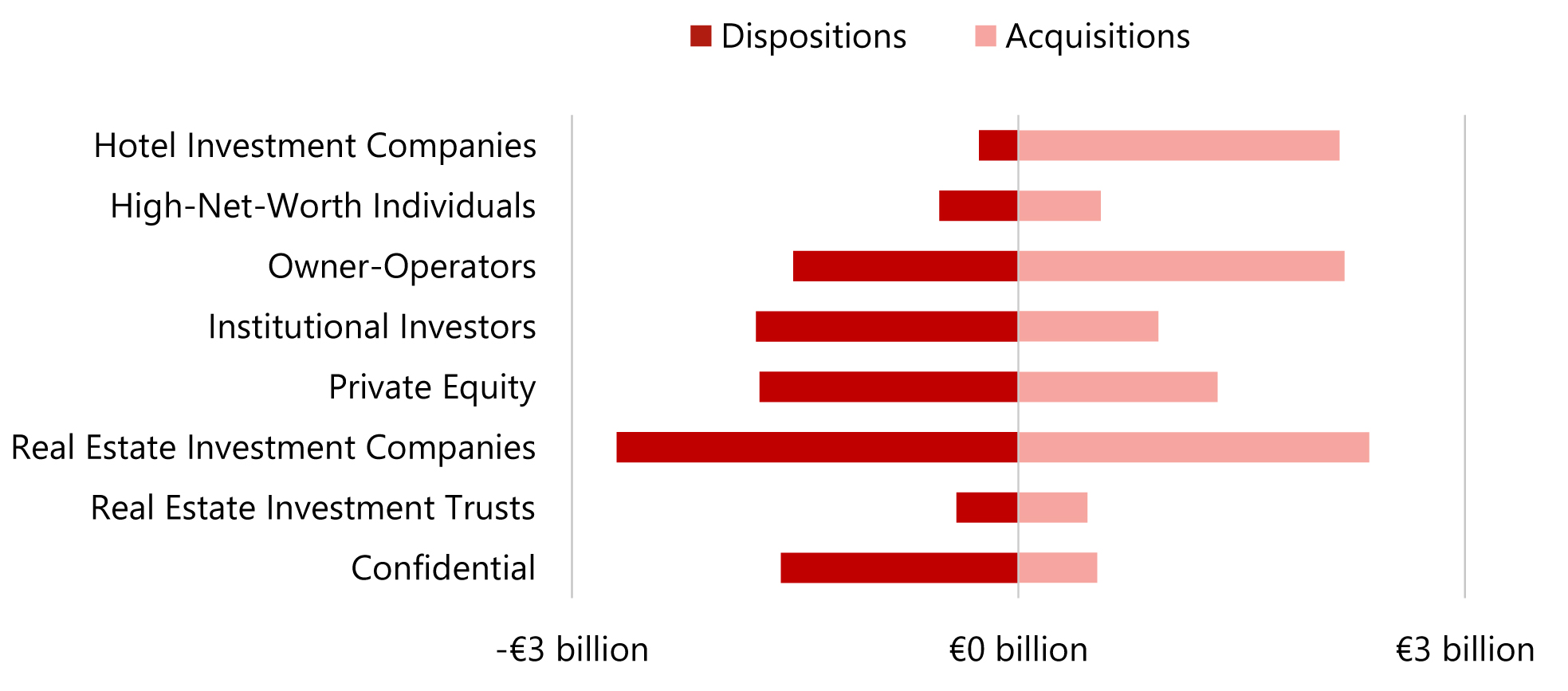

Activity by Investor Type

- In 2024, Private Equity investors were the most active, buying and selling nearly €8.6 billion in assets (a 315% increase over 2023), followed by Owner-Operators which transacted a combined €7.8 billion of properties (a 90% increase over 2023);

- Real Estate Investment Companies largely transacted similar volumes (€5.9 billion) as in 2023 (-0.9%);

- Along with Private Equity, Hotel Investment Companies were substantial net buyers in 2024 (+€1.9 billion);

- The largest net sellers, with a negative balance of €1.7 billion (compared to a positive balance of €2.8 billion in 2019) were Institutional Investors, who showed very little buying appetite in 2024 as a reflection of the higher interest rate environment.

Source: HVS – London Office

Source: HVS – London Office

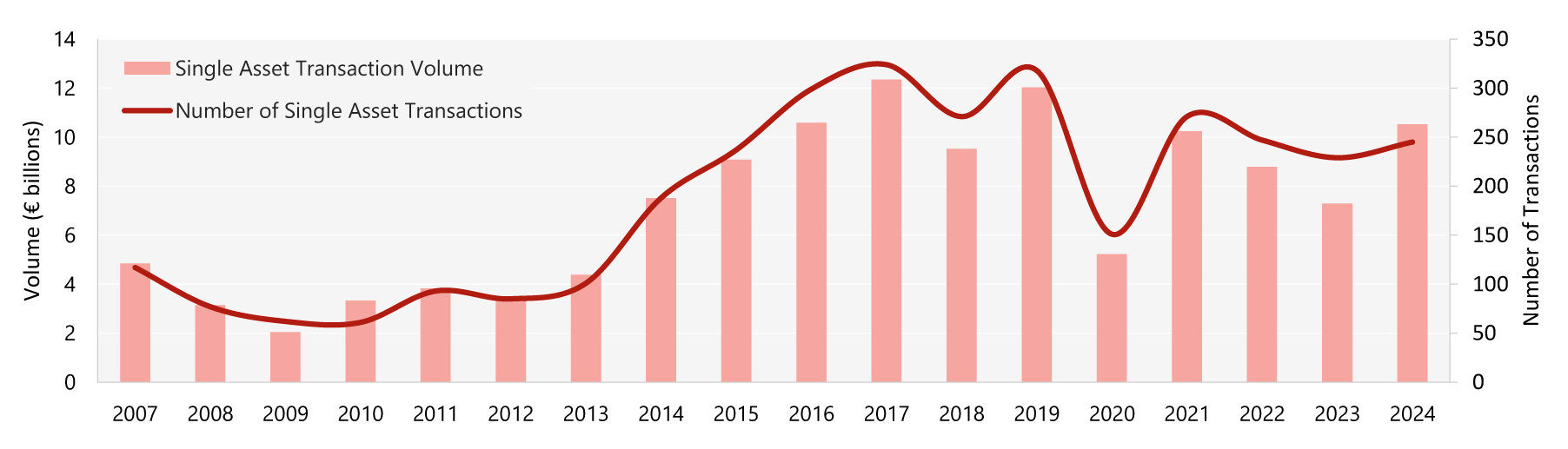

Single Assets

Single asset transaction activity increased significantly in 2024, led primarily by the combination of interest rate cuts across European central banks and strong hotel trading performances, which ultimately fuelled investors’ appetite for hotel deals.

Source: HVS – London Office

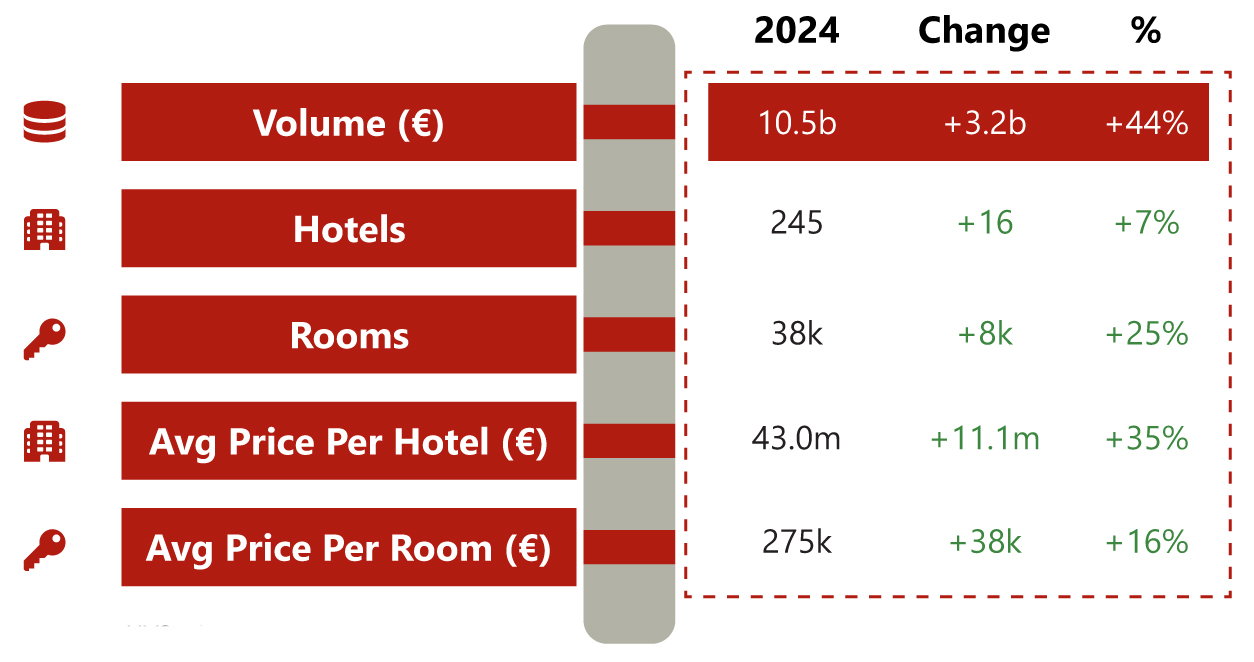

Volume

- Single asset transaction volume in 2024 totalled €10.5 billion, which was 44% greater than 2023 volumes and only 13% below 2019. This also made 2024 the fourth highest year on record for single asset hotel transaction volume in Europe;

- Activity was split evenly between H1 and H2 2024, with Q4 being the busiest quarter;

- Supported by a larger number of high-value transactions and a higher average price per room, the average price per hotel surged by 35% above 2023;

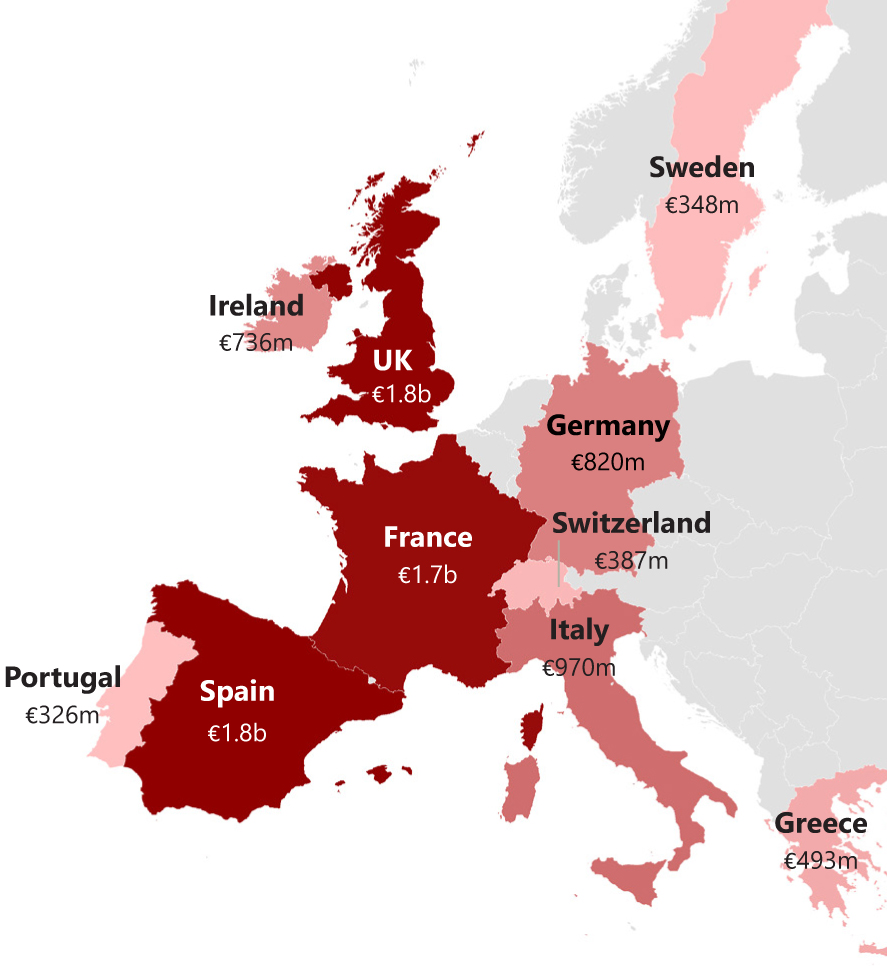

- The three most liquid European single asset markets in 2024 were Spain (€1.8 billion), the UK (€1.8 billion) and France (€1.7 billion). Each commanded 17% of total transaction activity;

- Other countries that saw significant increased single asset activity in 2024 were Italy (+€493 million and up to fourth position), Ireland (+€543 million and up to sixth) and Greece (+€478 million and up to seventh).

|

Chart 7: Single Asset Top Countries (Total Activity by Volume)

|

|

|

|

|

Source: HVS – London Office |

|

Source: HVS – London Office

Source: HVS – London Office

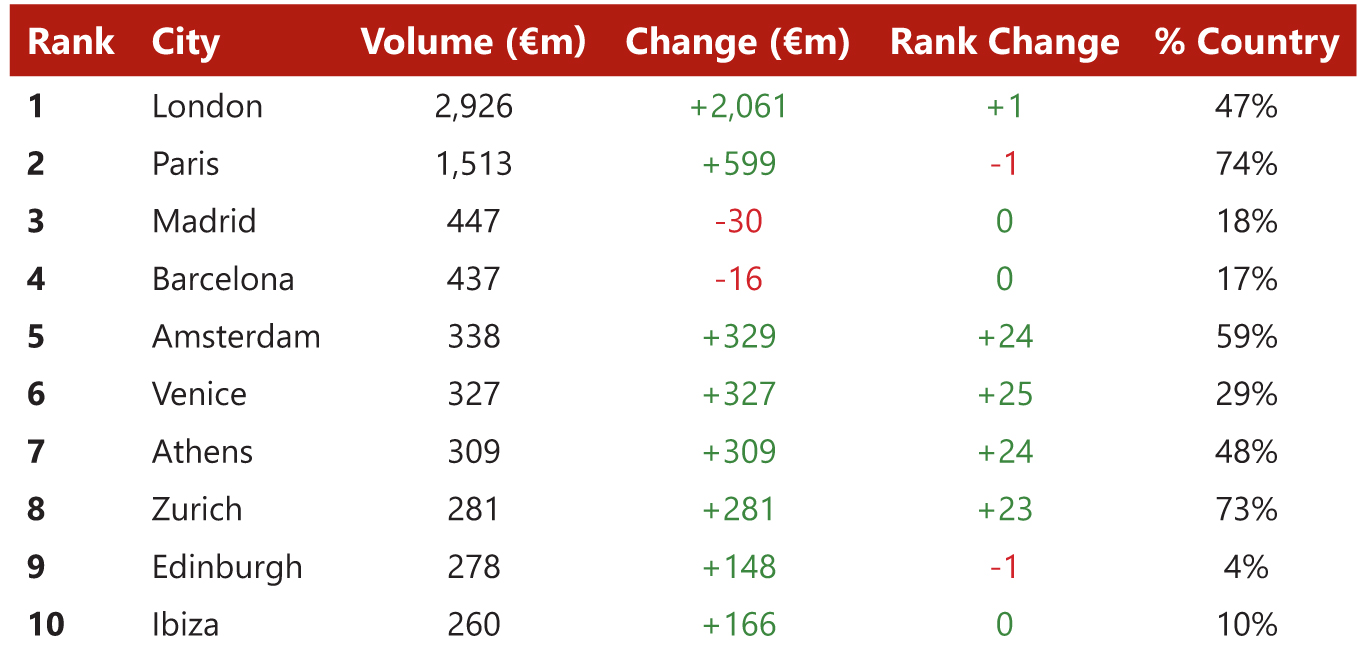

Cities

Most major European cities attracted larger investments in 2024 than they did in 2023.

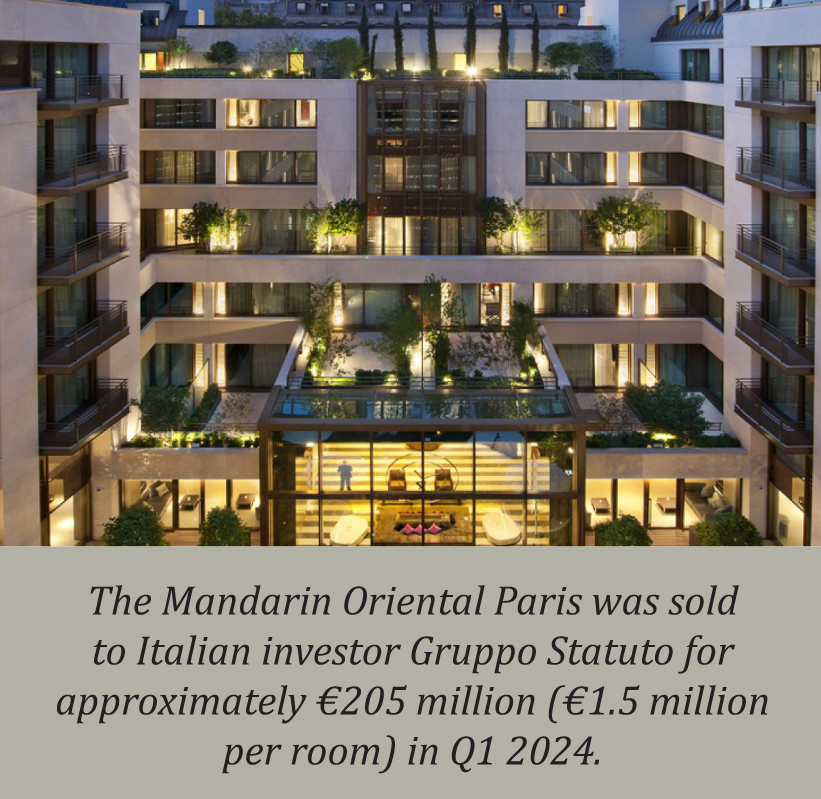

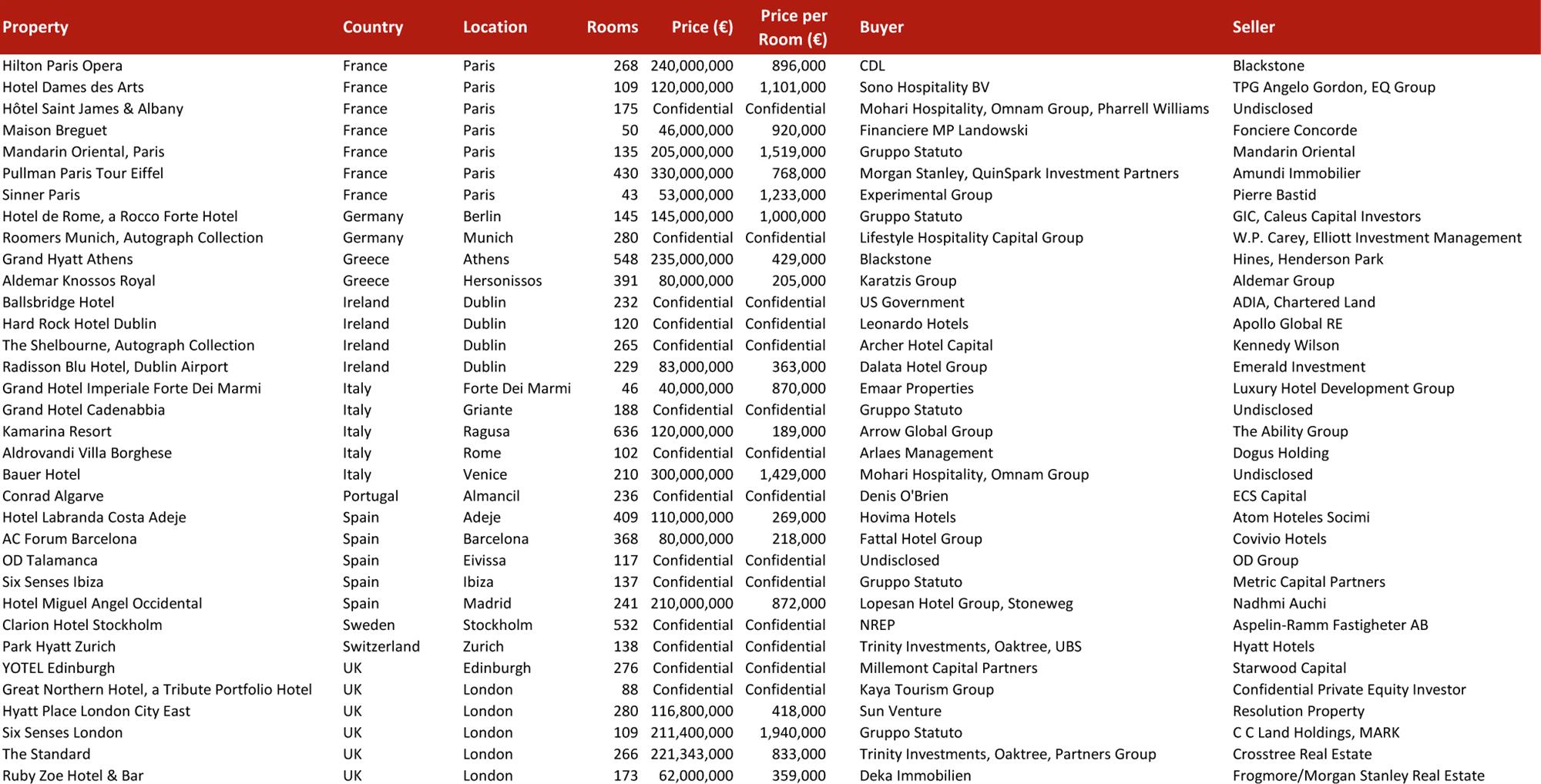

- Paris was the most liquid single asset city market for the second year in a row, with more than €1.4 billion in transaction volume in 2024, a 65% increase over 2023. This was led by numerous large transactions such as those of the Mandarin Oriental, the Pullman Tour Eiffel and the Hilton Opera, with investors rushing into this market ahead of the Olympics;

- London was second, with volume reaching €1 billion (an 80% increase over 2023), strongly driven by the forward-sale of the Six Senses in Bayswater and the transaction of The Standard in King’s Cross;

- The transaction of the Hotel Miguel Angel Occidental carried Madrid into third place, a three-place improvement over 2023, with the Spanish capital recording single asset investment volume of €435 million (a €270 million increase over 2023). Barcelona trailed just behind at €334 million (a €55 million decrease over 2023);

- Some of the impressive ranking improvements included Venice (€327 million and climbing into fifth place) and Athens (€309 million and reaching sixth place).

- The largest capital movers in 2024 were Real Estate Investment Companies, shifting a total of €5.1 billion in single asset acquisitions and disposals (a 26% increase over 2023);

- Hotel Investment Companies were 2024’s largest net buyers of single assets at €1.9 billion (a €1.8 billion increase in net acquisitions over 2023);

- Institutional Investors were the largest net sellers of single assets in 2024 at €822 million. Private Equity followed, with total net sales reaching €403 million;

- Real Estate Investment Companies were net sellers in 2024, with net sales of €341 million, while High-Net-Worth-Individuals and Real Estate Investment Trusts remained largely neutral.

Source: HVS – London Office

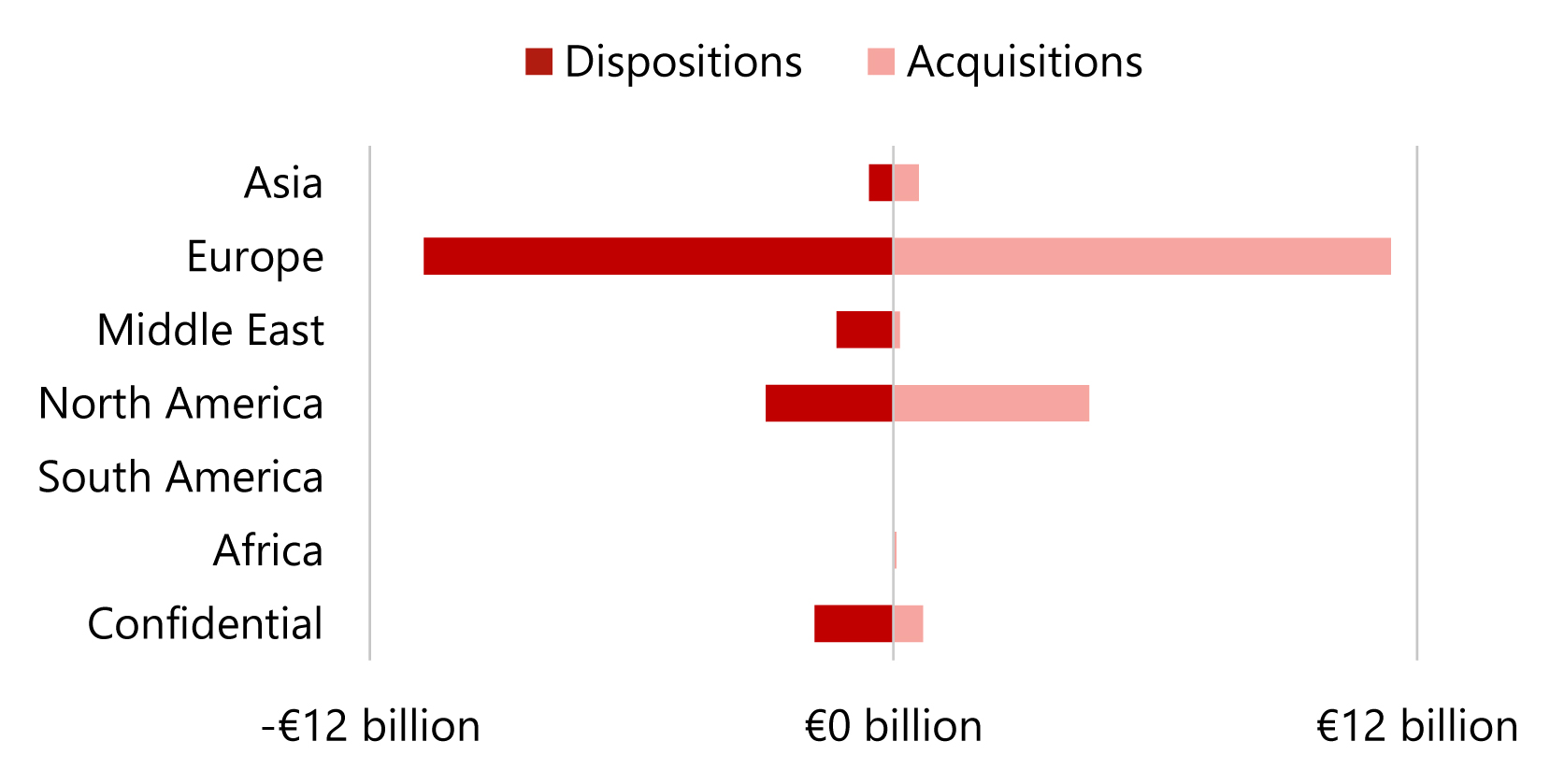

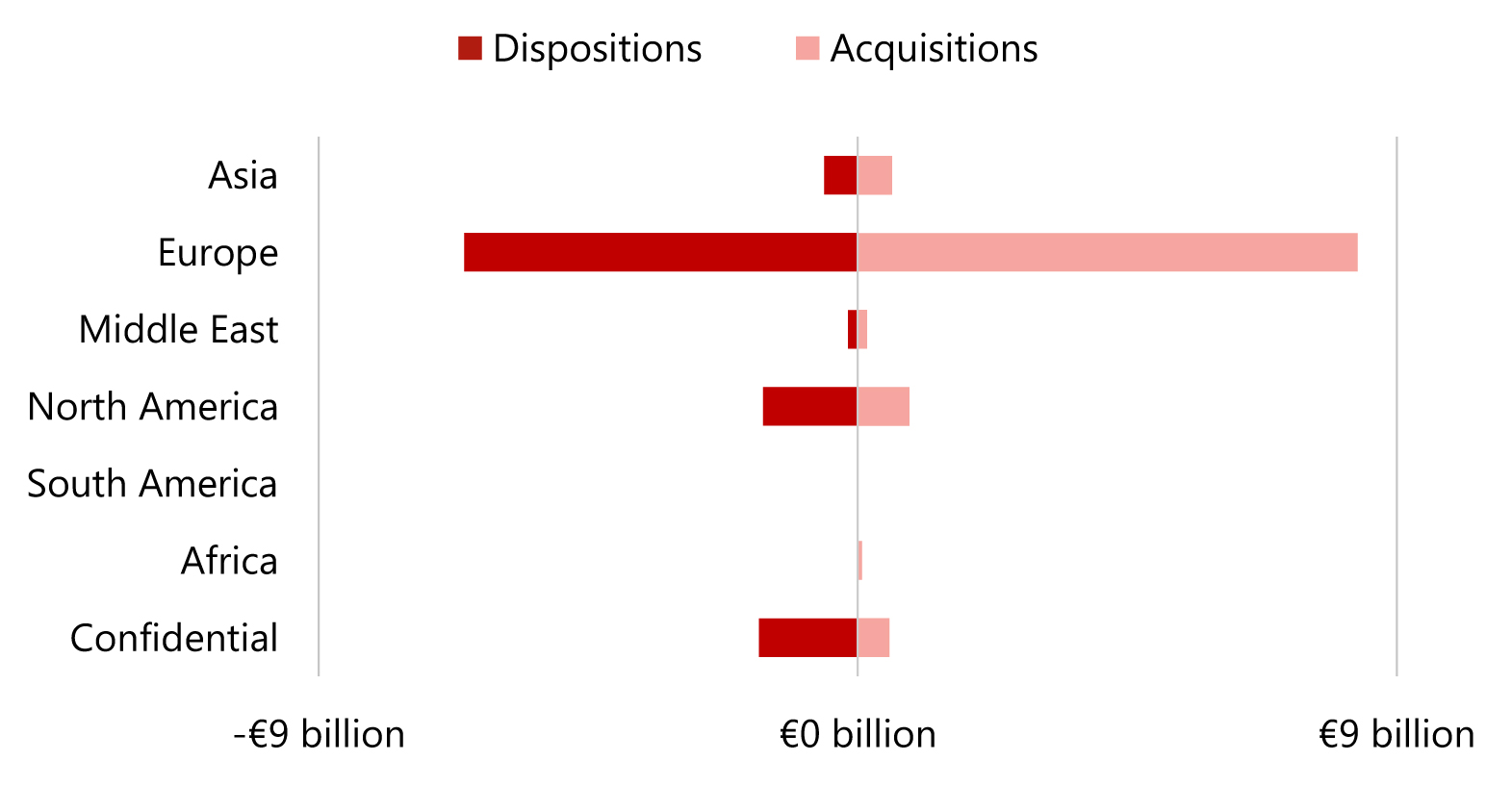

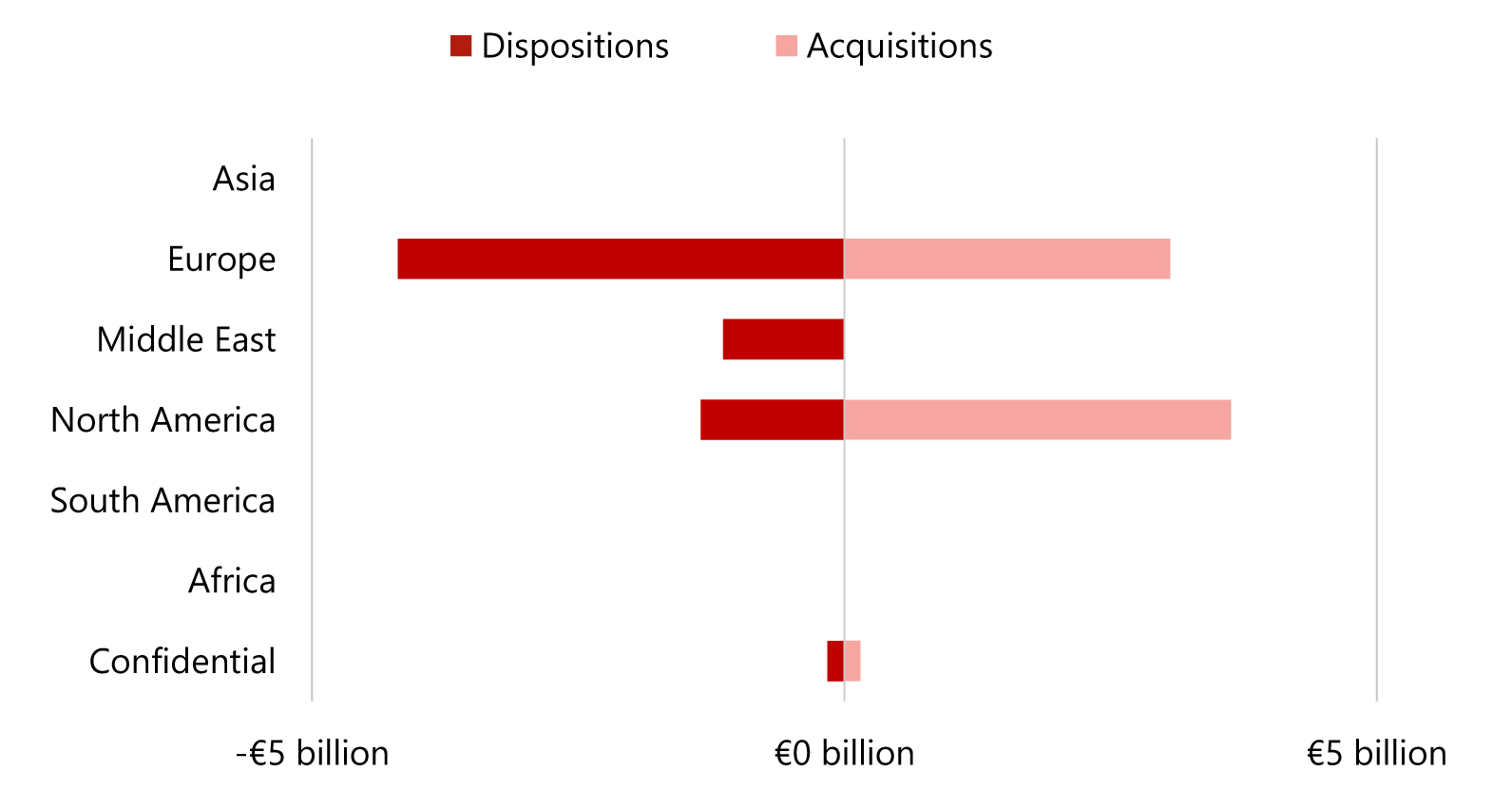

Capital by Continent

- Europeans were the most active buyers of single assets in 2024, accounting for 82% of total transaction activity (up from 81% in 2023), with net acquisitions of €2 billion, significantly up from €703 million in 2023;

- North American investors recorded €722 million in net sales, while Asian investors remained largely neutral, accounting for 12% and 5% of total single asset transaction volume, respectively;

- Middle Eastern interest was largely neutral in 2024, with acquisition volumes closely mirroring disposal volumes, at €153 million and €165 million, respectively.

Source: HVS – London Office

|

|

|

|

Notable Single Asset Transactions

Presented below is a selection of single asset transactions that occurred over the course of 2024.

Source: HVS – London Office

To request an expanded list of transactions, contact [email protected].

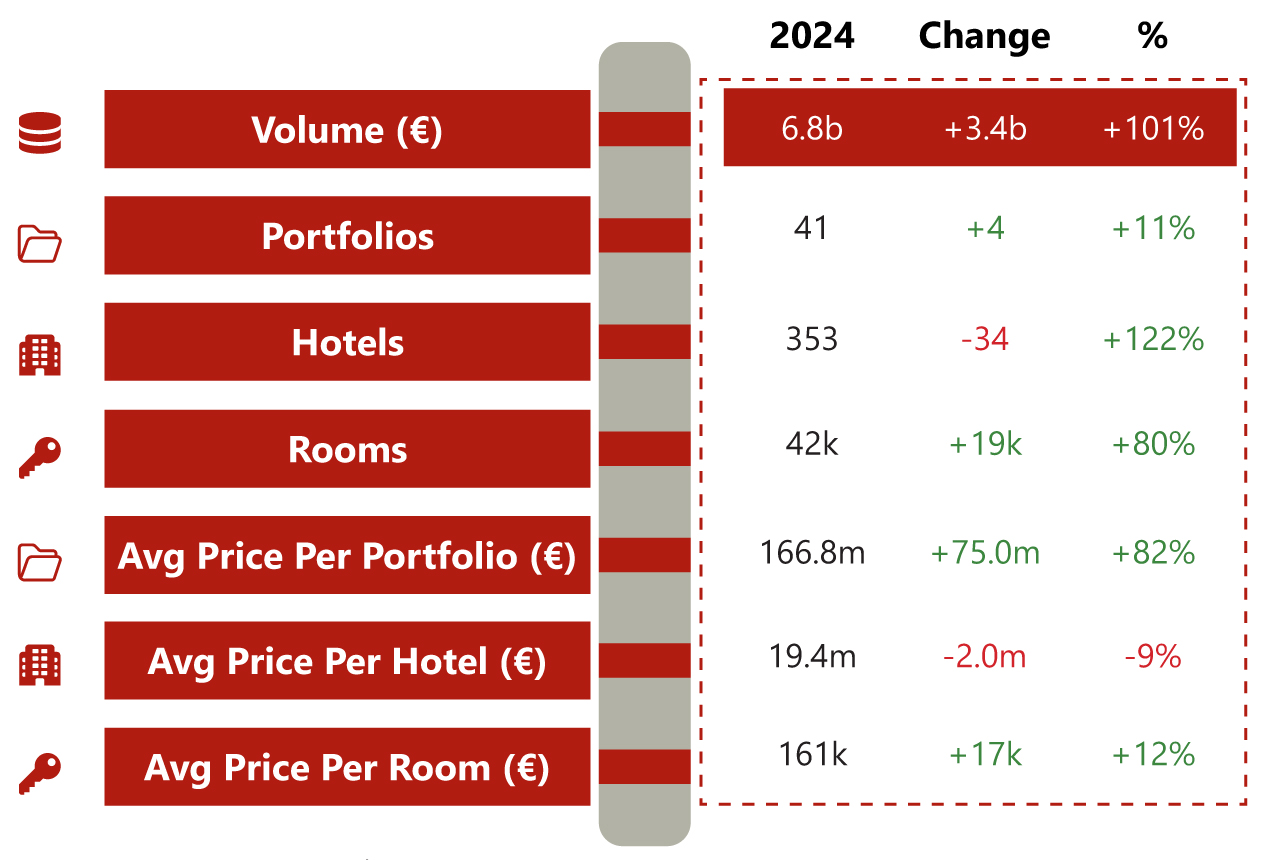

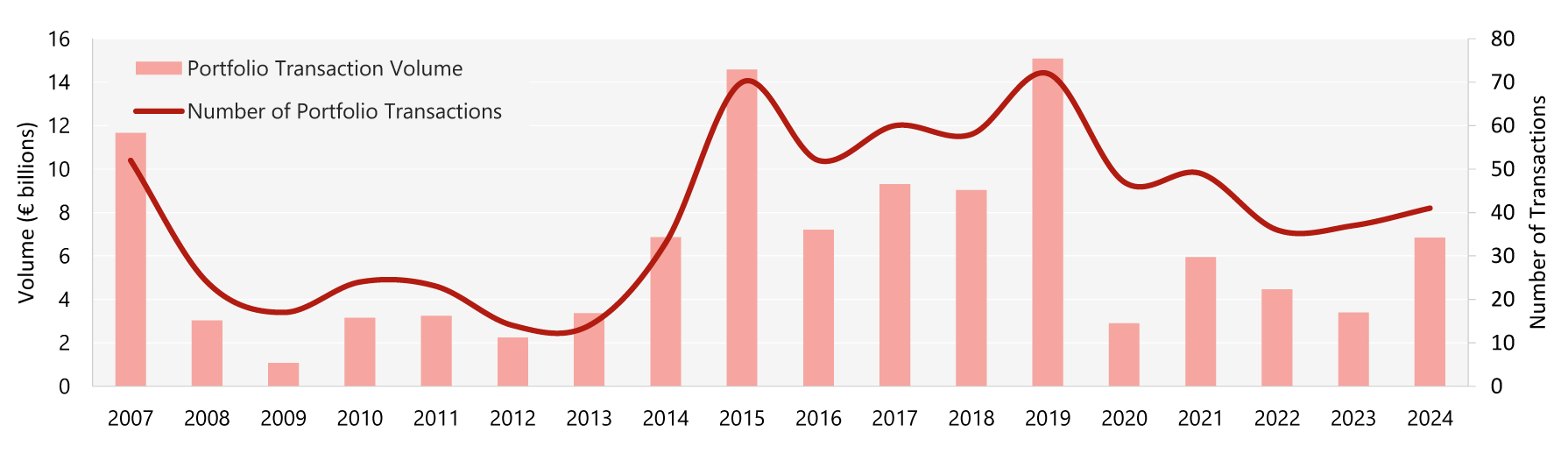

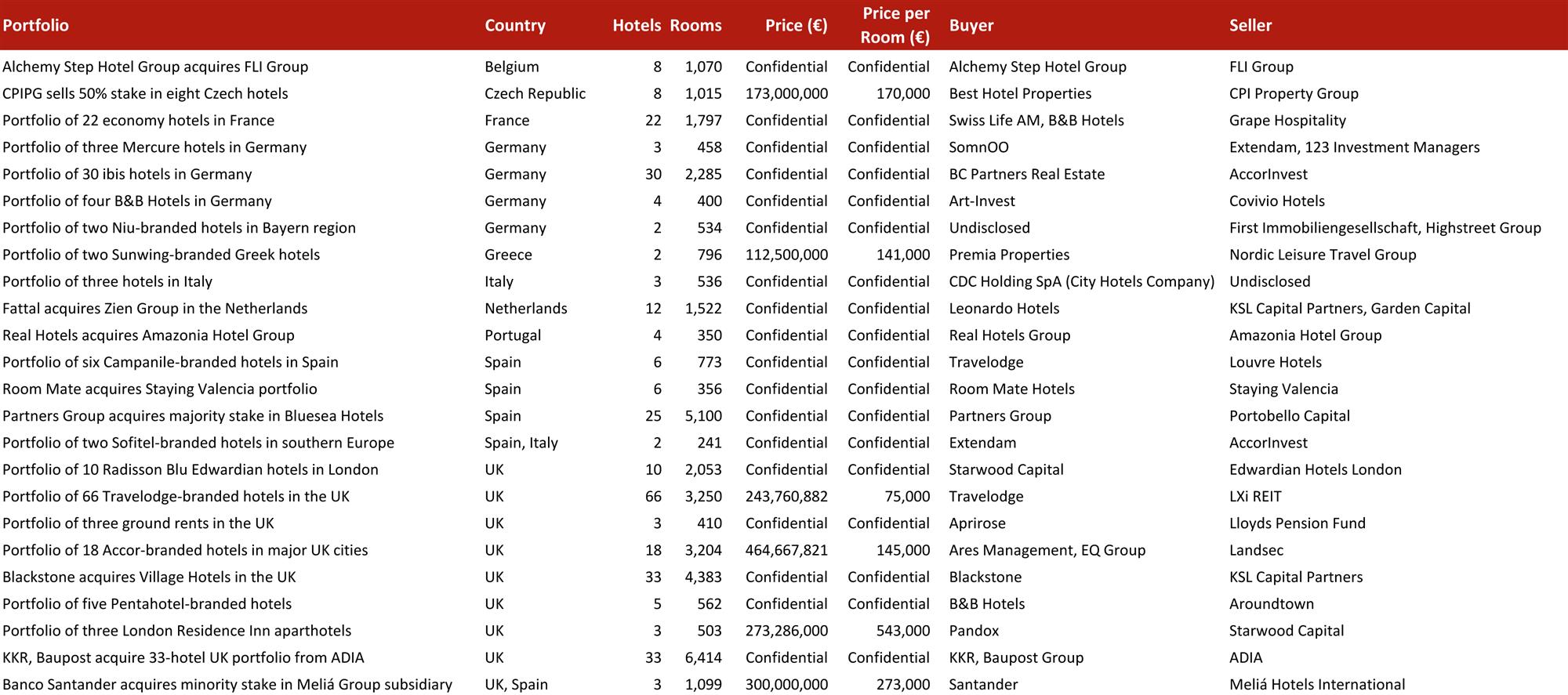

Portfolio Assets

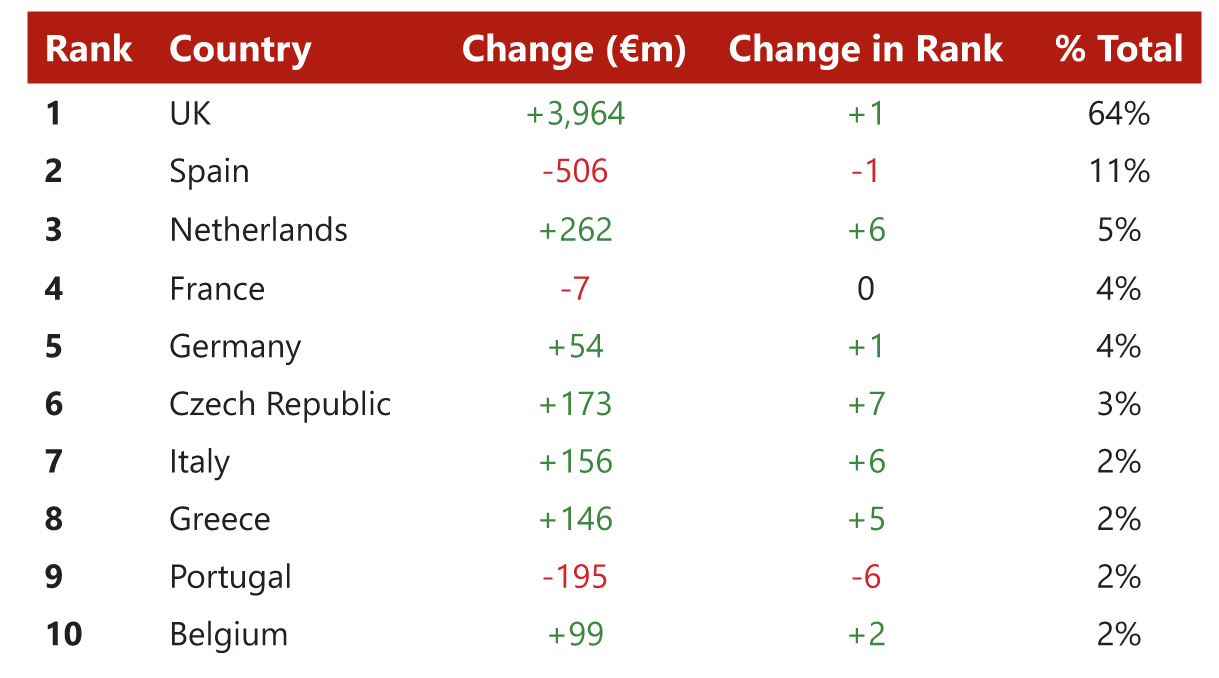

Portfolio transactions in 2024 increased dramatically over the previous year, reaching double the level recorded in 2023, and accounting for 40% of total European investment activity. Most of the annual difference was due to a huge increase in portfolio transactions in the UK, which was 2024’s most active transaction market for portfolios by some distance, having been home to some of Europe’s largest deals, including Starwood’s acquisition of 10 Edwardian hotels and Blackstone’s acquisition of 33 Village Hotels.

Overall, the average number of hotels per portfolio also doubled, from 4.3 in 2023 to 8.6 in 2024. While price per room reached €161,400 in 2024 (a 12% increase over 2023, although still 18% below 2019), the average price per hotel decreased to €19,377,000 (a 9% drop from 2023), in part due to the high number of economy portfolios that transacted with small-room-count properties, such as the portfolio of 30 ibis-branded hotels across Germany sold by AccorInvest to BC Partners.

Source: HVS – London Office

Volume

- Portfolio transaction volume in 2024 totalled €6.8 billion, which was, again, double the volume recorded in 2023, although still falling 55% short of 2019 volumes. However, it surpassed the 18-year average for the first time since 2019;

- Most of the increase in 2024 happened in the first half of the year, with H1 2024 portfolio volumes being more than five times those witnessed in H1 2023;

- By comparison, portfolio activity in H2 2024 was almost the same as in H2 2023 at €2.6 billion and €2.5 billion, respectively.

Source: HVS – London Office

Source: HVS – London Office

|

Chart 15: Portfolio Top Countries (Total Activity By Volume)

|

|

|

|

|

Source: HVS – London Office |

|

Cities

- Approximately half of the hotels that transacted across European portfolios in 2024 were located in secondary cities, with markets such as Spain, France, Germany and Belgium witnessing the largest trend towards secondary cities in the composition of transacted portfolios;

- London recorded the highest volume by some margin with €1.9 billion in portfolio transactions (a €1.6 billion increase over 2023), followed by Amsterdam with €240 million (dominated by Fattal’s acquisition of the Zien Group).

Investor Type

- Acquisition activity by Private Equity groups was the strongest of all investors in 2024 (having been virtually absent in 2023), with a total volume of €4 billion, representing 58% of all portfolio transactions;

- Next in line were Owner-Operators, which acquired roughly €1.6 billion worth of portfolios in 2024 (a €1 billion increase over 2023), and amounted to 24% of total volume;

- Real Estate Investment Companies, which represented 32% of the volume in 2023, contributed only 9% in 2024, witnessing a 44% decrease in acquisition volume;

- Net portfolio transaction volumes show Private Equity groups were still front-runners with net acquisitions of €2.4 billion in 2024, followed by Real Estate Investment Companies with €328 million;

- The largest net sellers in 2024 were Institutional Investors, Owner-Operators and Real Estate Investment Trusts at €874 million, €792 million and €748 million, respectively.

Source: HVS – London Office

Capital by Continent

- In contrast to 2023, European investors were not the largest portfolio buyers in 2024, representing 45% of total volume. Led by Private Equity groups, North American investors were responsible for the most acquisitions, with a total volume of €3.6 billion in 2024, having been largely absent in 2023;

- Despite also being major buyers in 2024, European investors were net sellers overall, with total net disposals of €1.1 billion, in contrast to the net acquisitions of €2.3 billion made by North American investors;

- Having been net buyers of portfolios in 2023, Middle Eastern investors, primarily led by ADIA, recorded net sales of €1.1 billion in 2024.

Source: HVS – London Office

Notable Portfolio Transactions

Presented below is a selection of portfolio transactions that occurred over the course of 2024.

Source: HVS – London Office

To request an expanded list of transactions, contact [email protected].

Conclusions

Hotel Transactions in 2024: A Market Reignited

After two years of substantial interest rate rises following the Russian invasion of Ukraine (and the resulting energy cost spikes that drove global inflation), 2024 marked a turning point for capital markets in Europe. As debt market conditions improved and cost inflation softened, combined with relatively little supply growth, transaction activity surged to its highest level for five years, registering an impressive 62% growth over 2023 (although still being only two-thirds of the volume registered in 2019).

The year saw several landmark single-asset transactions, including in the ultra-luxury segment, as well a major increase in portfolio deals which were double the level recorded in 2023. Higher volume, more hotels, more rooms and rising average prices per room compared to 2023 – all clear indicators of a market regaining momentum.

Private Equity groups led market activity, both as buyers and sellers, driving the most significant transaction volumes. They were followed by Owner-Operators, while traditionally influential Institutional Investors remained more restrained, a reflection of the lingering effects of the high-interest-rate environment.

Leading Markets: UK Reclaims the Top Spot

The UK emerged as the most liquid market, recording €6.2 billion in transactions, followed by Spain (€2.5 billion) and France (€2.0 billion). Paris alone accounted for €1.5 billion in deals, as transactions surged ahead of the 2024 Olympic Games.

London retained its position as Europe’s most transacted city, with €3 billion in deals—matching the combined total of the next five most active cities. This was largely driven by major portfolio transactions, reinforcing London’s status as a key global investment hub.

Looking Ahead

As we move further into 2025, the availability and cost of financing will remain a focal point for hotel investors. With interest rates expected to decline further, capital markets should see a resurgence in liquidity, boosting transaction volumes across key European markets.

While refinancing challenges persist, particularly for highly leveraged assets, widespread distress remains unlikely. Banks and alternative lenders have demonstrated greater flexibility in restructuring debt, and hotel assets continue to outperform most other real estate classes in investor preference.

Private Equity firms and Owner-Operators are expected to remain the dominant market players, with value-add investments to remain popular given the return potential in a higher interest rate environment.

Institutional Investors—previously hesitant due to interest rate volatility—could re-enter the market more aggressively should rates continue their downward trajectory. The return of the institutional buyer would add further momentum to the expected increase in portfolio transactions, but especially for core and core+ assets, which would improve the liquidity and valuation of leased hotels.

As seen in 2024, urban markets will remain the prime focus for investors, with cities like London, Paris, Madrid and Rome continuing to attract the highest capital inflows.

Beyond the major metropolitan hubs, resort destinations across Southern Europe—particularly in Spain, Italy and Greece—are expected to continue to gain significant attention, as investors look to capitalise further on the booming leisure- and experience-driven travel sector.

While macro uncertainties persist, particularly in relation to shifting global trade dynamics, the hospitality sector continues to outperform other real estate asset classes. Investors are recognising that travel remains a spending priority for many demographics, particularly in the luxury and experience-driven segments.

Europe’s ability to weather economic and geopolitical challenges while maintaining its status as the world’s most popular destination highlights the sector’s long-term attractiveness. This, combined with rising interest from Middle Eastern, North American and Asian investors, is expected to further fuel transaction activity in 2025.

0 Comments

Success

It will be displayed once approved by an administrator.

Thank you.

Error